Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help determining what i did wrong, thanks. Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable,

need help determining what i did wrong, thanks.

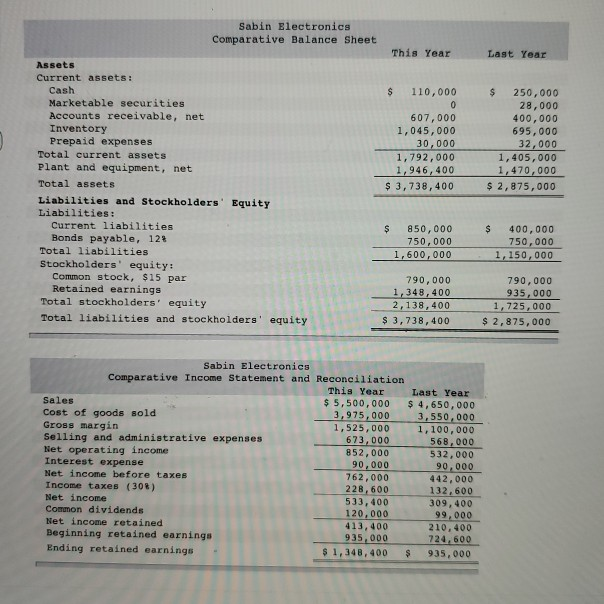

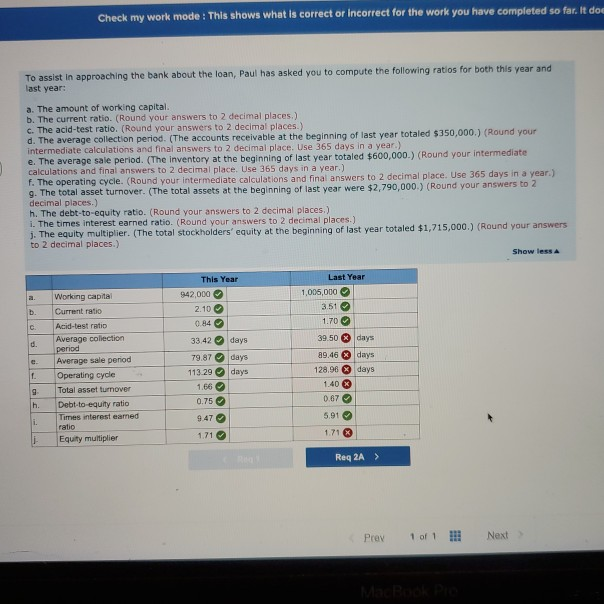

Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 12! Total liabilities Stockholders' equity: Common stock, $15 par Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 110,000 0 607,000 1,045,000 30,000 1,792,000 1,946,400 $ 3,738, 400 $ 250,000 28,000 400,000 695,000 32,000 1, 405,000 1,470,000 $ 2,875,000 $ 850,000 750,000 1,600,000 $ 400,000 750,000 1,150,000 790,000 1,348,400 2,138, 400 $ 3,738,400 790,000 935,000 1,725,000 $ 2,875,000 Sabin Electronics Comparative Income Statement and Reconciliation This Year Last Year Sales $ 5,500,000 $ 4,650,000 Cost of goods sold 3,975,000 3,550,000 Gross margin 1,525,000 1,100,000 Selling and administrative expenses 673,000 568,000 Net operating income 852,000 532,000 Interest expense 90,000 90,000 Net income before taxes 762,000 442,000 Income taxes (30%) 228,600 132,600 Net income 533, 400 309, 400 Common dividends 120,000 99,000 Net income retained 413, 400 210,400 Beginning retained earnings 935,000 724,600 Ending retained earnings $ 1,348, 400 $ 935,000 Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It doe To assist in approaching the bank about the loan, Paul has asked you to compute the following ratios for both this year and last year: a. The amount of working capital b. The current ratio. (Round your answers to 2 decimal places) c. The acid-test ratio. (Round your answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $350,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) e. The average sale period. (The inventory at the beginning of last year totaled $600,000.) (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) f. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place. Use 365 days in a year.) 9. The total asset turnover. (The total assets at the beginning of last year were $2,790,000.) (Round your answers to 2 decimal places.) h. The debt-to-equity ratio. (Round your answers to 2 decimal places.) i. The times interest earned ratio. (Round your answers to 2 decimal places.) 3. The equity multiplier. (The total stockholders' equity at the beginning of last year totaled $1,715,000.) (Round your answers to 2 decimal places.) Show less a. This Year 942,000 2.10 0.84 Last Year 1,005,000 3.51 1.70 d. Working capital Current ratio Acid-test ratio Average collection period Average sale period Operating cycle Total asset turnover Debt-to-equity ratio Times interest eamed ratio Equity multiplier e 33.42 days 79.87 days 113.29 days 1.66 0.75 39.50 89.46 days 128,96 days 1.40 X O OOO 9 0.67 h i. 9.47 5.91 1.71 1.71 Reg 2A > Prav 1 of 1 NextStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started