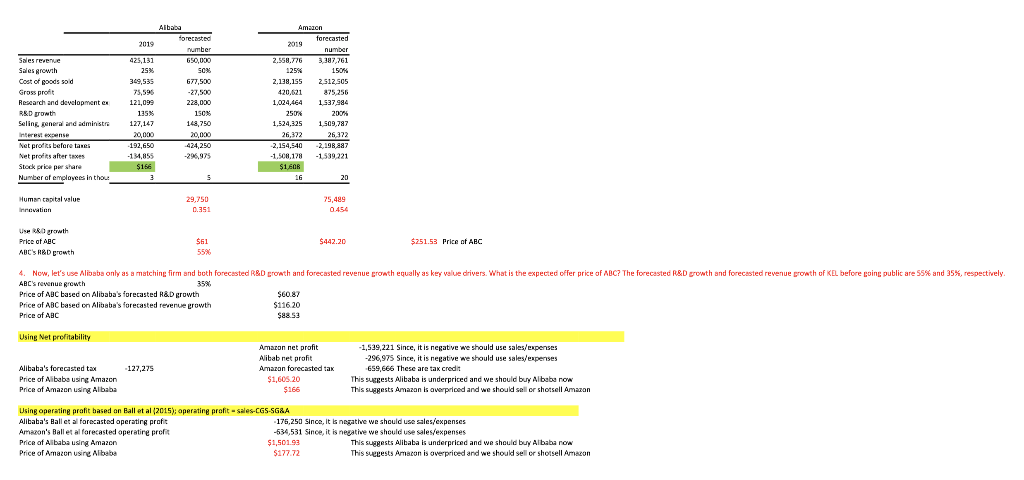

Need help explaining how the answers in red are correct. I do not understand it, thank you.

Alibaba 2019 forecasted number 425.131 650,000 25% SO 349,535 677,500 Sales revenue Sales growth Cost of goods sold Gross profit Research and development es RSD powth Seling general and administru interesent Net profits before taxes Net profits after taxes Stock price per share Number of employees in thous 121,099 135% 127,147 20,000 192,650 228,000 150% 148,750 20,000 424,250 Amazon forecasted 2019 number 2.558.776 3.392,761 125% 1504 2.138.155 2.512,505 420,621 875,256 1.024.464 1.537 984 250 200% 1,524,325 1509,787 26,372 26,372 -2.154.540 -2,198.887 -1.508,178 -1539,221 $1,60B 16 20 $166 3 5 Humanapital value Innovation 29,750 0.351 75,489 0.454 Usko growth Price of ABC ADC'S HAD growth $442.20 $ $251.53 Price of ABC $51 55% 4. Now, let's use Alibaba only as a matching firm and both forecasted R&D growth and forecasted revenue growth equally as key value drivers. What is the expected offer price of ABC? The forecasted R&D growth and forecasted revenue growth of KEL before going public are 55% and 35%, respectively. ABC's revenue growth 35% Price of ABC based on Alibaba's forecasted R&D growth $60.87 Price of ABC based on Alibaba's forecasted revenue growth $116.20 Price of ABC $88.53 Using Net profitability -127,275 Alibaba's forecasted tax Price of Albabs using Amazon Price of Amazon using Albaba Amazon net profit Alibab net profit Amazon forecasted tak $1,605.20 $166 -1,539,221 Since, it is negative we should use sales/expenses -296,975 Since, it is negative we should use sales/expenses 659,666 These are tak credit This suggests Alibaba is underpriced and we should buy Alibaba non This suggests Amazon is overpriced and we should sell or shotsell Amazon Using operating pratit based on Ball et al (2015); aperating profit-sales-CGS-SG&A Alibaba's Ballet al forecasted operating profit 175,250 since it is negative we should use sales/expenses Amazon's Ballet al forecasted operatire profit -534,531 Since, it is negative we should use sales/expenses Price of Alibaba using Amazon $1.501.93 This suggests Alibaba is underpriced and we should buy Albaba now Price of Amazon using Albaba $177.72 This suevests Amazon is overpriced and we should sell or shotsell Amazon Alibaba 2019 forecasted number 425.131 650,000 25% SO 349,535 677,500 Sales revenue Sales growth Cost of goods sold Gross profit Research and development es RSD powth Seling general and administru interesent Net profits before taxes Net profits after taxes Stock price per share Number of employees in thous 121,099 135% 127,147 20,000 192,650 228,000 150% 148,750 20,000 424,250 Amazon forecasted 2019 number 2.558.776 3.392,761 125% 1504 2.138.155 2.512,505 420,621 875,256 1.024.464 1.537 984 250 200% 1,524,325 1509,787 26,372 26,372 -2.154.540 -2,198.887 -1.508,178 -1539,221 $1,60B 16 20 $166 3 5 Humanapital value Innovation 29,750 0.351 75,489 0.454 Usko growth Price of ABC ADC'S HAD growth $442.20 $ $251.53 Price of ABC $51 55% 4. Now, let's use Alibaba only as a matching firm and both forecasted R&D growth and forecasted revenue growth equally as key value drivers. What is the expected offer price of ABC? The forecasted R&D growth and forecasted revenue growth of KEL before going public are 55% and 35%, respectively. ABC's revenue growth 35% Price of ABC based on Alibaba's forecasted R&D growth $60.87 Price of ABC based on Alibaba's forecasted revenue growth $116.20 Price of ABC $88.53 Using Net profitability -127,275 Alibaba's forecasted tax Price of Albabs using Amazon Price of Amazon using Albaba Amazon net profit Alibab net profit Amazon forecasted tak $1,605.20 $166 -1,539,221 Since, it is negative we should use sales/expenses -296,975 Since, it is negative we should use sales/expenses 659,666 These are tak credit This suggests Alibaba is underpriced and we should buy Alibaba non This suggests Amazon is overpriced and we should sell or shotsell Amazon Using operating pratit based on Ball et al (2015); aperating profit-sales-CGS-SG&A Alibaba's Ballet al forecasted operating profit 175,250 since it is negative we should use sales/expenses Amazon's Ballet al forecasted operatire profit -534,531 Since, it is negative we should use sales/expenses Price of Alibaba using Amazon $1.501.93 This suggests Alibaba is underpriced and we should buy Albaba now Price of Amazon using Albaba $177.72 This suevests Amazon is overpriced and we should sell or shotsell Amazon