Answered step by step

Verified Expert Solution

Question

1 Approved Answer

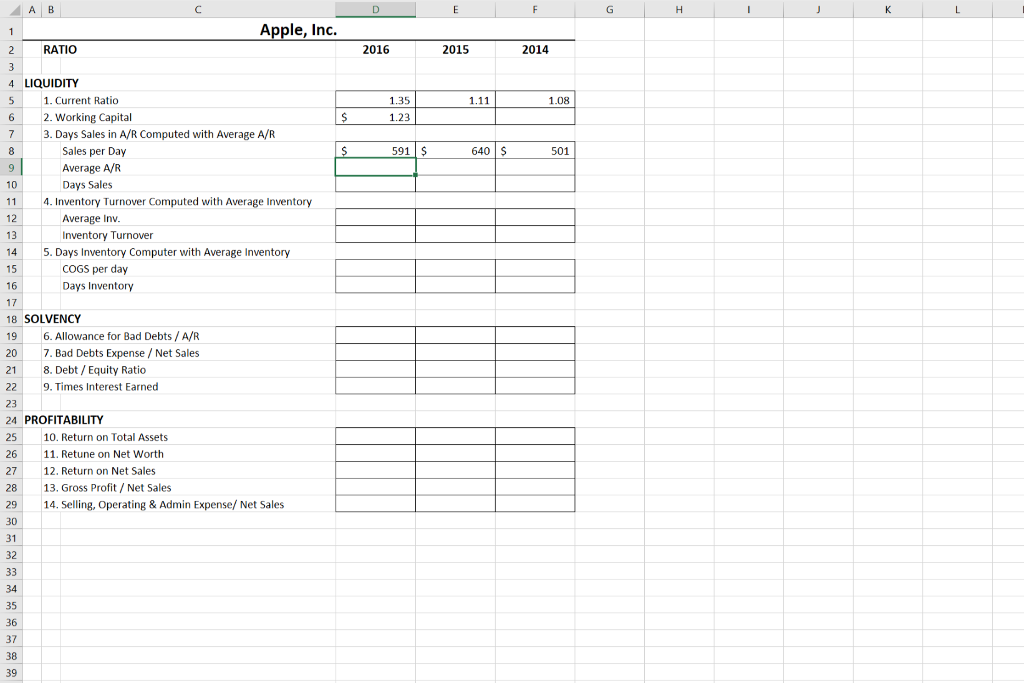

Need help figuring out these numbers A B Apple, Inc 2 RATIO 2016 2015 2014 4 LIQUIDITY 1.35 1.23 1. Current Ratio 1.11 1.08 6

Need help figuring out these numbers

A B Apple, Inc 2 RATIO 2016 2015 2014 4 LIQUIDITY 1.35 1.23 1. Current Ratio 1.11 1.08 6 2. Working Capital 7 3. Days Sales in A/R Computed with Average A/R 591 $ 640 S 501 Sales per Day Average A/R Days Sales 10 11 4. Inventory Turnover Computed with Average Inventory Average Inv Inventory Turnover 13 14 5. Days Inventory Computer with Average Inventory 15 16 17 18 SOLVENCY 19 6. Allowance for Bad Debts/ A/R 20 7. Bad Debts Expense Net Sales 21 8. Debt/ Equity Ratio 22 9. Times Interest Earned 23 24 PROFITABILITY 25 10. Return on Total Assets 26 27 12. Return on Net Sales 28 13, Gross Profit Net Sales 29 14. Selling, Operating &Admin Expense/ Net Sales COGS per day Days Inventory 11. Retune on Net Worth 31 32 34 35 36 37 39 A B Apple, Inc 2 RATIO 2016 2015 2014 4 LIQUIDITY 1.35 1.23 1. Current Ratio 1.11 1.08 6 2. Working Capital 7 3. Days Sales in A/R Computed with Average A/R 591 $ 640 S 501 Sales per Day Average A/R Days Sales 10 11 4. Inventory Turnover Computed with Average Inventory Average Inv Inventory Turnover 13 14 5. Days Inventory Computer with Average Inventory 15 16 17 18 SOLVENCY 19 6. Allowance for Bad Debts/ A/R 20 7. Bad Debts Expense Net Sales 21 8. Debt/ Equity Ratio 22 9. Times Interest Earned 23 24 PROFITABILITY 25 10. Return on Total Assets 26 27 12. Return on Net Sales 28 13, Gross Profit Net Sales 29 14. Selling, Operating &Admin Expense/ Net Sales COGS per day Days Inventory 11. Retune on Net Worth 31 32 34 35 36 37 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started