Need help filling in all the blanks thanks!

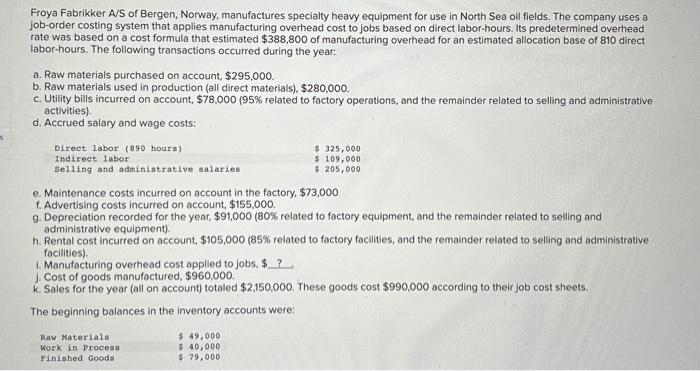

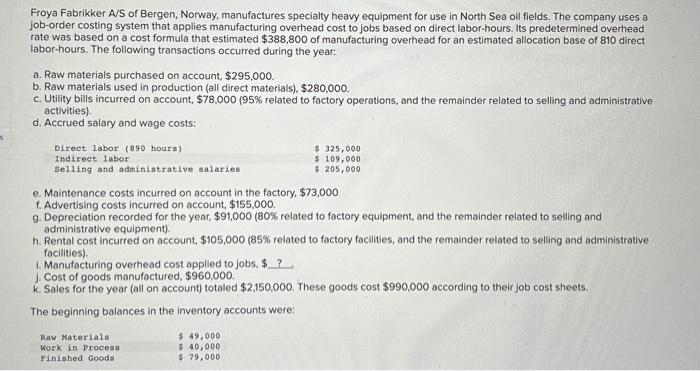

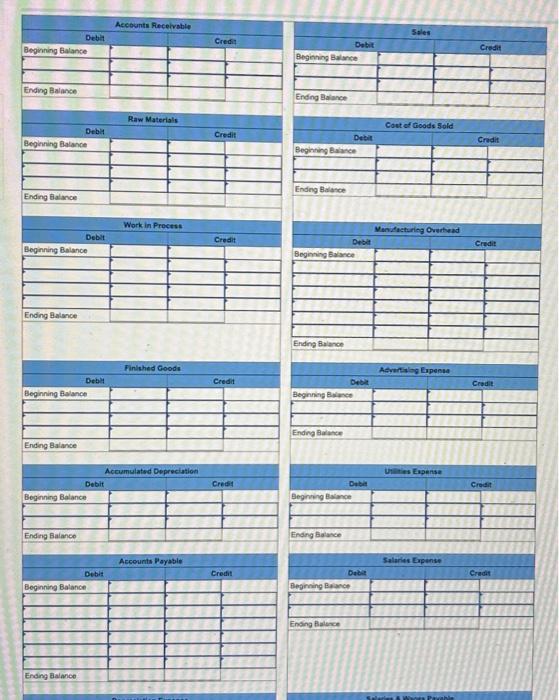

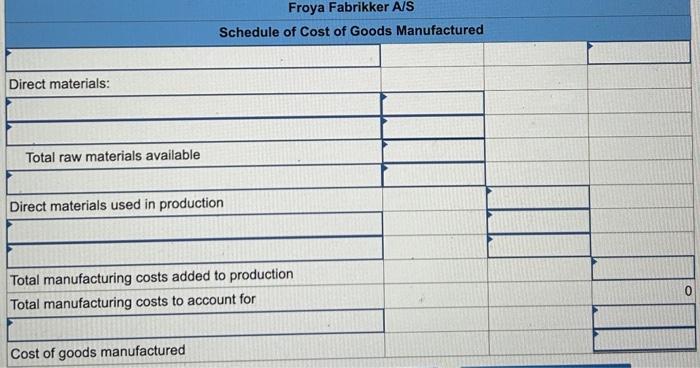

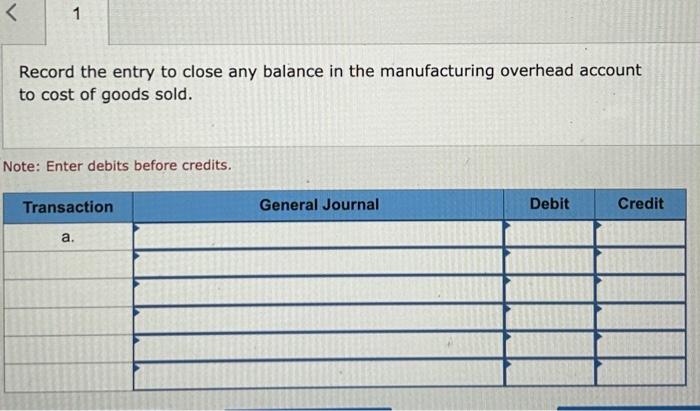

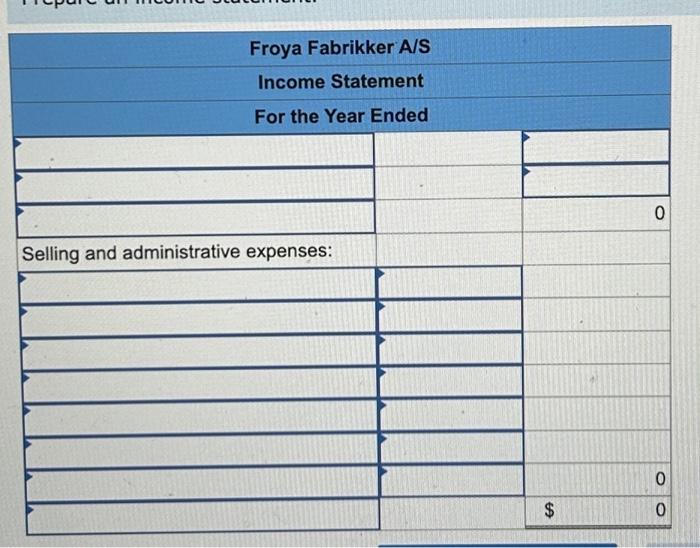

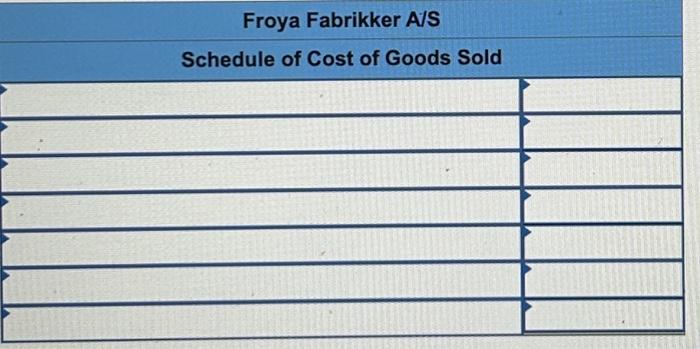

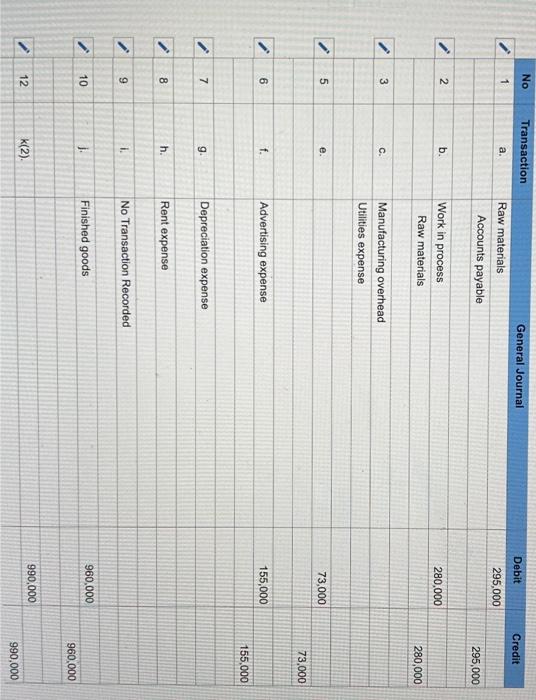

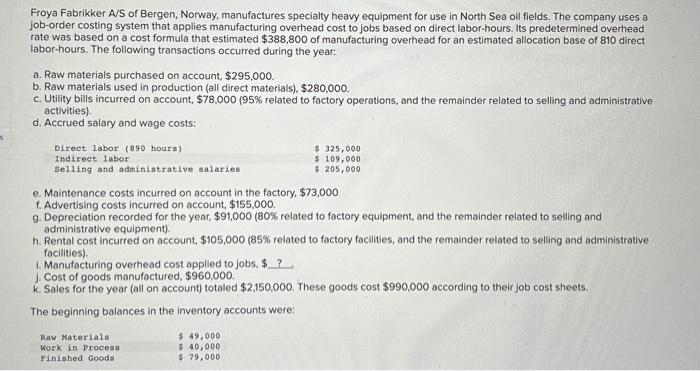

Froya Fabrikker A/S of Bergen, Norway, manufactures specialty heavy equipment for use in North Sea oil fields. The company uses a job-order costing system that applies manufacturing overhead cost to jobs based on direct labor-hours. Its predetermined overhead rate was based on a cost formula that estimated $388,800 of manufacturing overhead for an estimated allocation base of 810 direct labor-hours. The following transactions occurred during the year: a. Raw materials purchased on account, $295,000. b. Raw materials used in production (all direct materials), $280,000. c. Utility bills incurred on account, $78,000 (95\% related to factory operations, and the remainder related to selling and administrative activities). d. Accrued salary and wage costs: e. Maintenance costs incurred on account in the factory, $73,000 f. Advertising costs incurred on account, $155,000. g. Depreciation recorded for the year, $91,000 ( 80% related to factory equipment, and the remainder related to selling and administrative equipment]. h. Rental cost incurred on account, $105,000 (85\% related to factory facilities, and the remainder related to selling and administrative facilities). 1. Manufacturing overhead cost applied to jobs, \$? j. Cost of goods manufactured, $960,000. k. Sales for the year (all on account) totaled $2,150,000. These goods cost $990,000 according to their job cost sheets. The beginning balances in the inventory accounts were: Froya Fabrikker A/S Schedule of Cost of Goods Manufactured \begin{tabular}{|l|l|} \hline & \\ \hline Direct materials: & \\ \hline Total raw materials available & \\ \hline Direct materials used in production & \\ \hline Total manufacturing costs added to production \\ \hline Cost of goods manufactured \\ \hline \end{tabular} Record the entry to close any balance in the manufacturing overhead account to cost of goods sold. Note: Enter debits before credits. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Depreciation Expense } \\ \hline Beginning Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Rent Expense \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|c|}{ Credit } \\ \hline Beoining Balance & & & \\ \hline & & & \\ \hline & & & \\ \hline Ending Balance & & & \\ \hline \end{tabular} Froya Fabrikker A/S Schedule of Cost of Goods Sold