Answered step by step

Verified Expert Solution

Question

1 Approved Answer

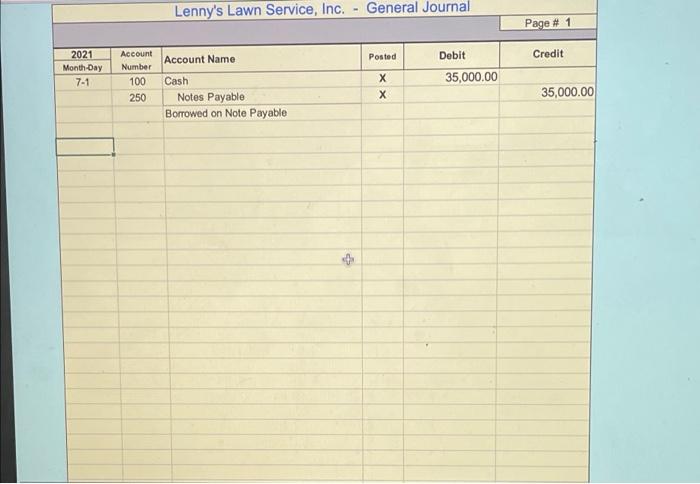

Need help filling out the Journals July 2021 Transactions July 1 UDUD Date Description of the Transaction Borrow $35,000.00 from 1st Bank by signing a

Need help filling out the Journals

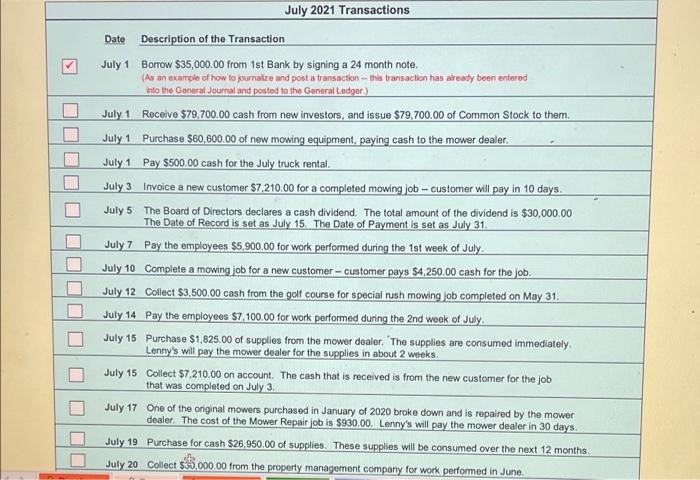

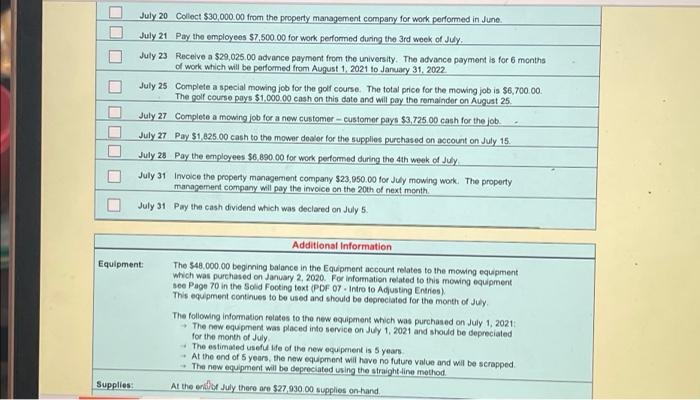

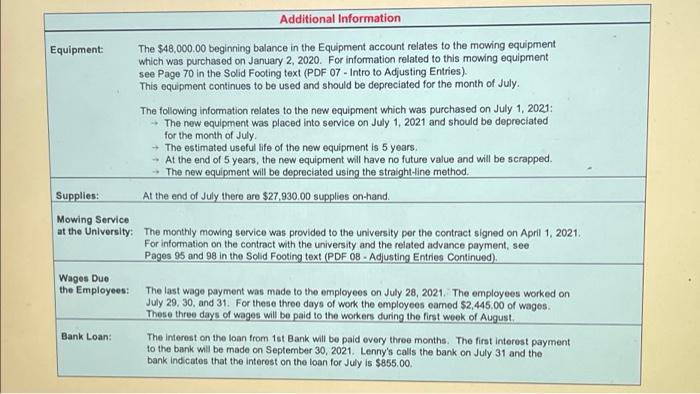

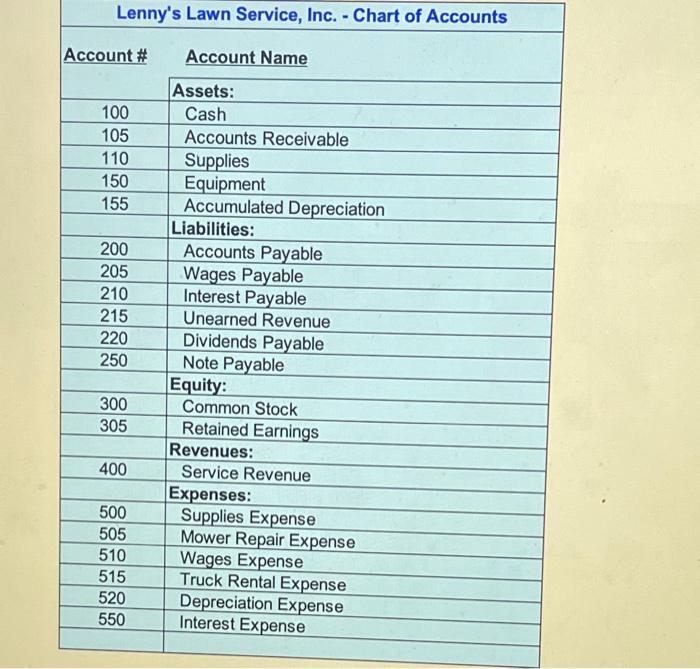

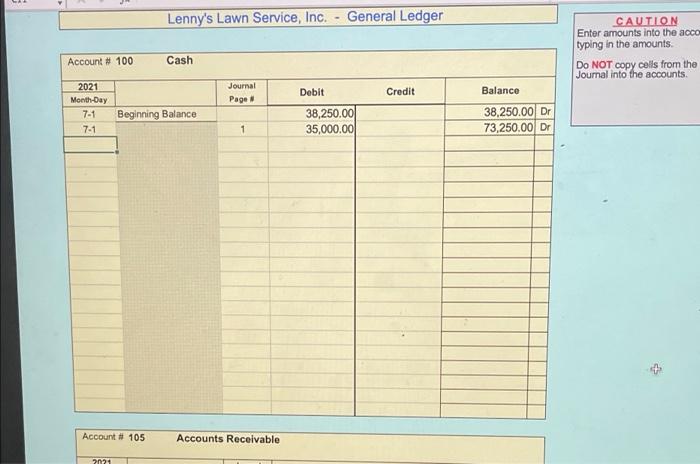

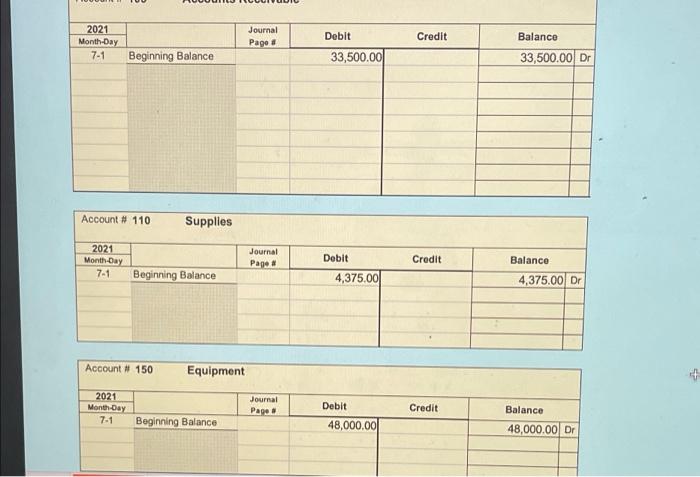

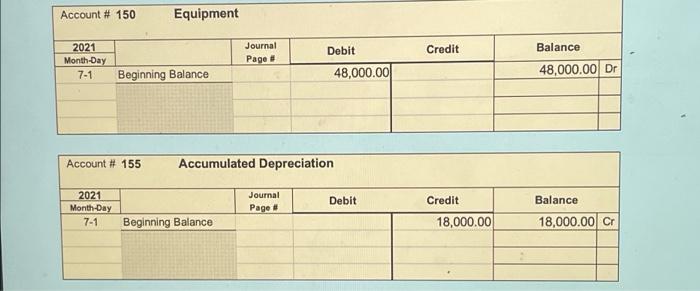

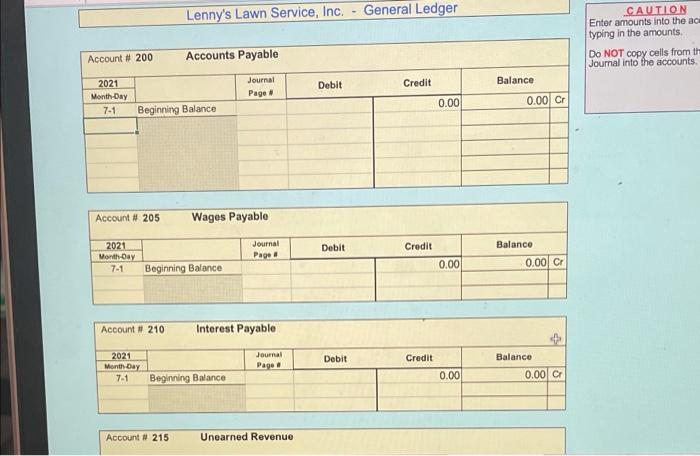

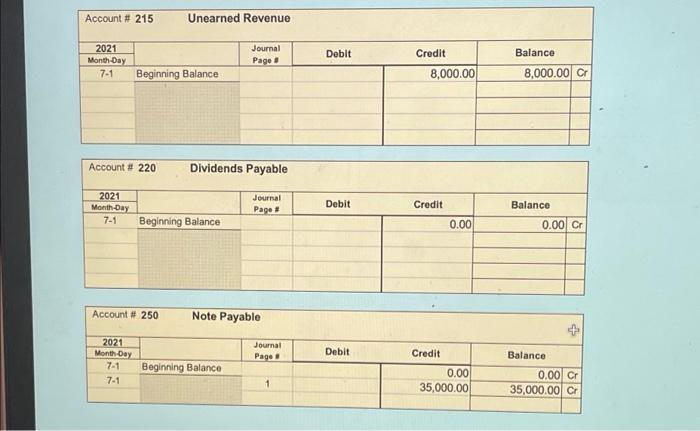

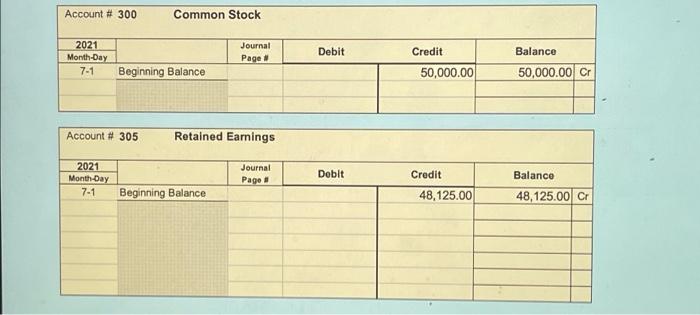

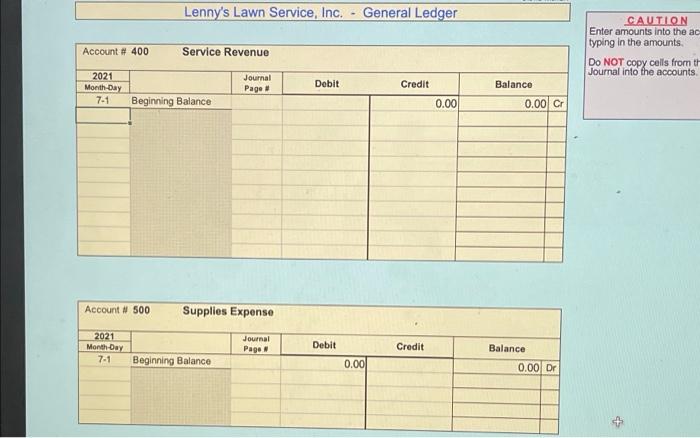

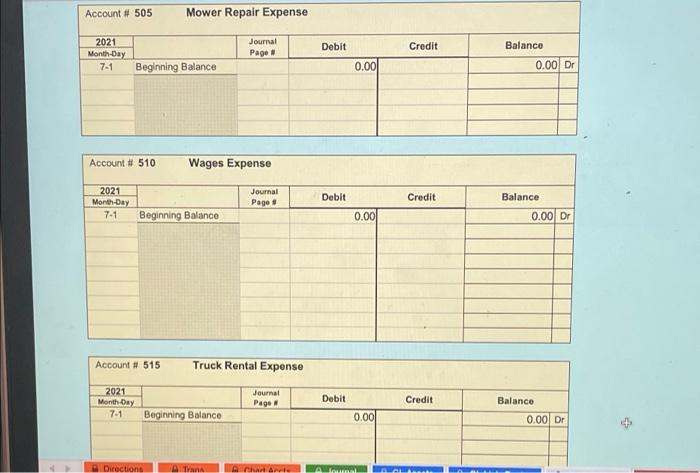

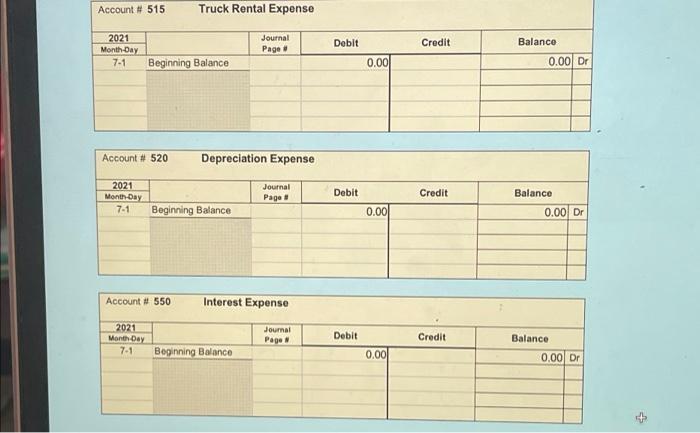

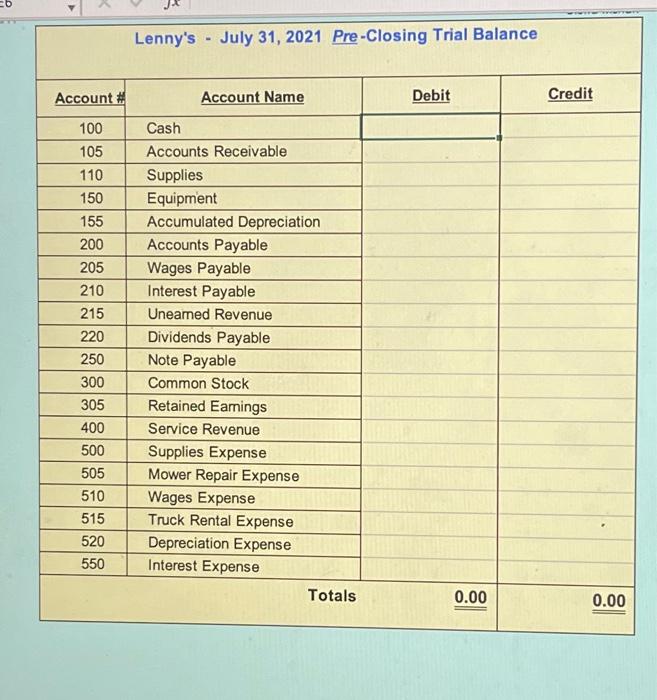

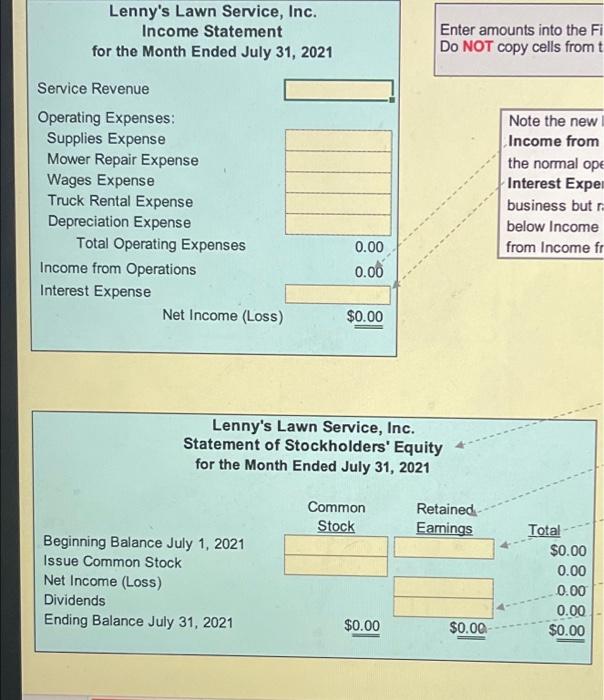

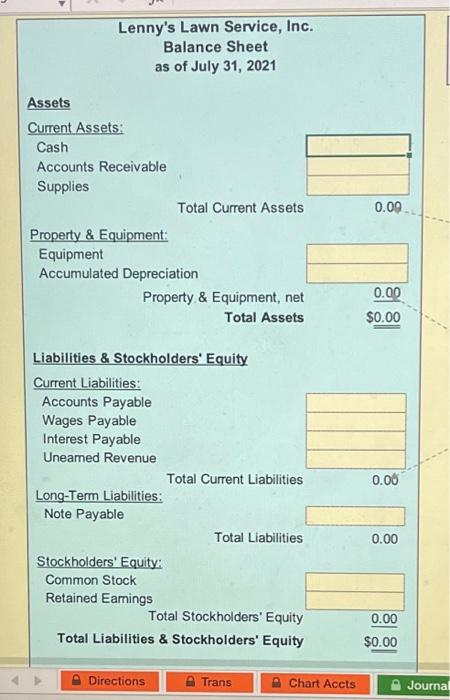

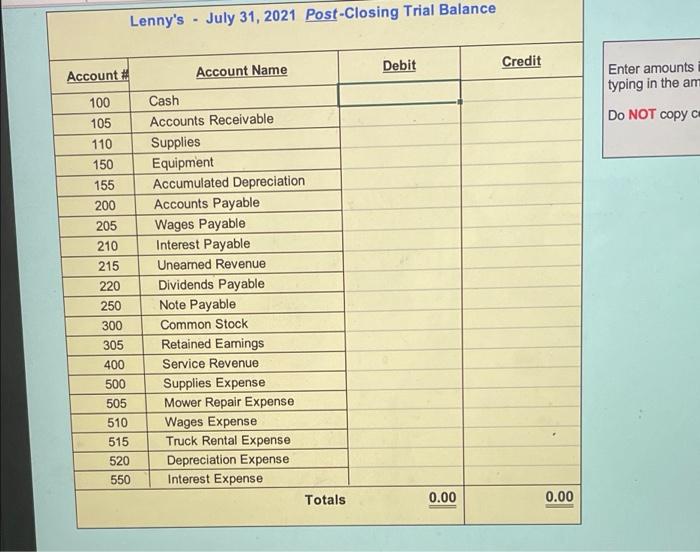

July 2021 Transactions July 1 UDUD Date Description of the Transaction Borrow $35,000.00 from 1st Bank by signing a 24 month note. (As an example of how to journaize and post a transaction--the transaction has already been entered into the General Journal and posted to the General Ledger) July 1 Receive $79,700.00 cash from new investors, and issue $79,700.00 of Common Stock to them July 1 Purchase $60,600.00 of new mowing equipment, paying cash to the mower dealer. July 1 Pay $500.00 cash for the July truck rental. July 3 Invoice a new customer $7,210.00 for a completed mowing job - customer will pay in 10 days. July 5 The Board of Directors declares a cash dividend. The total amount of the dividend is $30,000.00 The Date of Record is set as July 15. The Date of Payment is set as July 31 July 7 Pay the employees $5,900.00 for work performed during the 1st week of July. July 10 Complete a mowing job for a new customer customer pays $4,250.00 cash for the job. July 12 Collect $3,500.00 cash from the golf course for special rush mowing job completed on May 31, July 14 Pay the employees $7,100.00 for work performed during the 2nd week of July. July 15 Purchase $1,825.00 of supplies from the mower dealer. The supplies are consumed immediately Lenny's will pay the mower dealer for the supplies in about 2 weeks. July 15 Collect $7,210.00 on account. The cash that is received is from the new customer for the job that was completed on July 3. July 17 One of the original mowers purchased in January of 2020 broke down and is repaired by the mower dealer. The cost of the Mower Repair job is $930.00, Lenny's will pay the mower dealer in 30 days July 19 Purchase for cash $26.950.00 of supplies. These supplies will be consumed over the next 12 months July 20 Collect $335,000.00 from the property management company for work performed in June. . LU OOO O July 20 Collect $30,000.00 from the property management company for work performed in June. July 21 Pay the employees $7,500.00 for work performed during the 3rd woek of Juy, July 23 Receive a $29,025.00 advance payment from the university. The advance payment is for 6 months of work which will be performed from August 1, 2021 10 January 31, 2022 July 25 Complete a special mowing job for the golf course. The total price for the mowing job is $6,700.00 The golf course pays $1,000.00 cash on this date and will pay the remainder on August 25 July 27 Complete a mowing job for a new customer Customer pays $3,725.00 cash for the job July 27 pay $1,825.00 cash to the mower dealer for the supplies purchased on account on July 15. July 28 Pay the employees $6,890.00 for work performed during the 4th week of July July 31 Invoice the property management company $23,050.00 for July mowing work. The property management company will pay the invoice on the 20th of next month July 31 Pay the cash dividend which was declared on July 5. Additional Information Equipment The 548.000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For information related to this mowing equipment see Page 70 in the Solid Footing text (PDF 07 - Intro to Adjusting Entro) This equipment continues to be used and should be depreciated for the month of July The following information relates to the new equipment which was purchased on July 1, 2021 The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July The estimated useful le of the new equipment is 5 years - At the end of 5 years, the new equipment will have no future value and will be scrapped The new equipment will be depreciated using the straight-line method At the end of July there are $27.930,00 supplies on hand. Supplies Additional Information Equipment: The $48,000.00 beginning balance in the Equipment account relates to the mowing equipment which was purchased on January 2, 2020. For Information related to this mowing equipment see Page 70 in the Solid Footing text (PDF 07 - Intro to Adjusting Entries). This equipment continues to be used and should be depreciated for the month of July. The following information relates to the new equipment which was purchased on July 1, 2021: The new equipment was placed into service on July 1, 2021 and should be depreciated for the month of July The estimated useful life of the new equipment is 5 years. At the end of 5 years, the new equipment will have no future value and will be scrapped. The new equipment will be depreciated using the straight-line method. Supplies: At the end of July there are $27,930.00 supplies on-hand. Mowing Service at the University: The monthly mowing service was provided to the university per the contract signed on April 1, 2021, For information on the contract with the university and the related advance payment, see Pages 95 and 98 in the Solid Footing text (PDF 08 - Adjusting Entries Continued) Wages Duo the Employees: The last wage payment was made to the employees on July 28, 2021. The employees worked on July 29, 30, and 31. For these three days of work the employees camod 2,445.00 of wagos. These three days of wages will be paid to the workers during the first week of August Bank Loan: The Interest on the loan from 1st Bank will be paid every three months. The first interest payment to the bank will be made on September 30, 2021. Lenny's calls the bank on July 31 and the bank Indicates that the interest on the loan for July is $855.00 Lenny's Lawn Service, Inc. - Chart of Accounts Account # Account Name 100 105 110 150 155 200 205 210 215 220 250 Assets: Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Liabilities: Accounts Payable Wages Payable Interest Payable Unearned Revenue Dividends Payable Note Payable Equity: Common Stock Retained Earnings Revenues: Service Revenue Expenses: Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense 300 305 400 500 505 510 515 520 550 Lenny's Lawn Service, Inc. General Journal Page # 1 Posted Debit Credit 2021 Month-Day 7-1 Account Number 100 250 Account Name Cash Notes Payable Borrowed on Note Payable 35,000.00 35,000.00 Lenny's Lawn Service, Inc. - General Ledger CAUTION Enter amounts into the acco typing in the amounts Do NOT copy cells from the Journal into the accounts Account # 100 Cash Journal Page Debit Credit Balance 2021 Month-Day 7.1 7-1 Beginning Balance 38,250.00 35,000.00 38,250.00 Dr 73,250.00 DI 1 Account # 105 Accounts Receivable 2024 Journal Page 1 Credit 2021 Month-Day 7-1 Beginning Balance Balance Debit 33,500.00 33,500.00 Dr Account # 110 Supplies 2021 Month-Day 741 Journal Page Credit Beginning Balance Debit 4,375.00 Balance 4,375.00 Dr Account # 150 Equipment 2021 Month-Day 7-1 Journal Page Debit Credit Beginning Balance 48,000.00 Balance 48,000.00 Dr Account # 150 Equipment Journal Page 1 Debit 2021 Month-Day 7-1 Credit Balance 48,000.00) Dr Beginning Balance 48,000.00 Account # 155 Accumulated Depreciation 2021 Month-Day 7-1 Journal Page # Debit Credit 18,000.00 Balance 18,000.00 CM Beginning Balance Lenny's Lawn Service, Inc. - General Ledger CAUTION Enter amounts into the ac typing in the amounts Do NOT copy cells from th Journal into the accounts Account # 200 Accounts Payable Debit Journal Page Credit Balance 2021 Month-Day 7-1 0.001 0.00 CP Beginning Balance Account # 205 Wages Payable Journal Page 1 Debit 2021 Month-Day 7-1 Credit Balance 0.00 Cr 0.00 Beginning Balance Account # 210 Interest Payable Journal Page Debit 2021 Month Day 7-1 Credit Balance 0.00 CE Beginning Balance 0.00 Account # 215 Unearned Revenue Account # 215 Unearned Revenue Journal Page Debit 2021 Month-Day 7-1 Credit Balance 8,000.00 C Beginning Balance 8,000.00 Account # 220 Dividends Payable Journal Page 1 Debit 2021 Month-Day 7-1 Beginning Balance Credit Balance 0.00 0.00 CE Account # 250 Note Payable Journal Page 1 Debit 2021 Month Day 7-1 7-1 Credit Beginning Balance 0.00 35,000.00 Balance 0.00 C 35,000.00 C 1 Account # 300 Common Stock Journal Debit Balance 2021 Month-Day 7-1 Page# Credit 50,000.00 Beginning Balance 50,000.00 Cr Account # 305 Retained Earnings 2021 Month-Day 7-1 Journal Page 1 Debit Credit Balanco Beginning Balance 48,125.00 48,125.00 Cr Lenny's Lawn Service, Inc. - General Ledger CAUTION Enter amounts into the ac typing in the amounts Do NOT copy cells from th Journal into the accounts Account # 400 Service Revenue 2021 Month-Day Journal Page Debit Credit Balance 7-1 Beginning Balance 0.00 0.00 Cr Account 500 Supplies Expense 2021 Month Day 7-1 Journal Page : Debit Credit Beginning Balance 0.00 Balance 0.00 Dr Account # 505 Mower Repair Expense Journal Page 1 Debit Credit 2021 Month-Day 7-1 Balance Beginning Balance 0.00 0.00 Dr Account # 510 Wages Expense 2021 Month-Day 7-1 Journal Page Debit Credit Balance Beginning Balance 0.00 0.00 Dr Account # 515 Truck Rental Expense 2021 Month Day 721 Journal Page 1 Debit Credit Beginning Balance Balance 0.00 Dr 0.001 Directions DT A Arte Account # 515 Truck Rental Expense Journal Debit Credit Balance 2021 Month-Day 7-1 Page Beginning Balance 0.00 0.00 Dr Account # 520 Depreciation Expense 2021 Month-Day 7-1 Journal Page 1 Debit Credit Balance 0.00 Dr Beginning Balance 0.00 Account # 550 Interest Expense 2021 Month Day 7-1 Journal Page 1 Debit Credit Balance Beginning Balance 0.001 0.00 Dr Lenny's - July 31, 2021 Pre-Closing Trial Balance Account # Account Name Debit Credit 100 105 110 150 155 200 205 210 215 220 250 Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Uneamed Revenue Dividends Payable Note Payable Common Stock Retained Earings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense Totals 300 305 400 500 505 510 515 520 550 0.00 0.00 Lenny's Lawn Service, Inc. Income Statement for the Month Ended July 31, 2021 Enter amounts into the Fi Do NOT copy cells from t Service Revenue Operating Expenses: Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Total Operating Expenses Income from Operations Interest Expense Net Income (Loss) Note the new Income from the normal ope Interest Expe business but below Income from Income fr 0.00 0.00 $0.00 Lenny's Lawn Service, Inc. Statement of Stockholders' Equity for the Month Ended July 31, 2021 Common Stock Retained Earnings Beginning Balance July 1, 2021 Issue Common Stock Net Income (Loss) Dividends Ending Balance July 31, 2021 Total $0.00 0.00 0.00 0.00 $0.00 $0.00 $0.00 Lenny's Lawn Service, Inc. Balance Sheet as of July 31, 2021 Assets Current Assets: Cash Accounts Receivable Supplies Total Current Assets Property & Equipment: Equipment Accumulated Depreciation Property & Equipment, net Total Assets 0.09 0.00 $0.00 0.00 Liabilities & Stockholders' Equity Current Liabilities: Accounts Payable Wages Payable Interest Payable Uneamed Revenue Total Current Liabilities Long-Term Liabilities: Note Payable Total Liabilities Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' Equity 0.00 0.00 $0.00 Directions Trans Chart Accts Journal Lenny's - July 31, 2021 Post-Closing Trial Balance Debit Credit Account # Account Name Enter amounts typing in the am Do NOT copy ce 100 105 110 150 155 200 205 210 215 220 250 300 305 400 500 505 510 515 520 550 Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Wages Payable Interest Payable Uneamed Revenue Dividends Payable Note Payable Common Stock Retained Eamings Service Revenue Supplies Expense Mower Repair Expense Wages Expense Truck Rental Expense Depreciation Expense Interest Expense Totals 0.00 0.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started