Need help filling the forms

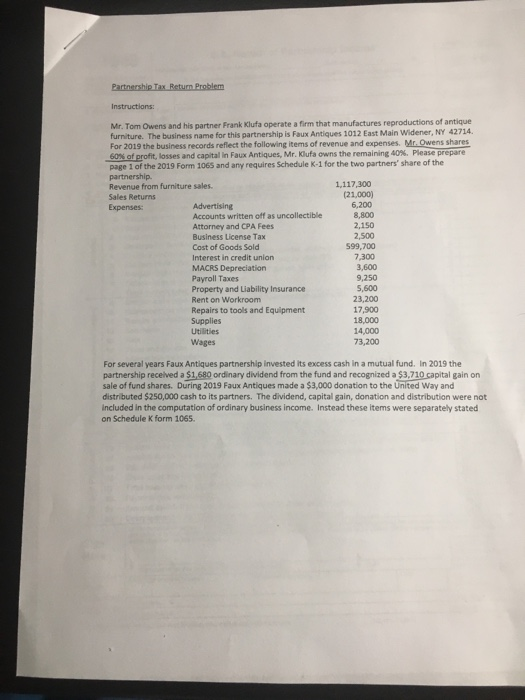

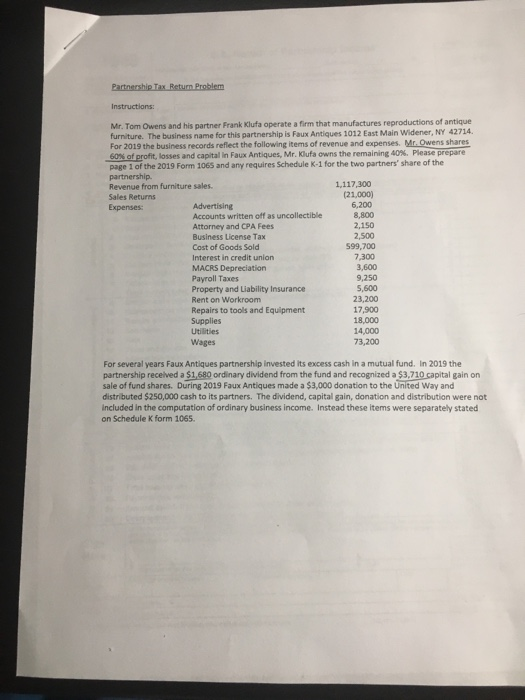

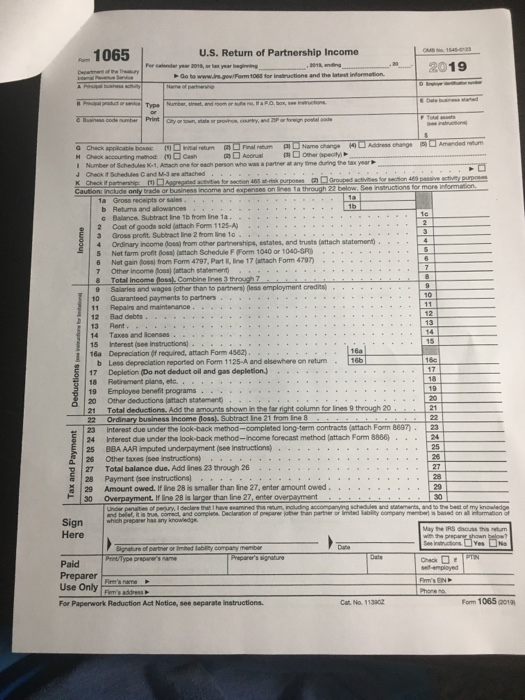

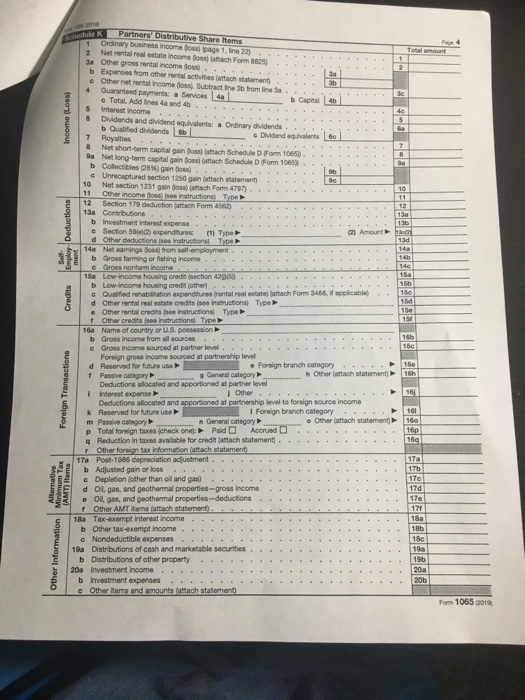

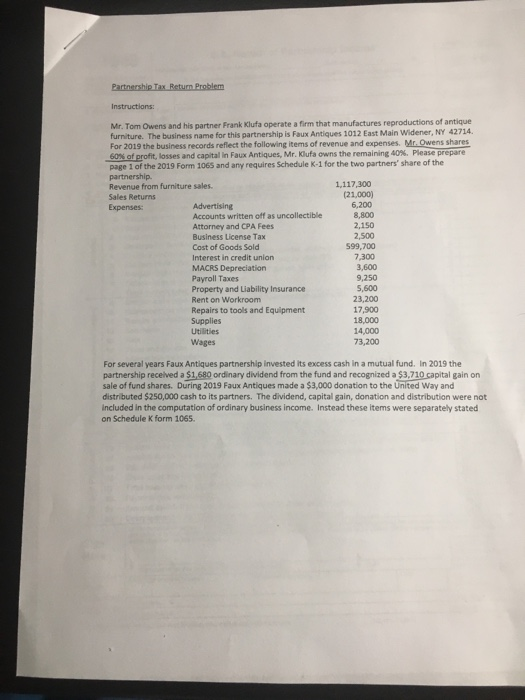

Partnership Tax Return Problem Instructions Mr. Tom Owens and his partner Frank Klufa operate a firm that manufactures reproductions of antique furniture. The business name for this partnership is Faux Antiques 1012 East Main Widener, NY 42714 For 2019 the business records reflect the following items of revenue and expenses. Mr. Owens shares 60% of profit, losses and capital in Faux Antiques, Mr. Klufa owns the remaining 40%. Please prepare page 1 of the 2019 Form 1065 and any requires Schedule K-1 for the two partners' share of the partnership Revenue from furniture sales. 1,117,300 Sales Returns (21,000) Expenses: Advertising 6,200 Accounts written off as uncollectible 8,800 Attorney and CPA Fees 2,150 Business License Tax 2.500 Cost of Goods Sold 599,700 Interest in credit union 7,300 MACRS Depreciation 3,600 Payroll Taxes 9,250 Property and Liability Insurance 5,600 Rent on Workroom 23,200 Repairs to tools and Equipment 17,900 Supplies 18,000 Utilities 14,000 Wages 73,200 For several years Faux Antiques partnership invested its excess cash in a mutual fund. In 2019 the partnership received a $1,680 ordinary dividend from the fund and recognized a $3,710 capital gain on sale of fund shares. During 2019 Faux Antiques made a $3,000 donation to the United Way and distributed $250,000 cash to its partners. The dividend, capital gain, donation and distribution were not Included in the computation of ordinary business income. Instead these items were separately stated on Schedule K form 1065. OM OS 1065 For U.S. Return of Partnership Income Ferdryer, year being Go to www.is.gov/Form 1065 forintions and the latest information Name or part 2019 B Procedure Type Number om or whose Business code bar Print Cyr sur, tata or pronon, CO and Perforeign postal de FT Income Check applicables Drum Palau Name change Address change Amended retum Check accounting method cash DA Other specity | Number of Schedules K-1. Anach one for each person who was a partner any time during the year Jokisches and we attached K Check pom pregledati forsetion purposes Grouped activities for action 480 picture Caution include only trade or business Income and expenses online ta through 22 below. See Instructions for more information 1a Gross receipts or sales. ta b Returns and allowances 1b Balance Subtract line 1b from Ineta 1c Cost of goods sold attach Form 1125-A) 2 Gross profit. Subtract line 2 from line to Ordinary income oss from other partnerships, estates, and trusts (attach statement 5 Netfarm profit oss utach Schedule Form 1040 or 1040-8FO 5 Net gain from Form 4797, Part I line 17 latach Form 4797 6 7 Other Income Rottach statement 7 8 Total income fossl. Combine lines through 7 8 9 Salaries and wages other than to partner des employment credits 9 10 Guaranteed payments to partners 10 11 Repairs and maintenance 11 12 Bad debts. 12 13 Rent 13 14 Taxes and licenses. 14 15 Interest (see instructions 15 16a Depreciation of required, attach Form 4562). 160 b Less depreciation reported on Form 1125-A and elsewhere on rotum 165 17 Depletion (Do not deduct oil and gas depletion. 17 Retirement plans, etc.. 18 19 Employee benefit programs. 19 20 Other deductions ach statement 21 Total deductions. Add the amounts shown in the right column for lines 9 through 20 21 22 Ordinary business Income (loss). Subtract Ino 21 from line 8 22 23 Interest due under the look back method-completed long-term contracts (attach Form 8697) 23 24 Interest due under the look back method-income forecast metho (attach 8866) 25 BBA AAR imputed underpayment (see instructions) 25 26 Other taxes (see Instructions) 28 27 Total balance due. Add lines 23 through 26 27 28 Payment (see instructions). 28 29 Amount owed. If line 28 is smaller than line 27, enter amount owed. 29 30 Overpayment. If line 28 is larger than line 27, enter overpayment Under penalties of perjury declare that I have examined his retum, nuding accompanying schedule and statements, and to the besed my knowledge and boilet, it is correct and completa. Declaration of prepare other than partner or limited ability company members based on a min Sign which preparar hasany knowledge Here May the IRS drum w the prepare shown below? Signature of the orimited liability company member Son Yes No Pentlype preparar's name Preparer's signature Check PN sel-employed Preparer FEND Los For Paperwork Reduction Act Notice, se separate instructions Cat No. 113802 Form 1065 2010 Deductions were Tax and Payment Pald Use Only Post hedule 3h Income (LOSS) eductions Employ Credits Partners Distributive Share inoms Ordinary business income to page 1. in 22 Page 4 To mount Net rental real estate income och Form 1805 3 Other gross rental income foss 2 b Expenses from other rental activities ach statement 3a Othernet rental income Subtractineb from in 4 Guaranteed payments a Services Se Total. Add lines and 4a Capital 4b Interest income 46 6 Dividends and dividend equivalents: a Ordinary dividends 5 b Qualified dividends sb ba 7 Royalties c Dividend equivalents te 8 Net short-term capital gain otach Schedule Form 1050 B sa Netlong-term capital gain for attach Schedule D Form 10653 Sa Collectibles (284) gains ob c Unrecaptured section 1250 gain attach statement 90 10 Net section 1231 gain ach Form 4707) 10 11 Other income de instructional Type 11 12 Section 179 deduction attach Form 4502) 12 13a Centrbutions 13a bInvestment interest expense 13b Section 502) axpenditures (1) Type (2) Amount d Other deductions is instructions Type 130 14a Net caringsfoss from soll-employment 14 b Gross farming or fishing income 140 Gross nontam income 14 150 15a Low-income housing credit section 420510 b Low-income housing credit (other) 150 156 Qualified rehabilitation expenditures frontal real estate attach Form 3460, it applicable) 150 d Other rental real estate credits (instructions Type 150 Other rental credits se instructions Type 1 Other credits Instruction Type 154 16a Name of country or U.S. possession 16 b Gross income from all sources Gross income sourced at partner level 166 Foreign gross income sourced at partnership level d Reserved for future se Foreign branch category 160 16h Passive category General category h Other (attach statement Deductions allocated and apportioned at partner level Interest expense Other 16 Deductions allocated and apportioned at partnership level to foreign source income k Reserved for future use I Foreign branch category 161 m Passive category 160 General category Other (attach statement P Total foreign taxes (check one: Paid Accrued 16p Reduction in taxes available for credit (attach statement) 169 Other foreign tax information attach statement 17a 17a Post-1986 depreciation adjustment. 17b b Adjusted gain or loss 170 o Depletion (other than oil and gas) d Olgas, and geothermal properties-gross income 170 e Oilgas, and geothermal properties -deductions 17e | Other AMT items attach statement 171 18a 18a Tax-exempt interest income 18b b Other tax-exempt income. 18c c Nordeductible expenses 19a Distributions of cash and marketable securities 19a b Distributions of other property 19b 20a Investment Income 20a b Investment expenses 20b Other items and amounts (attach statement Form 1065 2010 1 Foreign Transactions Alternative Minimum Tax (AMT) Items Other Information Partnership Tax Return Problem Instructions Mr. Tom Owens and his partner Frank Klufa operate a firm that manufactures reproductions of antique furniture. The business name for this partnership is Faux Antiques 1012 East Main Widener, NY 42714 For 2019 the business records reflect the following items of revenue and expenses. Mr. Owens shares 60% of profit, losses and capital in Faux Antiques, Mr. Klufa owns the remaining 40%. Please prepare page 1 of the 2019 Form 1065 and any requires Schedule K-1 for the two partners' share of the partnership Revenue from furniture sales. 1,117,300 Sales Returns (21,000) Expenses: Advertising 6,200 Accounts written off as uncollectible 8,800 Attorney and CPA Fees 2,150 Business License Tax 2.500 Cost of Goods Sold 599,700 Interest in credit union 7,300 MACRS Depreciation 3,600 Payroll Taxes 9,250 Property and Liability Insurance 5,600 Rent on Workroom 23,200 Repairs to tools and Equipment 17,900 Supplies 18,000 Utilities 14,000 Wages 73,200 For several years Faux Antiques partnership invested its excess cash in a mutual fund. In 2019 the partnership received a $1,680 ordinary dividend from the fund and recognized a $3,710 capital gain on sale of fund shares. During 2019 Faux Antiques made a $3,000 donation to the United Way and distributed $250,000 cash to its partners. The dividend, capital gain, donation and distribution were not Included in the computation of ordinary business income. Instead these items were separately stated on Schedule K form 1065. OM OS 1065 For U.S. Return of Partnership Income Ferdryer, year being Go to www.is.gov/Form 1065 forintions and the latest information Name or part 2019 B Procedure Type Number om or whose Business code bar Print Cyr sur, tata or pronon, CO and Perforeign postal de FT Income Check applicables Drum Palau Name change Address change Amended retum Check accounting method cash DA Other specity | Number of Schedules K-1. Anach one for each person who was a partner any time during the year Jokisches and we attached K Check pom pregledati forsetion purposes Grouped activities for action 480 picture Caution include only trade or business Income and expenses online ta through 22 below. See Instructions for more information 1a Gross receipts or sales. ta b Returns and allowances 1b Balance Subtract line 1b from Ineta 1c Cost of goods sold attach Form 1125-A) 2 Gross profit. Subtract line 2 from line to Ordinary income oss from other partnerships, estates, and trusts (attach statement 5 Netfarm profit oss utach Schedule Form 1040 or 1040-8FO 5 Net gain from Form 4797, Part I line 17 latach Form 4797 6 7 Other Income Rottach statement 7 8 Total income fossl. Combine lines through 7 8 9 Salaries and wages other than to partner des employment credits 9 10 Guaranteed payments to partners 10 11 Repairs and maintenance 11 12 Bad debts. 12 13 Rent 13 14 Taxes and licenses. 14 15 Interest (see instructions 15 16a Depreciation of required, attach Form 4562). 160 b Less depreciation reported on Form 1125-A and elsewhere on rotum 165 17 Depletion (Do not deduct oil and gas depletion. 17 Retirement plans, etc.. 18 19 Employee benefit programs. 19 20 Other deductions ach statement 21 Total deductions. Add the amounts shown in the right column for lines 9 through 20 21 22 Ordinary business Income (loss). Subtract Ino 21 from line 8 22 23 Interest due under the look back method-completed long-term contracts (attach Form 8697) 23 24 Interest due under the look back method-income forecast metho (attach 8866) 25 BBA AAR imputed underpayment (see instructions) 25 26 Other taxes (see Instructions) 28 27 Total balance due. Add lines 23 through 26 27 28 Payment (see instructions). 28 29 Amount owed. If line 28 is smaller than line 27, enter amount owed. 29 30 Overpayment. If line 28 is larger than line 27, enter overpayment Under penalties of perjury declare that I have examined his retum, nuding accompanying schedule and statements, and to the besed my knowledge and boilet, it is correct and completa. Declaration of prepare other than partner or limited ability company members based on a min Sign which preparar hasany knowledge Here May the IRS drum w the prepare shown below? Signature of the orimited liability company member Son Yes No Pentlype preparar's name Preparer's signature Check PN sel-employed Preparer FEND Los For Paperwork Reduction Act Notice, se separate instructions Cat No. 113802 Form 1065 2010 Deductions were Tax and Payment Pald Use Only Post hedule 3h Income (LOSS) eductions Employ Credits Partners Distributive Share inoms Ordinary business income to page 1. in 22 Page 4 To mount Net rental real estate income och Form 1805 3 Other gross rental income foss 2 b Expenses from other rental activities ach statement 3a Othernet rental income Subtractineb from in 4 Guaranteed payments a Services Se Total. Add lines and 4a Capital 4b Interest income 46 6 Dividends and dividend equivalents: a Ordinary dividends 5 b Qualified dividends sb ba 7 Royalties c Dividend equivalents te 8 Net short-term capital gain otach Schedule Form 1050 B sa Netlong-term capital gain for attach Schedule D Form 10653 Sa Collectibles (284) gains ob c Unrecaptured section 1250 gain attach statement 90 10 Net section 1231 gain ach Form 4707) 10 11 Other income de instructional Type 11 12 Section 179 deduction attach Form 4502) 12 13a Centrbutions 13a bInvestment interest expense 13b Section 502) axpenditures (1) Type (2) Amount d Other deductions is instructions Type 130 14a Net caringsfoss from soll-employment 14 b Gross farming or fishing income 140 Gross nontam income 14 150 15a Low-income housing credit section 420510 b Low-income housing credit (other) 150 156 Qualified rehabilitation expenditures frontal real estate attach Form 3460, it applicable) 150 d Other rental real estate credits (instructions Type 150 Other rental credits se instructions Type 1 Other credits Instruction Type 154 16a Name of country or U.S. possession 16 b Gross income from all sources Gross income sourced at partner level 166 Foreign gross income sourced at partnership level d Reserved for future se Foreign branch category 160 16h Passive category General category h Other (attach statement Deductions allocated and apportioned at partner level Interest expense Other 16 Deductions allocated and apportioned at partnership level to foreign source income k Reserved for future use I Foreign branch category 161 m Passive category 160 General category Other (attach statement P Total foreign taxes (check one: Paid Accrued 16p Reduction in taxes available for credit (attach statement) 169 Other foreign tax information attach statement 17a 17a Post-1986 depreciation adjustment. 17b b Adjusted gain or loss 170 o Depletion (other than oil and gas) d Olgas, and geothermal properties-gross income 170 e Oilgas, and geothermal properties -deductions 17e | Other AMT items attach statement 171 18a 18a Tax-exempt interest income 18b b Other tax-exempt income. 18c c Nordeductible expenses 19a Distributions of cash and marketable securities 19a b Distributions of other property 19b 20a Investment Income 20a b Investment expenses 20b Other items and amounts (attach statement Form 1065 2010 1 Foreign Transactions Alternative Minimum Tax (AMT) Items Other Information