need help final 2

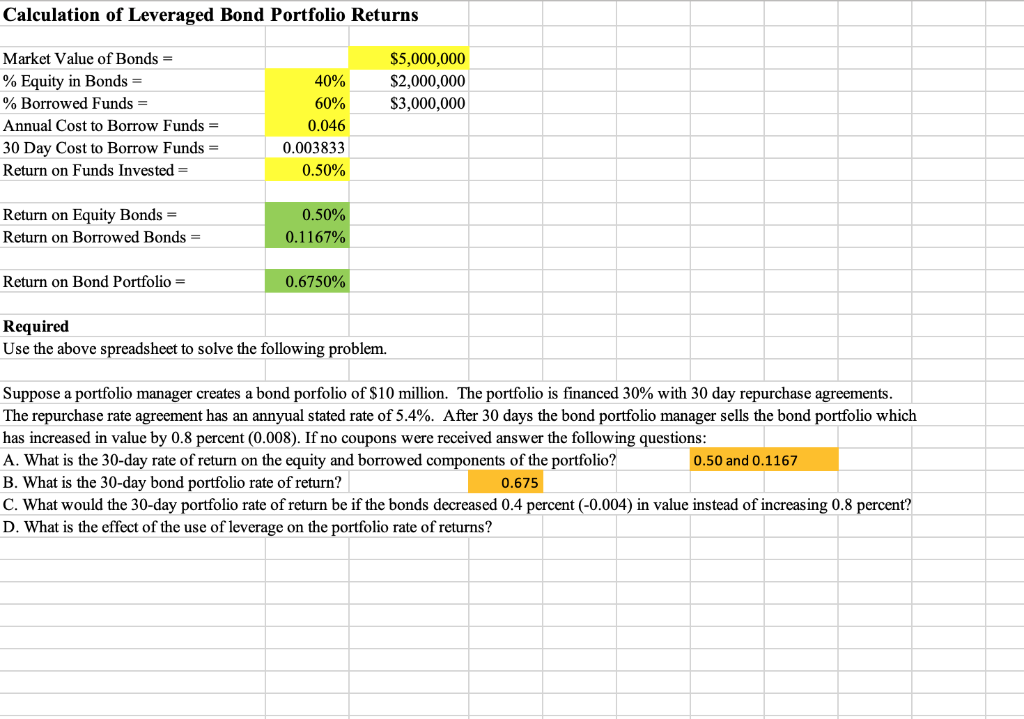

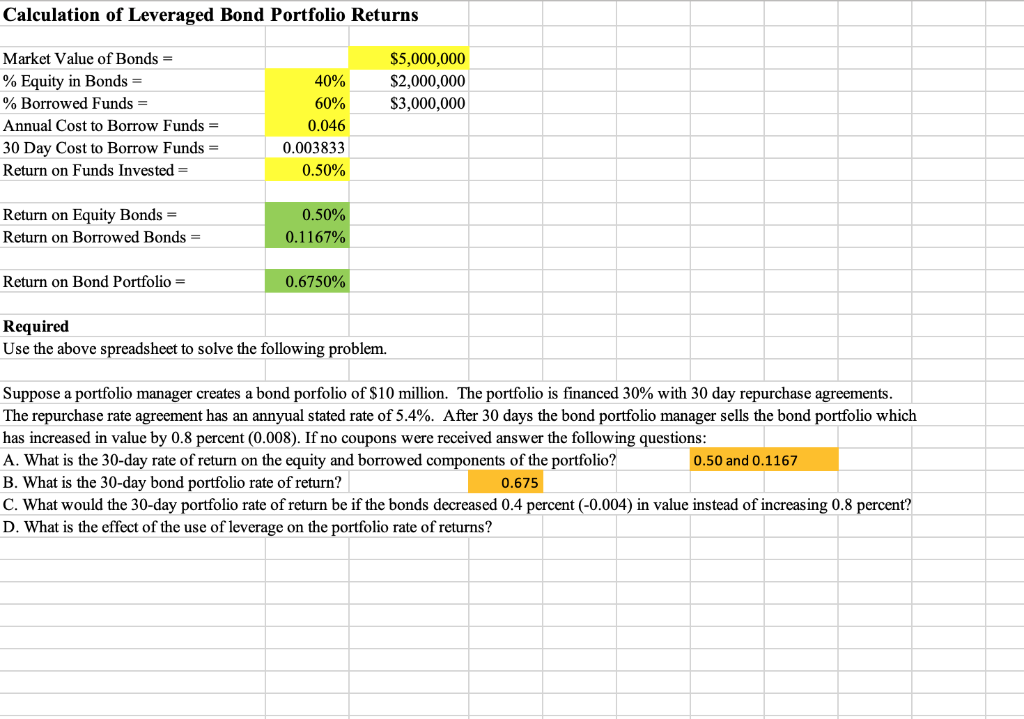

Calculation of Leveraged Bond Portfolio Returns Market Value of Bonds = % Equity in Bonds % Borrowed Funds = Annual Cost to Borrow Funds = 30 Day Cost to Borrow Funds = Return on Funds Invested = $5,000,000 $2,000,000 $3,000,000 40% 60% 0.046 0.003833 0.50% Return on Equity Bonds = Return on Borrowed Bonds = 0.50% 0.1167% Return on Bond Portfolio = 0.6750% Required Use the above spreadsheet to solve the following problem. Suppose a portfolio manager creates a bond porfolio of $10 million. The portfolio is financed 30% with 30 day repurchase agreements. The repurchase rate agreement has an annyual stated rate of 5.4%. After 30 days the bond portfolio manager sells the bond portfolio which has increased in value by 0.8 percent (0.008). If no coupons were received answer the following questions: A. What is the 30-day rate of return on the equity and borrowed components of the portfolio? 0.50 and 0.1167 B. What is the 30-day bond portfolio rate of return? 0.675 C. What would the 30-day portfolio rate of return be if the bonds decreased 0.4 percent (-0.004) in value instead of increasing 0.8 percent? D. What is the effect of the use of leverage on the portfolio rate of returns? Calculation of Leveraged Bond Portfolio Returns Market Value of Bonds = % Equity in Bonds % Borrowed Funds = Annual Cost to Borrow Funds = 30 Day Cost to Borrow Funds = Return on Funds Invested = $5,000,000 $2,000,000 $3,000,000 40% 60% 0.046 0.003833 0.50% Return on Equity Bonds = Return on Borrowed Bonds = 0.50% 0.1167% Return on Bond Portfolio = 0.6750% Required Use the above spreadsheet to solve the following problem. Suppose a portfolio manager creates a bond porfolio of $10 million. The portfolio is financed 30% with 30 day repurchase agreements. The repurchase rate agreement has an annyual stated rate of 5.4%. After 30 days the bond portfolio manager sells the bond portfolio which has increased in value by 0.8 percent (0.008). If no coupons were received answer the following questions: A. What is the 30-day rate of return on the equity and borrowed components of the portfolio? 0.50 and 0.1167 B. What is the 30-day bond portfolio rate of return? 0.675 C. What would the 30-day portfolio rate of return be if the bonds decreased 0.4 percent (-0.004) in value instead of increasing 0.8 percent? D. What is the effect of the use of leverage on the portfolio rate of returns