Need help finding the expected return, standard deviation and covariances for a 4 factor model.

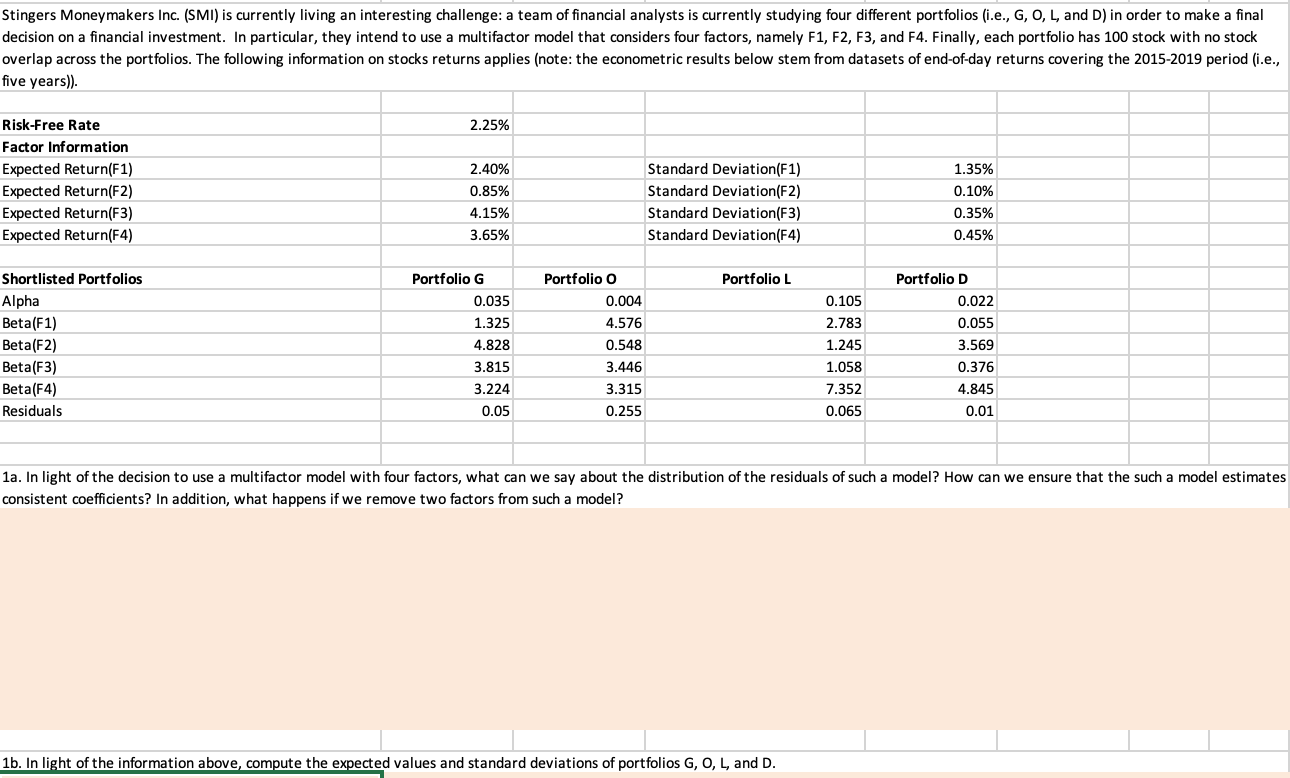

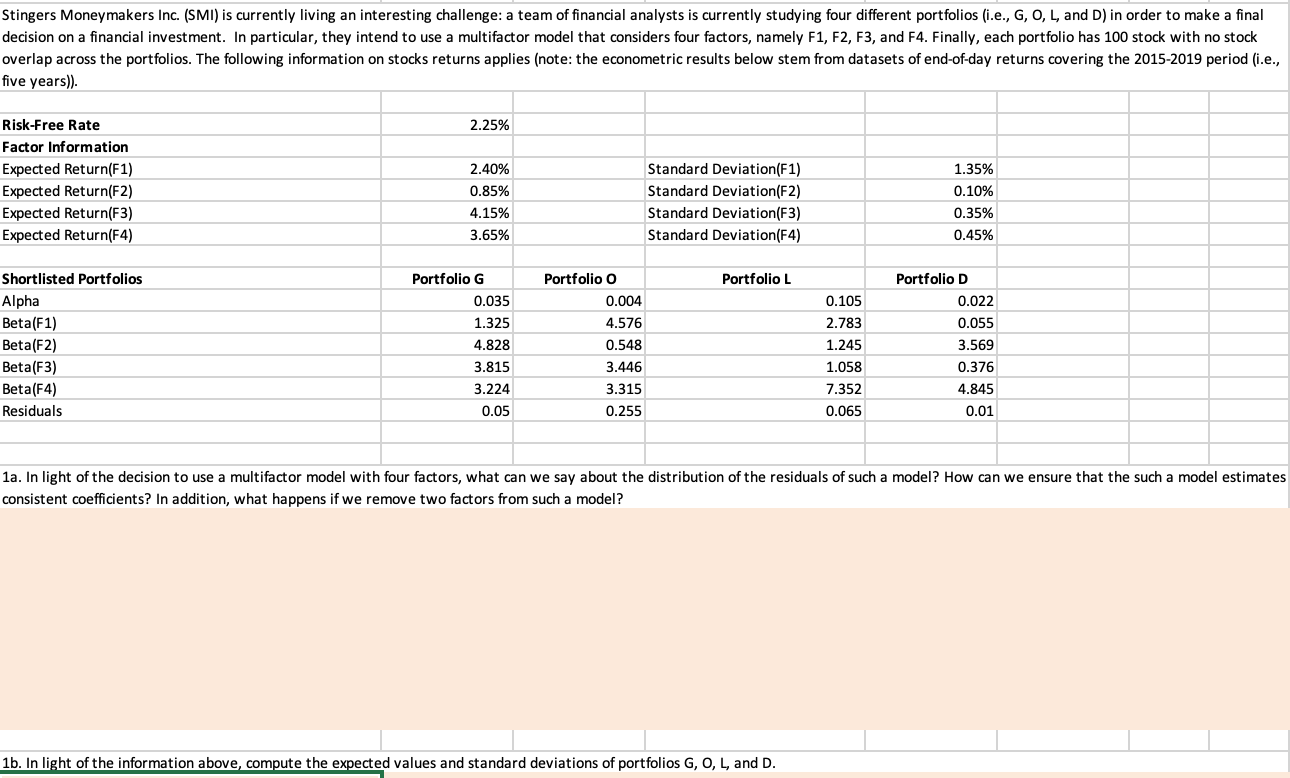

Stingers Moneymakers Inc. (SMI) is currently living an interesting challenge: a team of financial analysts is currently studying four different portfolios (i.e., G, O, L, and D) in order to make a final decision on a financial investment. In particular, they intend to use a multifactor model that considers four factors, namely F1, F2, F3, and F4. Finally, each portfolio has 100 stock with no stock overlap across the portfolios. The following information on stocks returns applies (note: the econometric results below stem from datasets of end-of-day returns covering the 2015-2019 period (i.e., five years). 2.25% Risk-Free Rate Factor Information Expected Return(F1) Expected Return(F2) Expected Return(F3) Expected Return(F4) 2.40% 0.85% 4.15% 3.65% Standard Deviation(F1) Standard Deviation(F2) Standard Deviation(F3) Standard Deviation(F4) 1.35% 0.10% 0.35% 0.45% Portfolio L Shortlisted Portfolios Alpha Beta(F1) Beta(F2) Beta(F3) Beta(F4) Residuals Portfolio G 0.035 1.325 4.828 3.815 3.224 Portfolio o 0.004 4.576 0.548 3.446 3.315 0.105 2.783 1.245 1.058 7.352 0.065 Portfolio D 0.022 0.055 3.569 0.376 4.845 0.01 0.05 0.255 1a. In light of the decision to use a multifactor model with four factors, what can we say about the distribution of the residuals of such a model? How can we ensure that the such a model estimates consistent coefficients? In addition, what happens if we remove two factors from such a model? 1b. In light of the information above, compute the expected values and standard deviations of portfolios G, O, L, and D. Stingers Moneymakers Inc. (SMI) is currently living an interesting challenge: a team of financial analysts is currently studying four different portfolios (i.e., G, O, L, and D) in order to make a final decision on a financial investment. In particular, they intend to use a multifactor model that considers four factors, namely F1, F2, F3, and F4. Finally, each portfolio has 100 stock with no stock overlap across the portfolios. The following information on stocks returns applies (note: the econometric results below stem from datasets of end-of-day returns covering the 2015-2019 period (i.e., five years). 2.25% Risk-Free Rate Factor Information Expected Return(F1) Expected Return(F2) Expected Return(F3) Expected Return(F4) 2.40% 0.85% 4.15% 3.65% Standard Deviation(F1) Standard Deviation(F2) Standard Deviation(F3) Standard Deviation(F4) 1.35% 0.10% 0.35% 0.45% Portfolio L Shortlisted Portfolios Alpha Beta(F1) Beta(F2) Beta(F3) Beta(F4) Residuals Portfolio G 0.035 1.325 4.828 3.815 3.224 Portfolio o 0.004 4.576 0.548 3.446 3.315 0.105 2.783 1.245 1.058 7.352 0.065 Portfolio D 0.022 0.055 3.569 0.376 4.845 0.01 0.05 0.255 1a. In light of the decision to use a multifactor model with four factors, what can we say about the distribution of the residuals of such a model? How can we ensure that the such a model estimates consistent coefficients? In addition, what happens if we remove two factors from such a model? 1b. In light of the information above, compute the expected values and standard deviations of portfolios G, O, L, and D