Need help finishing consolidating this... show work please

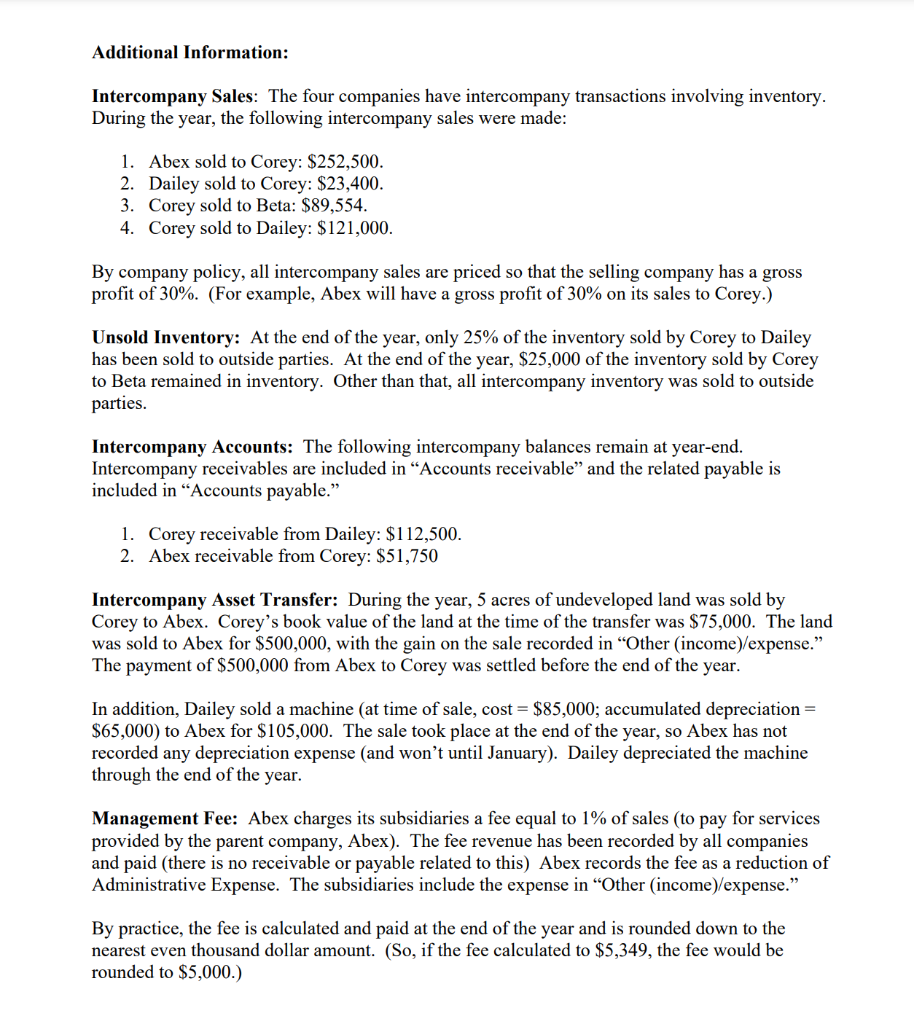

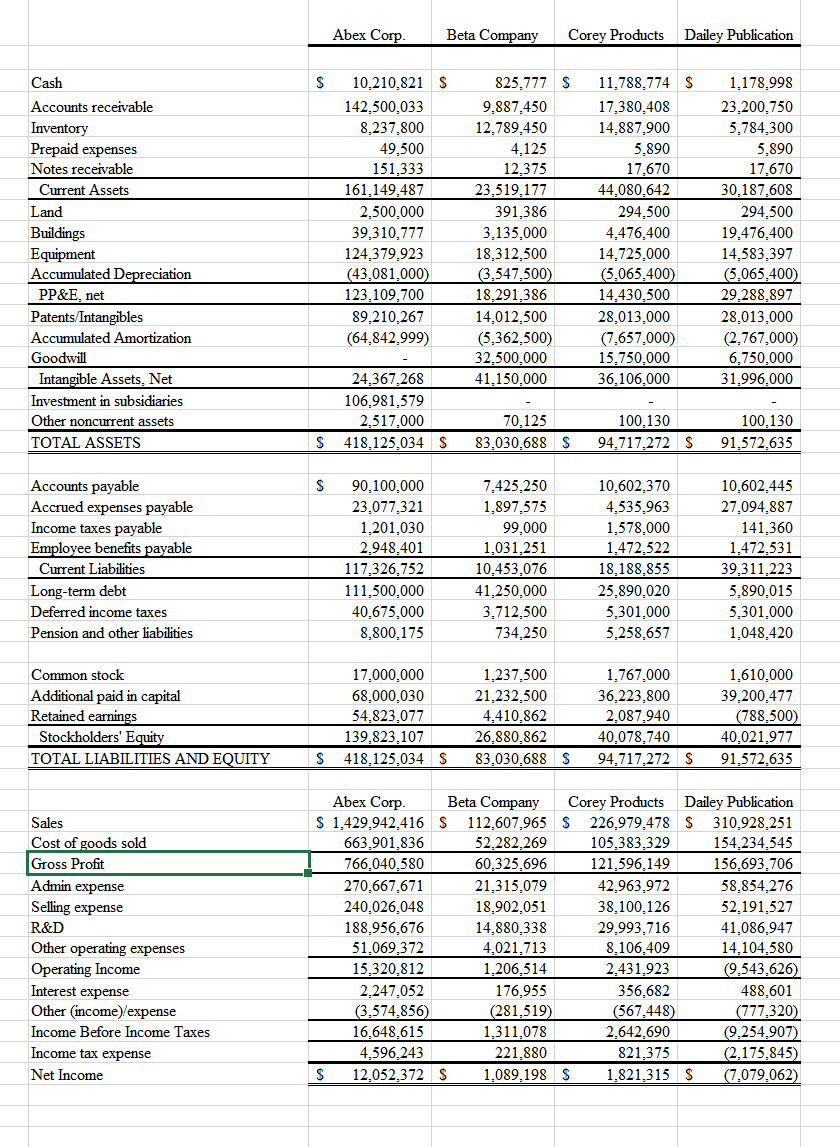

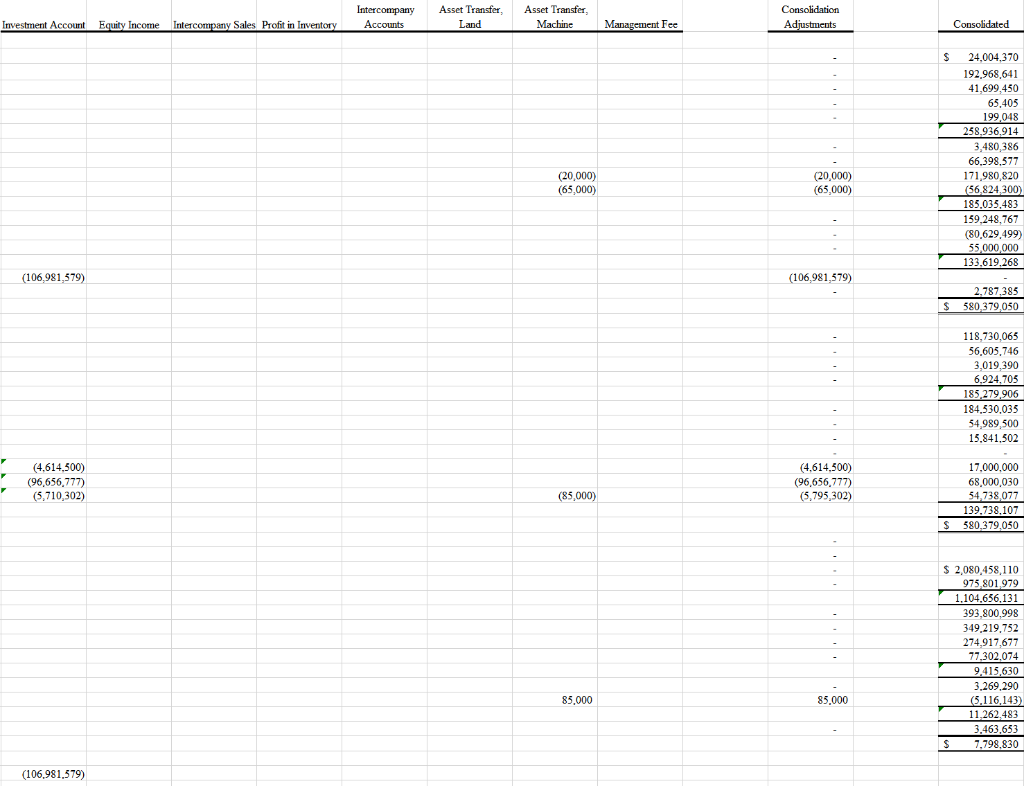

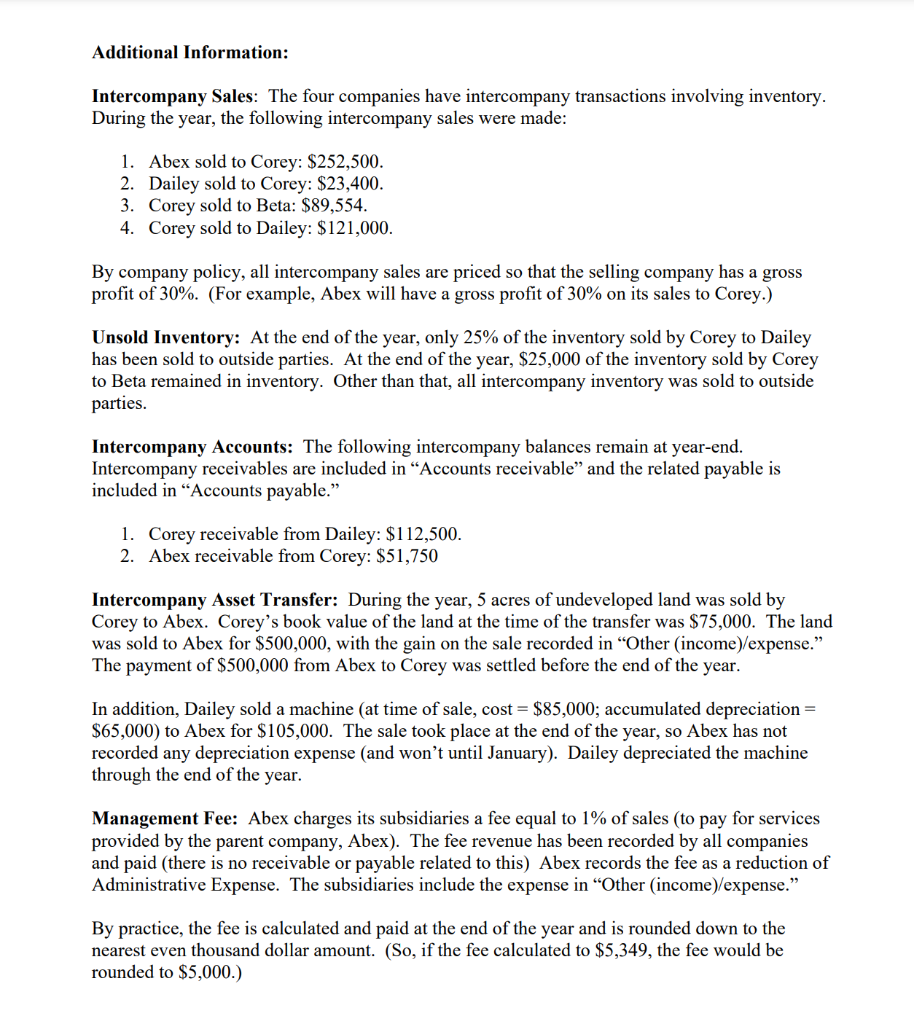

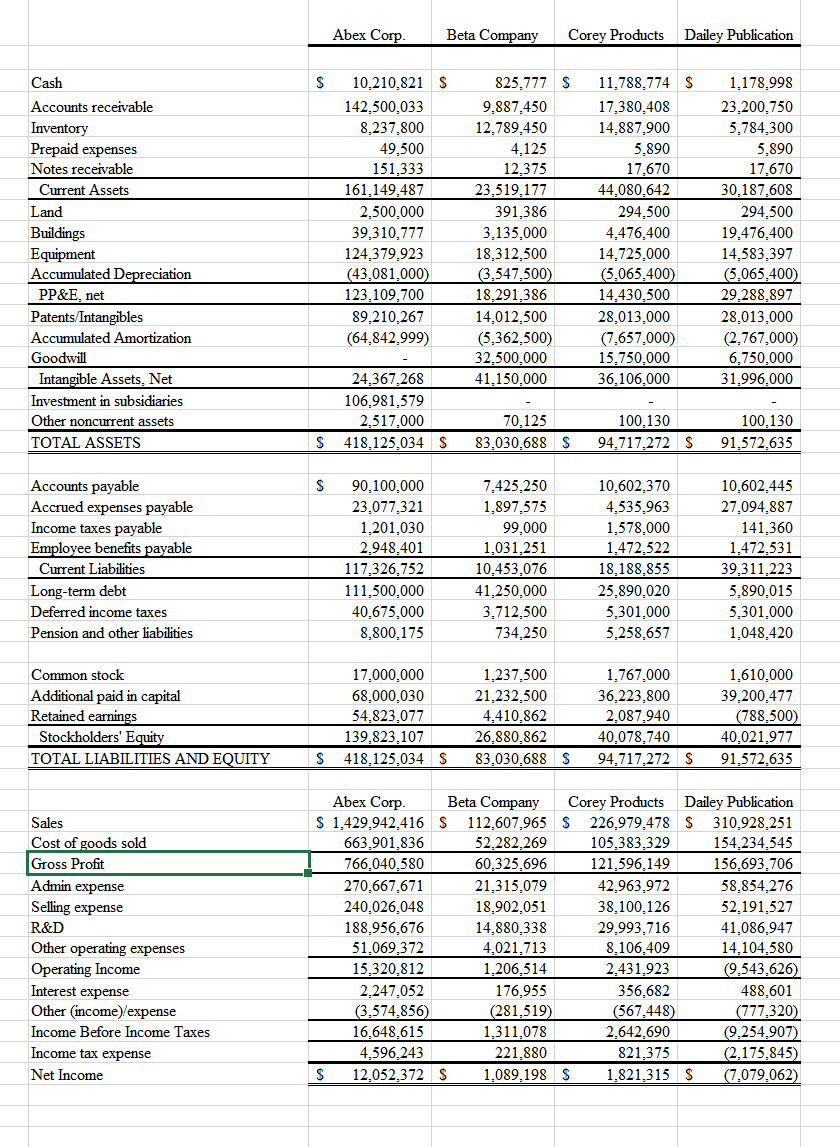

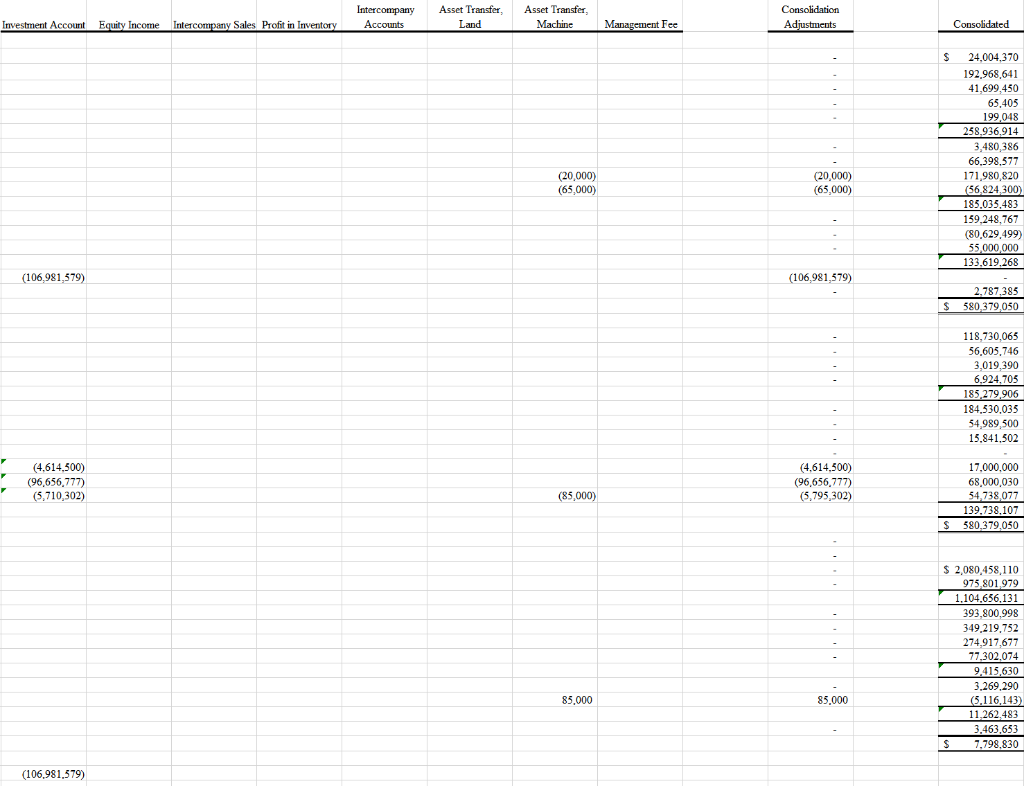

Additional Information: Intercompany Sales: The four companies have intercompany transactions involving inventory. During the year, the following intercompany sales were made: 1. Abex sold to Corey: $252,500. 2. Dailey sold to Corey: $23,400. 3. Corey sold to Beta: $89,554. 4. Corey sold to Dailey: $121,000. By company policy, all intercompany sales are priced so that the selling company has a gross profit of 30%. (For example, Abex will have a gross profit of 30% on its sales to Corey.) Unsold Inventory: At the end of the year, only 25% of the inventory sold by Corey to Dailey has been sold to outside parties. At the end of the year, $25,000 of the inventory sold by Corey to Beta remained in inventory. Other than that, all intercompany inventory was sold to outside parties. Intercompany Accounts: The following intercompany balances remain at year-end. Intercompany receivables are included in Accounts receivable and the related payable is included in Accounts payable. 1. Corey receivable from Dailey: $112,500. 2. Abex receivable from Corey: $51,750 Intercompany Asset Transfer: During the year, 5 acres of undeveloped land was sold by Corey to Abex. Corey's book value of the land at the time of the transfer was $75,000. The land was sold to Abex for $500,000, with the gain on the sale recorded in Other (income)/expense. The payment of $500,000 from Abex to Corey was settled before the end of the year. In addition, Dailey sold a machine (at time of sale, cost = $85,000; accumulated depreciation = $65,000) to Abex for $105,000. The sale took place at the end of the year, so Abex has not recorded any depreciation expense and won't until January). Dailey depreciated the machine through the end of the year. Management Fee: Abex charges its subsidiaries a fee equal to 1% of sales (to pay for services provided by the parent company, Abex). The fee revenue has been recorded by all companies and paid (there is no receivable or payable related to this) Abex records the fee as a reduction of Administrative Expense. The subsidiaries include the expense in Other (income)/expense. By practice, the fee is calculated and paid at the end of the year and is rounded down to the nearest even thousand dollar amount. (So, if the fee calculated to $5,349, the fee would be rounded to $5,000.) Abex Corp. Beta Company Corey Products Dailey Publication Cash S Accounts receivable Inventory Prepaid expenses Notes receivable Current Assets Land Buildings Equipment Accumulated Depreciation PP&E, net Patents/Intangibles Accumulated Amortization Goodwill Intangible Assets, Net Investment in subsidiaries Other noncurrent assets TOTAL ASSETS 10,210,821 $ 142,500.033 8.237,800 49,500 151,333 161.149,487 2,500,000 39,310,777 124,379.923 (43,081,000) 123,109,700 89,210,267 (64.842.999) 825,777 S 9,887,450 12,789,450 4.125 12,375 23,519,177 391,386 3.135.000 18,312,500 (3,547,500) 18,291,386 14.012,500 (5.362,500) 32,500,000 41,150,000 11,788,774 S 17,380,408 14.887,900 5.890 17,670 44,080,642 294,500 4.476,400 14,725,000 (5,065,400) 14,430,500 28,013,000 (7.657,000) 15.750,000 36,106,000 1,178,998 23,200.750 5,784,300 5,890 17,670 30.187,608 294,500 19,476,400 14,583,397 (5,065,400) 29,288,897 28.013,000 (2,767,000) 6,750,000 31,996,000 24,367,268 106,981,579 2,517,000 $ 418,125,034 S 70.125 83,030,688 S 100,130 94,717,272 $ 100.130 91,572,635 $ Accounts payable Accrued expenses payable Income taxes payable Employee benefits payable Current Liabilities Long-term debt Deferred income taxes Pension and other liabilities 90.100,000 23,077,321 1,201,030 2.948,401 117,326,752 111,500,000 40,675,000 8.800,175 7,425,250 1.897,575 99,000 1,031,251 10,453,076 41.250,000 3,712,500 734,250 10.602,370 4,535,963 1,578,000 1,472,522 18.188.855 25,890,020 5,301.000 5,258,657 10,602.445 27,094,887 141,360 1,472,531 39,311,223 5.890,015 5,301,000 1,048,420 Common stock Additional paid in capital Retained earnings Stockholders' Equity TOTAL LIABILITIES AND EQUITY 17,000,000 68,000,030 54,823,077 139,823,107 418.125,034 S 1,237,500 21,232,500 4,410,862 26,880,862 83,030,688 $ 1,767,000 36.223.800 2,087,940 40,078,740 94,717,272 S 1,610,000 39,200,477 (788,500) 40,021.977 91,572,635 S Sales Cost of goods sold Gross Profit Admin expense Selling expense R&D Other operating expenses Operating Income Interest expense Other (income) expense Income Before Income Taxes Income tax expense Net Income Abex Corp. Beta Company Corey Products Dailey Publication $ 1,429,942,416 S 112,607,965 S 226,979,478 $ 310,928,251 663,901,836 52,282,269 105,383,329 154,234,545 766,040,580 60,325,696 121,596,149 156,693,706 270,667,671 21,315,079 42,963.972 58,854,276 240,026,048 18,902,051 38.100.126 52,191,527 188,956,676 14,880,338 29,993,716 41,086,947 51,069,372 4,021,713 8,106,409 14.104,580 15,320,812 1,206,514 2,431,923 9,543,626) 2.247,052 176,955 356,682 488,601 (3,574,856) (281,519) (567,448) (777,320) 16,648,615 1,311,078 2,642,690 9.254,907 4,596,243 221,880 821,375 (2.175.845) S 12,052,372 S 1,089,198 $ 1,821,315 $ (7,079,062) Intercompany Accounts Asset Transfer Land Asset Transfer Machine Consolidation Adjustments Investment Account Equity Income Intercompany Sales Profit in Inventory Management Fee Consolidated $ 24,004,370 192.968,641 41,699,450 65.405 199,048 258.936,914 3,480,386 66.398.577 171,980,820 (56,824,300) 185,035.483 159.248.767 (80,629,499) 55,000,000 133,619,268 (20.000) () (65,000) (20.000) (65 000) (106,981,579) (106,981,579) 2,787,385 $ 580,379,050 118,730,065 56,605,746 3,019,390 6,924,705 185,279,906 184,530.035 54,989,500 15.841,502 (4.614,500) (96,656 777) (5,710,302) (4.614,500) (96,656, 777) (5.795,302) (85,000) 17,000,000 68,000,030 54.738 077 139.738.107 580,379,050 $ $ 2,080,458,110 975,801 979 1,104,656,131 393,800,998 349,219,752 274.917,677 77,302,074 9,415,630 3.269,290 (5,116,143) 11,262,483 3.463,653 $ 7.798.830 85.000 85.000 (106,981,579) Additional Information: Intercompany Sales: The four companies have intercompany transactions involving inventory. During the year, the following intercompany sales were made: 1. Abex sold to Corey: $252,500. 2. Dailey sold to Corey: $23,400. 3. Corey sold to Beta: $89,554. 4. Corey sold to Dailey: $121,000. By company policy, all intercompany sales are priced so that the selling company has a gross profit of 30%. (For example, Abex will have a gross profit of 30% on its sales to Corey.) Unsold Inventory: At the end of the year, only 25% of the inventory sold by Corey to Dailey has been sold to outside parties. At the end of the year, $25,000 of the inventory sold by Corey to Beta remained in inventory. Other than that, all intercompany inventory was sold to outside parties. Intercompany Accounts: The following intercompany balances remain at year-end. Intercompany receivables are included in Accounts receivable and the related payable is included in Accounts payable. 1. Corey receivable from Dailey: $112,500. 2. Abex receivable from Corey: $51,750 Intercompany Asset Transfer: During the year, 5 acres of undeveloped land was sold by Corey to Abex. Corey's book value of the land at the time of the transfer was $75,000. The land was sold to Abex for $500,000, with the gain on the sale recorded in Other (income)/expense. The payment of $500,000 from Abex to Corey was settled before the end of the year. In addition, Dailey sold a machine (at time of sale, cost = $85,000; accumulated depreciation = $65,000) to Abex for $105,000. The sale took place at the end of the year, so Abex has not recorded any depreciation expense and won't until January). Dailey depreciated the machine through the end of the year. Management Fee: Abex charges its subsidiaries a fee equal to 1% of sales (to pay for services provided by the parent company, Abex). The fee revenue has been recorded by all companies and paid (there is no receivable or payable related to this) Abex records the fee as a reduction of Administrative Expense. The subsidiaries include the expense in Other (income)/expense. By practice, the fee is calculated and paid at the end of the year and is rounded down to the nearest even thousand dollar amount. (So, if the fee calculated to $5,349, the fee would be rounded to $5,000.) Abex Corp. Beta Company Corey Products Dailey Publication Cash S Accounts receivable Inventory Prepaid expenses Notes receivable Current Assets Land Buildings Equipment Accumulated Depreciation PP&E, net Patents/Intangibles Accumulated Amortization Goodwill Intangible Assets, Net Investment in subsidiaries Other noncurrent assets TOTAL ASSETS 10,210,821 $ 142,500.033 8.237,800 49,500 151,333 161.149,487 2,500,000 39,310,777 124,379.923 (43,081,000) 123,109,700 89,210,267 (64.842.999) 825,777 S 9,887,450 12,789,450 4.125 12,375 23,519,177 391,386 3.135.000 18,312,500 (3,547,500) 18,291,386 14.012,500 (5.362,500) 32,500,000 41,150,000 11,788,774 S 17,380,408 14.887,900 5.890 17,670 44,080,642 294,500 4.476,400 14,725,000 (5,065,400) 14,430,500 28,013,000 (7.657,000) 15.750,000 36,106,000 1,178,998 23,200.750 5,784,300 5,890 17,670 30.187,608 294,500 19,476,400 14,583,397 (5,065,400) 29,288,897 28.013,000 (2,767,000) 6,750,000 31,996,000 24,367,268 106,981,579 2,517,000 $ 418,125,034 S 70.125 83,030,688 S 100,130 94,717,272 $ 100.130 91,572,635 $ Accounts payable Accrued expenses payable Income taxes payable Employee benefits payable Current Liabilities Long-term debt Deferred income taxes Pension and other liabilities 90.100,000 23,077,321 1,201,030 2.948,401 117,326,752 111,500,000 40,675,000 8.800,175 7,425,250 1.897,575 99,000 1,031,251 10,453,076 41.250,000 3,712,500 734,250 10.602,370 4,535,963 1,578,000 1,472,522 18.188.855 25,890,020 5,301.000 5,258,657 10,602.445 27,094,887 141,360 1,472,531 39,311,223 5.890,015 5,301,000 1,048,420 Common stock Additional paid in capital Retained earnings Stockholders' Equity TOTAL LIABILITIES AND EQUITY 17,000,000 68,000,030 54,823,077 139,823,107 418.125,034 S 1,237,500 21,232,500 4,410,862 26,880,862 83,030,688 $ 1,767,000 36.223.800 2,087,940 40,078,740 94,717,272 S 1,610,000 39,200,477 (788,500) 40,021.977 91,572,635 S Sales Cost of goods sold Gross Profit Admin expense Selling expense R&D Other operating expenses Operating Income Interest expense Other (income) expense Income Before Income Taxes Income tax expense Net Income Abex Corp. Beta Company Corey Products Dailey Publication $ 1,429,942,416 S 112,607,965 S 226,979,478 $ 310,928,251 663,901,836 52,282,269 105,383,329 154,234,545 766,040,580 60,325,696 121,596,149 156,693,706 270,667,671 21,315,079 42,963.972 58,854,276 240,026,048 18,902,051 38.100.126 52,191,527 188,956,676 14,880,338 29,993,716 41,086,947 51,069,372 4,021,713 8,106,409 14.104,580 15,320,812 1,206,514 2,431,923 9,543,626) 2.247,052 176,955 356,682 488,601 (3,574,856) (281,519) (567,448) (777,320) 16,648,615 1,311,078 2,642,690 9.254,907 4,596,243 221,880 821,375 (2.175.845) S 12,052,372 S 1,089,198 $ 1,821,315 $ (7,079,062) Intercompany Accounts Asset Transfer Land Asset Transfer Machine Consolidation Adjustments Investment Account Equity Income Intercompany Sales Profit in Inventory Management Fee Consolidated $ 24,004,370 192.968,641 41,699,450 65.405 199,048 258.936,914 3,480,386 66.398.577 171,980,820 (56,824,300) 185,035.483 159.248.767 (80,629,499) 55,000,000 133,619,268 (20.000) () (65,000) (20.000) (65 000) (106,981,579) (106,981,579) 2,787,385 $ 580,379,050 118,730,065 56,605,746 3,019,390 6,924,705 185,279,906 184,530.035 54,989,500 15.841,502 (4.614,500) (96,656 777) (5,710,302) (4.614,500) (96,656, 777) (5.795,302) (85,000) 17,000,000 68,000,030 54.738 077 139.738.107 580,379,050 $ $ 2,080,458,110 975,801 979 1,104,656,131 393,800,998 349,219,752 274.917,677 77,302,074 9,415,630 3.269,290 (5,116,143) 11,262,483 3.463,653 $ 7.798.830 85.000 85.000 (106,981,579)