Answered step by step

Verified Expert Solution

Question

1 Approved Answer

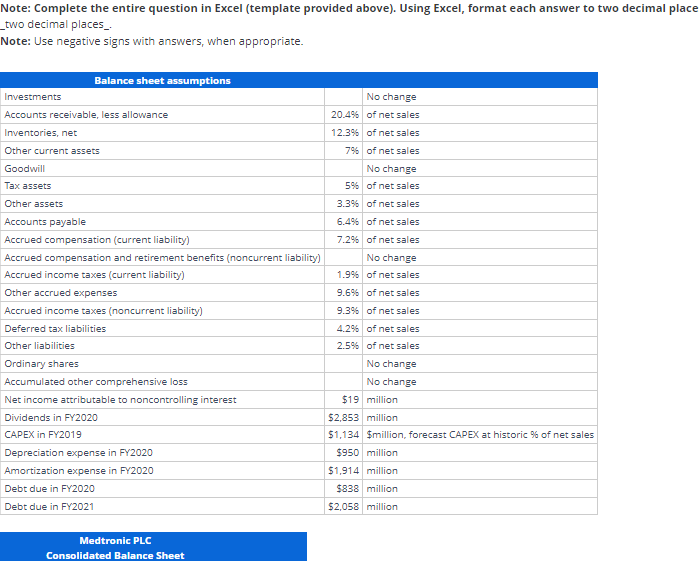

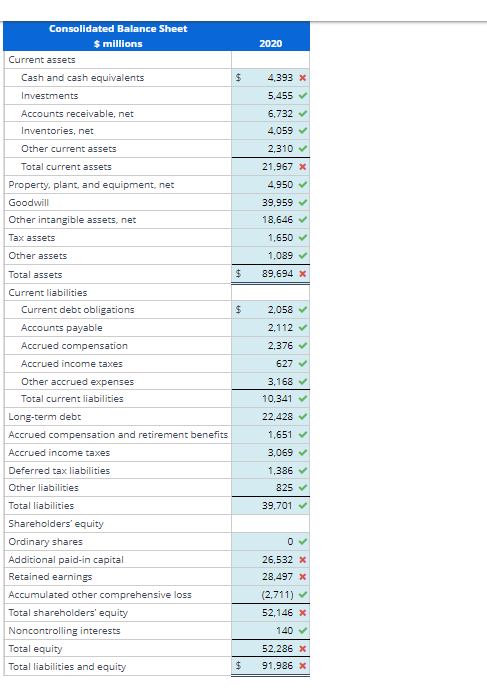

Need help finishing the balance sheet. Thank you!! Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two

Need help finishing the balance sheet. Thank you!!

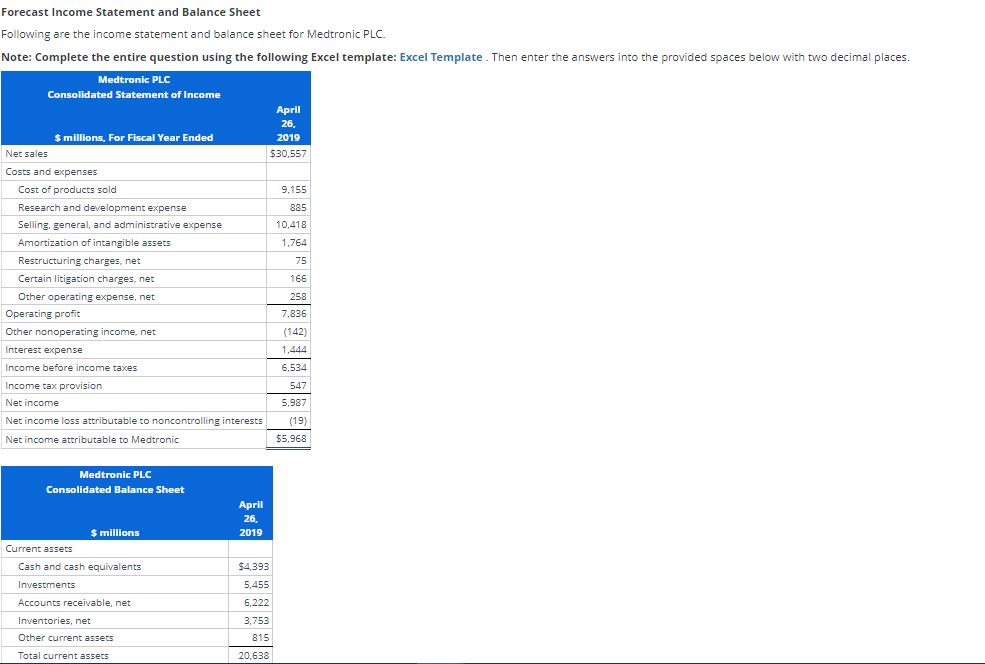

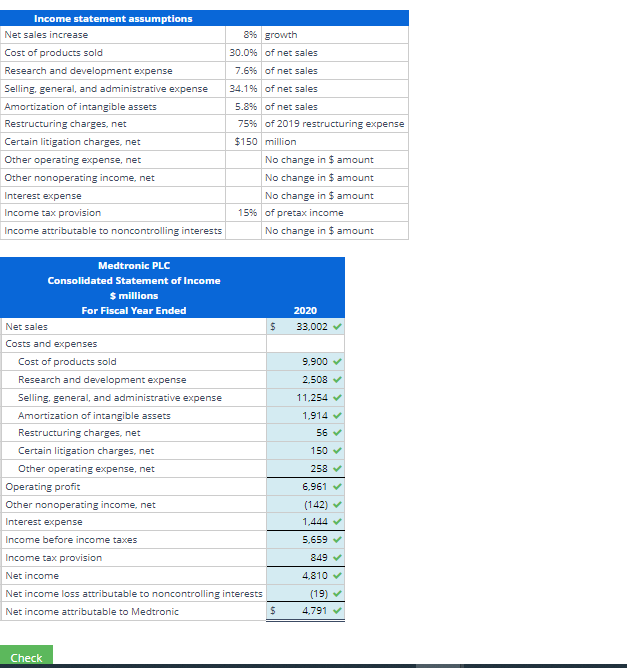

Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal place two decimal places_. Note: Use negative signs with answers, when appropriate. Forecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. \begin{tabular}{|l|r|l|} \hline \multicolumn{2}{|c|}{ Income statement assumptions } \\ \hline Net sales increase & 8% & growth \\ \hline Cost of products sold & 30.0% & of net sales \\ \hline Research and development expense & 7.6% & of net sales \\ \hline Selling, general, and administrative expense & 34.1% & of net sales \\ \hline Amortization of intangible assets & 5.8% & of net sales \\ \hline Restructuring charges, net & 75% & of 2019 restructuring expense \\ \hline Certain litigation charges, net & $150 & million \\ \hline Other operating expense, net & & No change in $ amount \\ \hline Other nonoperating income, net & & No change in $ amount \\ \hline Interest expense & 15% & of pretax income \\ \hline Income tax provision & & No change in $ amount \\ \hline Income attributable to noncontrolling interests & & \\ \hline \end{tabular} Medtronic PLC Consolidated Statement of Income $ millions For Fiscal Year Ended 2020 \begin{tabular}{|c|c|} \hline Net sales & $33,002 \\ \hline \multicolumn{2}{|l|}{ Costs and expenses } \\ \hline Cost of products sold & 9,900 \\ \hline Research and development expense & 2,508 \\ \hline Selling, general, and administrative expense & 11,254 \\ \hline Amortization of intangible assets & 1,914 \\ \hline Restructuring charges, net & 56 \\ \hline Certain litigation charges, net & 150 \\ \hline Other operating expense, net & 258 \\ \hline Operating profit & 6.961 \\ \hline Other nonoperating income, net & (142) \\ \hline Interest expense & 1,444 \\ \hline Income before income taxes & 5,659 \\ \hline Income tax provision & 849 \\ \hline Net income & 4,810 \\ \hline Net income loss attributable to noncontrolling interests & (19) \\ \hline Net income attributable to Medtronic & 4,791 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Other current assets & 815 \\ \hline Total current assets & 20,638 \\ \hline Property, plant, and equipment, net & 4,675 \\ \hline Goodwill & 39,959 \\ \hline Other intangible assets, net & 20,560 \\ \hline Tax assets & 577 \\ \hline Other assets & 1,014 \\ \hline Total assets & $87,423 \\ \hline \multicolumn{2}{|l|}{ Current liabilities } \\ \hline Current debt obligations & $838 \\ \hline Accounts payable & 1,953 \\ \hline Accrued compensation & 2,189 \\ \hline Accrued income taxes & 567 \\ \hline Other accrued expenses & 2,925 \\ \hline Total current liabilities & 8,472 \\ \hline Long-term debt & 24,486 \\ \hline Accrued compensation and retirement benefits & 1,651 \\ \hline Accrued income taxes & 2,838 \\ \hline Deferred tax liabilities & 1,278 \\ \hline Other liabilities & 288 \\ \hline Total liabilities & 39,013 \\ \hline \multicolumn{2}{|l|}{ Shareholders' equity } \\ \hline Ordinary shares & 0 \\ \hline Additional paid-in capital & 24,730 \\ \hline Retained earnings & 26,270 \\ \hline Accumulated other comprehensive loss & (2,711) \\ \hline Total shareholders' equity & 48,289 \\ \hline Noncontrolling interests & 121 \\ \hline Total equity & 48,410 \\ \hline Total liabilities and equity & $87,423 \\ \hline \end{tabular} Income Statement Balance Sheet \begin{tabular}{|l|r|l|} \hline \multicolumn{2}{|c|}{ Income statement assumptions } \\ \hline Net sales increase & 8% & growth \\ \hline Cost of products sold & 30.0% & of net sales \\ \hline Research and development expense & 7.6% & of net sales \\ \hline Selling, general, and administrative expense & 34.1% & of net sales \\ \hline Amortization of intangible assets & 5.8% & of net sales \\ \hline Restructuring charges, net & 75% & of 2019 restructuring expense \\ \hline Certain litigation charges, net & $150 & million \\ \hline Other operating expense, net & & No change in $ amount \\ \hline Other nonoperating income, net & & No change in $ amount \\ \hline Interest expense & 15% & of pretax income \\ \hline Income tax provision & & No change in $ amount \\ \hline Income attributable to noncontrolling interests & & \\ \hline \end{tabular} Medtronic PLC Consolidated Statement of Income $ millions For Fiscal Year Ended 2020 \begin{tabular}{|c|c|} \hline Net sales & $33,002 \\ \hline \multicolumn{2}{|l|}{ Costs and expenses } \\ \hline Cost of products sold & 9,900 \\ \hline Research and development expense & 2,508 \\ \hline Selling, general, and administrative expense & 11,254 \\ \hline Amortization of intangible assets & 1,914 \\ \hline Restructuring charges, net & 56 \\ \hline Certain litigation charges, net & 150 \\ \hline Other operating expense, net & 258 \\ \hline Operating profit & 6.961 \\ \hline Other nonoperating income, net & (142) \\ \hline Interest expense & 1,444 \\ \hline Income before income taxes & 5,659 \\ \hline Income tax provision & 849 \\ \hline Net income & 4,810 \\ \hline Net income loss attributable to noncontrolling interests & (19) \\ \hline Net income attributable to Medtronic & 4,791 \\ \hline \end{tabular} Note: Complete the entire question in Excel (template provided above). Using Excel, format each answer to two decimal place two decimal places_. Note: Use negative signs with answers, when appropriate. \begin{tabular}{|c|c|} \hline Other current assets & 815 \\ \hline Total current assets & 20,638 \\ \hline Property, plant, and equipment, net & 4,675 \\ \hline Goodwill & 39,959 \\ \hline Other intangible assets, net & 20,560 \\ \hline Tax assets & 577 \\ \hline Other assets & 1,014 \\ \hline Total assets & $87,423 \\ \hline \multicolumn{2}{|l|}{ Current liabilities } \\ \hline Current debt obligations & $838 \\ \hline Accounts payable & 1,953 \\ \hline Accrued compensation & 2,189 \\ \hline Accrued income taxes & 567 \\ \hline Other accrued expenses & 2,925 \\ \hline Total current liabilities & 8,472 \\ \hline Long-term debt & 24,486 \\ \hline Accrued compensation and retirement benefits & 1,651 \\ \hline Accrued income taxes & 2,838 \\ \hline Deferred tax liabilities & 1,278 \\ \hline Other liabilities & 288 \\ \hline Total liabilities & 39,013 \\ \hline \multicolumn{2}{|l|}{ Shareholders' equity } \\ \hline Ordinary shares & 0 \\ \hline Additional paid-in capital & 24,730 \\ \hline Retained earnings & 26,270 \\ \hline Accumulated other comprehensive loss & (2,711) \\ \hline Total shareholders' equity & 48,289 \\ \hline Noncontrolling interests & 121 \\ \hline Total equity & 48,410 \\ \hline Total liabilities and equity & $87,423 \\ \hline \end{tabular} Income Statement Balance SheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started