Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help fixing my problem Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold

Need help fixing my problem

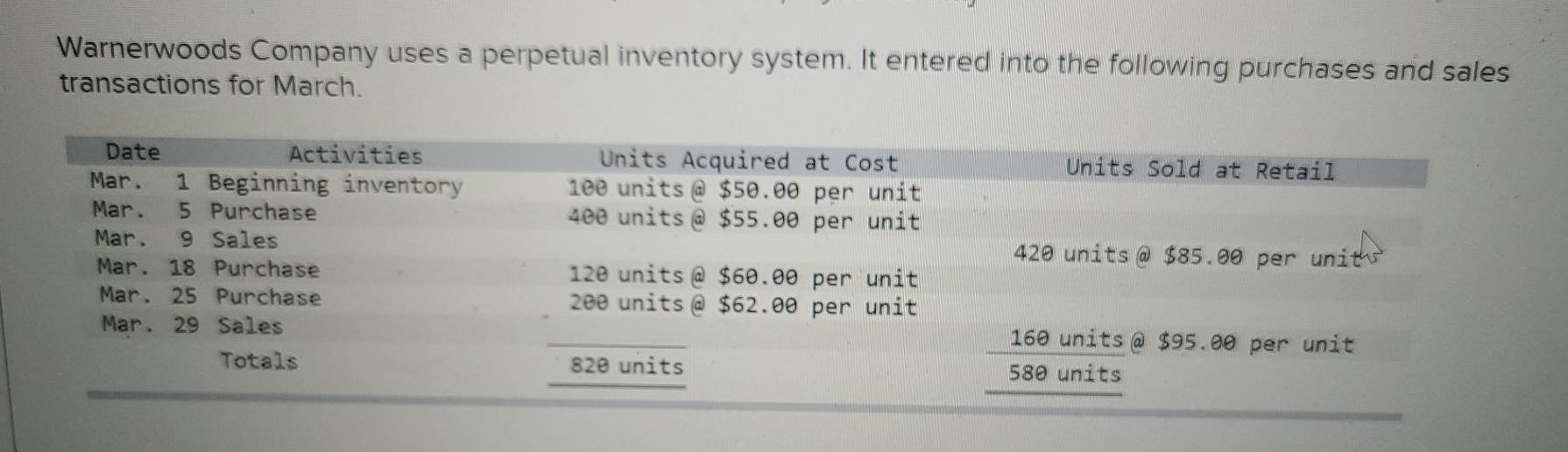

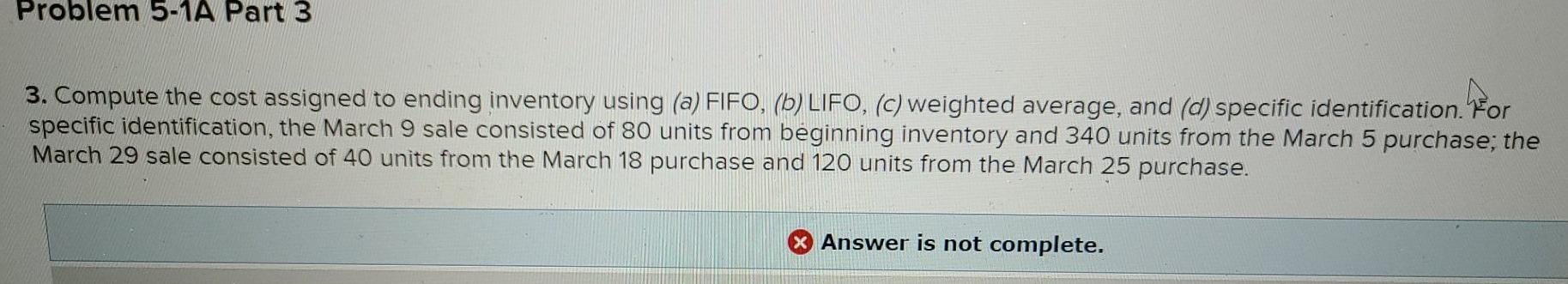

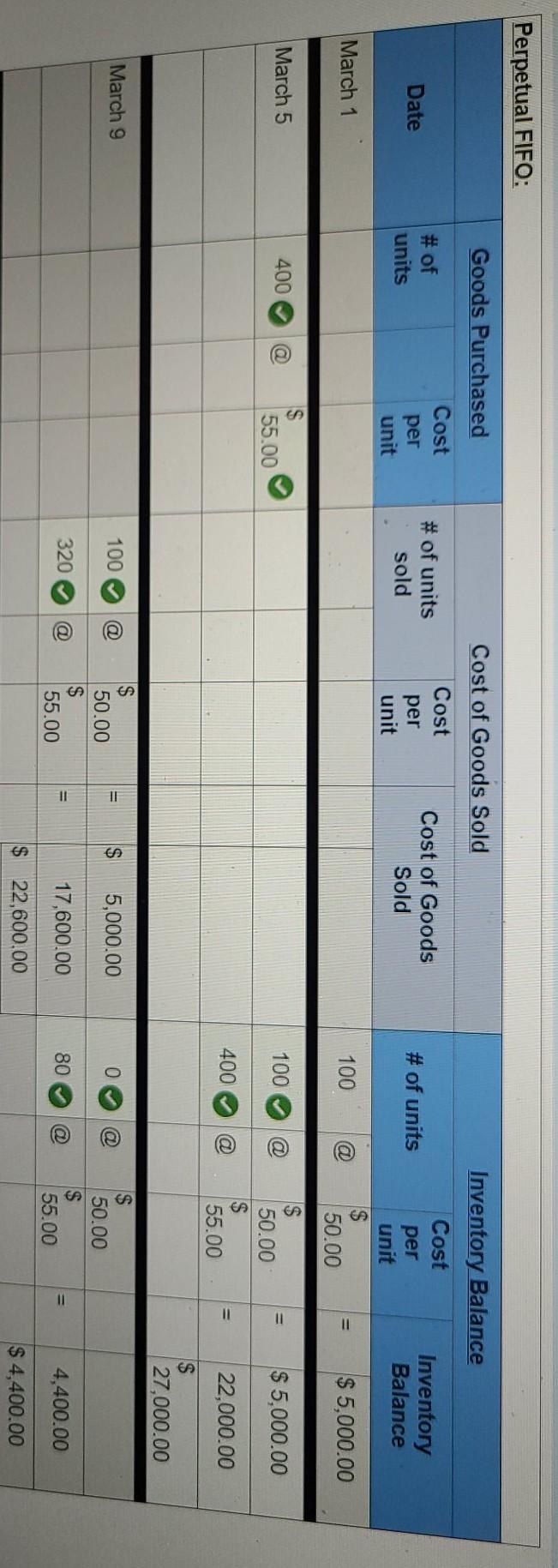

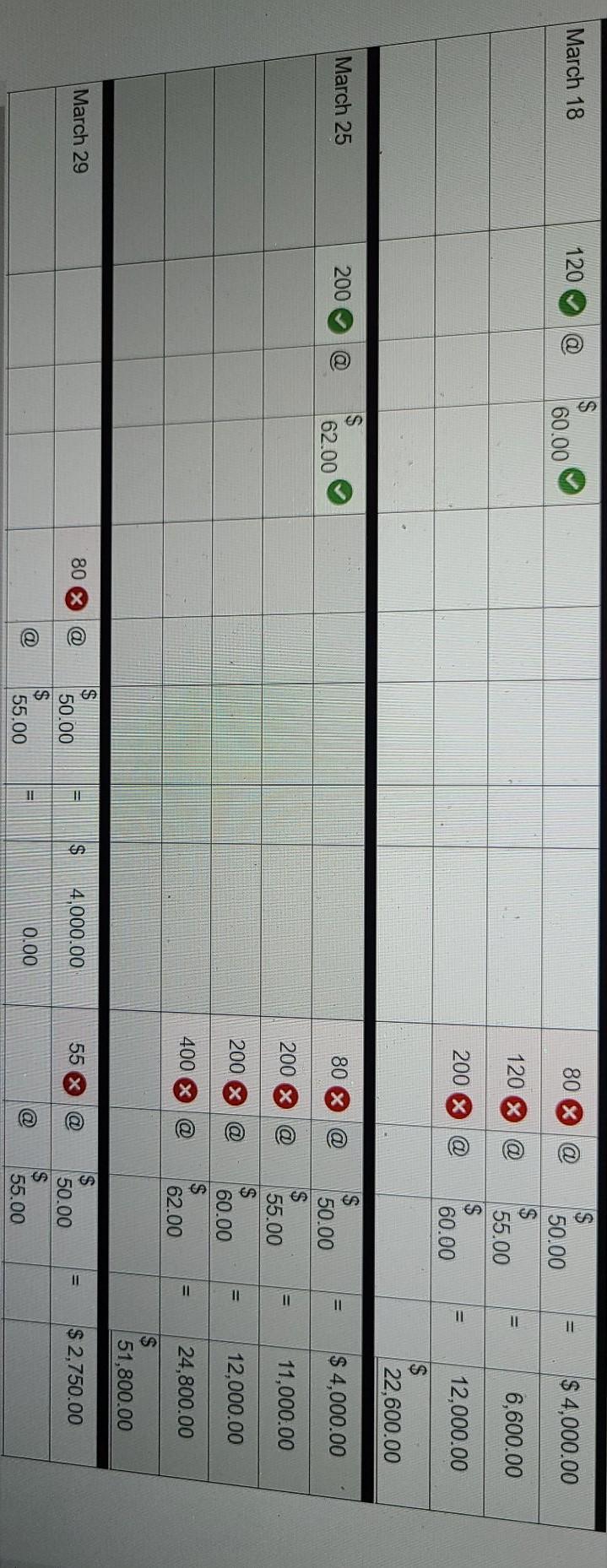

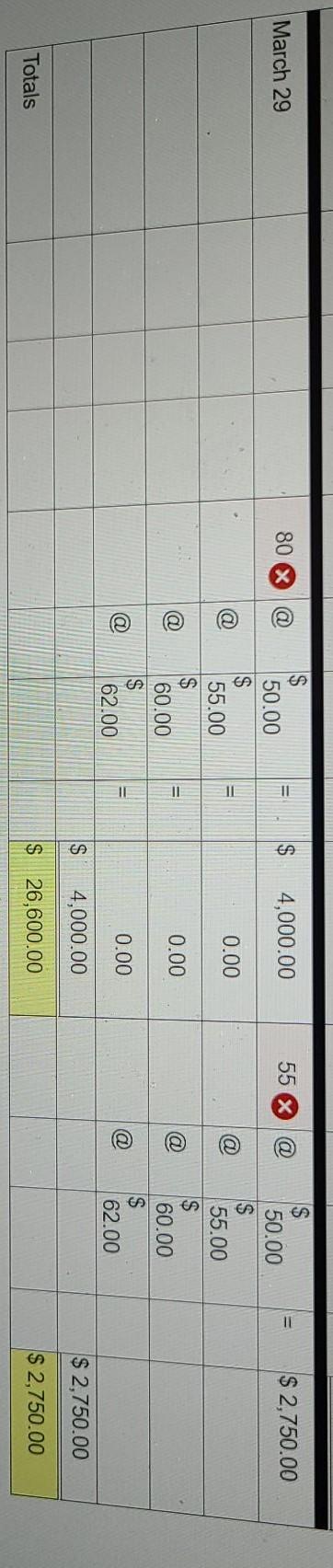

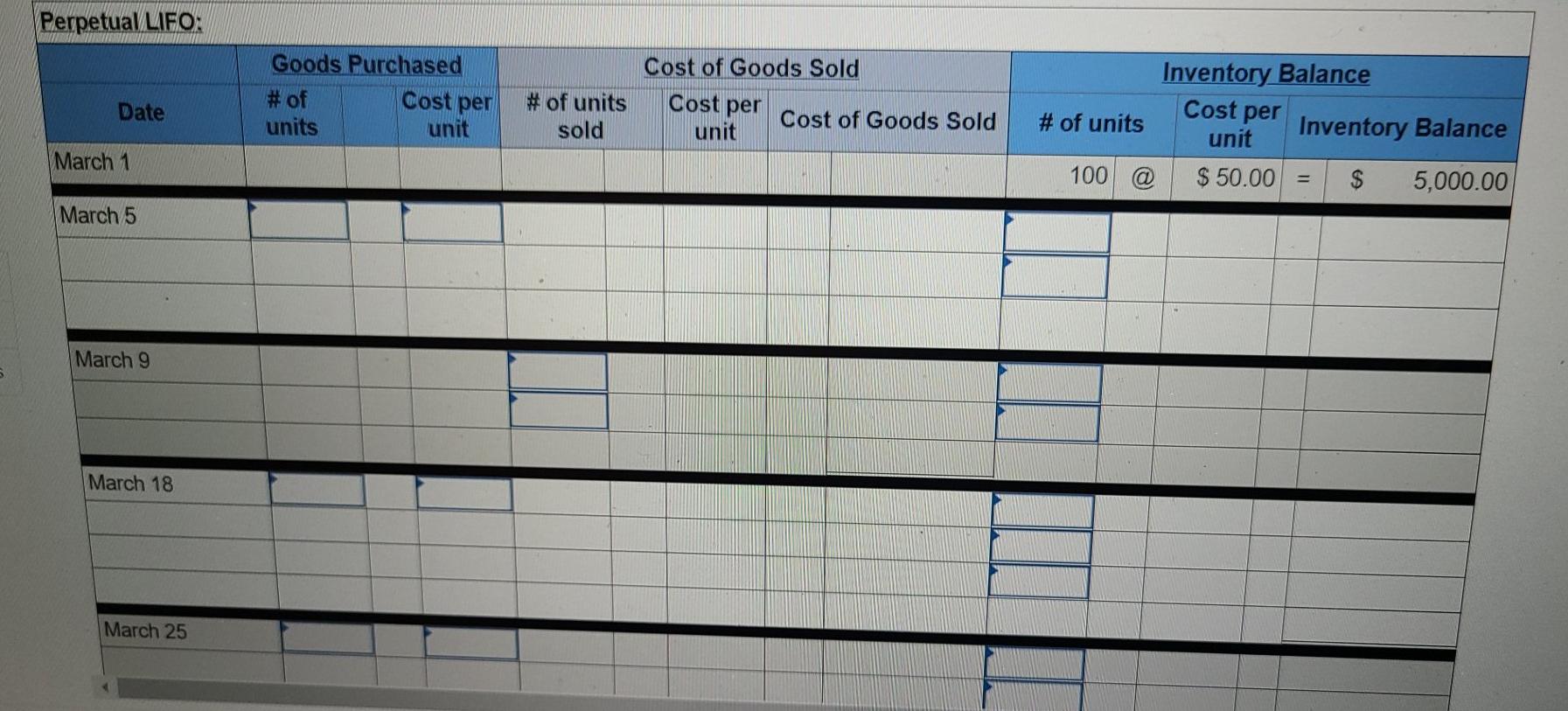

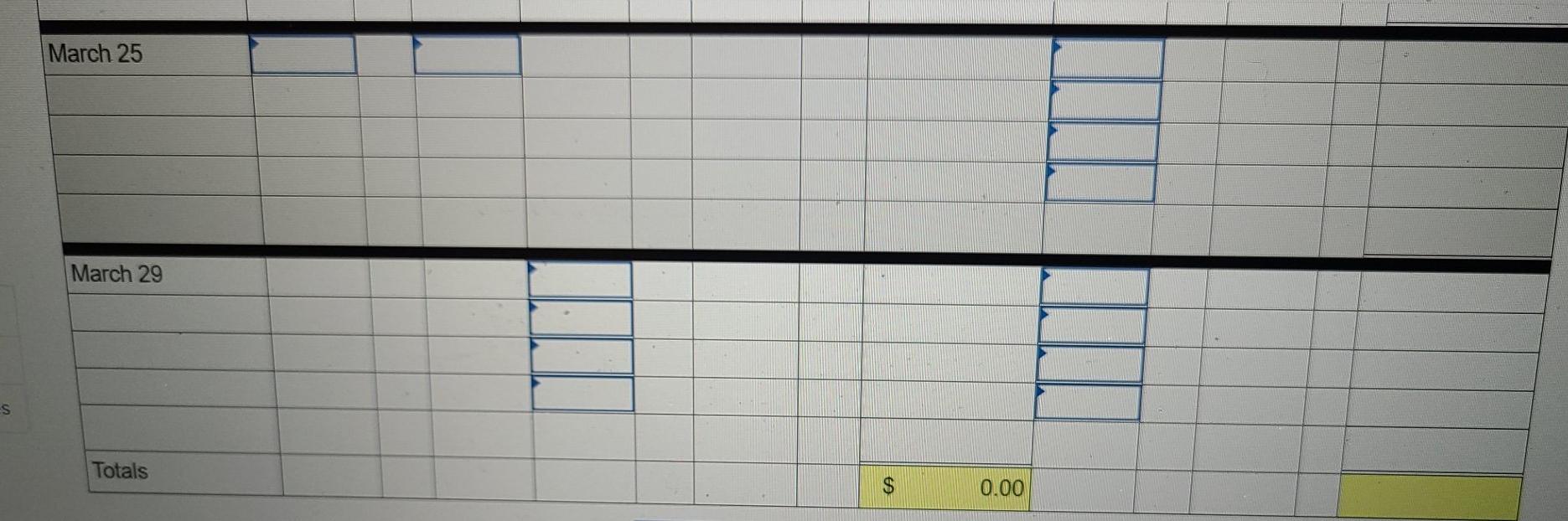

Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Units Sold at Retail Units Acquired at Cost 100 units @ $50.00 per unit 400 units @ $55.00 per unit Date Activities Mar. 1 Beginning inventory Mar. 5 Purchase Mar. 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar. 29 Sales Totals 420 units @ $85.00 per unith 120 units @ $60.00 per unit zee units @ $62.00 per unit 828 units 160 units @ $95.00 per unit 580 units Problem 5-14 Part 3 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (C) weighted average, and (d) specific identification. For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase. X Answer is not complete. Perpetual FIFO: Goods Purchased Cost of Goods Sold Date # of units Cost per unit # of units sold Cost per unit Cost of Goods Sold Inventory Balance Cost # of units Inventory per Balance unit $ 100 a $ 5,000.00 50.00 March 1 March 5 400 100 a 55.00 $ 5,000.00 $ 50.00 S 55.00 400 22,000.00 $ 27,000.00 March 9 100 a = $ 5,000.00 0 50.00 $ 55.00 $ 50.00 $ 55.00 320 II 17,600.00 80 Il 4,400.00 $ 22,600.00 $ 4,400.00 March 18 120 80 X @ $ 60.00 $ 4,000.00 120 X a 50.00 $ 55.00 $ 60.00 6,600.00 200 X @ 12,000.00 22,600.00 March 25 200 $ 80 62.00 = $ 4,000.00 200 X @ 11,000.00 200 X @ 50.00 $ 55.00 $ 60.00 S 62.00 12,000.00 400 @ = 24,800.00 $ 51,800.00 March 29 80 x a $ 4,000.00 55 = $ 2,750.00 $ 50.00 $ 55.00 $ 50.00 $ 55.00 @ 0.00 @ 80 March 29 a $ 55 4,000.00 II @ $ 2,750.00 50.00 a = 0.00 a $ 50.00 $ 55.00 $ 60.00 $ 62.00 55.00 $ 60.00 $ 62.00 0.00 0.00 @ $ 4,000.00 $ 2,750.00 Totals $ 26,600.00 $ 2,750.00 Perpetual LIFO: Cost of Goods Sold Goods Purchased # of units unit Cost per Date Cost per # of units sold unit Cost of Goods Sold Inventory Balance Cost per # of units unit Inventory Balance 100 @ $ 50.00 = $ 5,000.00 March 1 March 5 March 9 March 18 March 25 March 25 March 29 s Totals 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started