Answered step by step

Verified Expert Solution

Question

1 Approved Answer

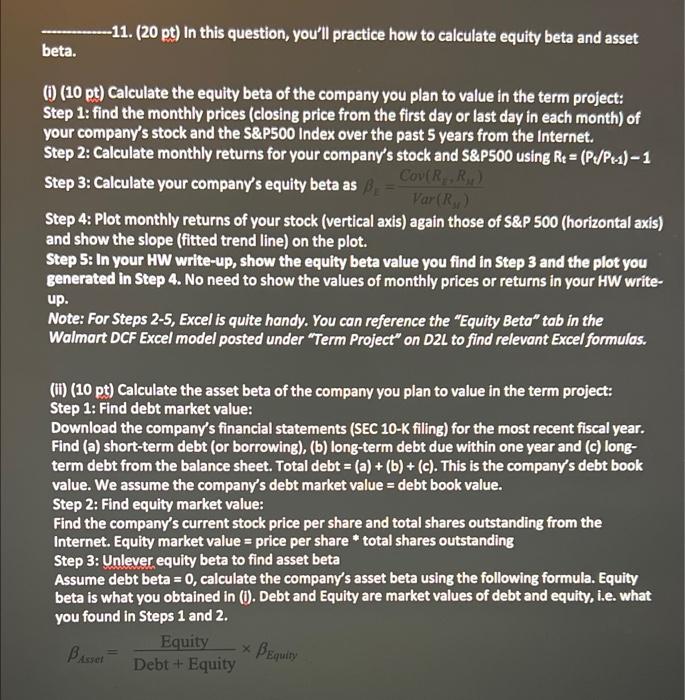

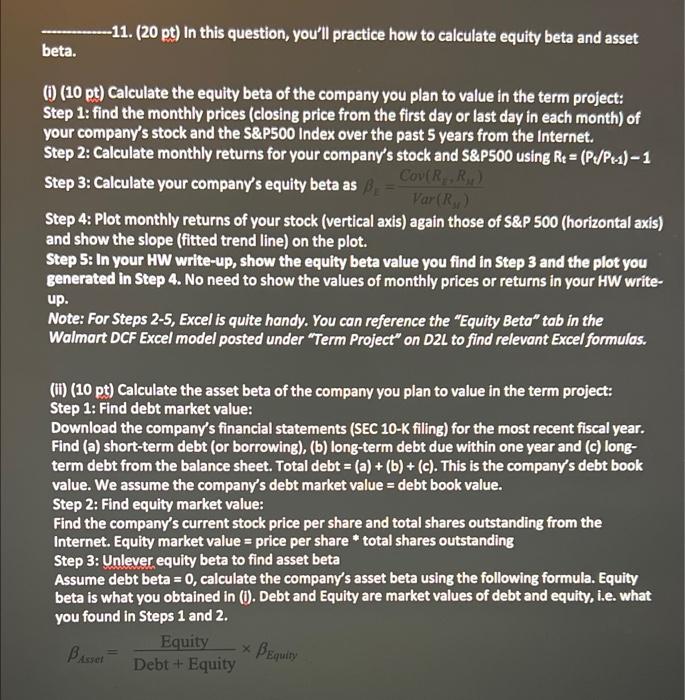

need help i and ii. thank you beta. -11. (20 pt) In this question, you'll practice how to calculate equity beta and asset (j) (10

need help i and ii. thank you

beta. -11. (20 pt) In this question, you'll practice how to calculate equity beta and asset (j) (10 pt) Calculate the equity beta of the company you plan to value in the term project: Step 1: find the monthly prices (closing price from the first day or last day in each month) of your company's stock and the S\&P500 Index over the past 5 years from the internet. Step 2: Calculate monthly returns for your company's stock and S\&P500 using Rt=(Pt/Pt11)1 Step 3: Calculate your company's equity beta as 1=Var(RN)Cov(R1,R31) Step 4: Plot monthly returns of your stock (vertical axis) again those of S\&P 500 (horizontal axis) and show the slope (fitted trend line) on the plot. Step 5: In your HW write-up, show the equity beta value you find in Step 3 and the plot you generated in Step 4. No need to show the values of monthly prices or returns in your HW writeup. Note: For Steps 2-5, Excel is quite handy. You can reference the "Equity Beta" tab in the Walmart DCF Excel model posted under "Term Project" on D2L to find relevant Excel formulas. (ii) (10 pt) Calculate the asset beta of the company you plan to value in the term project: Step 1: Find debt market value: Download the company's financial statements (SEC 10-K filing) for the most recent fiscal year. Find (a) short-term debt (or borrowing), (b) long-term debt due within one year and (c) longterm debt from the balance sheet. Total debt =(a)+(b)+(c). This is the company's debt book value. We assume the company's debt market value = debt book value. Step 2: Find equity market value: Find the company's current stock price per share and total shares outstanding from the Internet. Equity market value = price per share total shares outstanding Step 3: Unlever equity beta to find asset beta Assume debt beta =0, calculate the company's asset beta using the following formula. Equity beta is what you obtained in (j). Debt and Equity are market values of debt and equity, i.e. what you found in Steps 1 and 2. Asset=Debt+EquityEquityEquity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started