need help in the excercise number 21 , number 23 , number 27 and number 31

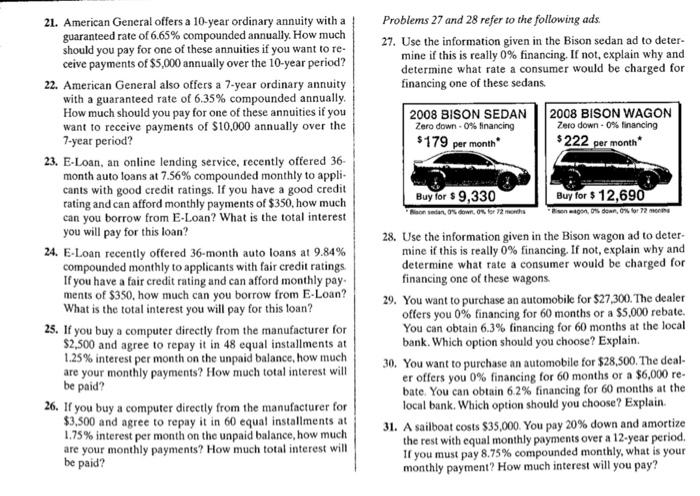

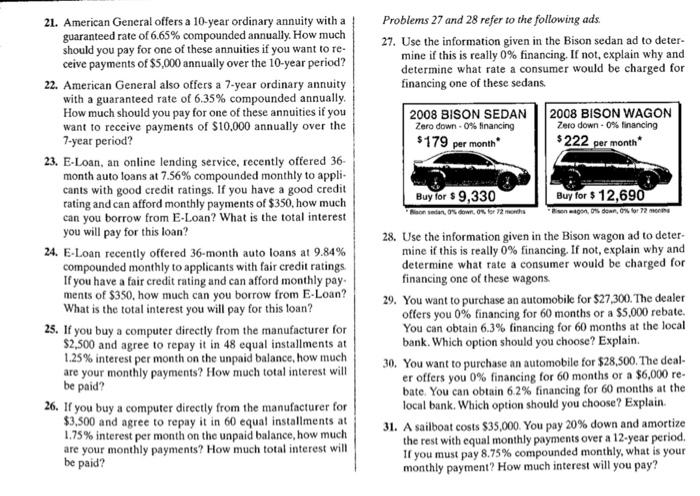

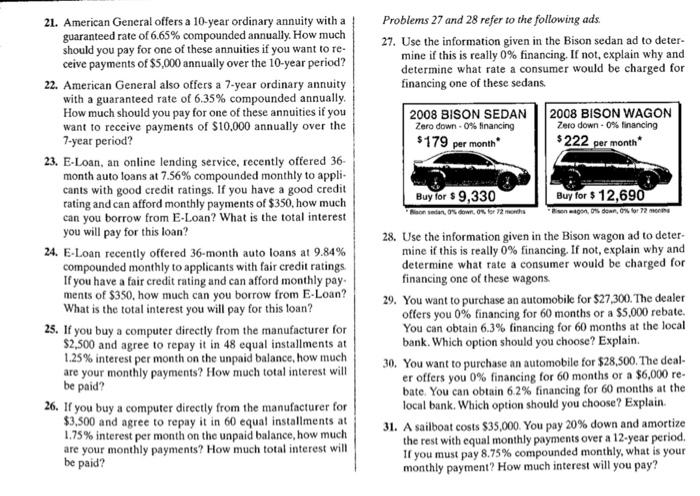

21. American General offers a 10-year ordinary annuity with a guaranteed rate of 6.65% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $5,000 annually over the 10 -year period? 22. American General also offers a 7-year ordinary annuity with a guaranteed rate of 6.35% compounded annually. How much should you pay for one of these annuities if you want to receive payments of $10.000 annually over the 7-year period? 23. E-Loan, an online lending service, recently offered 36 month auto loans at 7.56% compounded monthly to applicants with good credit ratings. If you have a good credit rating and can afford monthly payments of $350, how much can you borrow from E-Loan? What is the total interest you will pay for this loan? 24. E-Loan recently offered 36-month auto loans at 9.84% compounded monthly to applicants with fair credit ratings If you have a fair credit rating and can afford monthly pay. ments of $350, how much can you borrow from E-Loan? What is the total interest you will pay for this loan? 25. If you buy a computer directly from the manufacturer for $2,500 and agree to repay it in 48 equal installments at 1.25% interest per month on the unpaid balance, how much are your monthly payments? How much total interest will be paid? 26. If you buy a computer directly from the manufacturer for $3,500 and agree to repay it in 60 equal installments at 1.75% interest per month on the unpaid balance, how much are your monthly payments? How much total interest will be paid? Problems 27 and 28 refer to the following ads. 27. Use the information given in the Bison sedan ad to determine if this is really 0% financing. If not, explain why and determine what rate a consumer would be charged for financing one of these sedans. " Blach sedar, os down, os for 72 nombs 28. Use the information given in the Bison wagon ad to determine if this is really 0% financing. If not, explain why and determine what rate a consumer would be charged for financing one of these wagons. 29. You want to purchase an automobile for $27,300. The dealer offers you 0% financing for 60 months or a $5,000 rebate. You can obtain 6.3% financing for 60 months at the local bank. Which option should you choose? Explain. 30. You want to purchase an automobile for $28,500. The dealer offers you 0% financing for 60 months or a $6,000 rebate. You can obtain 6.2% financing for 60 months at the local bank. Which option should you choose? Explain. 31. A sailboat costs $35,000. You pay 20% down and amortize the rest with equal monthly payments over a 12-year period. If you must pay 8.75% compounded monthly, what is your monthly payment? How much interest will you pay