Question: MASTER BUDGET PROJECT: ADJUSTING AND CLOSING BOOK ENTRIES TEMPLATE ACCT 5362 Accounting Principles WEEK 7: To close the books for the year, review Principles

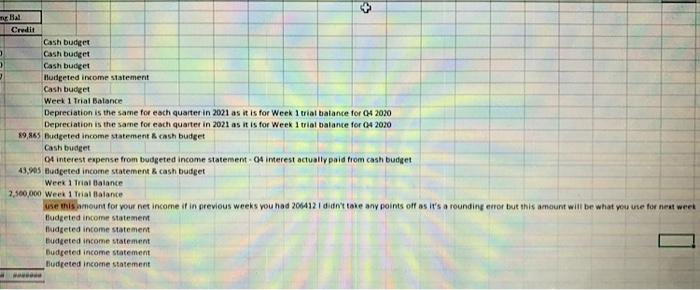

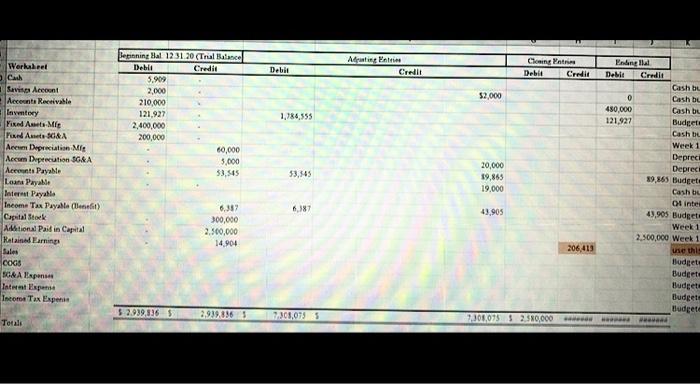

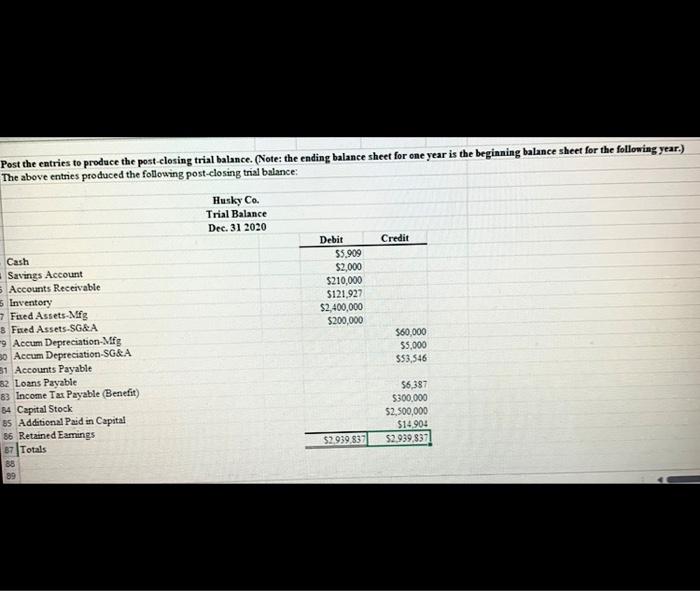

MASTER BUDGET PROJECT: ADJUSTING AND CLOSING BOOK ENTRIES TEMPLATE ACCT 5362 Accounting Principles WEEK 7: To "close the books" for the year, review Principles of Accounting, Volume 1: Financial Accounting, Chapter 4, The Adjustment Process. Specifically, refer to the 10-column worksheet on p. 248 for the conceptual layout. Following is an 8-column format that can serve the same purpose. Use whichever makes more sense to you. Prepare the adjusting and closing entries for 2021 based on the budgeted income statement and Cash budget from prior week. Fixed assets have no salvage value over a 10 year period. mg Bal Credit Cash budget Cash budget Cash budget Budgeted income statement Cash budget Week 1 Trial Balance Depreciation is the same for each quarter in 2021 as it is for Week 1 trial balance for Q4 2020 Depreciation is the same for each quarter in 2021 as it is for Week 1 trial balance for Q4 2020 89,865 Budgeted income statement & cash budget Cash budget 04 interest expense from budgeted income statement-04 interest actually paid from cash budget 43,905 Budgeted income statement & cash budget Week 1 Trial Balance 2,500,000 Week 1 Trial Balance 1 suse this amount for your net income if in previous weeks you had 206412 I didn't take any points off as it's a rounding error but this amount will be what you use for next week Budgeted income statement Budgeted income statement Budgeted income statement Budgeted income statement Budgeted income statement Ending Hal Credit Debit Credit Cash bu 0 Cash bu 480,000 121,927 Cash bu Budgets Cash b Week 1 Depreca Depreci Beginning Bal 12.31.20 (Trial Balance Worksheet Cash Debit Credit 5,909 Savings Account 2,000 Adrasting Entries Closing Entrie Debit Credit Debit $2,000 Accounts Receivable 210,000 Inventory 121,927 1,784,555 Fixed Assets Mig 2,400,000 Fixed Assets SG&A 200,000 Accum Depreciation Mig 60,000 Accum Depreciation SG&A 5,000 20,000 Accounts Payable 53,545 53,545 19,865 Loans Payable 19,000 Interest Payable Income Tax Payable (Benefit) 6,387 6,387 Capital Stock 43,905 300,000 Additional Paid in Capital 2,500,000 Retained Earnings 14,904 Sales COGS SG&A Expenses Internt Expense Income Tax Expense $2.939,836 $ 2.939.836 1 7,308,0755 7,308,075 $ 2.580,000 Totals 89,865 Budgets Cash bu 04 inter 43,905 Budgets Week 1 2,500,000 Week 1 206,413 use this Budgets Budgets Budgets Budgetm Budgete Post the entries to produce the post-closing trial balance. (Note: the ending balance sheet for one year is the beginning balance sheet for the following year.) The above entries produced the following post-closing trial balance: Husky Co. Trial Balance Cash Savings Account 5 Accounts Receivable 5 Inventory 7 Faxed Assets-Mfg 8 Faxed Assets-SG&A 9 Accum Depreciation-Mfg 30 Accum Depreciation-SG&A 31 Accounts Payable 32 Loans Payable 83 Income Tax Payable (Benefit). 84 Capital Stock 85 Additional Paid in Capital 86 Retained Eamings 87 Totals 88 89 Dec. 31 2020 Debit Credit $5,909 $2,000 $210,000 $121,927 $2,400,000 $200,000 $60,000 $5,000 $53,546 $6,387 $300,000 $2,500,000 $14,904 $2,939 837 $2,939,837

Step by Step Solution

There are 3 Steps involved in it

It seems youve uploaded multiple images related to a financial accounting exercise for a master budget project including adjusting and closing book entries Based on the content of the images and your ... View full answer

Get step-by-step solutions from verified subject matter experts