Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help Nash Siovdlving Co, is owned by Nick and Amber. Business has been booming as baby boomers want to prove their moxie, and the

Need Help

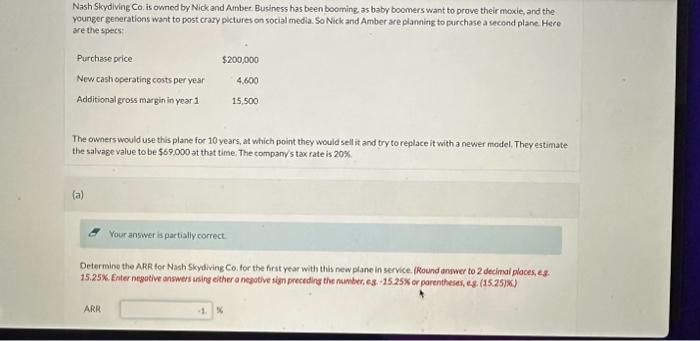

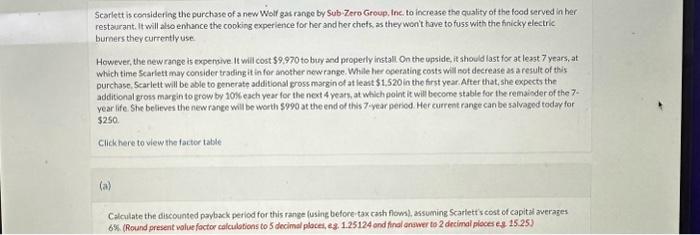

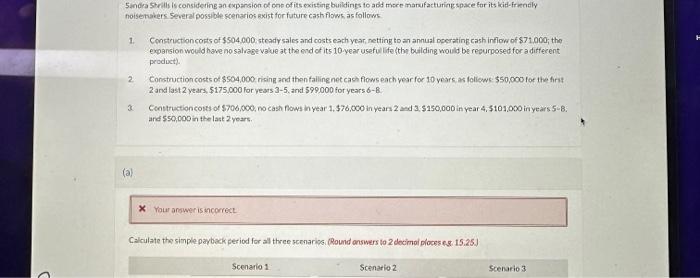

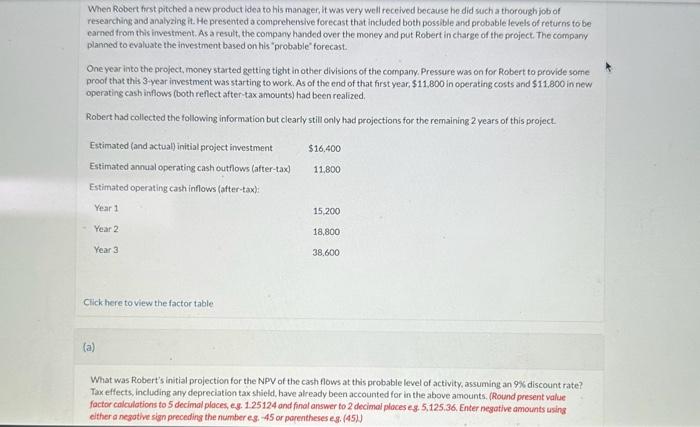

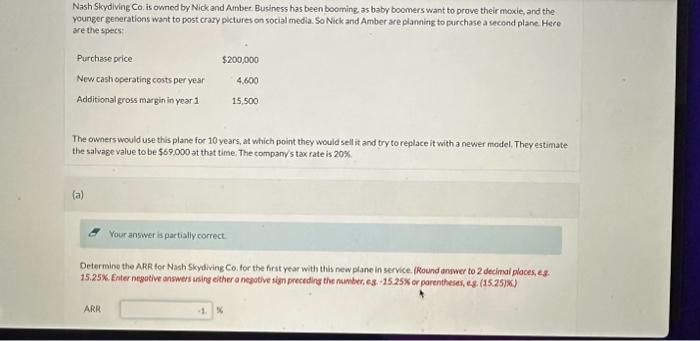

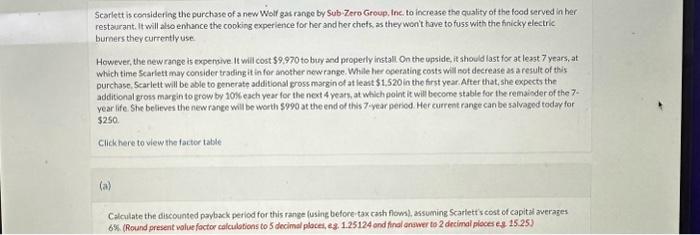

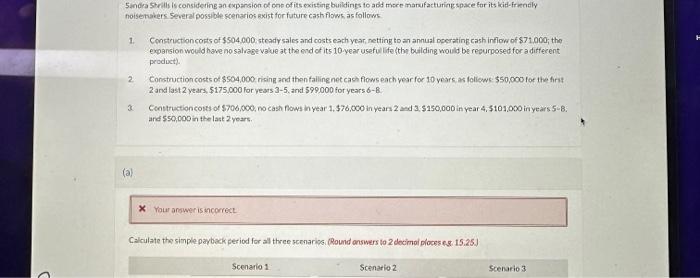

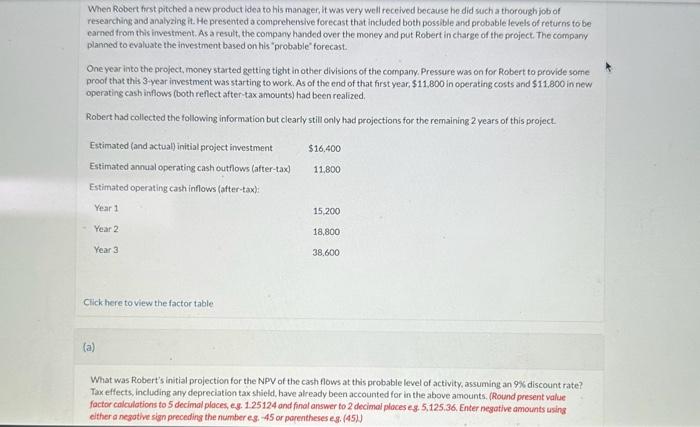

Nash Siovdlving Co, is owned by Nick and Amber. Business has been booming as baby boomers want to prove their moxie, and the younger generations want to post crary pictures on sociat medla. So Nick and Amber are planning to purchase a second plane. Here Me the specs: The ownerswould use this plane for 10 years, at which point they would sell it and try to replaceit with a newer model. They estimate the salvage value to be $69,000 at that time. The company's tax rate is 20% (a) O Your answer is pactiallycorrect. Determine the ARR for Nash Skydiving Co. for the frit year with this new plane in service. (kound dnwwer to 2 decinal glaces, es. Scarlett is considering the purchase of a new Welf gas range by Sub-Zero Group. Ine to incre ase the quality of the food served in her restaurant. It will also enhance the cooking exper lence for har and her chets as they won't have to fuss with the finicky electric bumers they currently use. However, the aewrange is expenaive It wili cost 59.970 to byry and properly install On the upside, it should last for at least 7 years, at Which time Scarlett may consider trading it in for another new range. While her operating costs will mot decrease as a result of this purchase, Scarlett will be able to eenerate additional gross margin of at leant 51,520 in the first year. After that, she expects the additional gross margin to grow by 10 each year for the noxt 4 yearh at which polnt it will become stable for the remaioder of the 7 year life. She believes the new rance will be worth 5990 at the end of this 7 -year period. Her current range can be salvaged today for 5250. Clickhere to view the factor table (3) Calculate the dikcounted payback period for this range (using before tax cash flom), assuming Scarlett s cost of capital averages 6 K. (Round present wolue factor calculotions to 5 decimal ploces, es. 1.25124 ond final anaver to 2 dreimal ploces es. 15.25) 5andra Shrills is considering an expengion of one of its exitting buildings to add more manufacturing space for its idid-fruenely foisenakers several possible scenarios axist for future cash flows as follows 1. Construction coits of $504,000 isteady sales and costs each year, netting to an annual operating cash infiow of $71.000; the expansion would have no salrage value at the end of its 10 year useful life lthe building would be repurposed for a ditferent. product) 2. Constructioncosts of $504,000 ricing and then falling net cach fiows each vear for 10 years as follewe: $50,000 foe the firs? 2 and last 2 years, $175,000 for years 35, and $99000 for years 68 3. Constructioncosts of $706,000, no cash fows in year 1,$76,000 in years 2 and 3,5150,000 in year 4, 5101,000 in years 58 : and $90,000 in the last 2 years. When Robert frest pitched a new product idea to his manager, it was very well received because he did such a thorough job of researching and analyzing it. He presented a combrehensive forecast that induded both possible and probable levels of returns to be earned from this imvestment. As a result, the company handed over the money and put Robert in charge of the project. The compary planned to evaluate the imestment based on his "probable" forecast. One year into the prolect, money started getting tight in other divisions of the company. Pressure was on for Robert to provide some proot that this 3 year investment was starting to work. As of the end of that first year, $11,800 in operating costs and $11.800 in new operating cash inflows (both reflect after-taxamounts) had been realized. Robert had collected the following information but clearly still only had projections for the remaining 2 years of this project. Click here to view the factor table (a) What was Robert's initial projection for the NPV of the cash flows at this probable level of activity, assuming an 9/k discount rate? Tax effects, including any depreciation tax shield, have already been accounted for in the above amounts, (Round present value factor colculations to 5 decimal places, e. 1.25124 and final answer to 2 decimal ploces eg. 5.125.36. Enter negative amounts using either a negotive sign preceding the number es. -45 ar porentheses eg. (45)) Nash Siovdlving Co, is owned by Nick and Amber. Business has been booming as baby boomers want to prove their moxie, and the younger generations want to post crary pictures on sociat medla. So Nick and Amber are planning to purchase a second plane. Here Me the specs: The ownerswould use this plane for 10 years, at which point they would sell it and try to replaceit with a newer model. They estimate the salvage value to be $69,000 at that time. The company's tax rate is 20% (a) O Your answer is pactiallycorrect. Determine the ARR for Nash Skydiving Co. for the frit year with this new plane in service. (kound dnwwer to 2 decinal glaces, es. Scarlett is considering the purchase of a new Welf gas range by Sub-Zero Group. Ine to incre ase the quality of the food served in her restaurant. It will also enhance the cooking exper lence for har and her chets as they won't have to fuss with the finicky electric bumers they currently use. However, the aewrange is expenaive It wili cost 59.970 to byry and properly install On the upside, it should last for at least 7 years, at Which time Scarlett may consider trading it in for another new range. While her operating costs will mot decrease as a result of this purchase, Scarlett will be able to eenerate additional gross margin of at leant 51,520 in the first year. After that, she expects the additional gross margin to grow by 10 each year for the noxt 4 yearh at which polnt it will become stable for the remaioder of the 7 year life. She believes the new rance will be worth 5990 at the end of this 7 -year period. Her current range can be salvaged today for 5250. Clickhere to view the factor table (3) Calculate the dikcounted payback period for this range (using before tax cash flom), assuming Scarlett s cost of capital averages 6 K. (Round present wolue factor calculotions to 5 decimal ploces, es. 1.25124 ond final anaver to 2 dreimal ploces es. 15.25) 5andra Shrills is considering an expengion of one of its exitting buildings to add more manufacturing space for its idid-fruenely foisenakers several possible scenarios axist for future cash flows as follows 1. Construction coits of $504,000 isteady sales and costs each year, netting to an annual operating cash infiow of $71.000; the expansion would have no salrage value at the end of its 10 year useful life lthe building would be repurposed for a ditferent. product) 2. Constructioncosts of $504,000 ricing and then falling net cach fiows each vear for 10 years as follewe: $50,000 foe the firs? 2 and last 2 years, $175,000 for years 35, and $99000 for years 68 3. Constructioncosts of $706,000, no cash fows in year 1,$76,000 in years 2 and 3,5150,000 in year 4, 5101,000 in years 58 : and $90,000 in the last 2 years. When Robert frest pitched a new product idea to his manager, it was very well received because he did such a thorough job of researching and analyzing it. He presented a combrehensive forecast that induded both possible and probable levels of returns to be earned from this imvestment. As a result, the company handed over the money and put Robert in charge of the project. The compary planned to evaluate the imestment based on his "probable" forecast. One year into the prolect, money started getting tight in other divisions of the company. Pressure was on for Robert to provide some proot that this 3 year investment was starting to work. As of the end of that first year, $11,800 in operating costs and $11.800 in new operating cash inflows (both reflect after-taxamounts) had been realized. Robert had collected the following information but clearly still only had projections for the remaining 2 years of this project. Click here to view the factor table (a) What was Robert's initial projection for the NPV of the cash flows at this probable level of activity, assuming an 9/k discount rate? Tax effects, including any depreciation tax shield, have already been accounted for in the above amounts, (Round present value factor colculations to 5 decimal places, e. 1.25124 and final answer to 2 decimal ploces eg. 5.125.36. Enter negative amounts using either a negotive sign preceding the number es. -45 ar porentheses eg. (45))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started