Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on #10 and below. Bill's Photos buys a truck on 4/1/2000 for the business. The cost is 150,000 and they expect to use

Need help on #10 and below.

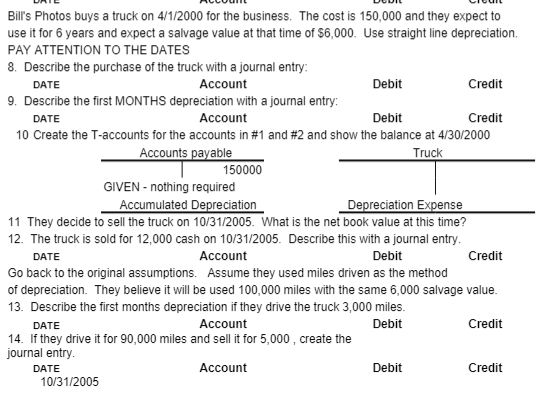

Bill's Photos buys a truck on 4/1/2000 for the business. The cost is 150,000 and they expect to use it for 6 years and expect a salvage value at that time of $6,000. Use straight line depreciation. PAY ATTENTION TO THE DATES 8. Describe the purchase of the truck with a journal entry: DATE Account Debit Credit 9. Describe the first MONTHS depreciation with a journal entry: DATE Account Debit Credit 10 Create the T-accounts for the accounts in #1 and #2 and show the balance at 4/30/2000 Accounts payable Truck 150000 GIVEN - nothing required Accumulated Depreciation Depreciation Expense 11 They decide to sell the truck on 10/31/2005. What is the net book value at this time? 12. The truck is sold for 12,000 cash on 10/31/2005. Describe this with a journal entry. DATE Account Debit Credit Go back to the original assumptions. Assume they used miles driven as the method of depreciation. They believe it will be used 100,000 miles with the same 6,000 salvage value. 13. Describe the first months depreciation if they drive the truck 3,000 miles. DATE Account Debit Credit 14. If they drive it for 90,000 miles and sell it for 5,000, create the journal entry. DATE Account Debit Credit 10/31/2005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started