Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on 19, 20, 21 You have been provided with the following information with respect to the capital structure of a plastic manufacturing plant:

need help on 19, 20, 21

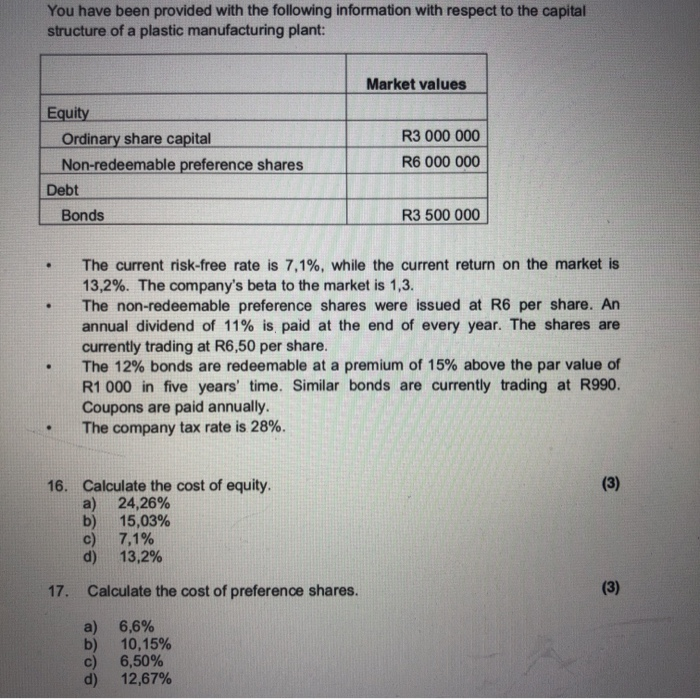

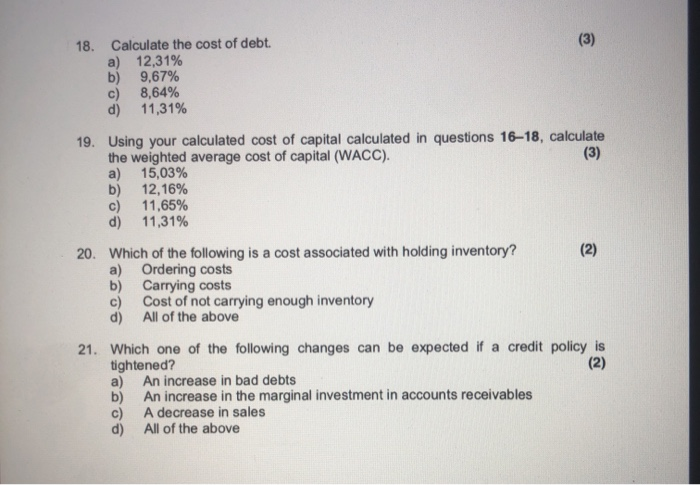

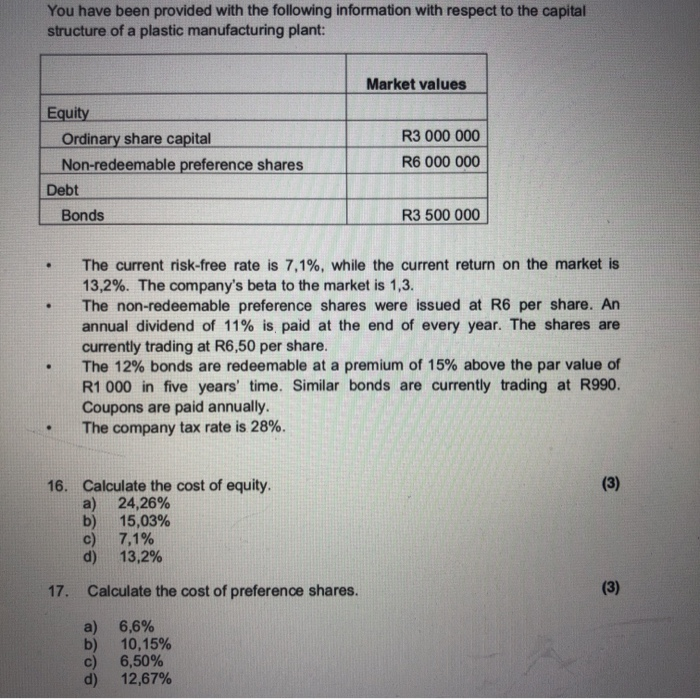

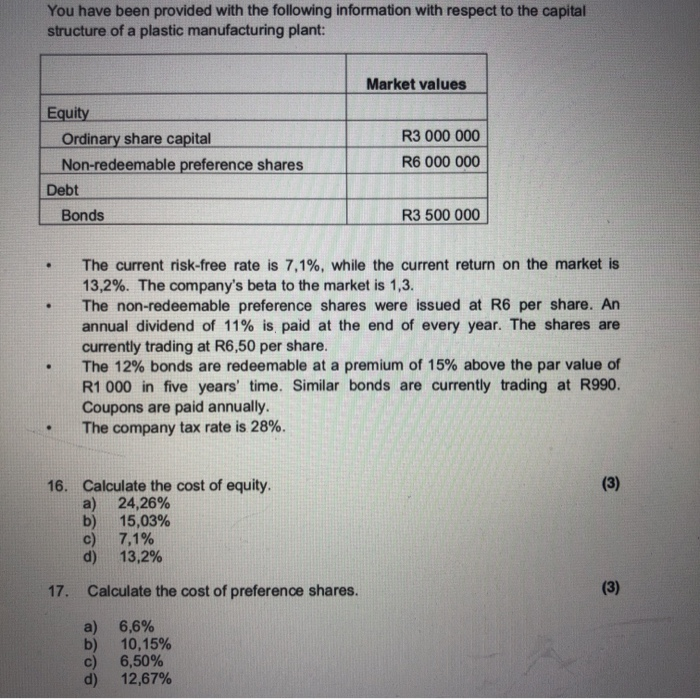

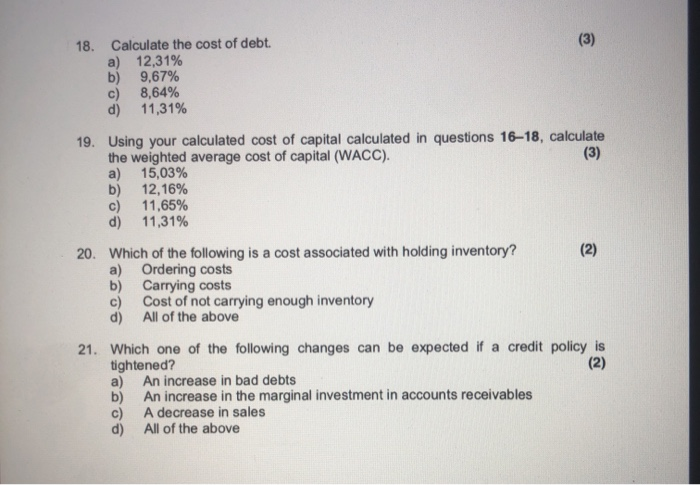

You have been provided with the following information with respect to the capital structure of a plastic manufacturing plant: Market values Equity Ordinary share capital Non-redeemable preference shares Debt Bonds R3 000 000 R6 000 000 R3 500 000 . The current risk-free rate is 7,1%, while the current return on the market is 13,2%. The company's beta to the market is 1,3. The non-redeemable preference shares were issued at R6 per share. An annual dividend of 11% is paid at the end of every year. The shares are currently trading at R6,50 per share. The 12% bonds are redeemable at a premium of 15% above the par value of R1 000 in five years' time. Similar bonds are currently trading at R990. Coupons are paid annually. The company tax rate is 28%. (3) 16. Calculate the cost of equity. a) 24,26% b) 15,03% c) 7,1% d) 13,2% 17. Calculate the cost of preference shares. (3) a) b) c) d) 6,6% 10,15% 6,50% 12,67% (3) 18. Calculate the cost of debt. a) 12,31% b) 9,67% c) 8,64% d) 11,31% 19. Using your calculated cost of capital calculated in questions 16-18, calculate the weighted average cost of capital (WACC). (3) a) 15,03% b) 12,16% c) 11,65% d) 11,31% 20. Which of the following is a cost associated with holding inventory? (2) a) Ordering costs b) Carrying costs c) Cost of not carrying enough inventory d) All of the above 21. Which one of the following changes can be expected if a credit policy is tightened? (2) a) An increase in bad debts b) An increase in the marginal investment in accounts receivables c) A decrease in sales d) All of the above You have been provided with the following information with respect to the capital structure of a plastic manufacturing plant: Market values Equity Ordinary share capital Non-redeemable preference shares Debt Bonds R3 000 000 R6 000 000 R3 500 000 . The current risk-free rate is 7,1%, while the current return on the market is 13,2%. The company's beta to the market is 1,3. The non-redeemable preference shares were issued at R6 per share. An annual dividend of 11% is paid at the end of every year. The shares are currently trading at R6,50 per share. The 12% bonds are redeemable at a premium of 15% above the par value of R1 000 in five years' time. Similar bonds are currently trading at R990. Coupons are paid annually. The company tax rate is 28%. (3) 16. Calculate the cost of equity. a) 24,26% b) 15,03% c) 7,1% d) 13,2% 17. Calculate the cost of preference shares. (3) a) b) c) d) 6,6% 10,15% 6,50% 12,67% (3) 18. Calculate the cost of debt. a) 12,31% b) 9,67% c) 8,64% d) 11,31% 19. Using your calculated cost of capital calculated in questions 16-18, calculate the weighted average cost of capital (WACC). (3) a) 15,03% b) 12,16% c) 11,65% d) 11,31% 20. Which of the following is a cost associated with holding inventory? (2) a) Ordering costs b) Carrying costs c) Cost of not carrying enough inventory d) All of the above 21. Which one of the following changes can be expected if a credit policy is tightened? (2) a) An increase in bad debts b) An increase in the marginal investment in accounts receivables c) A decrease in sales d) All of the above

You have been provided with the following information with respect to the capital structure of a plastic manufacturing plant: Market values Equity Ordinary share capital Non-redeemable preference shares Debt Bonds R3 000 000 R6 000 000 R3 500 000 . The current risk-free rate is 7,1%, while the current return on the market is 13,2%. The company's beta to the market is 1,3. The non-redeemable preference shares were issued at R6 per share. An annual dividend of 11% is paid at the end of every year. The shares are currently trading at R6,50 per share. The 12% bonds are redeemable at a premium of 15% above the par value of R1 000 in five years' time. Similar bonds are currently trading at R990. Coupons are paid annually. The company tax rate is 28%. (3) 16. Calculate the cost of equity. a) 24,26% b) 15,03% c) 7,1% d) 13,2% 17. Calculate the cost of preference shares. (3) a) b) c) d) 6,6% 10,15% 6,50% 12,67% (3) 18. Calculate the cost of debt. a) 12,31% b) 9,67% c) 8,64% d) 11,31% 19. Using your calculated cost of capital calculated in questions 16-18, calculate the weighted average cost of capital (WACC). (3) a) 15,03% b) 12,16% c) 11,65% d) 11,31% 20. Which of the following is a cost associated with holding inventory? (2) a) Ordering costs b) Carrying costs c) Cost of not carrying enough inventory d) All of the above 21. Which one of the following changes can be expected if a credit policy is tightened? (2) a) An increase in bad debts b) An increase in the marginal investment in accounts receivables c) A decrease in sales d) All of the above You have been provided with the following information with respect to the capital structure of a plastic manufacturing plant: Market values Equity Ordinary share capital Non-redeemable preference shares Debt Bonds R3 000 000 R6 000 000 R3 500 000 . The current risk-free rate is 7,1%, while the current return on the market is 13,2%. The company's beta to the market is 1,3. The non-redeemable preference shares were issued at R6 per share. An annual dividend of 11% is paid at the end of every year. The shares are currently trading at R6,50 per share. The 12% bonds are redeemable at a premium of 15% above the par value of R1 000 in five years' time. Similar bonds are currently trading at R990. Coupons are paid annually. The company tax rate is 28%. (3) 16. Calculate the cost of equity. a) 24,26% b) 15,03% c) 7,1% d) 13,2% 17. Calculate the cost of preference shares. (3) a) b) c) d) 6,6% 10,15% 6,50% 12,67% (3) 18. Calculate the cost of debt. a) 12,31% b) 9,67% c) 8,64% d) 11,31% 19. Using your calculated cost of capital calculated in questions 16-18, calculate the weighted average cost of capital (WACC). (3) a) 15,03% b) 12,16% c) 11,65% d) 11,31% 20. Which of the following is a cost associated with holding inventory? (2) a) Ordering costs b) Carrying costs c) Cost of not carrying enough inventory d) All of the above 21. Which one of the following changes can be expected if a credit policy is tightened? (2) a) An increase in bad debts b) An increase in the marginal investment in accounts receivables c) A decrease in sales d) All of the above

need help on 19, 20, 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started