Answered step by step

Verified Expert Solution

Question

1 Approved Answer

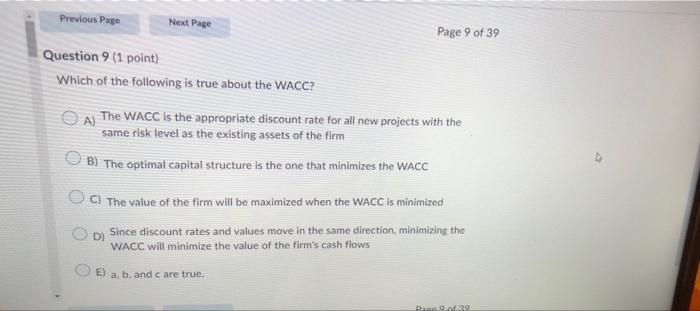

need help on 9 and 10 Previous Page Next Page Page 9 of 39 Question 9 (1 point) Which of the following is true about

need help on 9 and 10

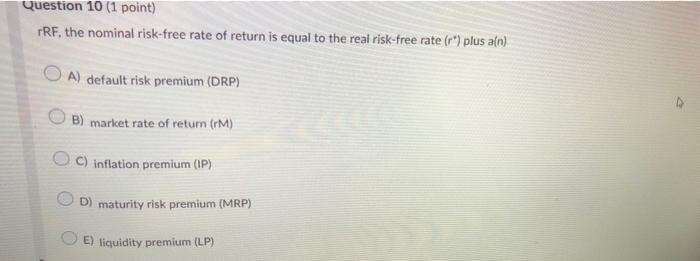

Previous Page Next Page Page 9 of 39 Question 9 (1 point) Which of the following is true about the WACC? A) The WACC is the appropriate discount rate for all new projects with the same risk level as the existing assets of the firm B) The optimal capital structure is the one that minimizes the WACC C) The value of the firm will be maximized when the WACC is minimized D) Since discount rates and values move in the same direction, minimizing the WACC will minimize the value of the firm's cash flows E) a, b, and c are true. Page 2 of 39 Question 10 (1 point) rRF, the nominal risk-free rate of return is equal to the real risk-free rate (r") plus a[n) OA) default risk premium (DRP) B) market rate of return (rM) OC) inflation premium (IP) D) maturity risk premium (MRP) E) liquidity premium (LP) a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started