NEED HELP ON A CASE STUDY BELOW PLEASE NEED HELP ON A CASE STUDY BELOW PLEASE NEED HELP ON A CASE STUDY BELOW PLEASE NEED HELP ON A CASE STUDY BELOW PLEASE

Big Rock Brewery:

To Invest or Not Invest?

The objective of the case study is to have you demonstrate basic financial statement analysis and communicate your thoughts and ideas in a written report. The financial statements will contain some items which go well-beyond the scope of an introductory accounting course. Examples include finance leases, share-based payments, deferred income taxes, and contributed surplus, all of which appear on the Consolidated Statement of Financial Position (also known as the Balance Sheet). For such items, go back to the basics and identify which type of financial statement element the item relates to is it an asset, liability, or equity item? Remember, a liability represents an obligation that will need to be settled at some point in the future by either transferring assets out of the company or providing goods/services. Dont get caught up in the detail on trying to define & understand these complex items. Should you decide to major in accounting, you will have a more in-depth look at complex items in intermediate and advanced level courses.

The financial statements have also been prepared on a consolidated basis. Dont be intimidated by the terminology all this means is that Big Rock is a parent company to some smaller companies it owns shares in. To make the financial statements useful for decision making, all financial records of both the parent and subsidiary companies have been combined to report the results for the entire economic entity (picture all companies operating together as if it were one large company).

Required:

A friend of yours is interested in purchasing some common shares of Big Rock Brewery Inc. and has asked for your help and advice. In an effort to learn more about the company and assess the overall risk associated with the investment, your friend has prepared some questions that need to be answered.

Prepare a written report that addresses your friends questions and concerns using the headings in bold below. The responses under each of the headings should be in a written paragraph format and provide clear answers/ recommendations to the questions your friend is asking. Where ratio calculations are required, use year-end amounts (rather than averages) as this will enable you to identify trends between the current year and the prior year.

Company Overview

Big Rock is a publicly-traded corporation. If I want to become a shareholder in Big Rock, what advantages does this legal form offer to me?

Who are the other main users of the financial statements? (Hint: Consider how the total assets of Big Rock have been financed other than through shareholder investment.)

Is Big Rock a Merchandiser, Manufacturer, or a Service-Based Company? What indicators exist on the Statement of Financial Position to support your answer?

What types of long-term assets has Big Rock invested in to operate its business?

What risks or competitive pressures would impact Big Rocks operations? Think of industry trends, substitute products, seasonality, and other market forces.

The Consolidated Statement of Comprehensive Income

What is Big Rocks revenue recognition policy?

Is Big Rock profitable? What is quality of earnings? Does Big Rock have quality earnings?

Ive noticed that net sales revenue has increased in total dollars, but Im wondering what Big Rocks profitability looks like when factoring out size due to growth. Ive heard profitability ratios can allow for this. Could you calculate & explain the following ratios to me?

Gross Margin Ratio

Profit Margin Ratio

Return on Equity

Return on Assets

Are the trends favorable or unfavorable? Why? What reasons could have accounted for these changes?

Earnings Per Share (EPS) is disclosed at the bottom of the Statement of Comprehensive Income. What does this mean? Why was the EPS negative?

The Cash Flow Statement

What information does the cash flow statement provide that is different from the Consolidated Statement of Comprehensive Income? And how does this relate to analyzing the quality of earnings of Big Rock?

What type of cash flow pattern does Big Rock have in the current and the prior year? Are there any items of concern that I should be aware of? Or is management doing a good job in handling the cash of the business?

The Consolidated Statement of Financial Position

Calculate and explain the following ratios for the current & the prior year:

Debt Ratio

Equity Ratio

Interest Coverage Ratio

Is the change in each ratio favorable or unfavorable? How does this relate to overall risk with respect to investing in the shares of Big Rock? (Hint: Consider the pros & cons of debt versus equity financing in your discussion.)

In the Equity section of the Statement of Financial Position, I see negative numbers called Accumulated Deficit? What does this mean?

What is liquidity and how is Big Rock doing with its liquidity position this year? Is it better or worse than last year? Calculate and explain the following ratios:

Current Ratio

Quick Ratio

Cash flows from regular operations are dependent on the ability to sell inventory and collect cash on credit sales. How many days on average would it take for Big Rock to sell finished goods inventory and collect cash from credit customers? Calculate and explain the following ratios:

Days to Sell Inventory

Average Collection Period

Note to Students: Use ending balances for receivables and inventory balances instead of average balances. Also, for 14(a), do not include inventory related to raw materials, containers, or brews in progress as only the completed, retail and consignment brews would be sold to customers.

Overall Conclusion

Overall, based on your analysis, should I purchase Big Rock shares? Or is this investment too risky? Explain your reasoning. _______________________________________________________________________________________________________________________________________________ Please refer on the ff ss:

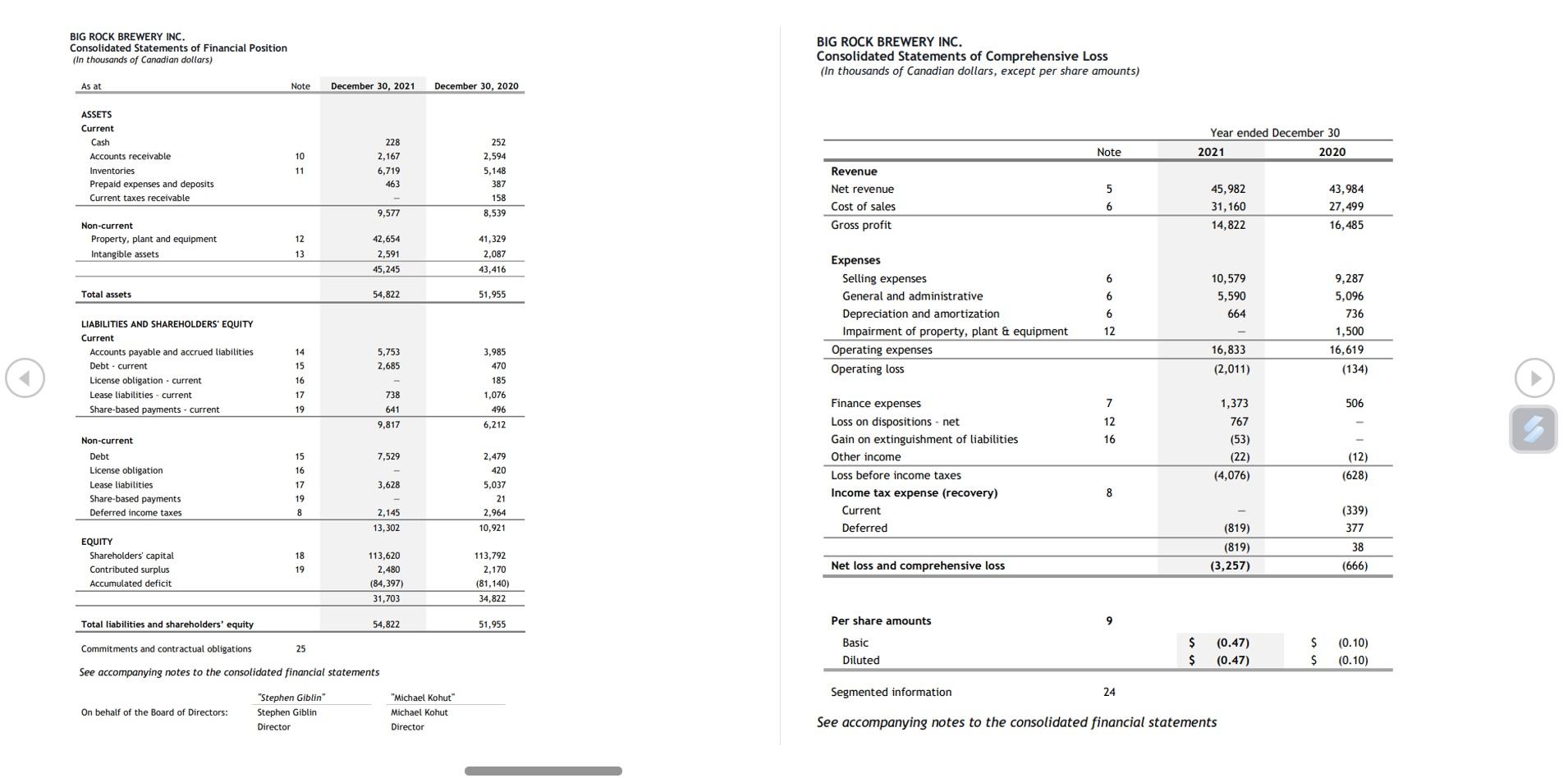

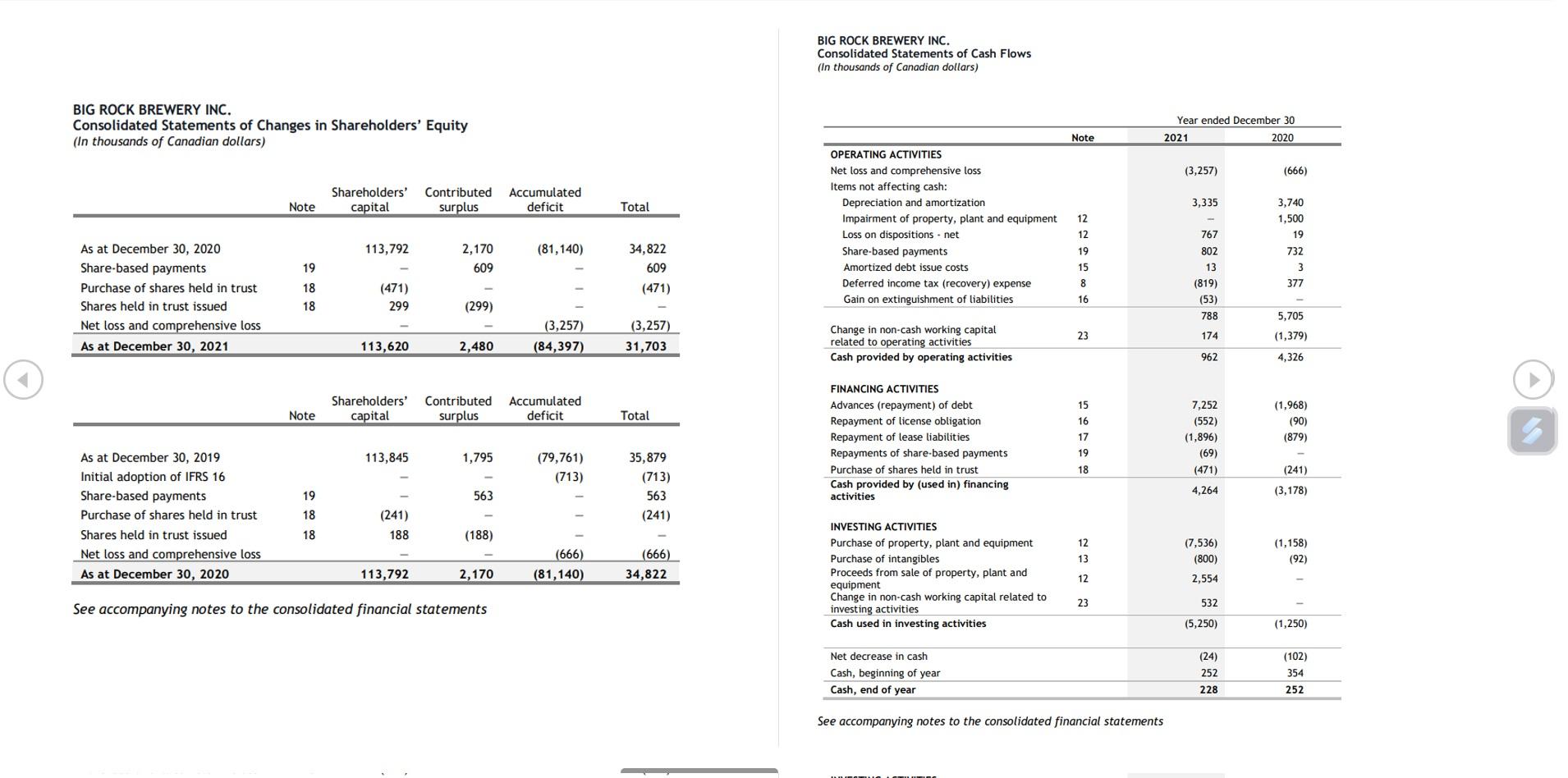

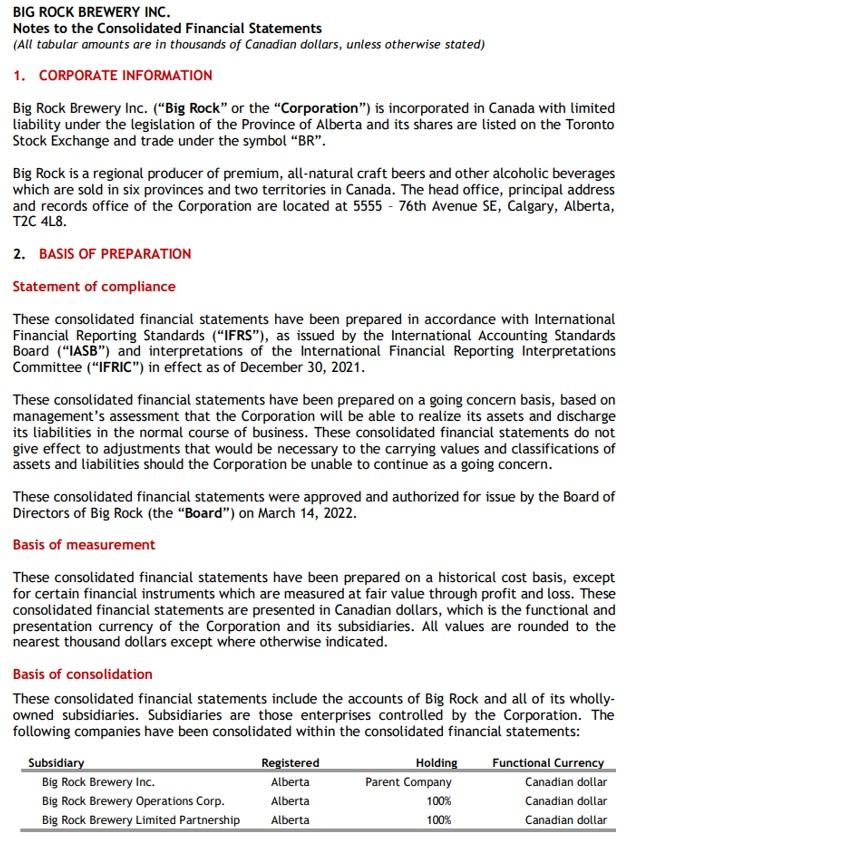

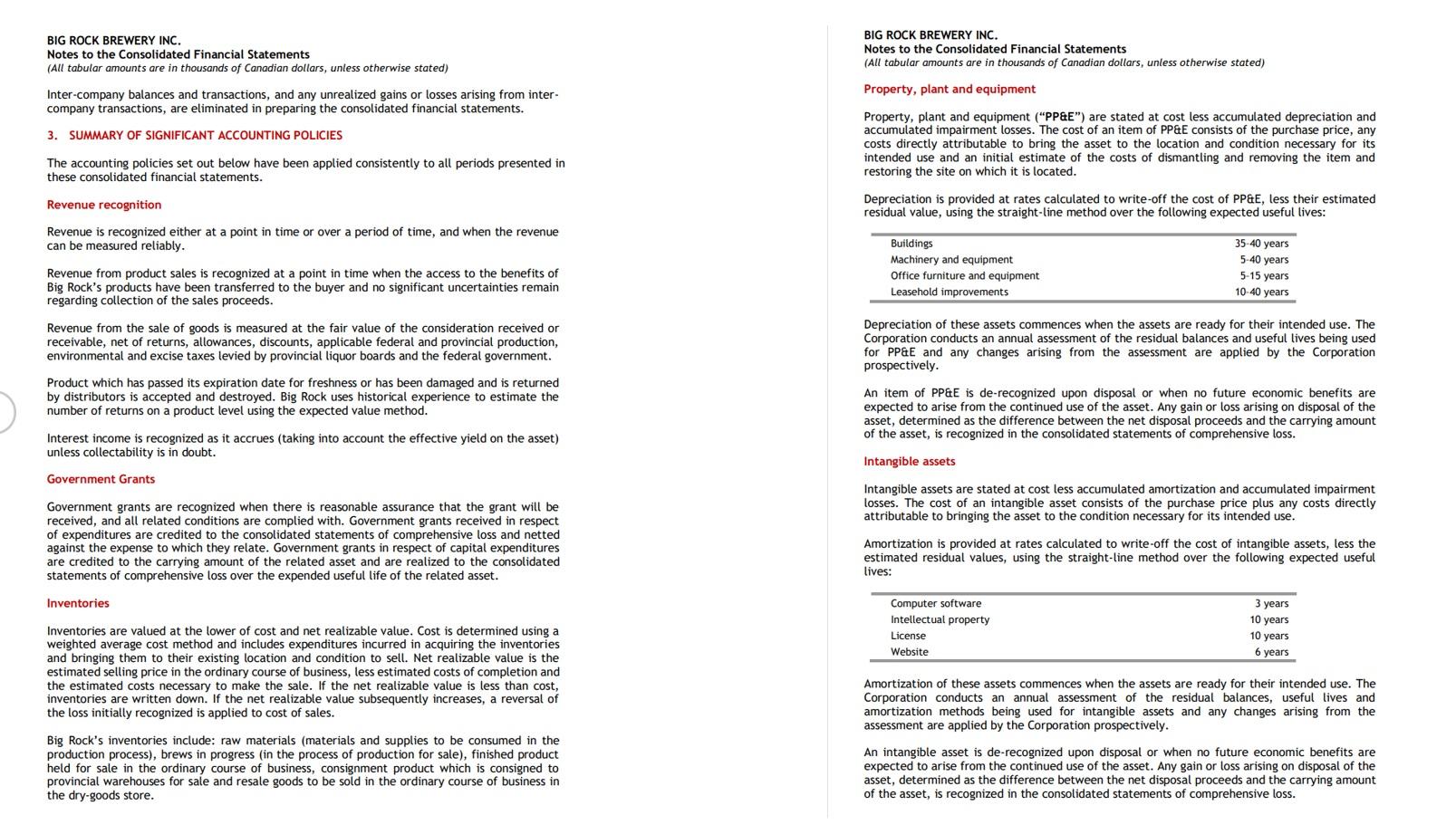

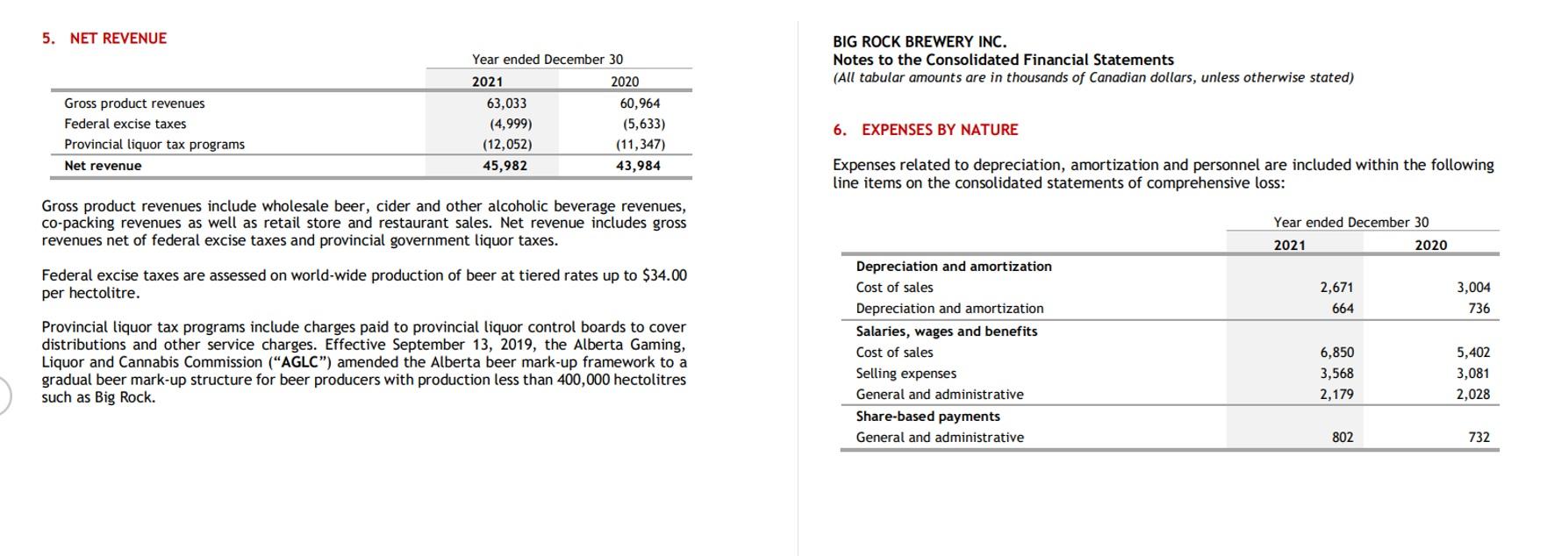

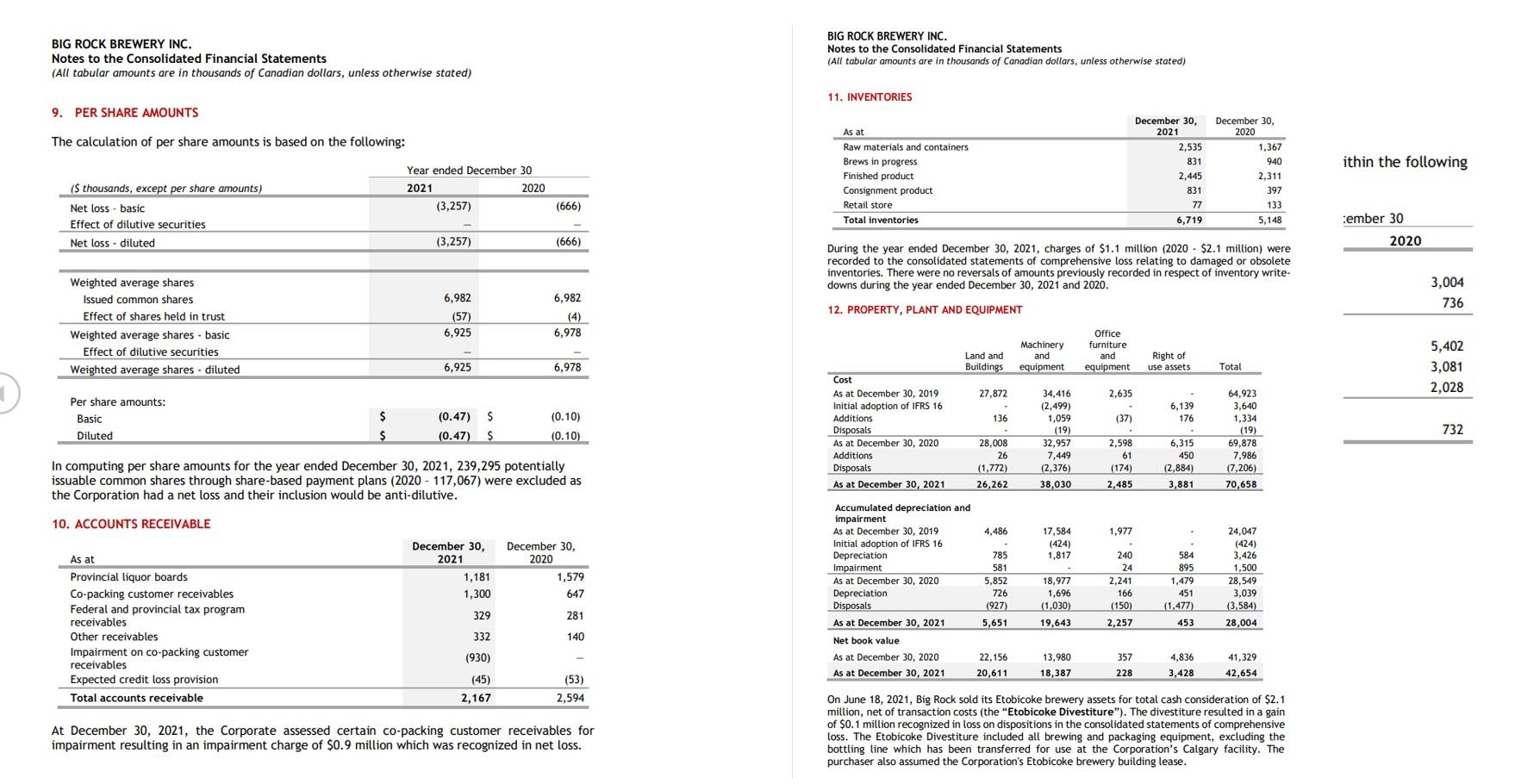

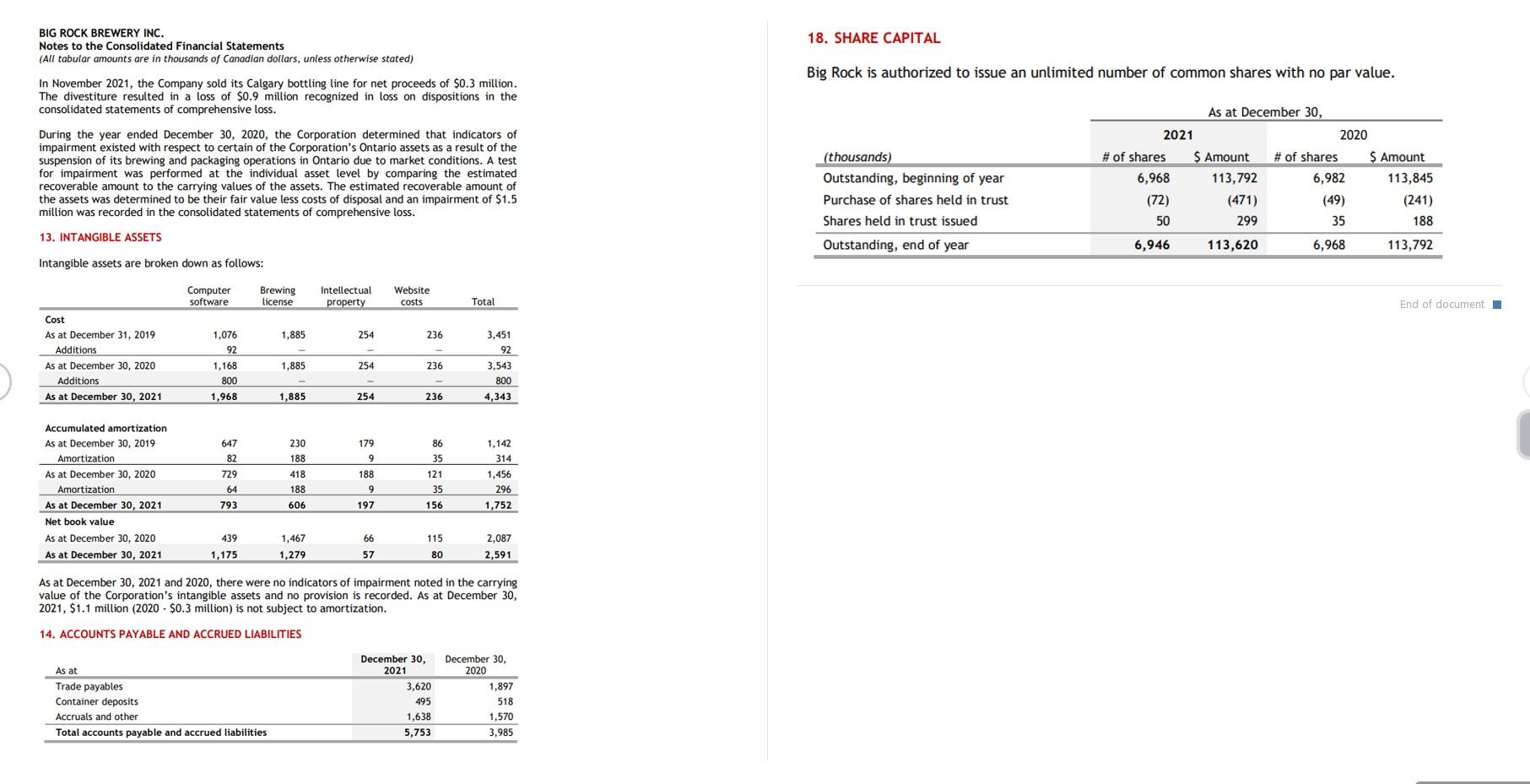

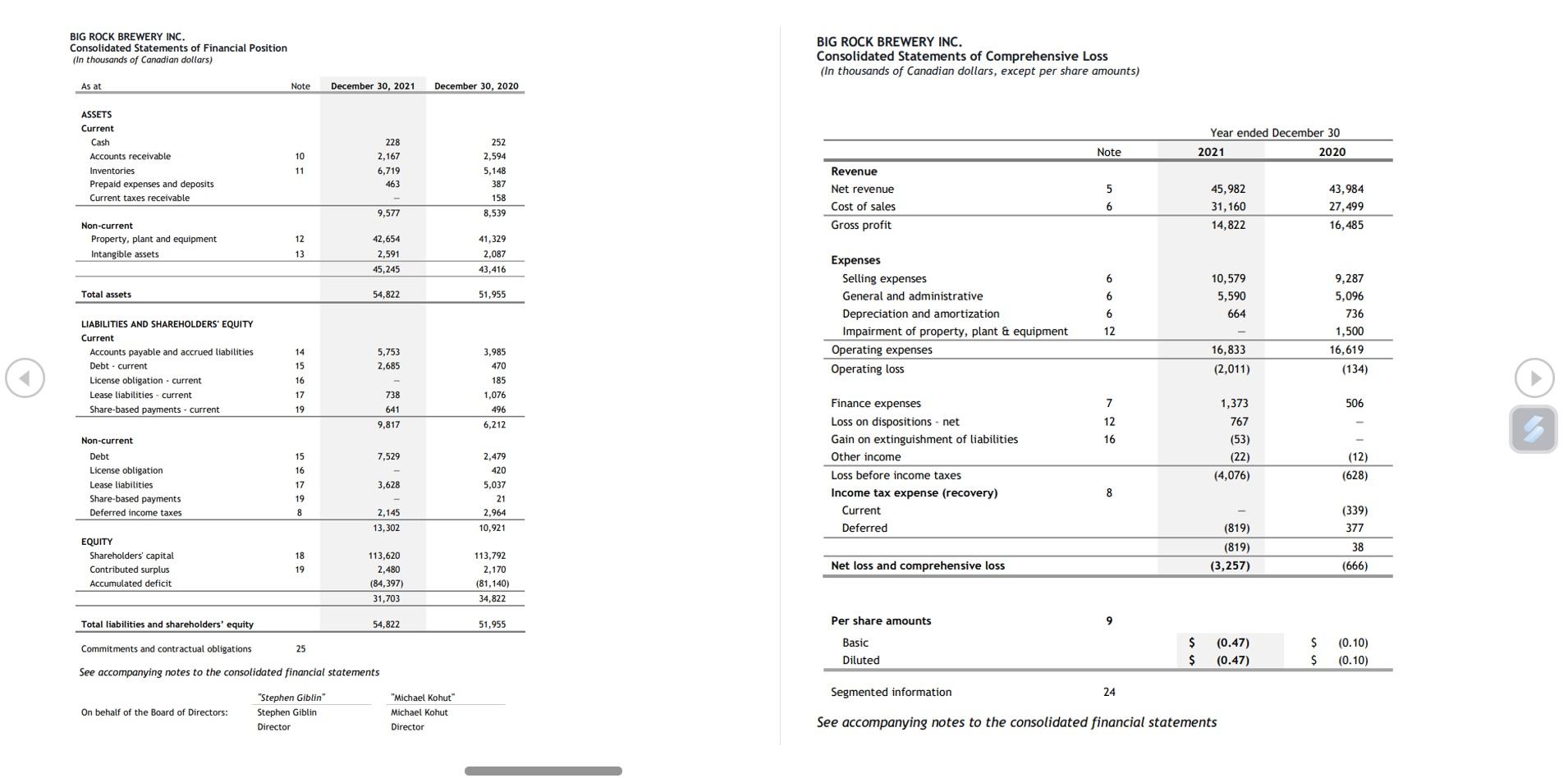

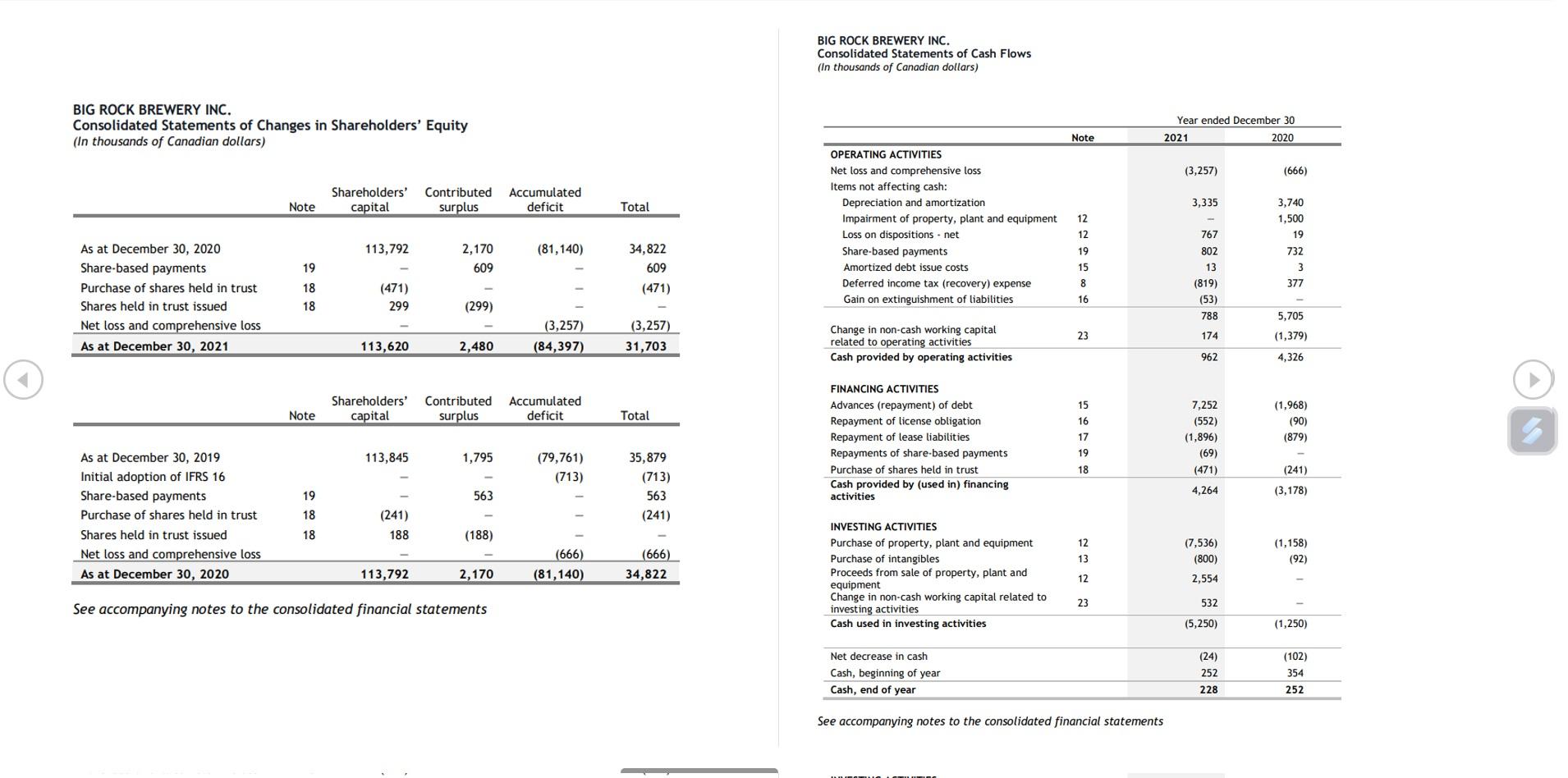

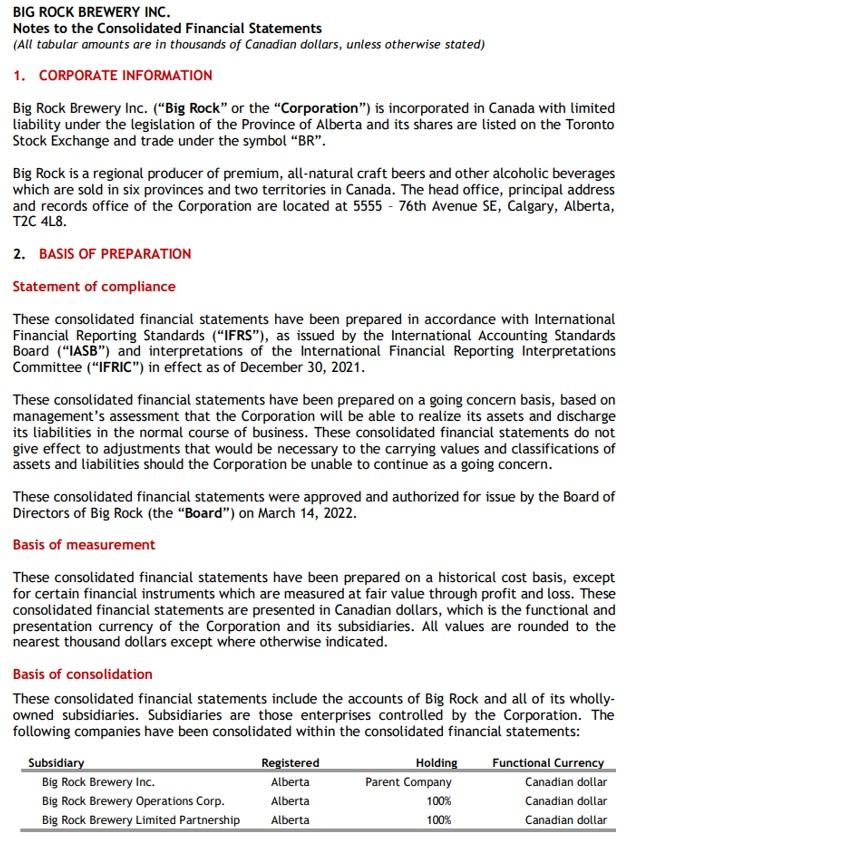

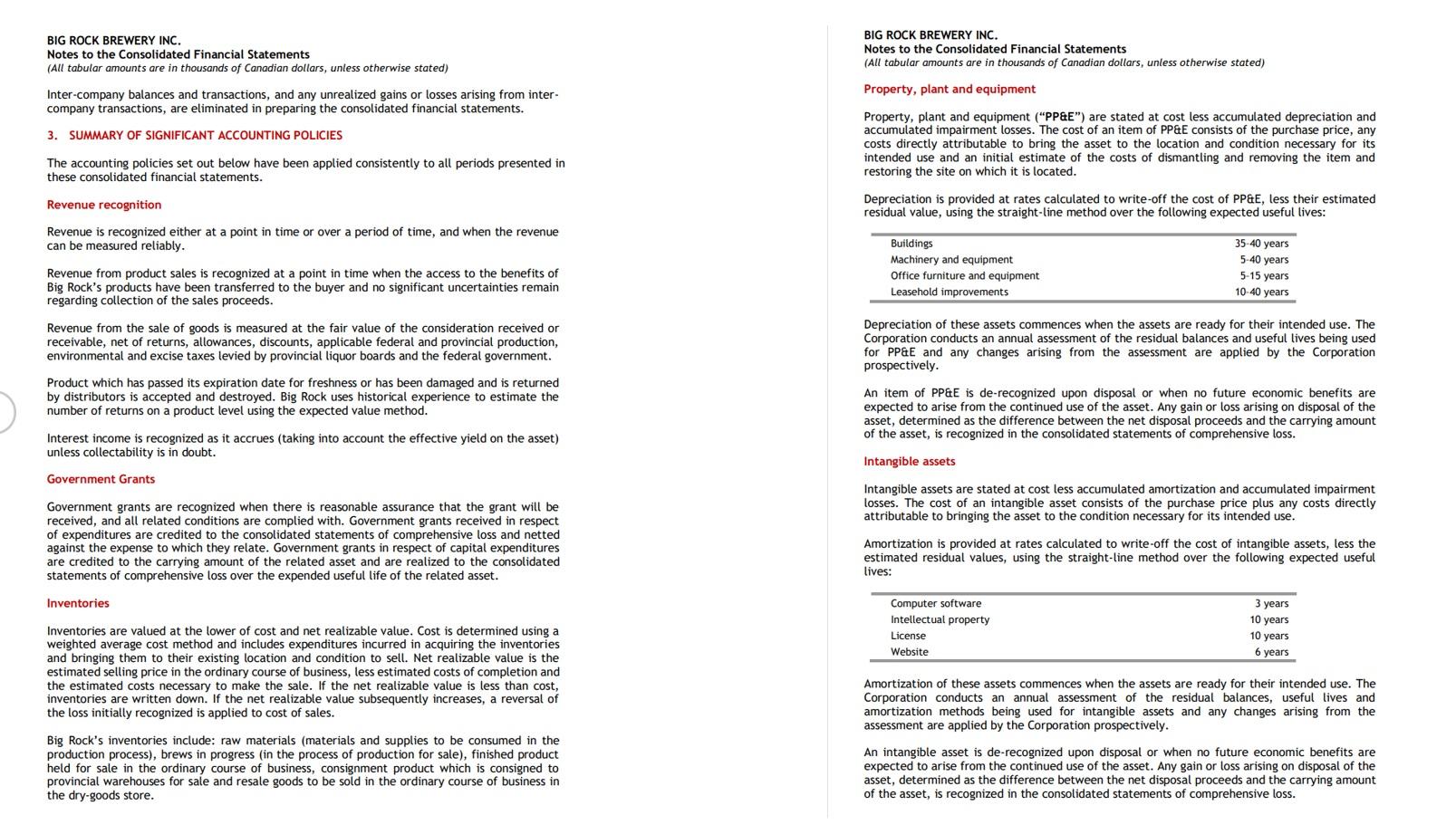

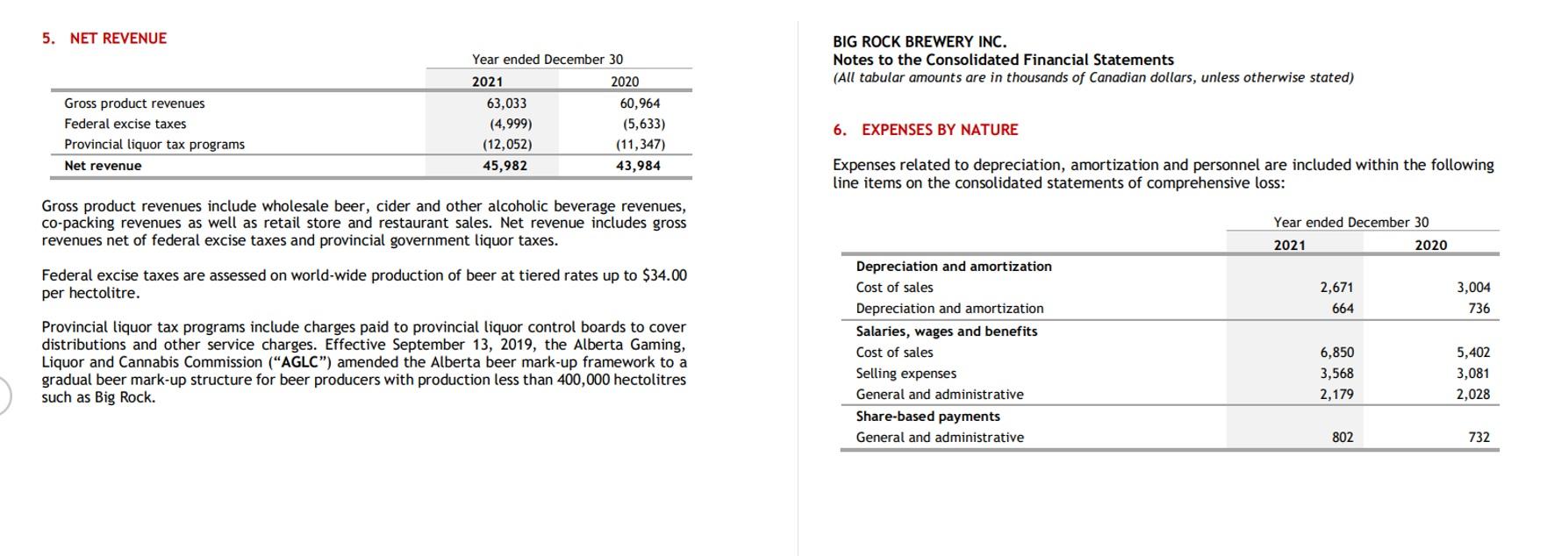

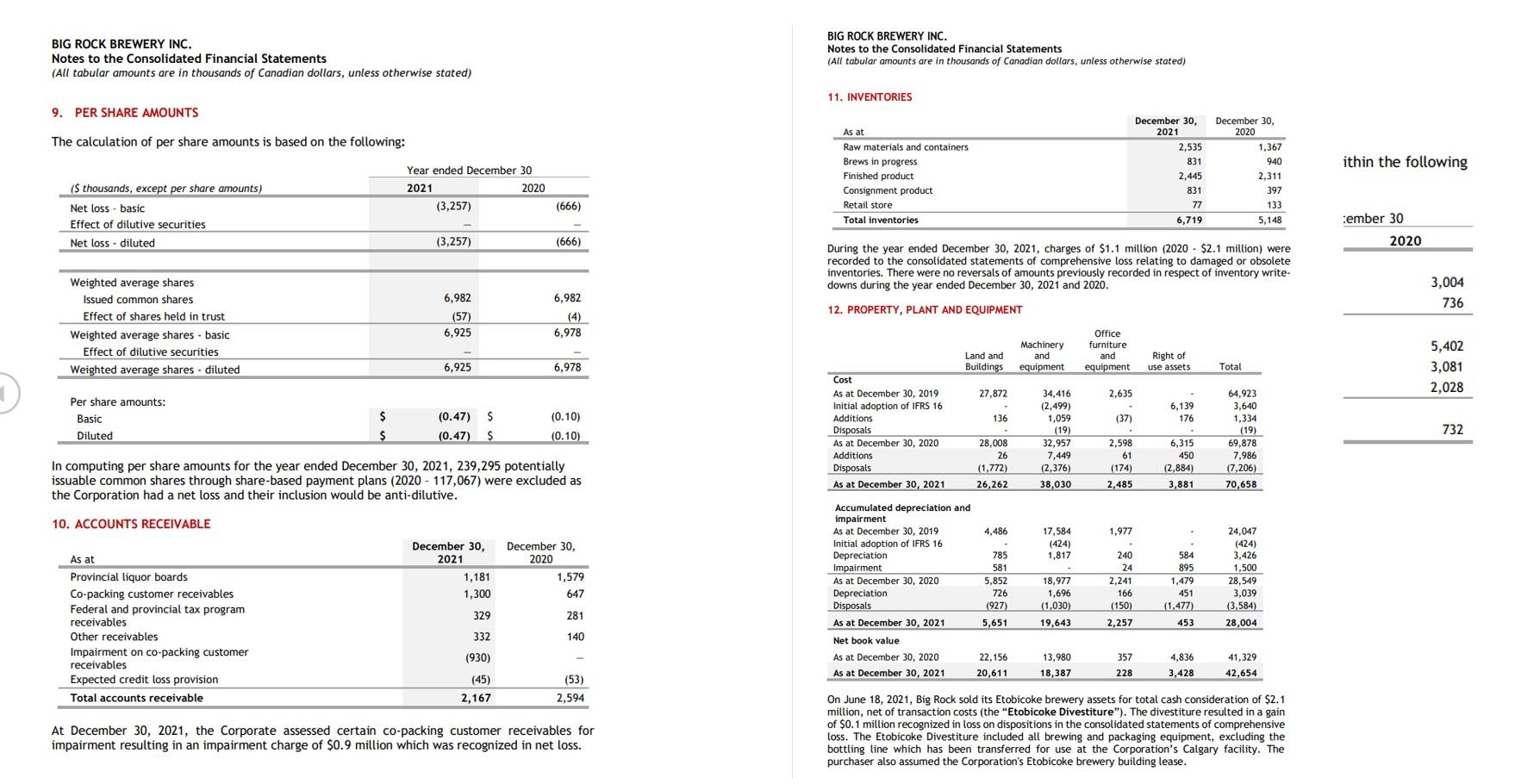

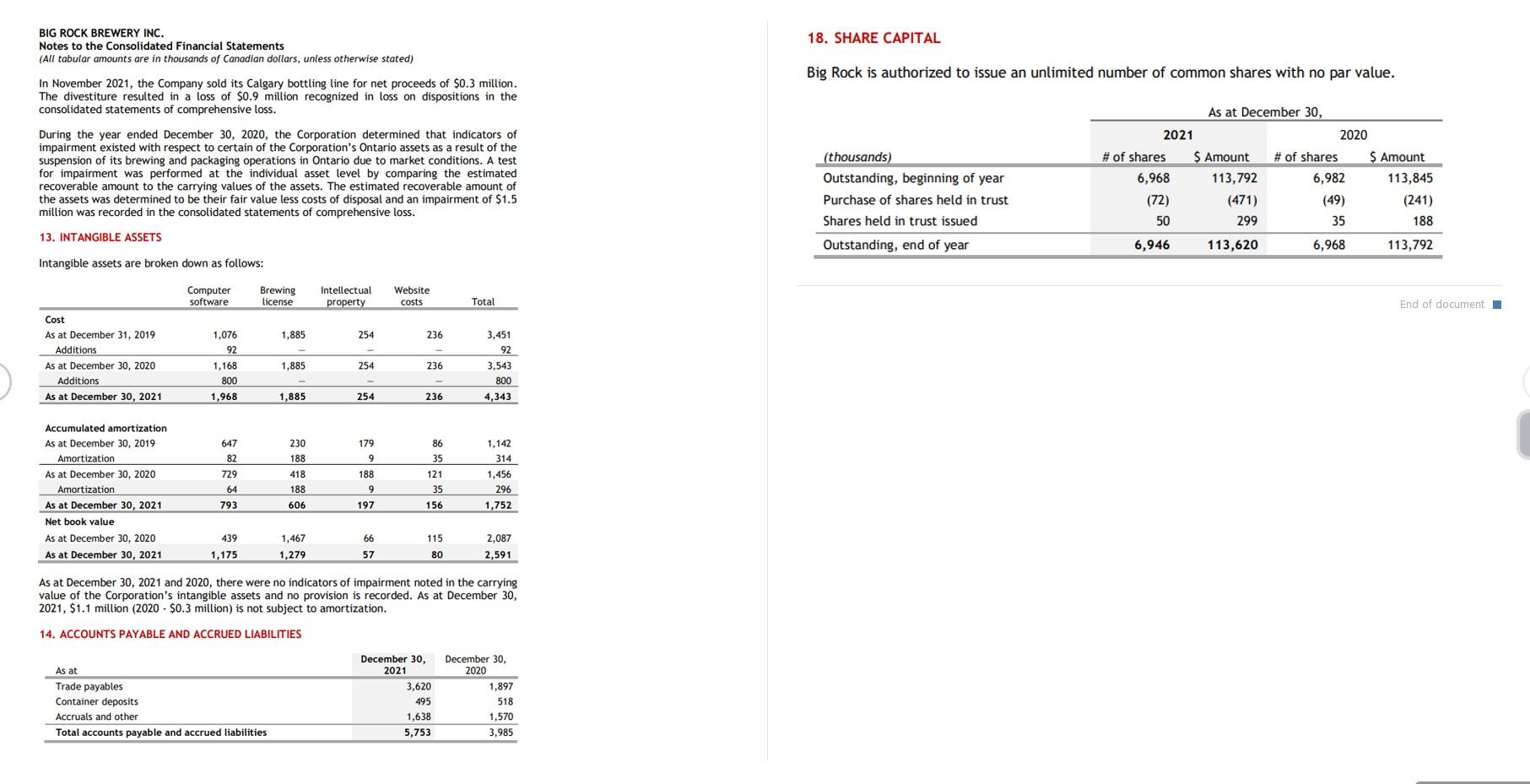

BIG ROCK BREWERY INC. Consolidated Statements of Financial Position BIG ROCK BREWERY INC. Consolidated Statements of Comprehensive Loss (In thousands of Canadian dollars, except per share amounts) Per share amounts 9 Basic Diluted Segmented information 24 See accompanying notes to the consolidated financial statements BIG ROCK BREWERY INC. Consolidated Statements of Cash Flows (In thousands of Canadian dollars) BIG ROCK BREWERY INC. Consolidated Statements of Changes in Shareholders' Equity (In thousands of Canadian dollars) See accompanying notes to the consolidated financial statements See accompanying notes to the consolidated financial statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 1. CORPORATE INFORMATION Big Rock Brewery Inc. ("Big Rock" or the "Corporation") is incorporated in Canada with limited liability under the legislation of the Province of Alberta and its shares are listed on the Toronto Stock Exchange and trade under the symbol "BR". Big Rock is a regional producer of premium, all-natural craft beers and other alcoholic beverages which are sold in six provinces and two territories in Canada. The head office, principal address and records office of the Corporation are located at 5555 - 76th Avenue SE, Calgary, Alberta, T2C 4L8. 2. BASIS OF PREPARATION Statement of compliance These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board ("IASB") and interpretations of the International Financial Reporting Interpretations Committee ("IFRIC") in effect as of December 30, 2021. These consolidated financial statements have been prepared on a going concern basis, based on management's assessment that the Corporation will be able to realize its assets and discharge its liabilities in the normal course of business. These consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classifications of assets and liabilities should the Corporation be unable to continue as a going concern. These consolidated financial statements were approved and authorized for issue by the Board of Directors of Big Rock (the "Board") on March 14, 2022. Basis of measurement These consolidated financial statements have been prepared on a historical cost basis, except for certain financial instruments which are measured at fair value through profit and loss. These consolidated financial statements are presented in Canadian dollars, which is the functional and presentation currency of the Corporation and its subsidiaries. All values are rounded to the nearest thousand dollars except where otherwise indicated. Basis of consolidation These consolidated financial statements include the accounts of Big Rock and all of its whollyowned subsidiaries. Subsidiaries are those enterprises controlled by the Corporation. The following companies have been consolidated within the consolidated financial statements: BIG ROCK BREWERY INC. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) Inter-company balances and transactions, and any unrealized gains or losses arising from inter- Property, plant and equipment company transactions, are eliminated in preparing the consolidated financial statements. Property, plant and equipment ("PPE") are stated at cost less accumulated depreciation and 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES accumulated impairment losses. The cost of an item of PPGE consists of the purchase price, any costs directly attributable to bring the asset to the location and condition necessary for its The accounting policies set out below have been applied consistently to all periods presented in intended use and an initial estimate of the costs of dismantling and removing the item and these consolidated financial statements. restoring the site on which it is located. Revenue recognition Depreciation is provided at rates calculated to write-off the cost of PP\&E, less their estimated residual value, using the straight-line method over the following expected useful lives: Revenue is recognized either at a point in time or over a period of time, and when the revenue can be measured reliably. Revenue from product sales is recognized at a point in time when the access to the benefits of Big Rock's products have been transferred to the buyer and no significant uncertainties remain regarding collection of the sales proceeds. Revenue from the sale of goods is measured at the fair value of the consideration received or Depreciation of these assets commences when the assets are ready for their intended use. The receivable, net of returns, allowances, discounts, applicable federal and provincial production, Corporation conducts an annual assessment of the residual balances and useful lives being used environmental and excise taxes levied by provincial liquor boards and the federal government. for PP\&E and any changes arising from the assessment are applied by the Corporation prospectively. Product which has passed its expiration date for freshness or has been damaged and is returned by distributors is accepted and destroyed. Big Rock uses historical experience to estimate the An item of PPAE is de-recognized upon disposal or when no future economic benefits are number of returns on a product level using the expected value method. expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the asset, determined as the difference between the net disposal proceeds and the carrying amount Interest income is recognized as it accrues (taking into account the effective yield on the asset) of the asset, is recognized in the consolidated statements of comprehensive loss. unless collectability is in doubt. Intangible assets Government Grants Intangible assets are stated at cost less accumulated amortization and accumulated impairment Government grants are recognized when there is reasonable assurance that the grant will be losses. The cost of an intangible asset consists of the purchase price plus any costs directly received, and all related conditions are complied with. Government grants received in respect attributable to bringing the asset to the condition necessary for its intended use. of expenditures are credited to the consolidated statements of comprehensive loss and netted against the expense to which they relate. Government grants in respect of capital expenditures Amortization is provided at rates calculated to write-off the cost of intangible assets, less the are credited to the carrying amount of the related asset and are realized to the consolidated estimated residual values, using the straight-line method over the following expected useful statements of comprehensive loss over the expended useful life of the related asset. lives: Inventories Inventories are valued at the lower of cost and net realizable value. Cost is determined using a weighted average cost method and includes expenditures incurred in acquiring the inventories and bringing them to their existing location and condition to sell. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated costs necessary to make the sale. If the net realizable value is less than cost, Amortization of these assets commences when the assets are ready for their intended use. The inventories are written down. If the net realizable value subsequently increases, a reversal of Corporation conducts an annual assessment of the residual balances, useful lives and the loss initially recognized is applied to cost of sales. amortization methods being used for intangible assets and any changes arising from the assessment are applied by the Corporation prospectively. Big Rock's inventories include: raw materials (materials and supplies to be consumed in the production process), brews in progress (in the process of production for sale), finished product An intangible asset is de-recognized upon disposal or when no future economic benefits are held for sale in the ordinary course of business, consignment product which is consigned to expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the provincial warehouses for sale and resale goods to be sold in the ordinary course of business in asset, determined as the difference between the net disposal proceeds and the carrying amount the dry-goods store. of the asset, is recognized in the consolidated statements of comprehensive loss. 5. NET REVENUE BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 6. EXPENSES BY NATURE Expenses related to depreciation, amortization and personnel are included within the following line items on the consolidated statements of comprehensive loss: Gross product revenues include wholesale beer, cider and other alcoholic beverage revenues, co-packing revenues as well as retail store and restaurant sales. Net revenue includes gross revenues net of federal excise taxes and provincial government liquor taxes. Federal excise taxes are assessed on world-wide production of beer at tiered rates up to $34.00 per hectolitre. Provincial liquor tax programs include charges paid to provincial liquor control boards to cover distributions and other service charges. Effective September 13, 2019, the Alberta Gaming, Liquor and Cannabis Commission ("AGLC") amended the Alberta beer mark-up framework to a gradual beer mark-up structure for beer producers with production less than 400,000 hectolitres such as Big Rock. BIG ROCK BREWERY INC. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 11. INVENTORIES 9. PER SHARE AMOUNTS The calculation of per share amounts is based on the following: ithin the following During the year ended December 30, 2021, charges of $1.1 million (2020 - $2.1 million) were recorded to the consolidated statements of comprehensive loss relating to damaged or obsolete downs during the year ended December 30,2021 and 2020. 12. PROPERTY, PLANT AND EQUIPMENT In computing per share amounts for the year ended December 30, 2021, 239,295 potentially issuable common shares through share-based payment plans (2020117,067) were excluded as the Corporation had a net loss and their inclusion would be anti-dilutive. 10. ACCOUNTS RECEIVABLE On June 18, 2021, Big Rock sold its Etobicoke brewery assets for total cash consideration of $2.1 million, net of transaction costs (the "Etobicoke Divestiture"). The divestiture resulted in a gain At December 30, 2021, the Corporate assessed certain co-packing customer receivables for of $0.1 million recognized in loss on dispositions in the consolidated statements of comprehensive impairment resulting in an impairment charge of $0.9 million which was recognized in net loss. loss. The Etobicoke Divestiture included all brewing and packaging equipment, excluding the purchaser also assumed the Corporation's Etobicoke brewery building lease. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements 18. SHARE CAPITAL (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) Big Rock is authorized to issue an unlimited number of common shares with no par value. In November 2021, the Company sold its Calgary bottling line for net proceeds of $0.3 million. The divestiture resulted in a loss of $0.9 million recognized in loss on dispositions in the consolidated statements of comprehensive loss. During the year ended December 30, 2020, the Corporation determined that indicators of impairment existed with respect to certain of the Corporation's Ontario assets as a result of the suspension of its brewing and packaging operations in Ontario due to market conditions. A test for impairment was performed at the individual asset level by comparing the estimated recoverable amount to the carrying values of the assets. The estimated recoverable amount of the assets was determined to be their fair value less costs of disposal and an impairment of $1.5 million was recorded in the consolidated statements of comprehensive loss. 13. INTANGIBLE ASSETS Intangible assets are broken down as follows: As at December 30, 2021 and 2020, there were no indicators of impairment noted in the carrying value of the Corporation's intangible assets and no provision is recorded. As at December 30 , 2021, $1.1 million (2020 - \$0.3 million) is not subject to amortization. 14. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES BIG ROCK BREWERY INC. Consolidated Statements of Financial Position BIG ROCK BREWERY INC. Consolidated Statements of Comprehensive Loss (In thousands of Canadian dollars, except per share amounts) Per share amounts 9 Basic Diluted Segmented information 24 See accompanying notes to the consolidated financial statements BIG ROCK BREWERY INC. Consolidated Statements of Cash Flows (In thousands of Canadian dollars) BIG ROCK BREWERY INC. Consolidated Statements of Changes in Shareholders' Equity (In thousands of Canadian dollars) See accompanying notes to the consolidated financial statements See accompanying notes to the consolidated financial statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 1. CORPORATE INFORMATION Big Rock Brewery Inc. ("Big Rock" or the "Corporation") is incorporated in Canada with limited liability under the legislation of the Province of Alberta and its shares are listed on the Toronto Stock Exchange and trade under the symbol "BR". Big Rock is a regional producer of premium, all-natural craft beers and other alcoholic beverages which are sold in six provinces and two territories in Canada. The head office, principal address and records office of the Corporation are located at 5555 - 76th Avenue SE, Calgary, Alberta, T2C 4L8. 2. BASIS OF PREPARATION Statement of compliance These consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board ("IASB") and interpretations of the International Financial Reporting Interpretations Committee ("IFRIC") in effect as of December 30, 2021. These consolidated financial statements have been prepared on a going concern basis, based on management's assessment that the Corporation will be able to realize its assets and discharge its liabilities in the normal course of business. These consolidated financial statements do not give effect to adjustments that would be necessary to the carrying values and classifications of assets and liabilities should the Corporation be unable to continue as a going concern. These consolidated financial statements were approved and authorized for issue by the Board of Directors of Big Rock (the "Board") on March 14, 2022. Basis of measurement These consolidated financial statements have been prepared on a historical cost basis, except for certain financial instruments which are measured at fair value through profit and loss. These consolidated financial statements are presented in Canadian dollars, which is the functional and presentation currency of the Corporation and its subsidiaries. All values are rounded to the nearest thousand dollars except where otherwise indicated. Basis of consolidation These consolidated financial statements include the accounts of Big Rock and all of its whollyowned subsidiaries. Subsidiaries are those enterprises controlled by the Corporation. The following companies have been consolidated within the consolidated financial statements: BIG ROCK BREWERY INC. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) Inter-company balances and transactions, and any unrealized gains or losses arising from inter- Property, plant and equipment company transactions, are eliminated in preparing the consolidated financial statements. Property, plant and equipment ("PPE") are stated at cost less accumulated depreciation and 3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES accumulated impairment losses. The cost of an item of PPGE consists of the purchase price, any costs directly attributable to bring the asset to the location and condition necessary for its The accounting policies set out below have been applied consistently to all periods presented in intended use and an initial estimate of the costs of dismantling and removing the item and these consolidated financial statements. restoring the site on which it is located. Revenue recognition Depreciation is provided at rates calculated to write-off the cost of PP\&E, less their estimated residual value, using the straight-line method over the following expected useful lives: Revenue is recognized either at a point in time or over a period of time, and when the revenue can be measured reliably. Revenue from product sales is recognized at a point in time when the access to the benefits of Big Rock's products have been transferred to the buyer and no significant uncertainties remain regarding collection of the sales proceeds. Revenue from the sale of goods is measured at the fair value of the consideration received or Depreciation of these assets commences when the assets are ready for their intended use. The receivable, net of returns, allowances, discounts, applicable federal and provincial production, Corporation conducts an annual assessment of the residual balances and useful lives being used environmental and excise taxes levied by provincial liquor boards and the federal government. for PP\&E and any changes arising from the assessment are applied by the Corporation prospectively. Product which has passed its expiration date for freshness or has been damaged and is returned by distributors is accepted and destroyed. Big Rock uses historical experience to estimate the An item of PPAE is de-recognized upon disposal or when no future economic benefits are number of returns on a product level using the expected value method. expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the asset, determined as the difference between the net disposal proceeds and the carrying amount Interest income is recognized as it accrues (taking into account the effective yield on the asset) of the asset, is recognized in the consolidated statements of comprehensive loss. unless collectability is in doubt. Intangible assets Government Grants Intangible assets are stated at cost less accumulated amortization and accumulated impairment Government grants are recognized when there is reasonable assurance that the grant will be losses. The cost of an intangible asset consists of the purchase price plus any costs directly received, and all related conditions are complied with. Government grants received in respect attributable to bringing the asset to the condition necessary for its intended use. of expenditures are credited to the consolidated statements of comprehensive loss and netted against the expense to which they relate. Government grants in respect of capital expenditures Amortization is provided at rates calculated to write-off the cost of intangible assets, less the are credited to the carrying amount of the related asset and are realized to the consolidated estimated residual values, using the straight-line method over the following expected useful statements of comprehensive loss over the expended useful life of the related asset. lives: Inventories Inventories are valued at the lower of cost and net realizable value. Cost is determined using a weighted average cost method and includes expenditures incurred in acquiring the inventories and bringing them to their existing location and condition to sell. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated costs necessary to make the sale. If the net realizable value is less than cost, Amortization of these assets commences when the assets are ready for their intended use. The inventories are written down. If the net realizable value subsequently increases, a reversal of Corporation conducts an annual assessment of the residual balances, useful lives and the loss initially recognized is applied to cost of sales. amortization methods being used for intangible assets and any changes arising from the assessment are applied by the Corporation prospectively. Big Rock's inventories include: raw materials (materials and supplies to be consumed in the production process), brews in progress (in the process of production for sale), finished product An intangible asset is de-recognized upon disposal or when no future economic benefits are held for sale in the ordinary course of business, consignment product which is consigned to expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the provincial warehouses for sale and resale goods to be sold in the ordinary course of business in asset, determined as the difference between the net disposal proceeds and the carrying amount the dry-goods store. of the asset, is recognized in the consolidated statements of comprehensive loss. 5. NET REVENUE BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 6. EXPENSES BY NATURE Expenses related to depreciation, amortization and personnel are included within the following line items on the consolidated statements of comprehensive loss: Gross product revenues include wholesale beer, cider and other alcoholic beverage revenues, co-packing revenues as well as retail store and restaurant sales. Net revenue includes gross revenues net of federal excise taxes and provincial government liquor taxes. Federal excise taxes are assessed on world-wide production of beer at tiered rates up to $34.00 per hectolitre. Provincial liquor tax programs include charges paid to provincial liquor control boards to cover distributions and other service charges. Effective September 13, 2019, the Alberta Gaming, Liquor and Cannabis Commission ("AGLC") amended the Alberta beer mark-up framework to a gradual beer mark-up structure for beer producers with production less than 400,000 hectolitres such as Big Rock. BIG ROCK BREWERY INC. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements Notes to the Consolidated Financial Statements (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) 11. INVENTORIES 9. PER SHARE AMOUNTS The calculation of per share amounts is based on the following: ithin the following During the year ended December 30, 2021, charges of $1.1 million (2020 - $2.1 million) were recorded to the consolidated statements of comprehensive loss relating to damaged or obsolete downs during the year ended December 30,2021 and 2020. 12. PROPERTY, PLANT AND EQUIPMENT In computing per share amounts for the year ended December 30, 2021, 239,295 potentially issuable common shares through share-based payment plans (2020117,067) were excluded as the Corporation had a net loss and their inclusion would be anti-dilutive. 10. ACCOUNTS RECEIVABLE On June 18, 2021, Big Rock sold its Etobicoke brewery assets for total cash consideration of $2.1 million, net of transaction costs (the "Etobicoke Divestiture"). The divestiture resulted in a gain At December 30, 2021, the Corporate assessed certain co-packing customer receivables for of $0.1 million recognized in loss on dispositions in the consolidated statements of comprehensive impairment resulting in an impairment charge of $0.9 million which was recognized in net loss. loss. The Etobicoke Divestiture included all brewing and packaging equipment, excluding the purchaser also assumed the Corporation's Etobicoke brewery building lease. BIG ROCK BREWERY INC. Notes to the Consolidated Financial Statements 18. SHARE CAPITAL (All tabular amounts are in thousands of Canadian dollars, unless otherwise stated) Big Rock is authorized to issue an unlimited number of common shares with no par value. In November 2021, the Company sold its Calgary bottling line for net proceeds of $0.3 million. The divestiture resulted in a loss of $0.9 million recognized in loss on dispositions in the consolidated statements of comprehensive loss. During the year ended December 30, 2020, the Corporation determined that indicators of impairment existed with respect to certain of the Corporation's Ontario assets as a result of the suspension of its brewing and packaging operations in Ontario due to market conditions. A test for impairment was performed at the individual asset level by comparing the estimated recoverable amount to the carrying values of the assets. The estimated recoverable amount of the assets was determined to be their fair value less costs of disposal and an impairment of $1.5 million was recorded in the consolidated statements of comprehensive loss. 13. INTANGIBLE ASSETS Intangible assets are broken down as follows: As at December 30, 2021 and 2020, there were no indicators of impairment noted in the carrying value of the Corporation's intangible assets and no provision is recorded. As at December 30 , 2021, $1.1 million (2020 - \$0.3 million) is not subject to amortization. 14. ACCOUNTS PAYABLE AND ACCRUED LIABILITIES