Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on AFN & WACC Questions! Describe and discuss each component of the AFN formula in terms of how it impacts increasing or decreasing

Need help on AFN & WACC Questions!

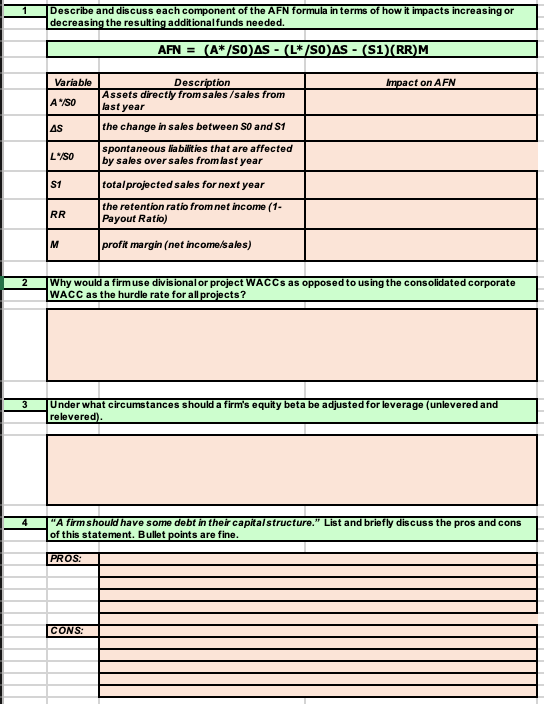

Describe and discuss each component of the AFN formula in terms of how it impacts increasing or decreasing the resulting additionalfunds needed. AFN = (A*/SOAS - (L*/SOAS - (S1/RR) M Impact on AFN Variable A/S AS Description Assets directly from sales /sales from last year the change in sales between SO and S1 etween so and 51 spontaneous liabilities that are affected fected by sales over sales from last year L/SO S1 total projected sales for next year the retention ratio from net income (1- Payout Ratio) profit margin (net income/sales) 2 Why would a firm use divisional or project WACCs as opposed to using the consolidated corporate WACC as the hurdle rate for all projects? 3 Under what circumstances should a firm's equity beta be adjusted for leverage (unlevered and relevered). "A firm should have some debt in their capital structure." List and briefly discuss the pros and cons of this statement. Bullet points are fine. PROS: CONS: Describe and discuss each component of the AFN formula in terms of how it impacts increasing or decreasing the resulting additionalfunds needed. AFN = (A*/SOAS - (L*/SOAS - (S1/RR) M Impact on AFN Variable A/S AS Description Assets directly from sales /sales from last year the change in sales between SO and S1 etween so and 51 spontaneous liabilities that are affected fected by sales over sales from last year L/SO S1 total projected sales for next year the retention ratio from net income (1- Payout Ratio) profit margin (net income/sales) 2 Why would a firm use divisional or project WACCs as opposed to using the consolidated corporate WACC as the hurdle rate for all projects? 3 Under what circumstances should a firm's equity beta be adjusted for leverage (unlevered and relevered). "A firm should have some debt in their capital structure." List and briefly discuss the pros and cons of this statement. Bullet points are fine. PROS: CONSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started