Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on all You borrow $1,000 from the bank and agree to repay the loan over the next year in 12 equal end-of-month payments

Need help on all

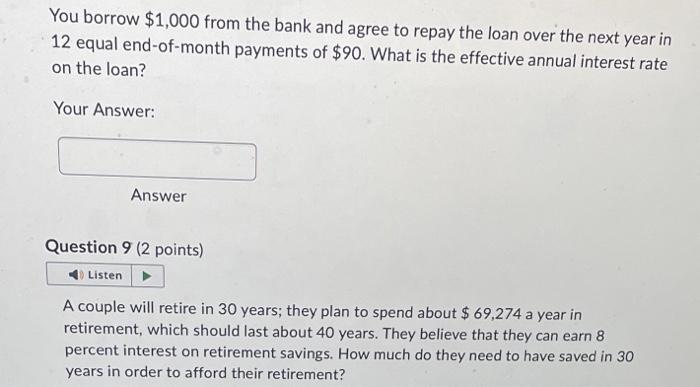

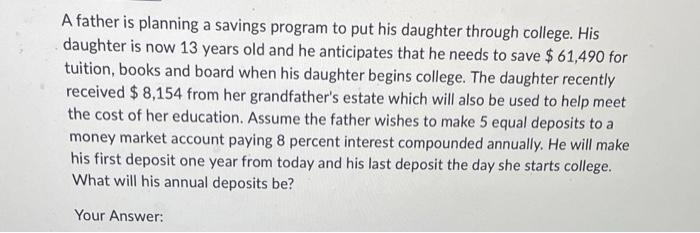

You borrow $1,000 from the bank and agree to repay the loan over the next year in 12 equal end-of-month payments of $90. What is the effective annual interest rate on the loan? Your Answer: Answer Question 9 ( 2 points) A couple will retire in 30 years; they plan to spend about $69,274 a year in retirement, which should last about 40 years. They believe that they can earn 8 percent interest on retirement savings. How much do they need to have saved in 30 years in order to afford their retirement? A father is planning a savings program to put his daughter through college. His daughter is now 13 years old and he anticipates that he needs to save $61,490 for tuition, books and board when his daughter begins college. The daughter recently received $8,154 from her grandfather's estate which will also be used to help meet the cost of her education. Assume the father wishes to make 5 equal deposits to a money market account paying 8 percent interest compounded annually. He will make his first deposit one year from today and his last deposit the day she starts college. What will his annual deposits be? Your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started