Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on both please Jackson & Sons uses packing machines to prepure its products for shipping. One machine costs 5136,500 and lasts about 4

need help on both please

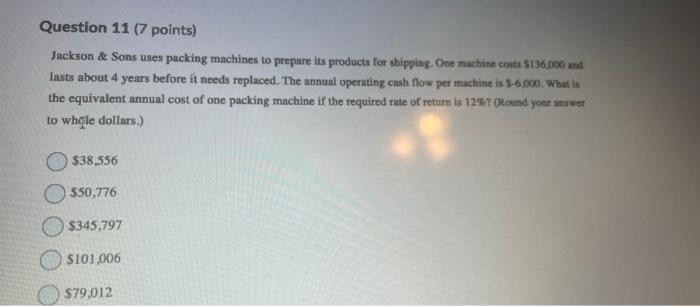

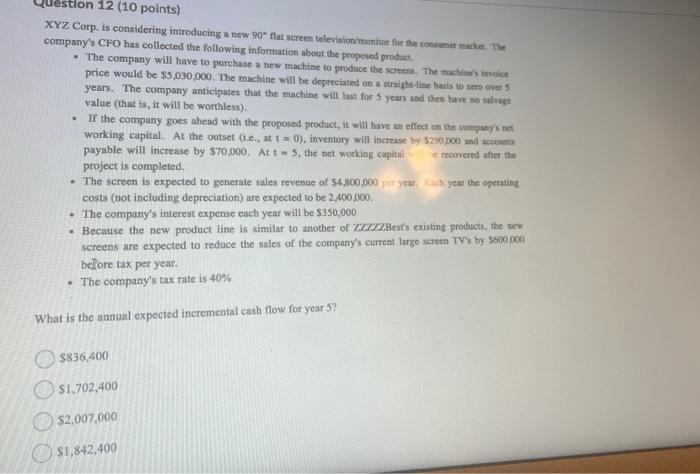

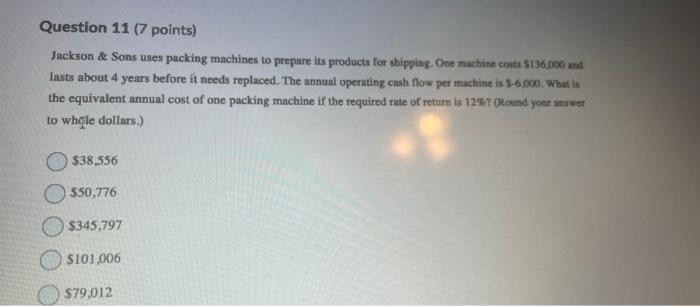

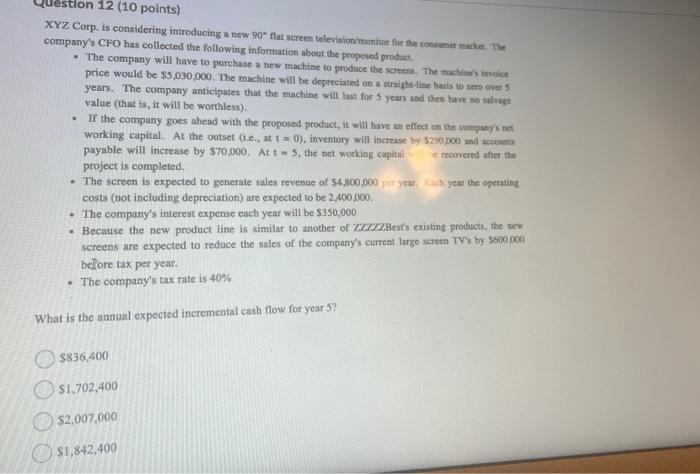

Jackson \& Sons uses packing machines to prepure its products for shipping. One machine costs 5136,500 and lasts about 4 years before it needs replaced. The annual operating cash flow per machine is 56,000. What is the equivalent annual cost of one packing machine if the required rate of return is 12%7 (Round your answer to whole dollars.) $38,556 $50,776 $345,797 5101,006 $79.012 XYZ Corp. is considering introducing a new 90 flat screen televirion/monitor for the consume marke The company's CFO has collocted the following information about the proposed product. - The company will have to purchase a new machine to produce the screeas. The machines involice price would be $5,030,000. The machine will be depreciated on a struigta-lise basis to rero over 5 years. The company anticipates that the machine will last for 5 yearn and then have 00 alvige value (that is, it will be worthless). - If the company goes ahead with the proposed prodoct, it witl have an effect on the compuny's net working capital. At the outset (i.e., at t=0 ), inventory will increase by $290,000 and account payable will increase by $70.000. At t=5, the net working capital a e recovered after the project is completed. - The screen is expected to generate sales revenue of $4,800,000 pet yeaw. Weh year the operating costs (not including depreciation) are expected to be 2,400,900. - The company's interest expense each year will be $350,000 - Because the new product line is similar to another of ZRXXZABest's existing products, the new screens are expected to reduce the sales of the company's current large screea TVi by 5600 no0 bellore tax per year. - The company's tax rate is 40% What is the annual expected incremental cash flow for year 5 ? $836,400 $1,702,400 $2,007,000 $1,842,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started