Need help on completing

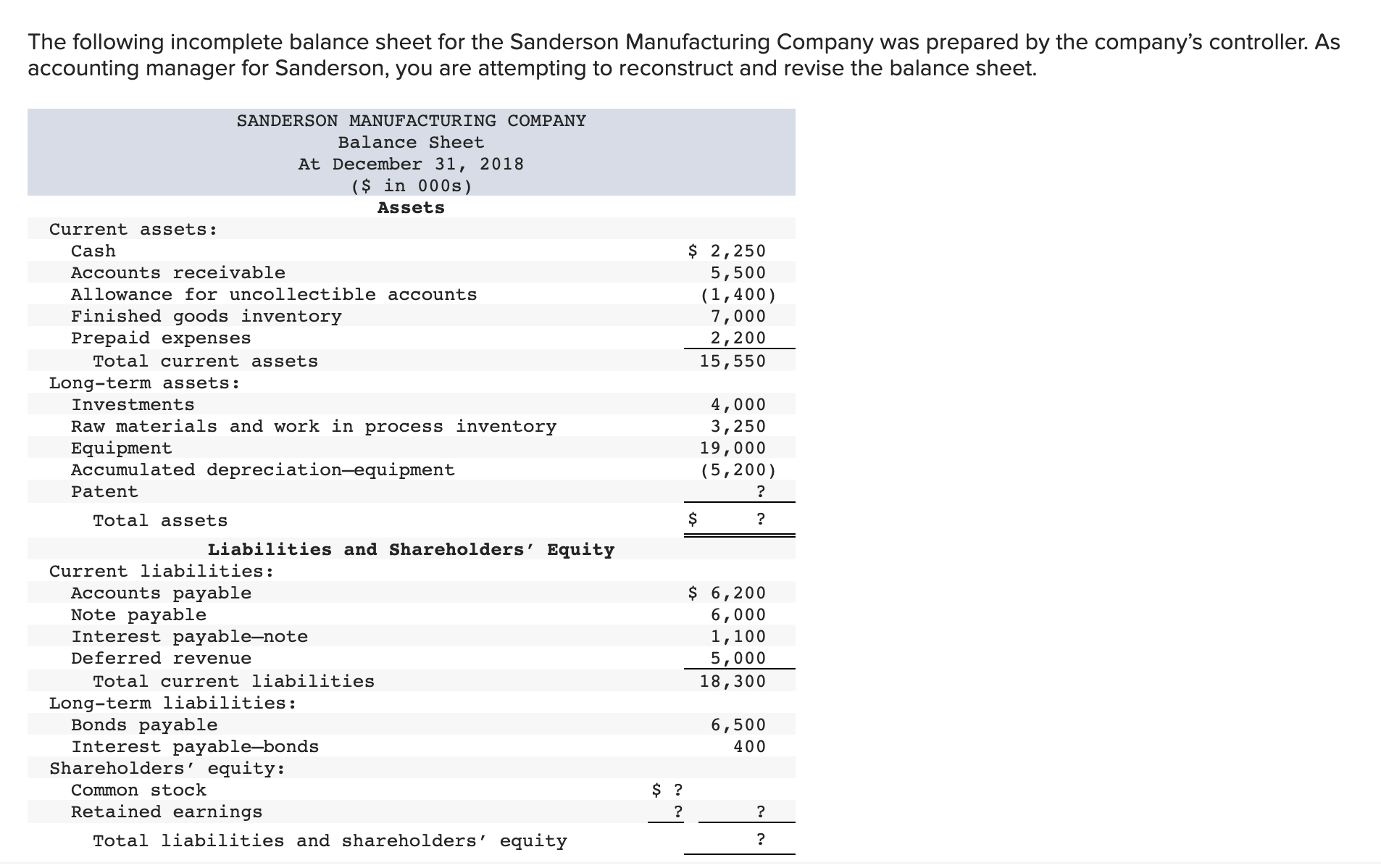

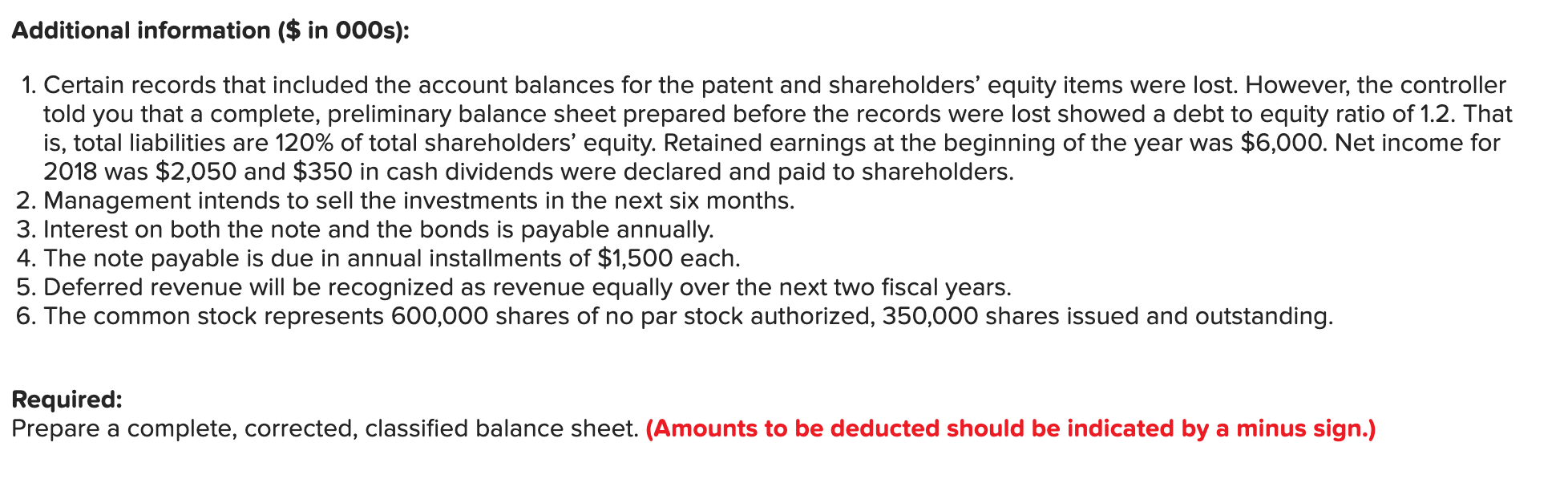

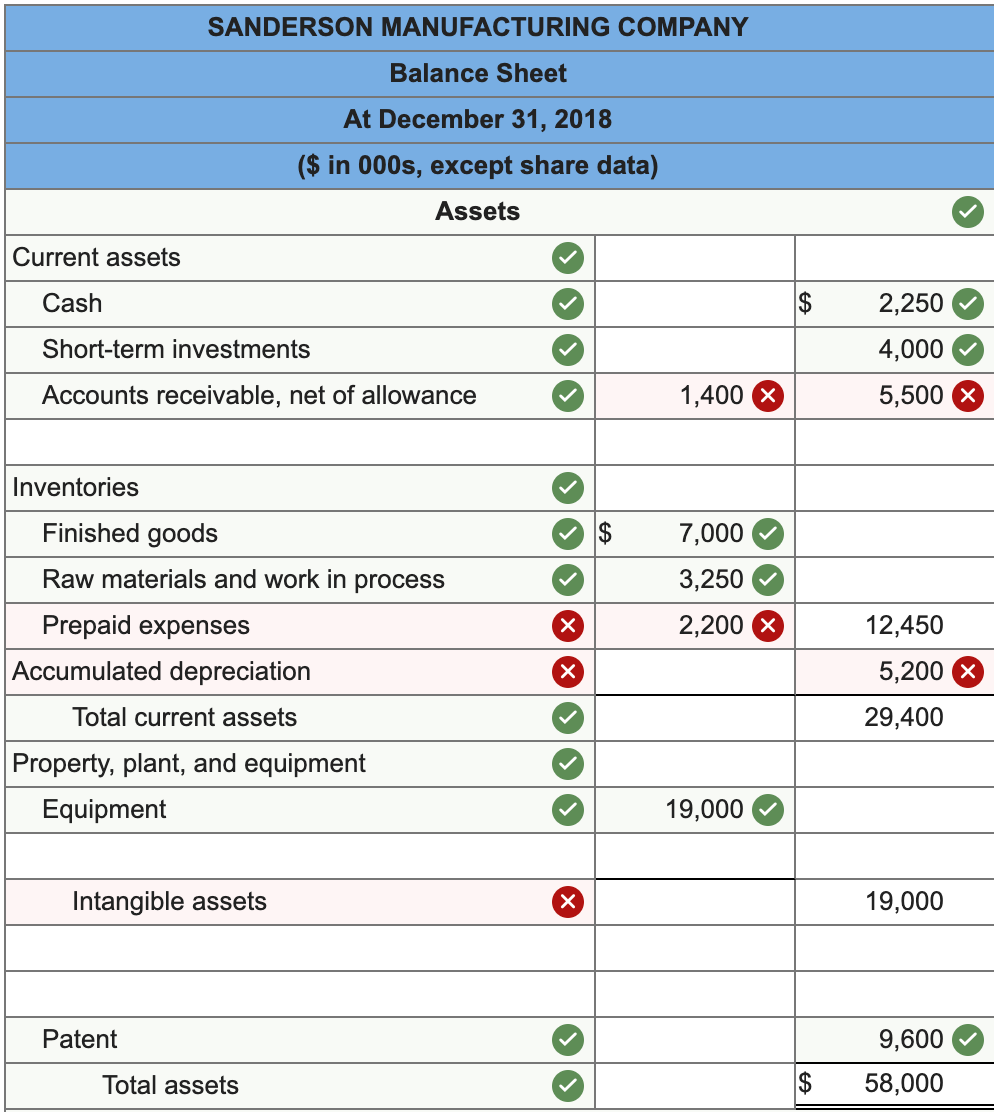

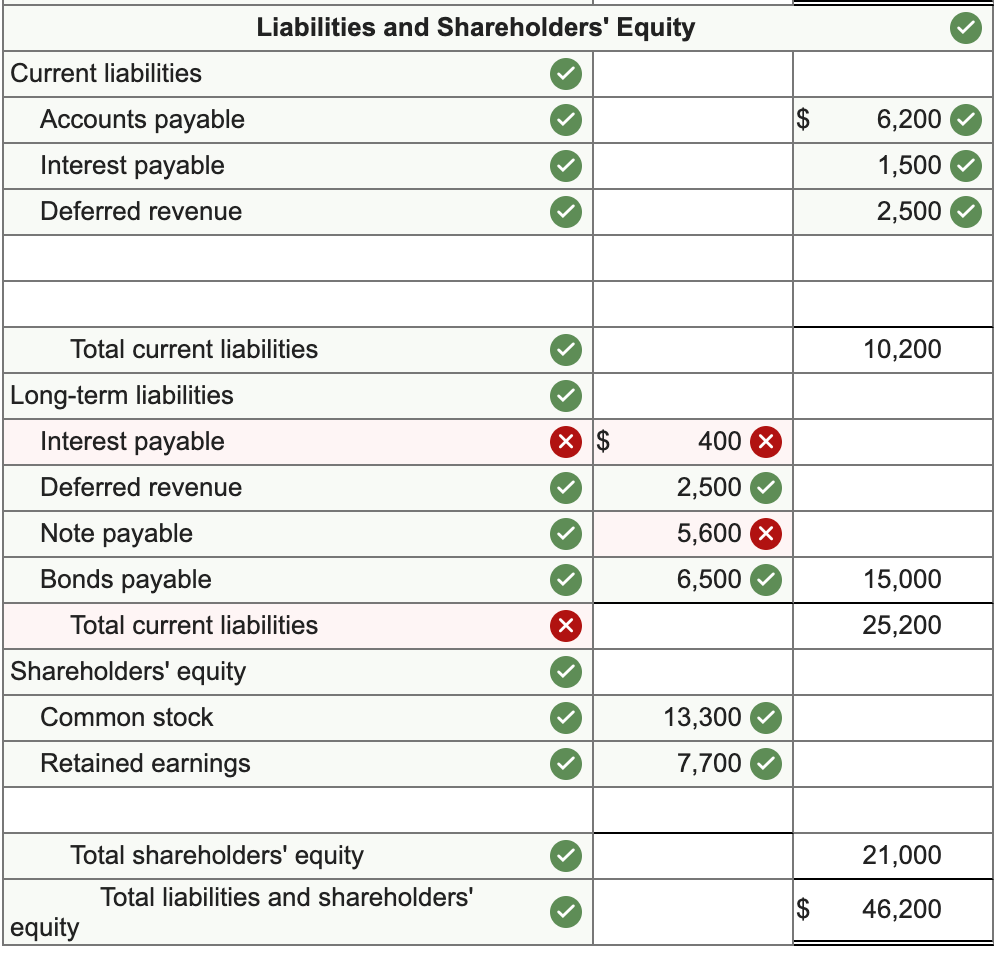

The following incomplete balance sheet for the Sanderson Manufacturing Company was prepared by the company's controller As accounting manager for Sanderson, you are attempting to reconstruct and revise the balance sheet. SANDERSON MANUFACTURING COMPANY Balance Sheet At December 31, 2018 ($ in 0003) Assets Current assets: Cash $ 2,250 Accounts receivable 5,500 Allowance for uncollectible accounts (1,400) Finished goods inventory 7,000 Prepaid expenses 2,200 Total current assets 15,550 Long-term assets: Investments 4,000 Raw materials and work in process inventory 3,250 Equipment 19,000 Accumulated depreciationequipment (5,200) Patent ? Total assets $ ? Liabilities and shareholders' Equity Current liabilities: Accounts payable $ 6,200 Note payable 6,000 Interest payablenote 1,100 Deferred revenue 5,000 Total current liabilities 18,300 Long-term liabilities: Bonds payable 6,500 Interest payablebonds 400 Shareholders' equity: Common stock $ ? Retained earnings 'd \"I I'd Total liabilities and shareholders' equity Additional information ($ in 0005): 1. Certain records that included the account balances for the patent and shareholders' equity items were lost. However, the controller told you that a complete, preliminary balance sheet prepared before the records were lost showed a debt to equity ratio of1.2. That is, total liabilities are 120% of total shareholders' equity. Retained earnings at the beginning ofthe year was $6,000. Net income for 2018 was $2,050 and $350 in cash dividends were declared and paid to shareholders. . Management intends to sell the investments in the next six months. . Interest on both the note and the bonds is payable annually. . The note payable is due in annual installments of $1,500 each. . Deferred revenue will be recognized as revenue equally over the next two scal years. The common stock represents 600,000 shares of no par stock authorized, 350,000 shares issued and outstanding. gum-bum Required: Prepare a complete, corrected, classified balance sheet. (Amounts to be deducted should be indicated by a minus sign.) SANDERSON MANUFACTURING COMPANY Balance Sheet At December 31, 2018 ($ in 000s, except share data) Assets V Current assets Cash $ 2,250 Short-term investments 4,000 Accounts receivable, net of allowance V 1,400 X 5,500 X Inventories V Finished goods V $ 7,000 V Raw materials and work in process 3,250 Prepaid expenses X 2,200 X 12,450 Accumulated depreciation X 5,200 X Total current assets 29,400 Property, plant, and equipment Equipment 19,000 Intangible assets X 19,000 Patent V 9,600 Total assets V $ 58,000Liabilities and Shareholders' Equity Current liabilities 99 Accounts payable Interest payable Deferred revenue Total current liabilities Long-term liabilities Interest payable Deferred revenue 5,600 9 6,500 a Note payable 15,000 25,200 Bonds payable Total current liabilities Shareholders' equity Common stock 13,300 a Retained earnings _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Total shareholders' equity Total liabilities and shareholders' 99 ~ on \"or "N o o c: c: equity