Question

need help on first screenshot attached previous assignment with correct answers Before Mike had a chance to move his business, the junk food tax was

need help on first screenshot attached previous assignment with correct answers

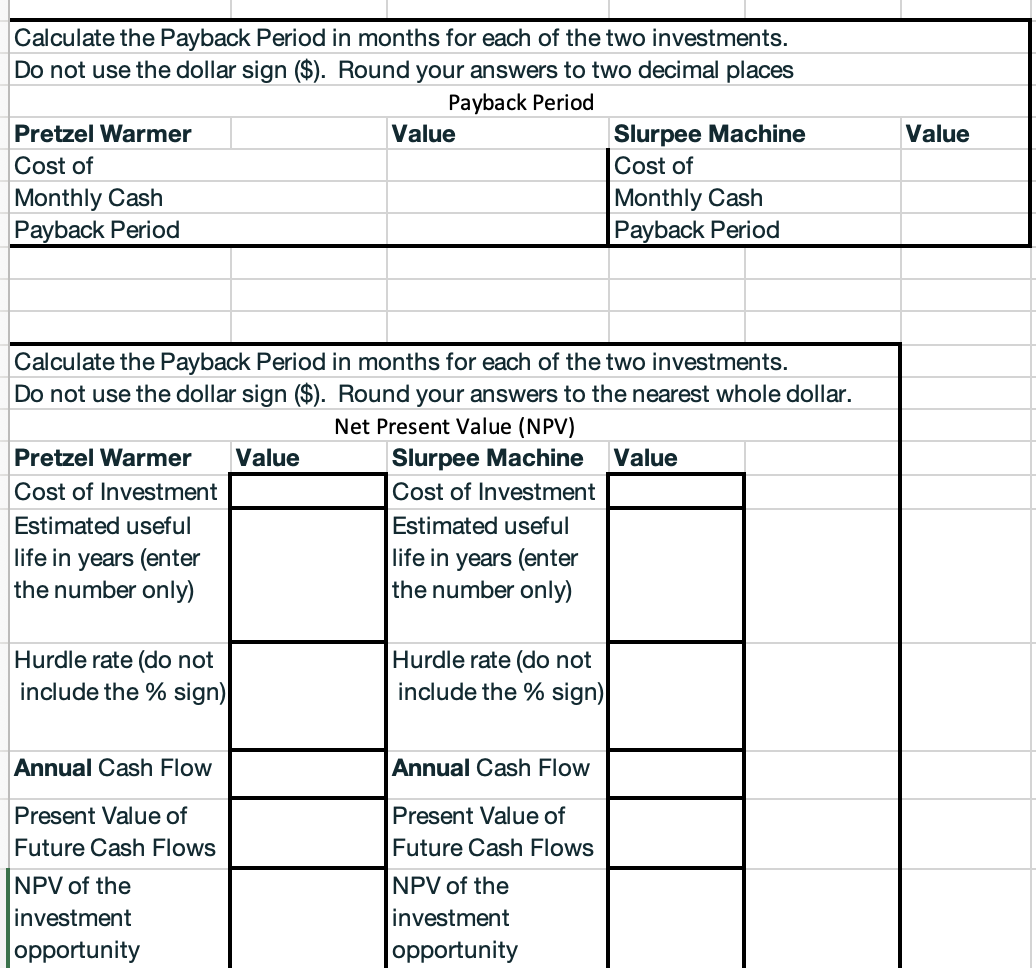

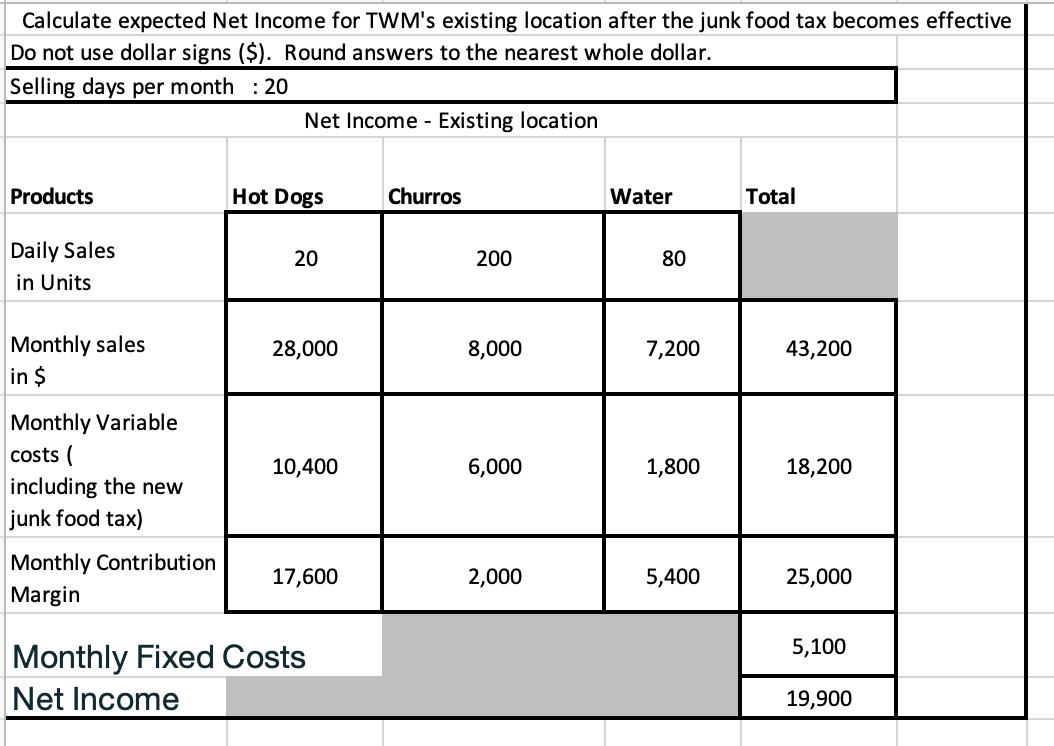

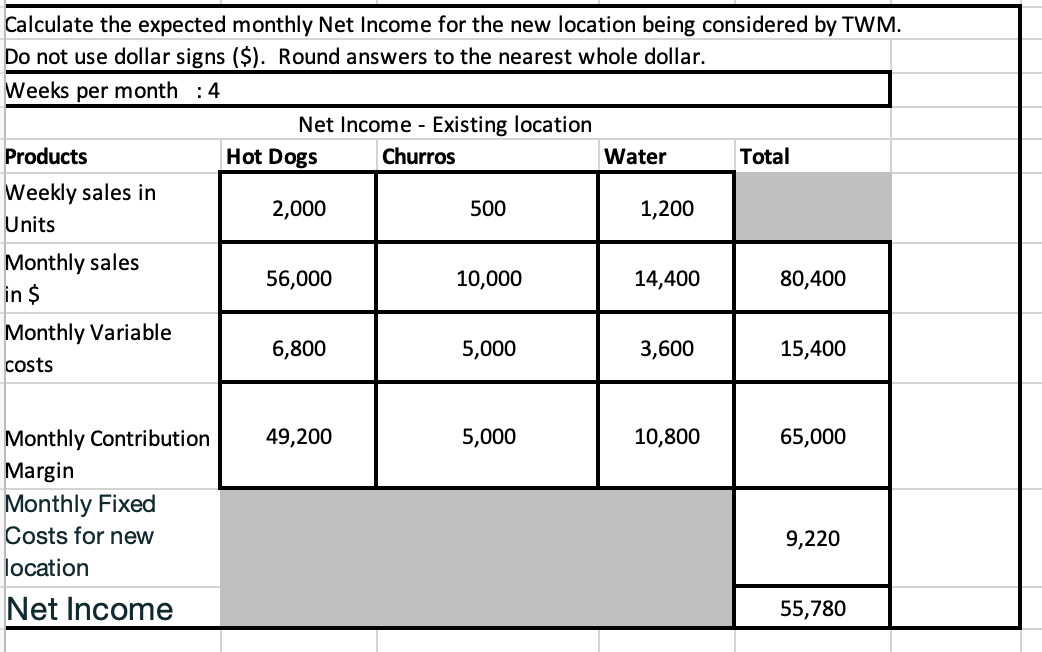

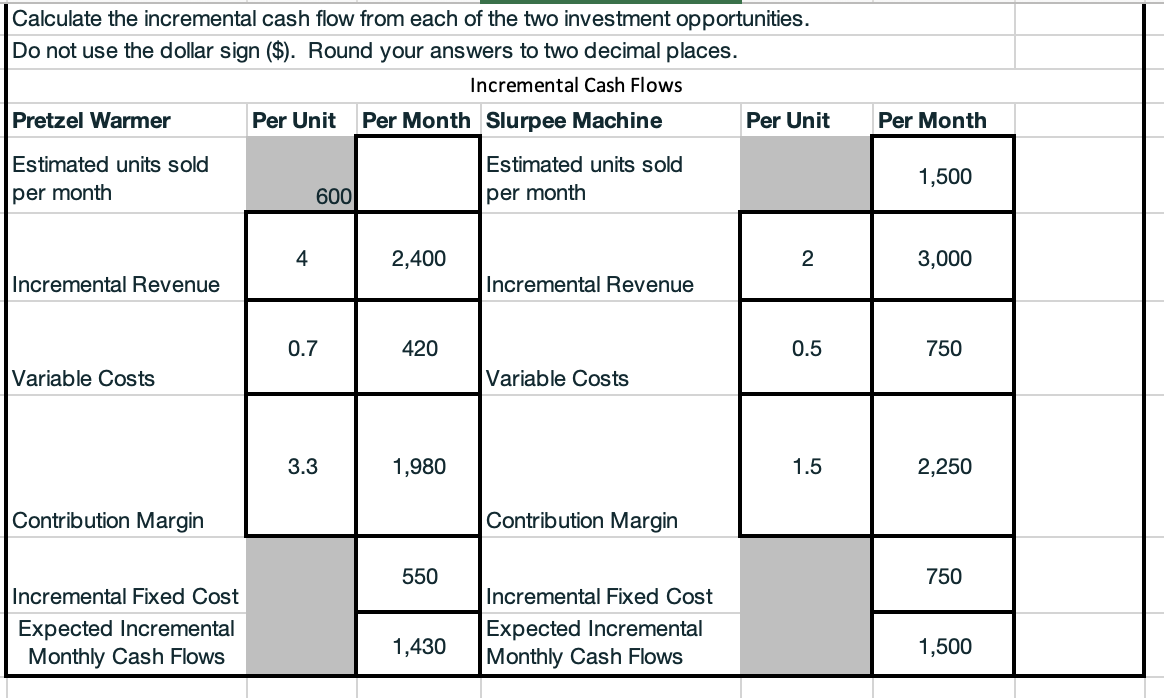

Before Mike had a chance to move his business, the junk food tax was repealed and he has decided to stick with his current location and keep his cart. He has also decided to add a menu item. He can either add hot pretzels or slurpees. When assessing his two investment options, Mike would like to make a minimum return of 10% on his investment.

Pretzels

Mike can buy a pretzel warmer for $25,000. He would sell pretzels for $4/each and can purchase them for $35 for a box of 50 pretzels. He will need a propane tank for the pretzel warmer and estimates he will spend $550/month on fuel. Mike estimates he will sell 30 pretzels each day. Mike estimates he can use the pretzel machine to generate income for five years, after which time it will have a zero value.

Slurpees

Mike can buy a slurpee machine for $35,000. He estimates he can sell 75 slurpees per day for $2/each. His variable costs for slurpees is $0.50 per slurpee for syrup and ice. His fuel costs for operating the slurpee machine should be about $750/month. Mike estimates he can use the slurpee machine to generate income for eight years, after which time it will have zero value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started