Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help on group project, I really need this completed correctly because it detemines my grade for an A or not and i have some

need help on group project, I really need this completed correctly because it detemines my grade for an A or not and i have some progress done but i dont know if its correct or not and i dont know if its fully done right

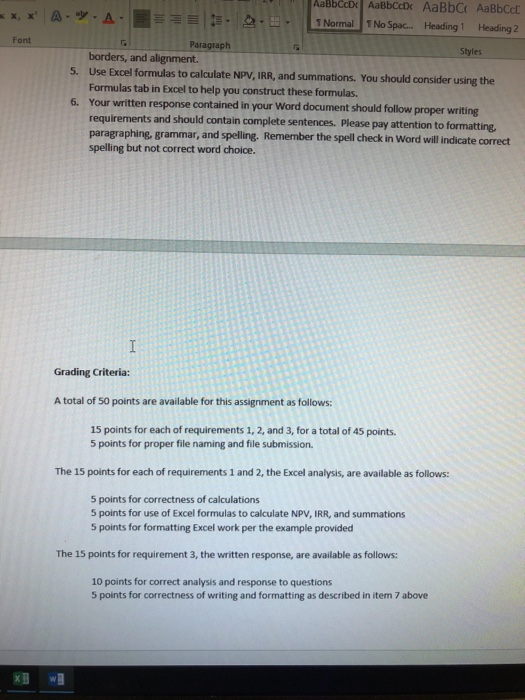

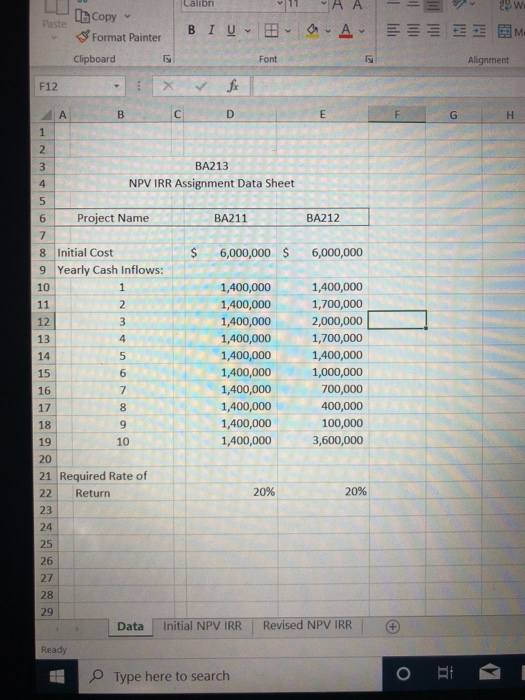

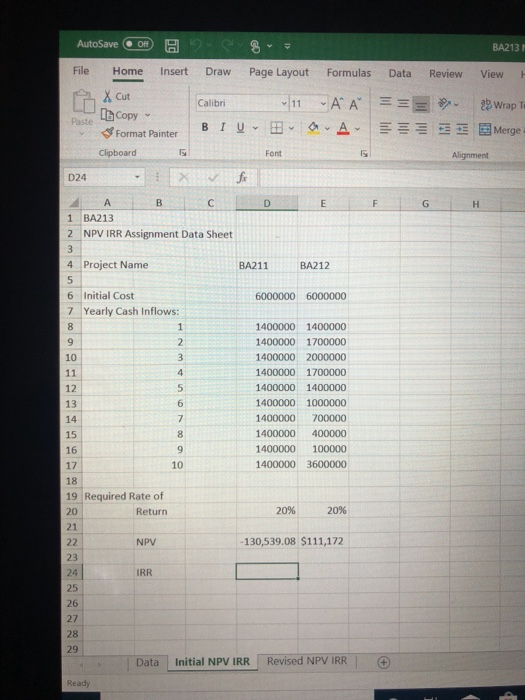

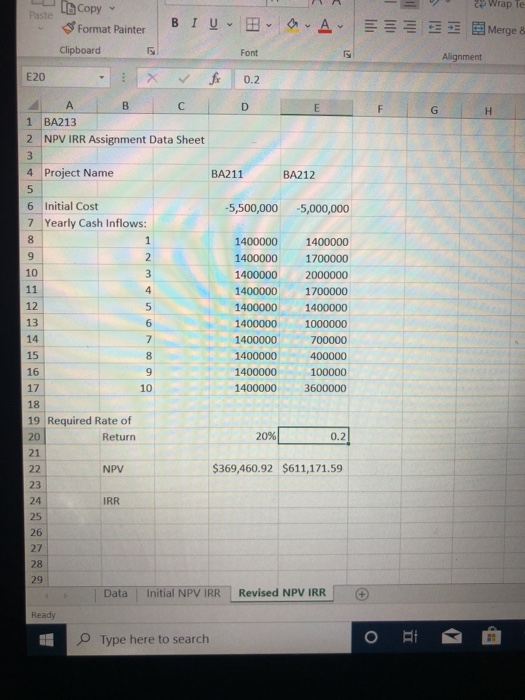

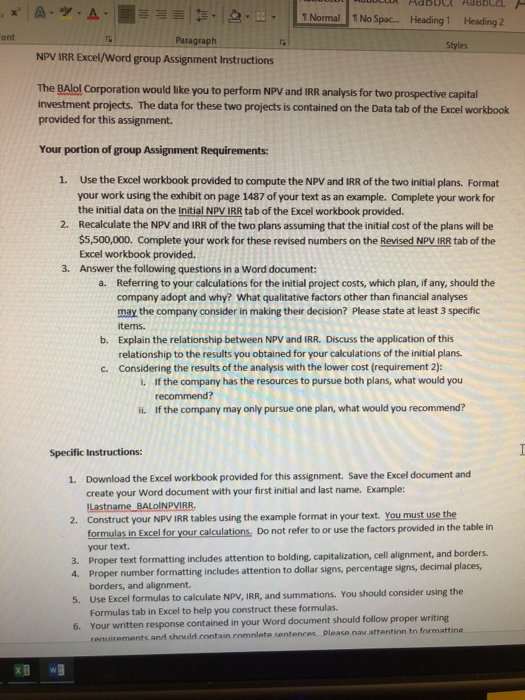

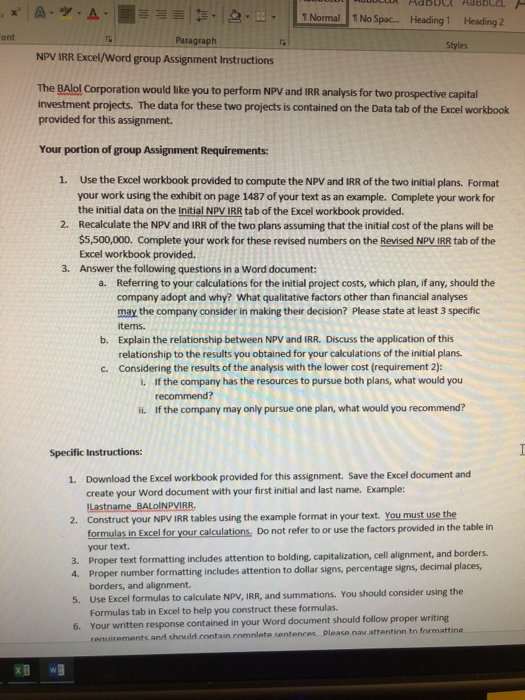

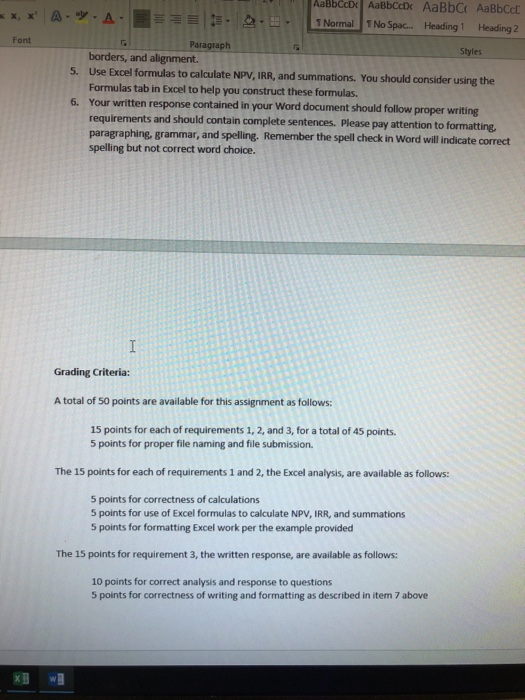

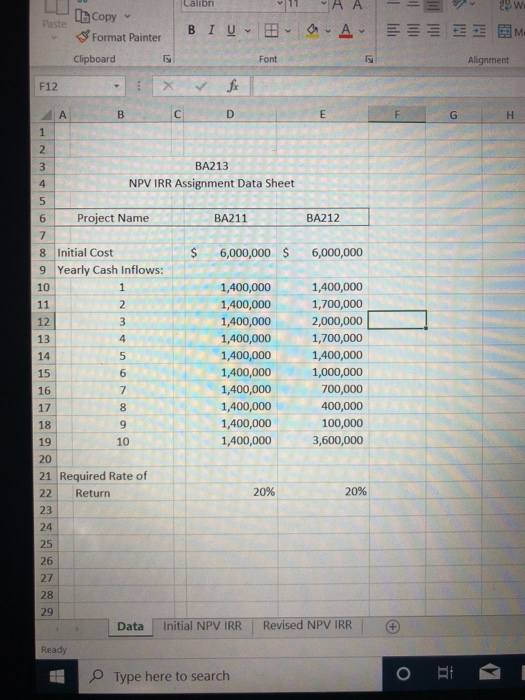

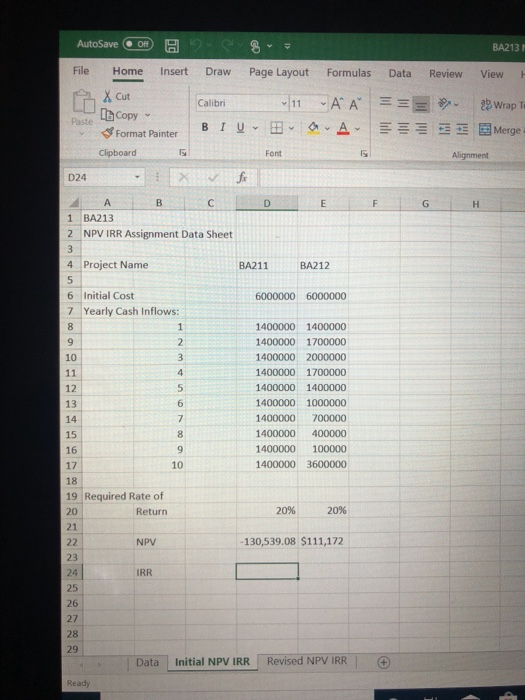

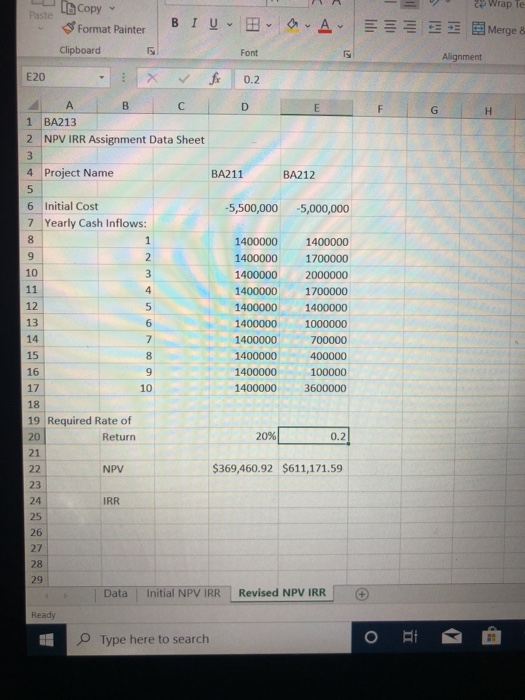

A- - A- 1 Normal 1 No Spac. Heading Heading 2 Font Paragraph Styles NPV IRR Excel/Word group Assignment Instructions The BAlol Corporation would like you to perform NPV and IRR analysis for two prospective capital investment projects. The data for these two projects is contained on the Data tab of the Excel workbook provided for this assignment. Your portion of group Assignment Requirements: Use the Excel workbook provided to compute the NPV and IRR of the two initial plans. Format 1. your work using the exhibit on page 1487 of your text as an example. Complete your work for the initial data on the Initial NPV IRR tab of the Excel workbook provided. 2. Recalculate the NPV and IRR of the two plans assuming that the initial cost of the plans will be $5,500,000. Complete your work for these revised numbers on the Revised NPV IRR tab of the Excel workbook provided. 3. Answer the following questions in a Word document: Referring to your calculations for the initial project costs, which plan, if any, should the company adopt and why? What qualitative factors other than financial analyses may the company consider in making their decision? Please state at least 3 specific a. items. b. Explain the relationship between NPV and IRR. Discuss the application of this relationship to the results you obtained for your calculations of the initial plans. c. Considering the results of the analysis with the lower cost (requirement 2): 1. If the company has the resources to pursue both plans, what would you recommend? il. If the company may only pursue one plan, what would you recommend? Specific Instructions: 1. Download the Excel workbook provided for this assignment. Save the Excel document and create your Word document with your first initial and last name. Example: ILastname_BALOINPVIRR. 2. Construct your NPV IRR tables using the example format in your text. You must use the formulas in Excel for your calculations. Do not refer to or use the factors provided in the table in your text. 3. Proper text formatting includes attention to bolding, capitalization, cell alignment, and borders. 4. Proper number formatting includes attention to dollar signs, percentage signs, decimal places, borders, and alignment. 5. Use Excel formulas to calculate NPV, IRR, and summations. You should consider using the Formulas tab in Excel to help you construct these formulas. 6. Your written response contained in your Word document should follow proper writing renuirements and shoild.contain.omnlete centences Please nav attention to formattine AabbCcD AaBbCcD AaBbC AaBbCct x, x' A- - A- 1No Spac. 1Normal Heading 1 Heading 2 Font Paragraph Styles borders, and alignment. 5. Use Excel formulas to calculate NPV, IRR, and summations. You should consider using the Formulas tab in Excel to help you construct these formulas. 6. Your written response contained in your Word document should follow proper writing requirements and should contain complete sentences. Please pay attention to formatting, paragraphing, grammar, and spelling. Remember the spell check in Word will indicate correct spelling but not correct word choice. Grading Criteria: A total of 50 points are available for this assignment as follows: 15 points for each of requirements 1, 2, and 3, for a total of 45 points. 5 points for proper file naming and file submission. The 15 points for each of requirements 1 and 2, the Excel analysis, are available as follows: 5 points for correctness of calculations 5 points for use of Excel formulas to calculate NPV, IRR, and summations 5 points for formatting Excel work per the example provided The 15 points for requirement 3, the written response, are available as follows: 10 points for correct analysis and response to questions 5 points for correctness of writing and formatting as described in item 7 above Calibri Copy Paste BIU avA EE EE EM Format Painter Clipboard Font Alignment F12 4. H. 2. 3. BA213 NPV IRR Assignment Data Sheet 4. Project Name 6. BA211 BA212 8 Initial Cost 9 Yearly Cash Inflows: $4 6,000,000 6,000,000 $ 10 1,400,000 1,400,000 1,700,000 1,400,000 11 1,400,000 2,000,000 12 1,400,000 1,700,000 13 4 1,400,000 1,400,000 14 1,400,000 1,000,000 15 1,400,000 700,000 16 1,400,000 400,000 8. 17 100,000 1,400,000 6. 18 1,400,000 3,600,000 10 19 21 Required Rate of 20% 20% 22 Return 23 24 25 26 27 28 29 Revised NPV IRR Initial NPV IRR Data Ready P Type here to search 67 AutoSave Off BA213 File Home Insert Draw Page Layout Formulas Data Review View X Cut A A = = BIU H a A- 11 2 Wrap Te Calibri Copy Paste Merge Format Painter Clipboard Font Alignment D24 H. BA213 2 NPV IRR Assignment Data Sheet 4 Project Name BA211 BA212 6 Initial Cost 6000000 6000000 7 Yearly Cash Inflows: 8. 1400000 1400000 9. 1400000 1700000 1400000 2000000 10 11 1400000 1700000 12 1400000 1400000 1400000 1000000 13 7. 1400000 700000 14 1400000 400000 15 1400000 100000 16 1400000 3600000 10 17 18 19 Required Rate of 20% 20% Return 20 21 -130,539.08 $111,172 22 NPV 23 IRR 24 25 26 27 28 29 Revised NPV IRR Initial NPV IRR Data Ready 123 S6 Copy Paste 2 Wrap Te BIU H- aA- Format Painter Merge & Clipboard Font Alignment E20 fr 0.2 B. BA213 2 NPV IRR Assignment Data Sheet 3. 4 Project Name BA211 BA212 6 Initial Cost 7 Yearly Cash Inflows: -5,500,000 -5,000,000 8. 1400000 1400000 9. 1400000 1700000 10 3 1400000 2000000 11 4 1400000 1700000 12 1400000 1400000 13 1400000 1000000 14 1400000 700000 15 1400000 400000 16 1400000 100000 1400000 17 10 3600000 18 19 Required Rate of 20% 0.2 20 Return 21 $369,460.92 $611,171.59 22 NPV 23 24 IRR 25 26 27 28 29 Initial NPV IRR Revised NPV IRR Data Ready P Type here to search also, it would help if the math for the blocks can be be used from my cell blocks so i know which exact ones it is reffering to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started