Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help on NPV profile. Im sure its very wrong Note Cells C17 and C18 include the initial cash flows today. Collumn D through G

Need help on NPV profile. Im sure its very wrong

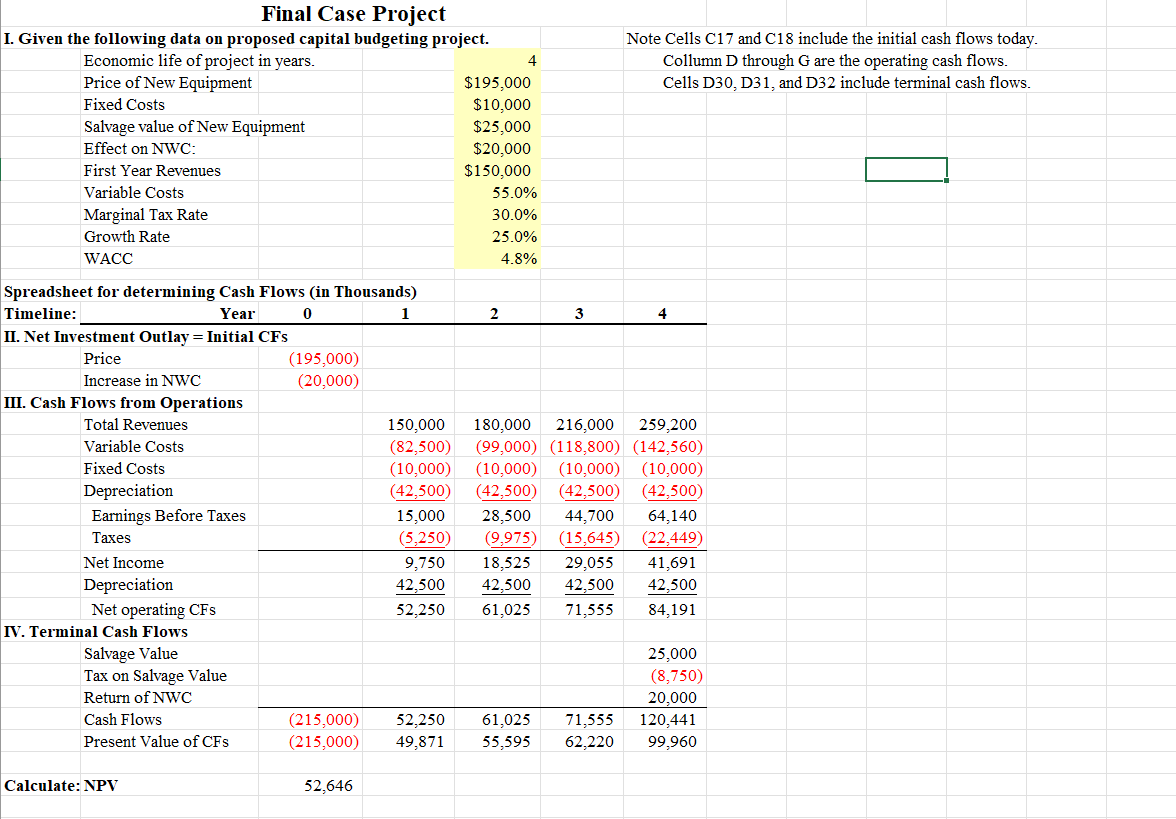

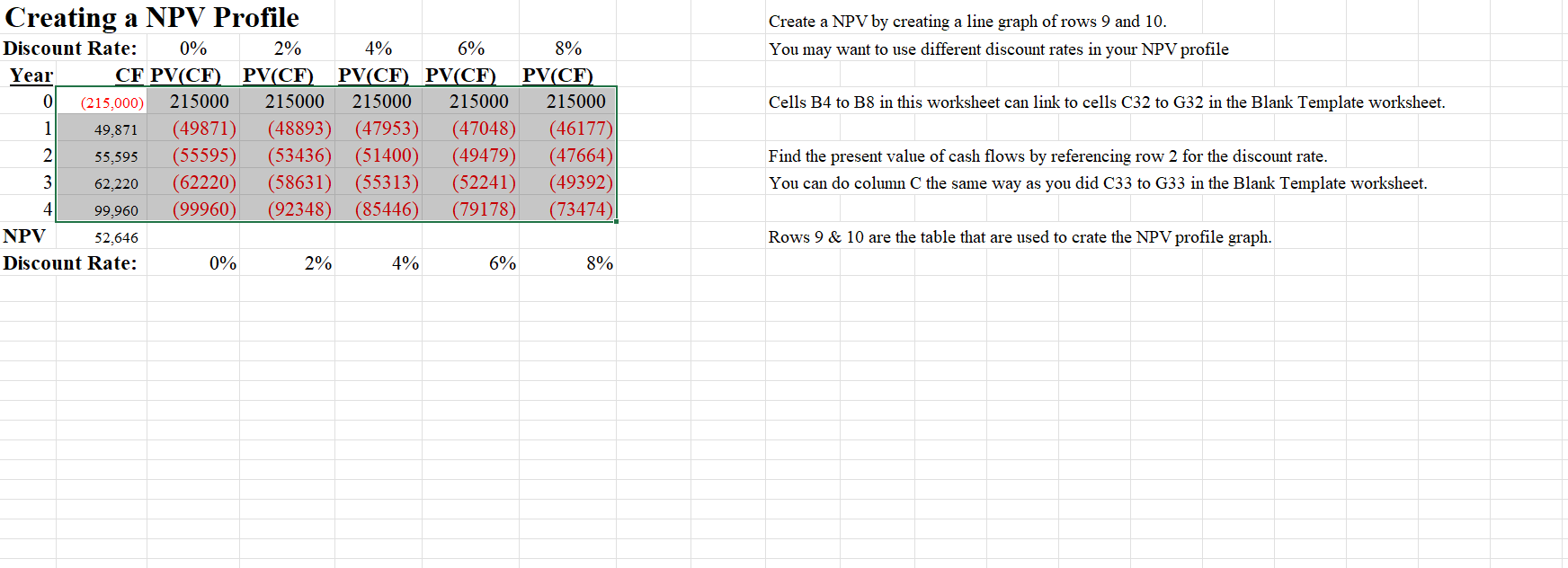

Note Cells C17 and C18 include the initial cash flows today. Collumn D through G are the operating cash flows. Cells D30, D31, and D32 include terminal cash flows. Final Case Project I. Given the following data on proposed capital budgeting project. Economic life of project in years. 4 Price of New Equipment $195,000 Fixed Costs $10,000 Salvage value of New Equipment $25,000 Effect on NWC: $20,000 First Year Revenues $150,000 Variable Costs 55.0% Marginal Tax Rate 30.0% Growth Rate 25.0% WACC 4.8% 2 3 4 Spreadsheet for determining Cash Flows (in Thousands) Timeline: Year 0 1 II. Net Investment Outlay = Initial CFS Price (195,000) Increase in NWC (20,000) III. Cash Flows from Operations Total Revenues 150,000 Variable Costs (82,500) Fixed Costs (10,000) Depreciation (42,500) Earnings Before Taxes 15,000 Taxes (5,250) Net Income 9,750 Depreciation 42,500 Net operating CFS 52,250 IV. Terminal Cash Flows Salvage Value Tax on Salvage Value Return of NWC Cash Flows (215,000) 52,250 Present Value of CFS (215,000) 49,871 180,000 216,000 259,200 (99,000) (118,800) (142,560) (10,000) (10,000) (10,000) (42,500) (42,500) (42,500) 28,500 44,700 64.140 9,975) (15,645) (22,449) 18,525 29,055 41,691 42,500 42,500 42,500 61,025 71,555 84,191 25,000 (8,750) 20,000 120,441 99,960 61,025 55,595 71,555 62,220 Calculate: NPV 52,646 Create a NPV by creating a line graph of rows 9 and 10. You may want to use different discount rates in your NPV profile Cells B4 to B8 in this worksheet can link to cells C32 to G32 in the Blank Template worksheet. Creating a NPV Profile Discount Rate: 0% 2% 4% 6% 8% Year CF PV(CF). PV(CF) PV(CF) PV(CF). PV(CF) 0 (215,000) 215000 215000 215000 215000 215000 1 49,871 (49871) (48893) (47953) (47048) (46177) 2 55,595 (55595) (53436) (51400) (49479) (47664) 3 62,220 (62220) (58631) (55313) (52241) (49392) 4 99.960 (99960) (92348) (85446) (79178) (73474) NPV 52,646 Discount Rate: 0% 2% 4% 6% 8% Find the present value of cash flows by referencing row 2 for the discount rate. You can do column C the same way as you did C33 to G33 in the Blank Template worksheet. Rows 9 & 10 are the table that are used to crate the NPV profile graph. Note Cells C17 and C18 include the initial cash flows today. Collumn D through G are the operating cash flows. Cells D30, D31, and D32 include terminal cash flows. Final Case Project I. Given the following data on proposed capital budgeting project. Economic life of project in years. 4 Price of New Equipment $195,000 Fixed Costs $10,000 Salvage value of New Equipment $25,000 Effect on NWC: $20,000 First Year Revenues $150,000 Variable Costs 55.0% Marginal Tax Rate 30.0% Growth Rate 25.0% WACC 4.8% 2 3 4 Spreadsheet for determining Cash Flows (in Thousands) Timeline: Year 0 1 II. Net Investment Outlay = Initial CFS Price (195,000) Increase in NWC (20,000) III. Cash Flows from Operations Total Revenues 150,000 Variable Costs (82,500) Fixed Costs (10,000) Depreciation (42,500) Earnings Before Taxes 15,000 Taxes (5,250) Net Income 9,750 Depreciation 42,500 Net operating CFS 52,250 IV. Terminal Cash Flows Salvage Value Tax on Salvage Value Return of NWC Cash Flows (215,000) 52,250 Present Value of CFS (215,000) 49,871 180,000 216,000 259,200 (99,000) (118,800) (142,560) (10,000) (10,000) (10,000) (42,500) (42,500) (42,500) 28,500 44,700 64.140 9,975) (15,645) (22,449) 18,525 29,055 41,691 42,500 42,500 42,500 61,025 71,555 84,191 25,000 (8,750) 20,000 120,441 99,960 61,025 55,595 71,555 62,220 Calculate: NPV 52,646 Create a NPV by creating a line graph of rows 9 and 10. You may want to use different discount rates in your NPV profile Cells B4 to B8 in this worksheet can link to cells C32 to G32 in the Blank Template worksheet. Creating a NPV Profile Discount Rate: 0% 2% 4% 6% 8% Year CF PV(CF). PV(CF) PV(CF) PV(CF). PV(CF) 0 (215,000) 215000 215000 215000 215000 215000 1 49,871 (49871) (48893) (47953) (47048) (46177) 2 55,595 (55595) (53436) (51400) (49479) (47664) 3 62,220 (62220) (58631) (55313) (52241) (49392) 4 99.960 (99960) (92348) (85446) (79178) (73474) NPV 52,646 Discount Rate: 0% 2% 4% 6% 8% Find the present value of cash flows by referencing row 2 for the discount rate. You can do column C the same way as you did C33 to G33 in the Blank Template worksheet. Rows 9 & 10 are the table that are used to crate the NPV profile graphStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started