Need help on Q. 10 and 11

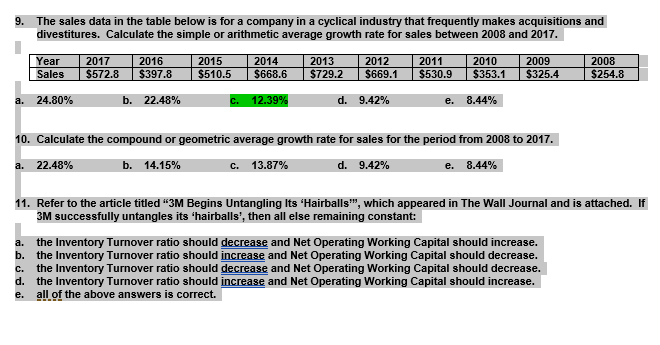

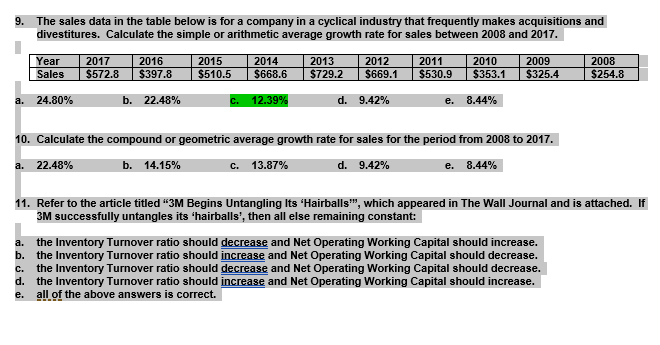

9. The sales data in the table below is for a company in a cyclical industry that frequently makes acquisitions and divestitures. Calculate the simple or arithmetic average growth rate for sales between 2008 and 2017. ar 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 e. 8.44% 10. Calculate the compound or geometric average growth rate for sales for the period from 2008 to 2017. a. 22.48% b. 14.15% 13.87% d. 9.42% e. 8.44% 11. Refer to the article titled "3M Begins Untangling Its 'Hairballs", which appeared in The Wall Journal and is attached. If 3M successfully untangles its 'hairballs', then all else remaining constant: a. b. c. d. e. the Inventory Turnover ratio should decrease and Net Operating Working Capital should increase. the Inventory Turnover ratio should increase and Net Operating Working Capital should decrease the Inventory Turnover ratio should decrease and Net Operating Working Capital should decrease. the Inventory Turnover ratio should increase and Net Operating Working Capital should increase. all of the above answers is correct. 9. The sales data in the table below is for a company in a cyclical industry that frequently makes acquisitions and divestitures. Calculate the simple or arithmetic average growth rate for sales between 2008 and 2017. ar 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 e. 8.44% 10. Calculate the compound or geometric average growth rate for sales for the period from 2008 to 2017. a. 22.48% b. 14.15% 13.87% d. 9.42% e. 8.44% 11. Refer to the article titled "3M Begins Untangling Its 'Hairballs", which appeared in The Wall Journal and is attached. If 3M successfully untangles its 'hairballs', then all else remaining constant: a. b. c. d. e. the Inventory Turnover ratio should decrease and Net Operating Working Capital should increase. the Inventory Turnover ratio should increase and Net Operating Working Capital should decrease the Inventory Turnover ratio should decrease and Net Operating Working Capital should decrease. the Inventory Turnover ratio should increase and Net Operating Working Capital should increase. all of the above answers is correct