Answered step by step

Verified Expert Solution

Question

1 Approved Answer

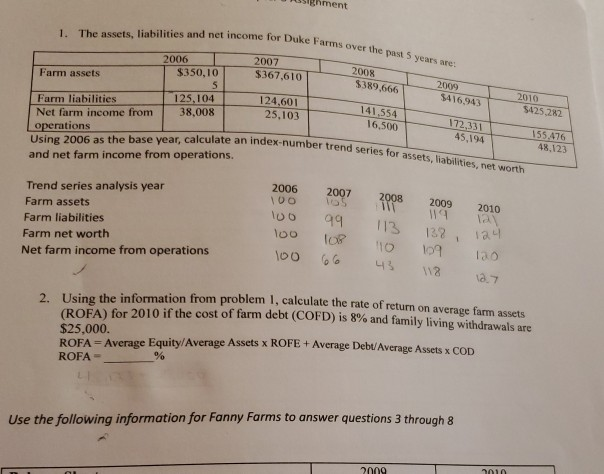

Need help on question #2 resighment 1. The assets, liabilities and net income for Duke : d net income for Duke farms over the past

Need help on question #2

resighment 1. The assets, liabilities and net income for Duke : d net income for Duke farms over the past 5 years Farm assets 2006 $350,10 2007 $367,610 2008 $389,666 2009 $416,943 2010 $425.282 Farm liabilities 125,104 124,601 Net farm income from 38.008 25.103 operations Using 2006 as the base year, calculate an index-number trend ser and net farm income from operations. 141,554 16,500 index-number trend series for assets, liabilities, net worth 172,331 45,194 155.476 48,123 2009 Trend series analysis year Farm assets Farm liabilities Farm net worth Net farm income from operations 2006 100 100 loo 2010 2007 OS 99 TOR 113 10 132, 124 109 10 100 166 43 118 12.7 2 Using the information from problem I, calculate the rate of return on average farm assets CROFA) for 2010 if the cost of farm debt (COFD) is 8% and family living withdrawals are $25,000. ROFA = Average Equity/Average Assets x ROFE + Average Debt/Average Assets x COD ROFA Use the following information for Fanny Farms to answer questions 3 through 8 2000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started