Question: need help on the whole project AaBlbCel AaBbcet Aab AaBbCel AaBbCcl daBbcl daBbl AabbCel AABBCC AABBCc Strong Subtitle Title No Spac... Subtle Em... Intense E...

need help on the whole project

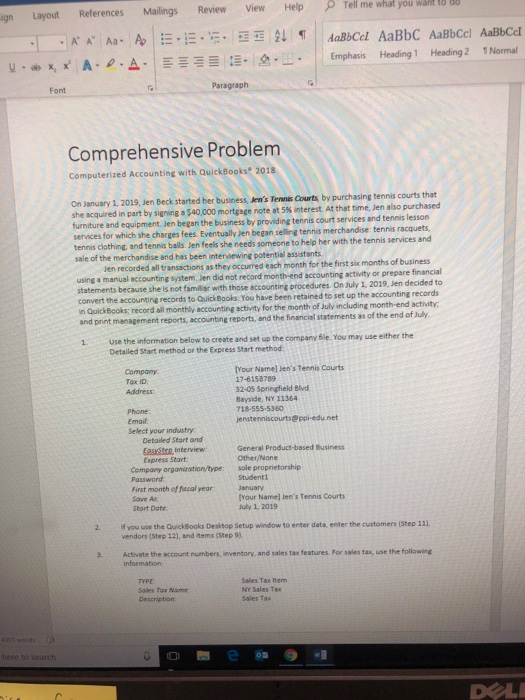

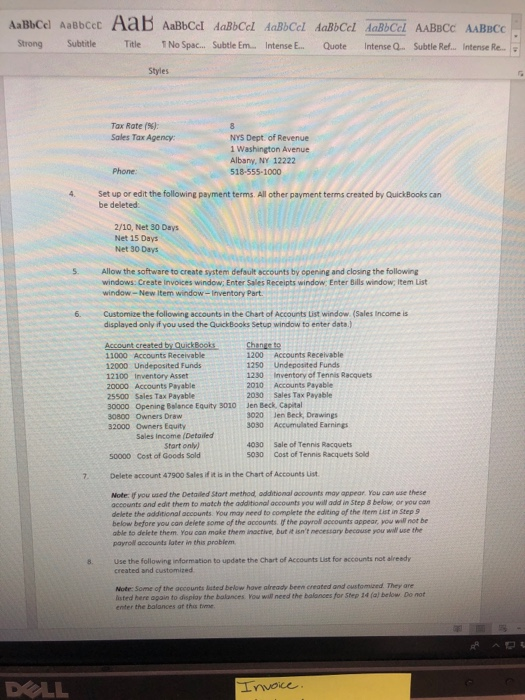

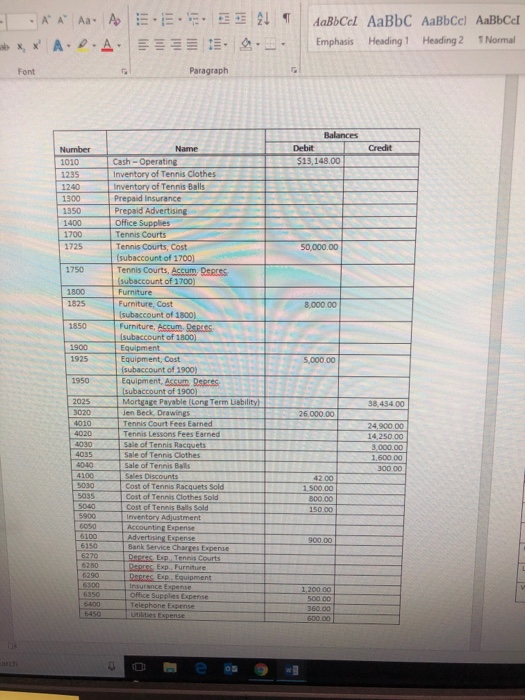

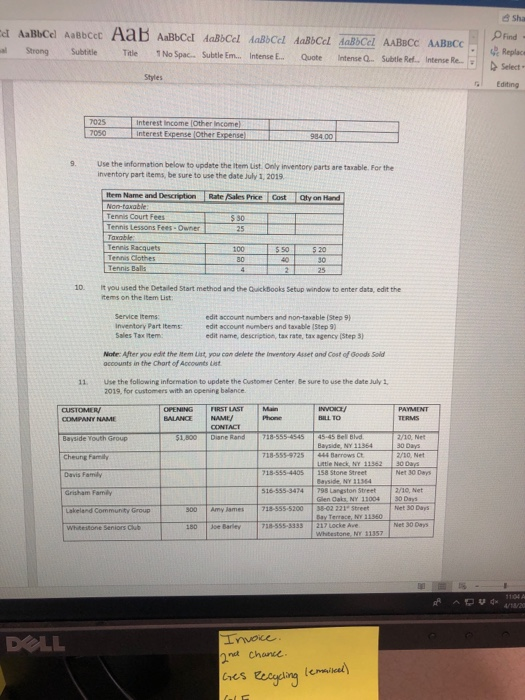

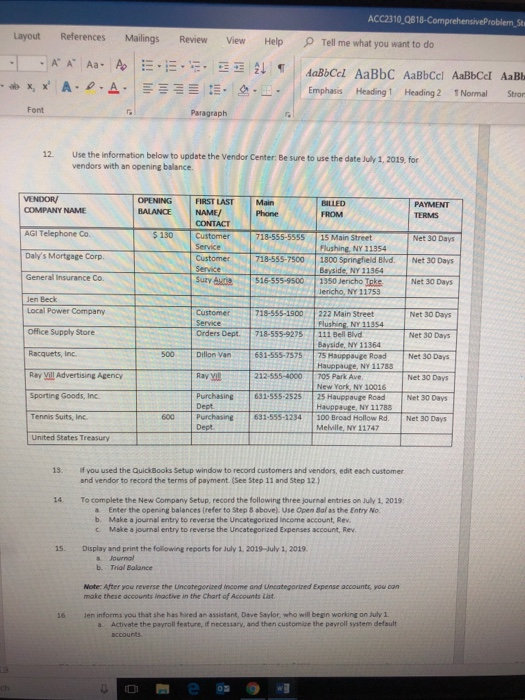

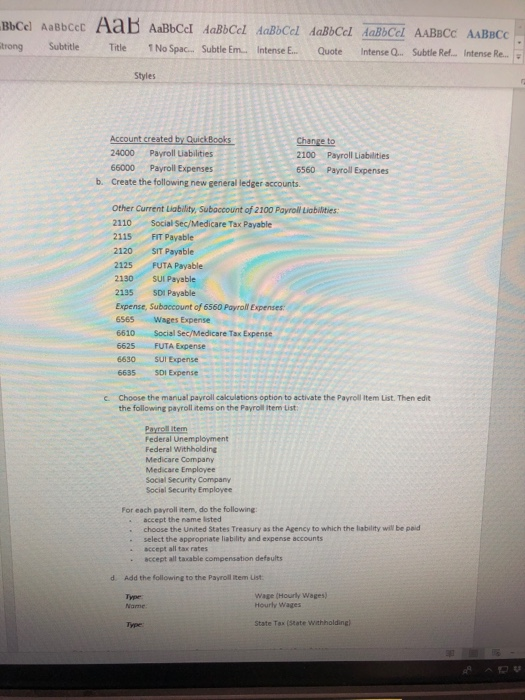

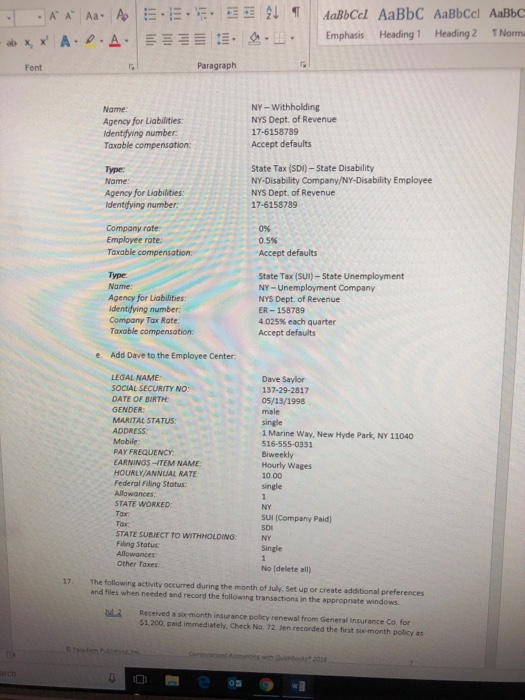

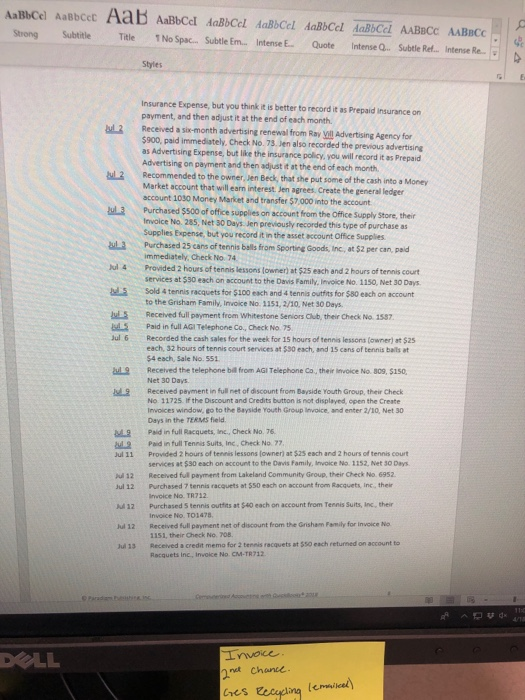

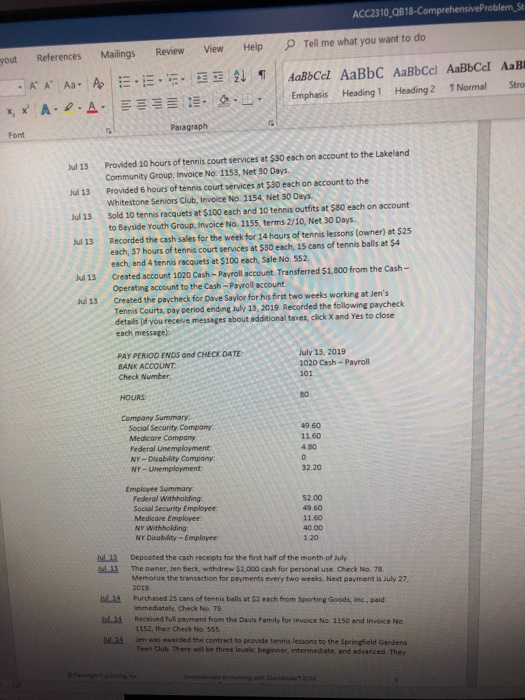

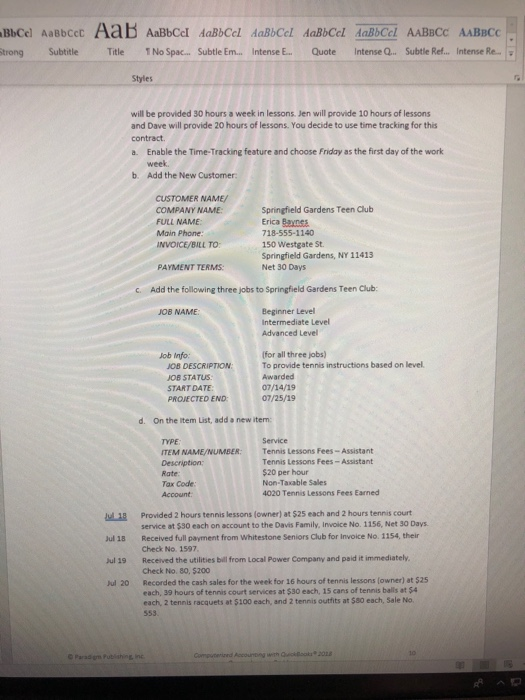

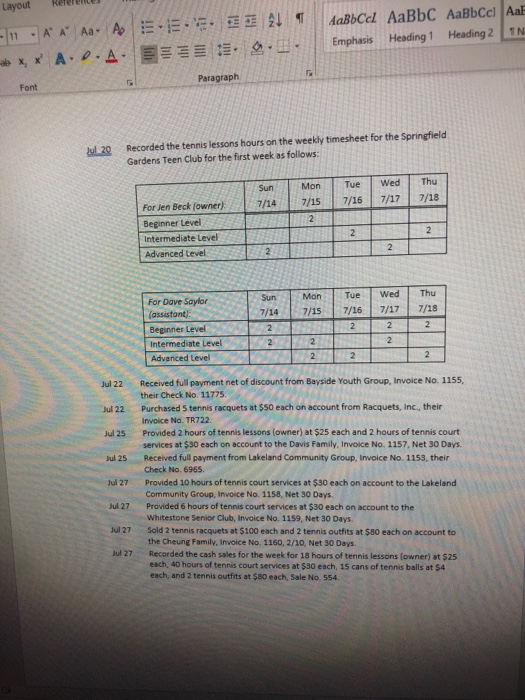

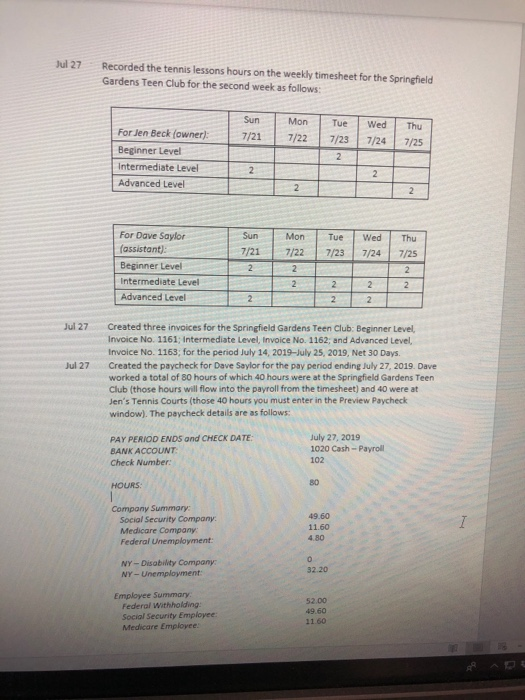

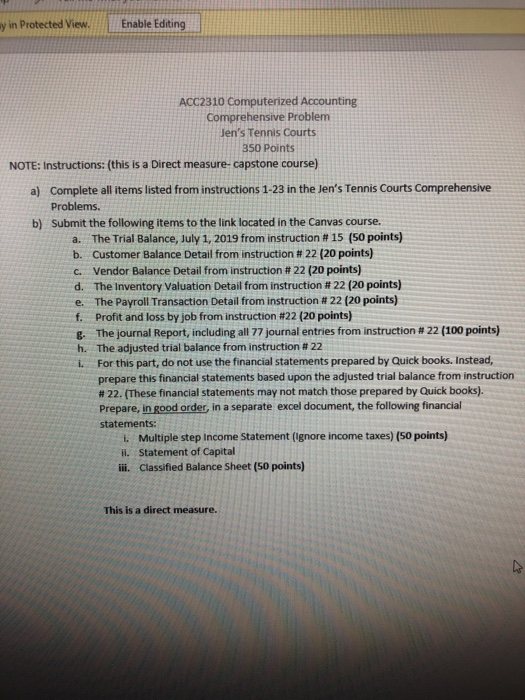

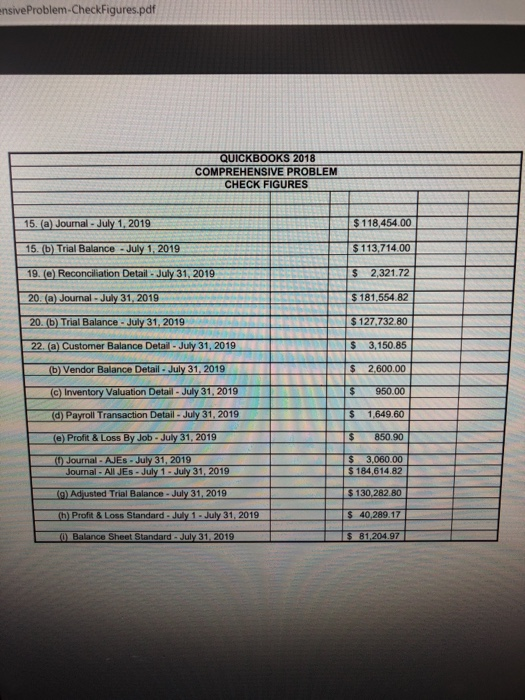

AaBlbCel AaBbcet Aab AaBbCel AaBbCcl daBbcl daBbl AabbCel AABBCC AABBCc Strong Subtitle Title No Spac... Subtle Em... Intense E... Quote Intense Q Subtle Ref... Intense Re. Styles Tax Rate (%): Sales Tax Agency NYS Dept of Revenue 1 Washington Avenue Albany, NY 12222 518-555-1000 Phone: 4. Set up or edit the following payment terms. All other payment terms created by QuickBooks can be deleted 2/10, Net 30 Days Net 15 Days Net 30 Days S. Allow the software to create system default accounts by cpening and closing the following windows: Create invoices window; Enter Sales Receipts window Enter Bills window; Item List window-New Item window-Inventory Part 6. Custormize the following accounts in the Chart of Accounts List window. (Sales Income is displayed only if you used the QuickBooks Setup window to enter date.) Chenge to 1200 Accounts Receivable 1250 Undeposited Funds 1230 Inventory of Tennis Racquets 2010 Accounts Payable 2030 Sales Tax Payable Jen Beck, Capital 3020 3030 11000 Accounts Receivable 12000 Undeposited Funds 12100 Iventory Asset 20000 Accounts Payable 25500 Sales Tax Payable 30000 Opening Balance Equity 3010 30800 Owners Draw 32000 Owners Equity Jen Beck, Drawings Accumulated Earnings Sales income (Detailed 4030 5030 Sale of Tennis Racquets Cost of Tennis Racquets Sold Start only) Cost of Goods Sold 50000 7 Delete account 47900 Sales if it is in the Chart of Accounts List Note: If you used the Detailed Stort method, additional accounts may appear. You can use these accounts and edit them to match the additional accounts you will add in Step & below or you can delete the odditional accounts. You may need to complete the editing of the item List in Step 9 below before you con deiete some of the accounts. if the payroll accounts appear, you wall not be able to delete them. You can make them noctive, but it isn't necessary because you w use the payroll accounts later in this probiem Use the following information to update the Chart of Accounts List for accounts not aireedy created and customized 8. Note: Some of the accounts lsted below have already been created and cusfomined. They are isted here again to disploy the balances. Yow wall need the balances for Step 14 (al below Do not enter the balances ot this time DOLL t Normal Heading 1 Heading 2 !:-.12.-. | . Emphasis . A.| x, x' A. Paragraph Font Balances Debit Number Name $13,148.00 Cash- Operating Inventory of Tennis Balls 1240 Prepaid Insurance Prepaid Advertising Office Supplies Tennis Courts Tennis Courts, Cost (subaccount of 1700) Tennis Courts, Accum. 2sess 1725 1750 1800 50,000.00 Furniture, Cost subaccount of 1800) Furniture, Accum. Dtees subaccount of 1800) Equipment Equipment, Cost (subaccount of 1900) Equipment,Assm 95eres 8,000.00 1925 5,000.00 len Beck, Dra Tennis Court Fees Earned Tennis Lessons Fees Earned 6,000.00 14,250.0o Sale of Tennis Clothes Sale of Tennis Balls 42.00 1,500.00 800.00 Cost of Tennis Racquets Sold Cost of Ter ost of Tennis Balls Advertising Expense Bank Service Charzes Expense 900.00 Exp, E 2 Office Supplies Expense 500.00 elephone Expense Sha cl AaBbCel AaBbCcC al Strong Subtitle Find Title 1No Spac.. Subtle Em." Subtle Em... Intense E... Quote Intense Q.. Subtle Ref. Intense R.. Intense E. Quote Select Editing Styles 025 050 Interest lincome (Other Incomel 984.00 9. Use the information below to updete the item List. Only inventory parts are taxable. For the inventory part items, be sure to use the date July 1, 2019 tem Name andDescriptionRate Sales Price Cost ty an Hand Tennis Court Fees Tennis Lessons Fees Owner 30 25 ennis Racquets Tennis Clothes Tennis Bals 100 30 25 10 It you used the Detailed Start method and the Quickbooks Setup window to enter data, edit the tems on the Item List Service Items: inventory Part Items:edit account mumbers and taxable (Step 9) Sales Tax item: edit account mumbers and non-taxable (Step 9) edit name, description, tax rate, tax agency (Step 3) Note: After you edit the ltem List, you con delete the inventory Asset and Cost of Goods Sold occounts in the Chart of Accounts List 11. Use the following information to updete the Customer Center. Be sure to use the date July 2 2019, for customers with an opening balance IRST LAST CUSTOMER OPENINC |F BALANCE NAME 1 Mar BILL TO COMPANY NAME Bayside Youth Group Cheung Famiy Davis Family Grisham Famly 51,800 Diane Rand 718-555-4545 45-45 Bel Blvd 718-555-9725 444 Barrows Ct /10, Net Net 30 Deys Bavside NY 516-555-3474 798 Langston Street 2/1o, Net Glen Oaks, NY 13004 30 Days Net 30 Days 0 Amy lames 718-555-5200 38-02 221 Street 180 Joe Barley738-555-3333 217 Locke Ave Seniors Club Lnvoice n chance DOLL cmesvicel ACC2310,0B18-ComprehensiveProblem,St ngs Review View Help ell me what you want to do x, x' A. .. ,.. . a.-. Emphasis Heading 1 Heading 2 INormai Stron Font Paragraph 12 Use the information below to update the Vendor Center Be sure to use the date July 1, 2019, for vendors with an opening balance. OPENING FIRST LAST Main BALANCE |NAME/ BILLED FROM PAYMENT TERMS COMPANY NAME AGI Telephone Co. Daly's Mortgage Corp. General Insurance Co. Phone CONTACT 130 Customer 718-555-5555 15 Main Street Net 30 Days Service lushing, NY 11354 Bayside. NY 11364 lericho, NY 11753 Customer718-555-7500 1800 Springtield Blvd. Net 30 Days Service Suzy 516-555-9500 1350 Jericho Taks Net 30 Days en Beck Local Power Company Office Supply Store Racquets, Inc. Ray Vill Advertising Agency Sporting Goods, Inc Tennis Suits,Inc. United States Treasury 718-555-1900 222 Main Street Net 30 Days Net 30 Days 500 Diflon Van631-555-7575 75 Hauppauge Road Net 30 Days Net 30 Days Purchasing631-55s-2525 25 Hauppauge Road Net 30 Days 600 Purchasing 633-555-1234 100 Broad Hollow Rd. Net 30 Days flushing NY 11354 111 Bell Blvd Bayside, NY 11364 Orders Dept. 718-555-9275 Hauppauge, NY 11783 Ray yil 212-555-4000 70S Park Ave Dept Hauppauge, NY 11783 Melville, NY 11747 13 If you used the QuickBooks Setup window to record customers and vendors, edit each customer and vendor to record the terms of payment. (See Step 11 and Step 12) 14 To complete the New Company Setup, record the following three journal entries on July 1, 2019 a Enter the opening balances (refer to Step 8 above). Use Open Bal as the Entry No. b. Make a journal entry to reverse the Uncategorized income account, Rev c. Make a journal entry to reverse the Uncategorized Expenses account, Rev 15. Display and print the following reports for July 1, 2019-July 1, 2019 Journal b. Trial Balance Note: After you reverse the Uncategorged incorne nd Uncategorized Expense accounts, you can make these accounts inactive in the Chart of Accounts List 16 Jen informs you that she has hired an assistant, Dave Saylor, who will begin working on July 1. Activate the payroll feature, if necessary, and then customize the payroll system default a. 0e@b@w , . .. | Emphasis Heading i Heading 2 fNarm EEmphasis Heading 1 Heading2 1 Norm al,x, x' A. .. | Paragraph Font NY- Withholding NYS Dept. of Revenue 17-6158789 Accept defaults Name: Agency for Liabilities: ldentifying number Taxable compensation: State Tax (SDI)-State Disability NY-Disability Company/NY-Disability Employee NYS Dept of Revenue 17-6158789 Name Agency for Liabilities dentifying number Company rate Employee rate: Taxable compensation: 0.5% Accept defaults Type Name Agency for Liabilities dentifying number Company Tax Rate Taxable compensation State Tax (SUI)-State Unemployment NY- Unemployment Company NYS Dept. of Revenue ER-158789 4 025% each quarter Accept defaults e. Add Dave to the Employee Center LEGAL NAME SOCIAL SECURITY NO: DATE OF BIRTH GENDER MARITAL STATUS ADDRESS Mobile PAY FREQUENCY: EARNINGS-ITEM NAME HOURLY/ANNUAL RATE Federal Filing Status Dave Saylor 137-29-2817 05/13/1998 single 1 Marine Way, New Hyde Park, NY 11040 516-555-0331 Hourly Wages 10.00 ingle STATE WORKED: NY SUI (Company Paid) SDI NY Single Tax STATE SUBJECT TO WITHHOLDING Filing Stotus Other Taxes No (delete all) The following activity occurred during the month of July. Set up or create additional preferences and files when needed and record the following transactions in the appropriate windows. 17. l2 Received a siox-month insurance policy renewal from General Insurance Co. for $1,200, paid immediately. Check No. 72.Jen recorded the first sie-month policy as 0eon @ w Strong Subtitle Title TNo Spac Suttle Ern.. Intense E- Quote Intersed. Sobele Rd. iemele, > Styles Insurance Expense, but you think it is better to record it as Prepaid insurance on payment, and then adjust it at the end of each month. ai 2 Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid immediately, Check No. 73. Jen also recorded the previous advertising as Advertising Expense, but like the insurance policy, you will record it as Prepaid Advertising on payment and then adjust it at the end of each month Recommended to the owner, Jen Beck, that she put some of the cash into a Money Market account that will earn interest. Jen agrees. Create the general ledger account 1030 Money Market and transfer $7,000 into the account ul3 Purchased $500 of office supplies on account from the Office Supply Store, their 3Purchased 25 cans of tennis balls from Sporting Goods, Inc, at $2 per can, paid ul 4 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court Invoice No. 285, Net 30 Days. Jen previously recorded this type of purchase as Supplies Expense, but you record it in the asset account Office Supplies immediately, Check No 74 services at $30 each on account to the Davis Family, Invoice No. 1150, Net 30 Days to the Grisham Family, Invoice No 1151, 2/10. Net 30 Days Sold 4 tennis racquets for $100 each and 4 tennis outfits for $80 each on account ul 3 Receved full payment from Whitestone Seniors Club, their Check No. 1557 Paid in full AGil Telephone Co., Check No. 75 Jul 6 Recorded the cash sales for the week for 15 hours of tennis lessons (owner) at $25 each, 32 hours of tennis court services at $30 each, and 15 cans of tennis bails at $4 each, Sale No. 551 Received the telephone ba from AGI Telephone Co., ther invoice No. 809, s150, Net 30 Days aaa Received payment in full net of discount from Bayside Youth Group, their Check No. 11725 If the Discount and Credits button is not displayed, open the Create Invoices window, go to the Bayside Youth Group Invoice, and enter 2/10, Net 30 Days in the TERMS fieled Pid in full Racquets, inc., Check No. 76 2 Paid in full Tennis Suits, Inc. Check No. 77 Jul 11 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court services at $30 each on account to the Davis Family, Invoice No. 1152, Net 30 Days u12 Received full payment from Lakeland Community Group, their Check No. 6952 ul 12 Purchased 7 tennis racquets at 550 each on account from Racquets, inc, their Au12 Purchased 5 tennis outlits at $40 each on account from Tennis Suits, Inc, their Jul 12 Received full payment net of discount from the Grisham Family for invoice No Jul 13 Received a credit memo for 2 tennis racquets at 5s0 each returned on account to Invoice No. TR712 Invoice No. TO1478 1151, their Check No. 708. Racquets Inc, Invoice No. CM-TR712 Invoice nt chante Cres Eecycling DOLL cmevicel ACC2310 Q818-ComprehensiveProblem St References Mailings Review View Help Tell me what you want to do yout Stro Heading 2-|Normal ! :-. 2--' !. Emphasis Heading 1 x,x'A-2-A- Paragraph Font Jul 13 Provided 10 hours of tennis court services at $30 each on account to the Lakeland Community Group, Invoice No. 1153, Net 30 Days. Whitestone Seniors Club, Invoice No. 1154, Net 30 Days to Bayside Youth Group, Invoice No. 1155, terms 2/10, Net 30 Days each, 37 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 Jul 13 Provided 6 hours of tennis court services at $30 each on account to the Jul 13 Sold 10 tennis racquets at $100 each and 10 tennis outfits at $80 each on account ul 13 Recorded the cash sales for the week for 14 hours of tennis lessons (owner) at $25 Jul 13 Created account 1020 Cash-Payroll account Transferred $1,800 from the Cash- Jul 13 Crested the paycheck for Dave Saylor for his first two weeks working at Jen's each, and 4 tennis racquets at $100 each, Sale No. 552. Operating account to the Cash-Payroll account. Tennis Courts, pay period ending July 13, 2019 Recorded the following paycheck details Iif you receive messages about additional taxes, click X and Yes to close each messagel: July 13, 2019 1020 Cash-Payroll 101 PAY PERIOD ENDS and CHECK DATE BANK ACCOUNT Check Number 80 HOURS Company Summary: 49.60 11.60 4.80 Social Security Company Medicare Company Federal Unemployment NY- Disabvity Company: NY-Unemployment 32.20 Employee Summary: 52.00 49.60 11.60 40.00 1.20 Federal Withholding Social Secunity Employee Medicare Employee NY Withholding NY Disability- Employee 13 Deposited the cash receipts for the first half of the month of July Memorize the transaction for payments every two weeks. Next payment is July 27 2019. mmediately, Check No. 79 1152, their Check No. 555 Teen Club There will be three levels begiener, intermediate, and advariced. They L14 Purchased 25 cans of tennis balls at $2 each from Sporting Goods, inc, paid b14 Received full payment from the Davis Family for invoice No 1150 and Invoice No u 14 Jen was awarded the contract to provide tennis lessons to the Springfield Gardens AaBbCcl AaBbCcl daBbCcl daBbCcl AaBbCcl AABBCC AABBCC BbCel AaBbCcC trong Subtitle Title 1 No Spac.. . Subtle Em... .Intense E... Quote Intense Q... Subtle Ref... Intense R... Styles will be provided 30 hours a week in lessons. Jen will provide 10 hours of lessons and Dave will provide 20 hours of lessons. You decide to use time tracking for this contract. a. Enable the Time-Tracking feature and choose Friday as the first day of the work week b. Add the New Customer CUSTOMER NAME/ COMPANY NAME FULL NAME Main Phone: Springfield Gardens Teen Club Erica 718-555-1140 150 Westgate St Springfield Gardens, NY 11413 Net 30 Days BILL TO PAYMENT TERMS: Add the following three jobs to Springfield Gardens Teen Club: c. Beginner Level Intermediate Level Advanced Level JOB NAME: for all three jobs) To provide tennis instructions based on level Awarded 07/14/19 Job info: JOB DESCRIPTION JOB STATUS START DATE PROIECTED END 7/25/19 d. On the item List, add a new item Service TYPE ITEM NAME/NUMBER Tennis Lessons Fees - Assistant Tennis Lessons Fees- Assistant $20 per hour Non-Taxable Sales 4020 Tennis Lessons Fees Earned Tax Code: Account 18 Provided 2 hours tennis lessons (owner) at $25 each and 2 hours tennis court Jul 18 Received full payment from Whitestone Seniors Club for Invoice No. 1154, their ul 19 Received the utilities bill from Local Power Company and paid it immediately Jul 20 Recorded the cash sales for the week for 16 hours of tennis lessons (owner) at 525 service at $30 each on account to the Davis Family, Invoice No. 1156, Net 30 Days. Check No. 1597 Check No. 80, $200 each, 39 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 each, 2 tennis racquets at $100 each, and 2 tennis outfits at $80 each, Sale No. 553. Computenined Accouting wih Qeikooks20 Layout Referenites Heading 2 Emphasis. Heading 1 . A-LI. | ab x, xa A. .. Paragraph Font Recorded the tennis lessons hours on the weekly timesheet for the Springfield Gardens Teen Club for the first week as follows: ul 20 Sun Mon Tue Wed Thu For Jen Beck (owner) Beginner Level Intermediate Level Advanced tevel MonTue WedThu 7/147/15 7/16 7/17 7/18 Sun For Dave Saylor (assistant) Beginner Level Intermediate Level Advanced Level Jul 22 Received full payment net of discount from Bayside Youth Group, Invoice No. 1155, their Check No. 11775. Invoice No. TR722. services at $30 each on account to the Davis Family, Invoice No. 1157, Net 30 Days ul 22 Purchased 5 tennis racquets at $s0 each on account from Racquets, Inc, their Jul 25 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court Jul 25 Received full payment from Lakeland Community Group, Invoice No. 1153, their Check No. 6965. Community Group, Invoice No. 1158, Net 30 Days. Whitestone Senior Club, Invoice No. 1159, Net 30 Days the Cheung Family, Invoice No. 1160, 2/10, Net 30 Days. Jul 27 Provided 10 hours of tennis court services at $30 each on account to the Lakeland Jul 27 Provided 6 hours of tennis court services at $30 each on account to the u 27 Sold 2 tennis racquets at $100 each and 2 tennis outfits at $80 each on account to ul 27 Recorded the cash sales for the week for 18 hours of tennis lessons (owner) at $25 each, 40 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 each, and 2 tennis outfits at $80 each, Sale No. 554 Jul 27 Recorded the tennis lessons hours on the weekly timesheet for the Springfield Gardens Teen Club for the second week as follows: Sun Mon Tue Wed Thu 7/21 7/22 7/23 7/24 7/25 For Jen Beck (owner): Beginner Level Intermediate Level Advanced Level For Dave Saylor (assistant) Beginner Level Intermediate Level Advanced Level Sun Mon Tue Wed Thu 7/21 7/22 7/23 7/24 7/25 Jul 27 Created three invoices for the Springfield Gardens Teen Club: Beginner Level, Invoice No. 1161; Intermediate Level, Invoice No.1162; and Advanced Level, Invoice No. 1163; for the period July 14, 2019-July 25, 2019, Net 30 Days. Jul 27 Created the paycheck for Dave Saylor for the pay period ending July 27, 2019. Dave worked a total of 80 hours of which 40 hours were at the Springfield Gardens Teen Club (those hours will flow into the payroll from the timesheet) and 40 were at Jen's Tennis Courts (those 40 hours you must enter in the Preview Paycheck window). The paycheck details are as follows: PAY PERIOD ENDS and CHECK DATE BANK ACCOUNT Check Number July 27, 2019 1020 Cash Payrol 102 80 HOURS Company Summary 49.60 11.60 4.80 Social Security Company Mediare Company Federal Unemployment NY-Disability Company NY 32.20 Employee Summary 52.00 49.60 11.60 Federal Withholding Social Security Employee Medicare Employee y in Protected View.Enable Editing ACC2310 Computerized Accounting Comprehensive Problem Jen's Tennis Courts 350 Points NOTE: Instructions: (this is a Direct measure- capstone course) Complete all items listed from instructions 1-23 in the Jen's Tennis Courts Comprehensive Problems. a) b) Submit the following items to the link located in the Canvas course. a. The Trial Balance, July 1, 2019 from instruction # 15 (50 points) b. Customer Balance Detail from instruction # 22 (20 points) c. Vendor Balance Detail from instruction # 22 (20 points) d, The Inventory Valuation Detail from instruction # 22 (20 points) e, The Payroll Transaction Detail from instruction # 22 (20 points) f. Profit and loss by job from instruction #22 (20 points) g. The journal Report, including all 77 journal entries from instruction # 22 (100 points) h. The adjusted trial balance from instruction # 22 i. For this part, do not use the financial statements prepared by Quick books. Instead, prepare this financial statements based upon the adjusted trial balance from instruction # 22, (These financial statements may not match those prepared by Quick books). Prepare, in good order, in a separate excel document, the following financial statements: . Multiple step Income Statement (ignore income taxes) (50 points) ii. Statement of Capital ii. Classified Balance Sheet (50 points) This is a direct measure. nsiveProblem-CheckFigures.pdf KB COMPREHENSIVE PROBLEM CHECK FIGURES 15. (a) Journal 1,2019 118,454 $ 113,714.00 2,321.72 $181,554.82 $ 127.732.80 3,150.85 2,600.00 Trial Balance 1, 2019 19. (e) Reconciliation Detail-July 31 201 20.(a) Journal - July 31, 2019 31, 2019 uly 31.201 Vendor Balance Detail uly 31. $ 184,614.82 Journal- All JEs $ 4.17 40,289 AaBlbCel AaBbcet Aab AaBbCel AaBbCcl daBbcl daBbl AabbCel AABBCC AABBCc Strong Subtitle Title No Spac... Subtle Em... Intense E... Quote Intense Q Subtle Ref... Intense Re. Styles Tax Rate (%): Sales Tax Agency NYS Dept of Revenue 1 Washington Avenue Albany, NY 12222 518-555-1000 Phone: 4. Set up or edit the following payment terms. All other payment terms created by QuickBooks can be deleted 2/10, Net 30 Days Net 15 Days Net 30 Days S. Allow the software to create system default accounts by cpening and closing the following windows: Create invoices window; Enter Sales Receipts window Enter Bills window; Item List window-New Item window-Inventory Part 6. Custormize the following accounts in the Chart of Accounts List window. (Sales Income is displayed only if you used the QuickBooks Setup window to enter date.) Chenge to 1200 Accounts Receivable 1250 Undeposited Funds 1230 Inventory of Tennis Racquets 2010 Accounts Payable 2030 Sales Tax Payable Jen Beck, Capital 3020 3030 11000 Accounts Receivable 12000 Undeposited Funds 12100 Iventory Asset 20000 Accounts Payable 25500 Sales Tax Payable 30000 Opening Balance Equity 3010 30800 Owners Draw 32000 Owners Equity Jen Beck, Drawings Accumulated Earnings Sales income (Detailed 4030 5030 Sale of Tennis Racquets Cost of Tennis Racquets Sold Start only) Cost of Goods Sold 50000 7 Delete account 47900 Sales if it is in the Chart of Accounts List Note: If you used the Detailed Stort method, additional accounts may appear. You can use these accounts and edit them to match the additional accounts you will add in Step & below or you can delete the odditional accounts. You may need to complete the editing of the item List in Step 9 below before you con deiete some of the accounts. if the payroll accounts appear, you wall not be able to delete them. You can make them noctive, but it isn't necessary because you w use the payroll accounts later in this probiem Use the following information to update the Chart of Accounts List for accounts not aireedy created and customized 8. Note: Some of the accounts lsted below have already been created and cusfomined. They are isted here again to disploy the balances. Yow wall need the balances for Step 14 (al below Do not enter the balances ot this time DOLL t Normal Heading 1 Heading 2 !:-.12.-. | . Emphasis . A.| x, x' A. Paragraph Font Balances Debit Number Name $13,148.00 Cash- Operating Inventory of Tennis Balls 1240 Prepaid Insurance Prepaid Advertising Office Supplies Tennis Courts Tennis Courts, Cost (subaccount of 1700) Tennis Courts, Accum. 2sess 1725 1750 1800 50,000.00 Furniture, Cost subaccount of 1800) Furniture, Accum. Dtees subaccount of 1800) Equipment Equipment, Cost (subaccount of 1900) Equipment,Assm 95eres 8,000.00 1925 5,000.00 len Beck, Dra Tennis Court Fees Earned Tennis Lessons Fees Earned 6,000.00 14,250.0o Sale of Tennis Clothes Sale of Tennis Balls 42.00 1,500.00 800.00 Cost of Tennis Racquets Sold Cost of Ter ost of Tennis Balls Advertising Expense Bank Service Charzes Expense 900.00 Exp, E 2 Office Supplies Expense 500.00 elephone Expense Sha cl AaBbCel AaBbCcC al Strong Subtitle Find Title 1No Spac.. Subtle Em." Subtle Em... Intense E... Quote Intense Q.. Subtle Ref. Intense R.. Intense E. Quote Select Editing Styles 025 050 Interest lincome (Other Incomel 984.00 9. Use the information below to updete the item List. Only inventory parts are taxable. For the inventory part items, be sure to use the date July 1, 2019 tem Name andDescriptionRate Sales Price Cost ty an Hand Tennis Court Fees Tennis Lessons Fees Owner 30 25 ennis Racquets Tennis Clothes Tennis Bals 100 30 25 10 It you used the Detailed Start method and the Quickbooks Setup window to enter data, edit the tems on the Item List Service Items: inventory Part Items:edit account mumbers and taxable (Step 9) Sales Tax item: edit account mumbers and non-taxable (Step 9) edit name, description, tax rate, tax agency (Step 3) Note: After you edit the ltem List, you con delete the inventory Asset and Cost of Goods Sold occounts in the Chart of Accounts List 11. Use the following information to updete the Customer Center. Be sure to use the date July 2 2019, for customers with an opening balance IRST LAST CUSTOMER OPENINC |F BALANCE NAME 1 Mar BILL TO COMPANY NAME Bayside Youth Group Cheung Famiy Davis Family Grisham Famly 51,800 Diane Rand 718-555-4545 45-45 Bel Blvd 718-555-9725 444 Barrows Ct /10, Net Net 30 Deys Bavside NY 516-555-3474 798 Langston Street 2/1o, Net Glen Oaks, NY 13004 30 Days Net 30 Days 0 Amy lames 718-555-5200 38-02 221 Street 180 Joe Barley738-555-3333 217 Locke Ave Seniors Club Lnvoice n chance DOLL cmesvicel ACC2310,0B18-ComprehensiveProblem,St ngs Review View Help ell me what you want to do x, x' A. .. ,.. . a.-. Emphasis Heading 1 Heading 2 INormai Stron Font Paragraph 12 Use the information below to update the Vendor Center Be sure to use the date July 1, 2019, for vendors with an opening balance. OPENING FIRST LAST Main BALANCE |NAME/ BILLED FROM PAYMENT TERMS COMPANY NAME AGI Telephone Co. Daly's Mortgage Corp. General Insurance Co. Phone CONTACT 130 Customer 718-555-5555 15 Main Street Net 30 Days Service lushing, NY 11354 Bayside. NY 11364 lericho, NY 11753 Customer718-555-7500 1800 Springtield Blvd. Net 30 Days Service Suzy 516-555-9500 1350 Jericho Taks Net 30 Days en Beck Local Power Company Office Supply Store Racquets, Inc. Ray Vill Advertising Agency Sporting Goods, Inc Tennis Suits,Inc. United States Treasury 718-555-1900 222 Main Street Net 30 Days Net 30 Days 500 Diflon Van631-555-7575 75 Hauppauge Road Net 30 Days Net 30 Days Purchasing631-55s-2525 25 Hauppauge Road Net 30 Days 600 Purchasing 633-555-1234 100 Broad Hollow Rd. Net 30 Days flushing NY 11354 111 Bell Blvd Bayside, NY 11364 Orders Dept. 718-555-9275 Hauppauge, NY 11783 Ray yil 212-555-4000 70S Park Ave Dept Hauppauge, NY 11783 Melville, NY 11747 13 If you used the QuickBooks Setup window to record customers and vendors, edit each customer and vendor to record the terms of payment. (See Step 11 and Step 12) 14 To complete the New Company Setup, record the following three journal entries on July 1, 2019 a Enter the opening balances (refer to Step 8 above). Use Open Bal as the Entry No. b. Make a journal entry to reverse the Uncategorized income account, Rev c. Make a journal entry to reverse the Uncategorized Expenses account, Rev 15. Display and print the following reports for July 1, 2019-July 1, 2019 Journal b. Trial Balance Note: After you reverse the Uncategorged incorne nd Uncategorized Expense accounts, you can make these accounts inactive in the Chart of Accounts List 16 Jen informs you that she has hired an assistant, Dave Saylor, who will begin working on July 1. Activate the payroll feature, if necessary, and then customize the payroll system default a. 0e@b@w , . .. | Emphasis Heading i Heading 2 fNarm EEmphasis Heading 1 Heading2 1 Norm al,x, x' A. .. | Paragraph Font NY- Withholding NYS Dept. of Revenue 17-6158789 Accept defaults Name: Agency for Liabilities: ldentifying number Taxable compensation: State Tax (SDI)-State Disability NY-Disability Company/NY-Disability Employee NYS Dept of Revenue 17-6158789 Name Agency for Liabilities dentifying number Company rate Employee rate: Taxable compensation: 0.5% Accept defaults Type Name Agency for Liabilities dentifying number Company Tax Rate Taxable compensation State Tax (SUI)-State Unemployment NY- Unemployment Company NYS Dept. of Revenue ER-158789 4 025% each quarter Accept defaults e. Add Dave to the Employee Center LEGAL NAME SOCIAL SECURITY NO: DATE OF BIRTH GENDER MARITAL STATUS ADDRESS Mobile PAY FREQUENCY: EARNINGS-ITEM NAME HOURLY/ANNUAL RATE Federal Filing Status Dave Saylor 137-29-2817 05/13/1998 single 1 Marine Way, New Hyde Park, NY 11040 516-555-0331 Hourly Wages 10.00 ingle STATE WORKED: NY SUI (Company Paid) SDI NY Single Tax STATE SUBJECT TO WITHHOLDING Filing Stotus Other Taxes No (delete all) The following activity occurred during the month of July. Set up or create additional preferences and files when needed and record the following transactions in the appropriate windows. 17. l2 Received a siox-month insurance policy renewal from General Insurance Co. for $1,200, paid immediately. Check No. 72.Jen recorded the first sie-month policy as 0eon @ w Strong Subtitle Title TNo Spac Suttle Ern.. Intense E- Quote Intersed. Sobele Rd. iemele, > Styles Insurance Expense, but you think it is better to record it as Prepaid insurance on payment, and then adjust it at the end of each month. ai 2 Received a six-month advertising renewal from Ray Vill Advertising Agency for $900, paid immediately, Check No. 73. Jen also recorded the previous advertising as Advertising Expense, but like the insurance policy, you will record it as Prepaid Advertising on payment and then adjust it at the end of each month Recommended to the owner, Jen Beck, that she put some of the cash into a Money Market account that will earn interest. Jen agrees. Create the general ledger account 1030 Money Market and transfer $7,000 into the account ul3 Purchased $500 of office supplies on account from the Office Supply Store, their 3Purchased 25 cans of tennis balls from Sporting Goods, Inc, at $2 per can, paid ul 4 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court Invoice No. 285, Net 30 Days. Jen previously recorded this type of purchase as Supplies Expense, but you record it in the asset account Office Supplies immediately, Check No 74 services at $30 each on account to the Davis Family, Invoice No. 1150, Net 30 Days to the Grisham Family, Invoice No 1151, 2/10. Net 30 Days Sold 4 tennis racquets for $100 each and 4 tennis outfits for $80 each on account ul 3 Receved full payment from Whitestone Seniors Club, their Check No. 1557 Paid in full AGil Telephone Co., Check No. 75 Jul 6 Recorded the cash sales for the week for 15 hours of tennis lessons (owner) at $25 each, 32 hours of tennis court services at $30 each, and 15 cans of tennis bails at $4 each, Sale No. 551 Received the telephone ba from AGI Telephone Co., ther invoice No. 809, s150, Net 30 Days aaa Received payment in full net of discount from Bayside Youth Group, their Check No. 11725 If the Discount and Credits button is not displayed, open the Create Invoices window, go to the Bayside Youth Group Invoice, and enter 2/10, Net 30 Days in the TERMS fieled Pid in full Racquets, inc., Check No. 76 2 Paid in full Tennis Suits, Inc. Check No. 77 Jul 11 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court services at $30 each on account to the Davis Family, Invoice No. 1152, Net 30 Days u12 Received full payment from Lakeland Community Group, their Check No. 6952 ul 12 Purchased 7 tennis racquets at 550 each on account from Racquets, inc, their Au12 Purchased 5 tennis outlits at $40 each on account from Tennis Suits, Inc, their Jul 12 Received full payment net of discount from the Grisham Family for invoice No Jul 13 Received a credit memo for 2 tennis racquets at 5s0 each returned on account to Invoice No. TR712 Invoice No. TO1478 1151, their Check No. 708. Racquets Inc, Invoice No. CM-TR712 Invoice nt chante Cres Eecycling DOLL cmevicel ACC2310 Q818-ComprehensiveProblem St References Mailings Review View Help Tell me what you want to do yout Stro Heading 2-|Normal ! :-. 2--' !. Emphasis Heading 1 x,x'A-2-A- Paragraph Font Jul 13 Provided 10 hours of tennis court services at $30 each on account to the Lakeland Community Group, Invoice No. 1153, Net 30 Days. Whitestone Seniors Club, Invoice No. 1154, Net 30 Days to Bayside Youth Group, Invoice No. 1155, terms 2/10, Net 30 Days each, 37 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 Jul 13 Provided 6 hours of tennis court services at $30 each on account to the Jul 13 Sold 10 tennis racquets at $100 each and 10 tennis outfits at $80 each on account ul 13 Recorded the cash sales for the week for 14 hours of tennis lessons (owner) at $25 Jul 13 Created account 1020 Cash-Payroll account Transferred $1,800 from the Cash- Jul 13 Crested the paycheck for Dave Saylor for his first two weeks working at Jen's each, and 4 tennis racquets at $100 each, Sale No. 552. Operating account to the Cash-Payroll account. Tennis Courts, pay period ending July 13, 2019 Recorded the following paycheck details Iif you receive messages about additional taxes, click X and Yes to close each messagel: July 13, 2019 1020 Cash-Payroll 101 PAY PERIOD ENDS and CHECK DATE BANK ACCOUNT Check Number 80 HOURS Company Summary: 49.60 11.60 4.80 Social Security Company Medicare Company Federal Unemployment NY- Disabvity Company: NY-Unemployment 32.20 Employee Summary: 52.00 49.60 11.60 40.00 1.20 Federal Withholding Social Secunity Employee Medicare Employee NY Withholding NY Disability- Employee 13 Deposited the cash receipts for the first half of the month of July Memorize the transaction for payments every two weeks. Next payment is July 27 2019. mmediately, Check No. 79 1152, their Check No. 555 Teen Club There will be three levels begiener, intermediate, and advariced. They L14 Purchased 25 cans of tennis balls at $2 each from Sporting Goods, inc, paid b14 Received full payment from the Davis Family for invoice No 1150 and Invoice No u 14 Jen was awarded the contract to provide tennis lessons to the Springfield Gardens AaBbCcl AaBbCcl daBbCcl daBbCcl AaBbCcl AABBCC AABBCC BbCel AaBbCcC trong Subtitle Title 1 No Spac.. . Subtle Em... .Intense E... Quote Intense Q... Subtle Ref... Intense R... Styles will be provided 30 hours a week in lessons. Jen will provide 10 hours of lessons and Dave will provide 20 hours of lessons. You decide to use time tracking for this contract. a. Enable the Time-Tracking feature and choose Friday as the first day of the work week b. Add the New Customer CUSTOMER NAME/ COMPANY NAME FULL NAME Main Phone: Springfield Gardens Teen Club Erica 718-555-1140 150 Westgate St Springfield Gardens, NY 11413 Net 30 Days BILL TO PAYMENT TERMS: Add the following three jobs to Springfield Gardens Teen Club: c. Beginner Level Intermediate Level Advanced Level JOB NAME: for all three jobs) To provide tennis instructions based on level Awarded 07/14/19 Job info: JOB DESCRIPTION JOB STATUS START DATE PROIECTED END 7/25/19 d. On the item List, add a new item Service TYPE ITEM NAME/NUMBER Tennis Lessons Fees - Assistant Tennis Lessons Fees- Assistant $20 per hour Non-Taxable Sales 4020 Tennis Lessons Fees Earned Tax Code: Account 18 Provided 2 hours tennis lessons (owner) at $25 each and 2 hours tennis court Jul 18 Received full payment from Whitestone Seniors Club for Invoice No. 1154, their ul 19 Received the utilities bill from Local Power Company and paid it immediately Jul 20 Recorded the cash sales for the week for 16 hours of tennis lessons (owner) at 525 service at $30 each on account to the Davis Family, Invoice No. 1156, Net 30 Days. Check No. 1597 Check No. 80, $200 each, 39 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 each, 2 tennis racquets at $100 each, and 2 tennis outfits at $80 each, Sale No. 553. Computenined Accouting wih Qeikooks20 Layout Referenites Heading 2 Emphasis. Heading 1 . A-LI. | ab x, xa A. .. Paragraph Font Recorded the tennis lessons hours on the weekly timesheet for the Springfield Gardens Teen Club for the first week as follows: ul 20 Sun Mon Tue Wed Thu For Jen Beck (owner) Beginner Level Intermediate Level Advanced tevel MonTue WedThu 7/147/15 7/16 7/17 7/18 Sun For Dave Saylor (assistant) Beginner Level Intermediate Level Advanced Level Jul 22 Received full payment net of discount from Bayside Youth Group, Invoice No. 1155, their Check No. 11775. Invoice No. TR722. services at $30 each on account to the Davis Family, Invoice No. 1157, Net 30 Days ul 22 Purchased 5 tennis racquets at $s0 each on account from Racquets, Inc, their Jul 25 Provided 2 hours of tennis lessons (owner) at $25 each and 2 hours of tennis court Jul 25 Received full payment from Lakeland Community Group, Invoice No. 1153, their Check No. 6965. Community Group, Invoice No. 1158, Net 30 Days. Whitestone Senior Club, Invoice No. 1159, Net 30 Days the Cheung Family, Invoice No. 1160, 2/10, Net 30 Days. Jul 27 Provided 10 hours of tennis court services at $30 each on account to the Lakeland Jul 27 Provided 6 hours of tennis court services at $30 each on account to the u 27 Sold 2 tennis racquets at $100 each and 2 tennis outfits at $80 each on account to ul 27 Recorded the cash sales for the week for 18 hours of tennis lessons (owner) at $25 each, 40 hours of tennis court services at $30 each, 15 cans of tennis balls at $4 each, and 2 tennis outfits at $80 each, Sale No. 554 Jul 27 Recorded the tennis lessons hours on the weekly timesheet for the Springfield Gardens Teen Club for the second week as follows: Sun Mon Tue Wed Thu 7/21 7/22 7/23 7/24 7/25 For Jen Beck (owner): Beginner Level Intermediate Level Advanced Level For Dave Saylor (assistant) Beginner Level Intermediate Level Advanced Level Sun Mon Tue Wed Thu 7/21 7/22 7/23 7/24 7/25 Jul 27 Created three invoices for the Springfield Gardens Teen Club: Beginner Level, Invoice No. 1161; Intermediate Level, Invoice No.1162; and Advanced Level, Invoice No. 1163; for the period July 14, 2019-July 25, 2019, Net 30 Days. Jul 27 Created the paycheck for Dave Saylor for the pay period ending July 27, 2019. Dave worked a total of 80 hours of which 40 hours were at the Springfield Gardens Teen Club (those hours will flow into the payroll from the timesheet) and 40 were at Jen's Tennis Courts (those 40 hours you must enter in the Preview Paycheck window). The paycheck details are as follows: PAY PERIOD ENDS and CHECK DATE BANK ACCOUNT Check Number July 27, 2019 1020 Cash Payrol 102 80 HOURS Company Summary 49.60 11.60 4.80 Social Security Company Mediare Company Federal Unemployment NY-Disability Company NY 32.20 Employee Summary 52.00 49.60 11.60 Federal Withholding Social Security Employee Medicare Employee y in Protected View.Enable Editing ACC2310 Computerized Accounting Comprehensive Problem Jen's Tennis Courts 350 Points NOTE: Instructions: (this is a Direct measure- capstone course) Complete all items listed from instructions 1-23 in the Jen's Tennis Courts Comprehensive Problems. a) b) Submit the following items to the link located in the Canvas course. a. The Trial Balance, July 1, 2019 from instruction # 15 (50 points) b. Customer Balance Detail from instruction # 22 (20 points) c. Vendor Balance Detail from instruction # 22 (20 points) d, The Inventory Valuation Detail from instruction # 22 (20 points) e, The Payroll Transaction Detail from instruction # 22 (20 points) f. Profit and loss by job from instruction #22 (20 points) g. The journal Report, including all 77 journal entries from instruction # 22 (100 points) h. The adjusted trial balance from instruction # 22 i. For this part, do not use the financial statements prepared by Quick books. Instead, prepare this financial statements based upon the adjusted trial balance from instruction # 22, (These financial statements may not match those prepared by Quick books). Prepare, in good order, in a separate excel document, the following financial statements: . Multiple step Income Statement (ignore income taxes) (50 points) ii. Statement of Capital ii. Classified Balance Sheet (50 points) This is a direct measure. nsiveProblem-CheckFigures.pdf KB COMPREHENSIVE PROBLEM CHECK FIGURES 15. (a) Journal 1,2019 118,454 $ 113,714.00 2,321.72 $181,554.82 $ 127.732.80 3,150.85 2,600.00 Trial Balance 1, 2019 19. (e) Reconciliation Detail-July 31 201 20.(a) Journal - July 31, 2019 31, 2019 uly 31.201 Vendor Balance Detail uly 31. $ 184,614.82 Journal- All JEs $ 4.17 40,289

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts