Question

Need help on this accounting problem. There's no need to actually use excel if you prefer to handwrite/draw it instead that's completely fine. Part B

Need help on this accounting problem. There's no need to actually use excel if you prefer to handwrite/draw it instead that's completely fine.

Part B:

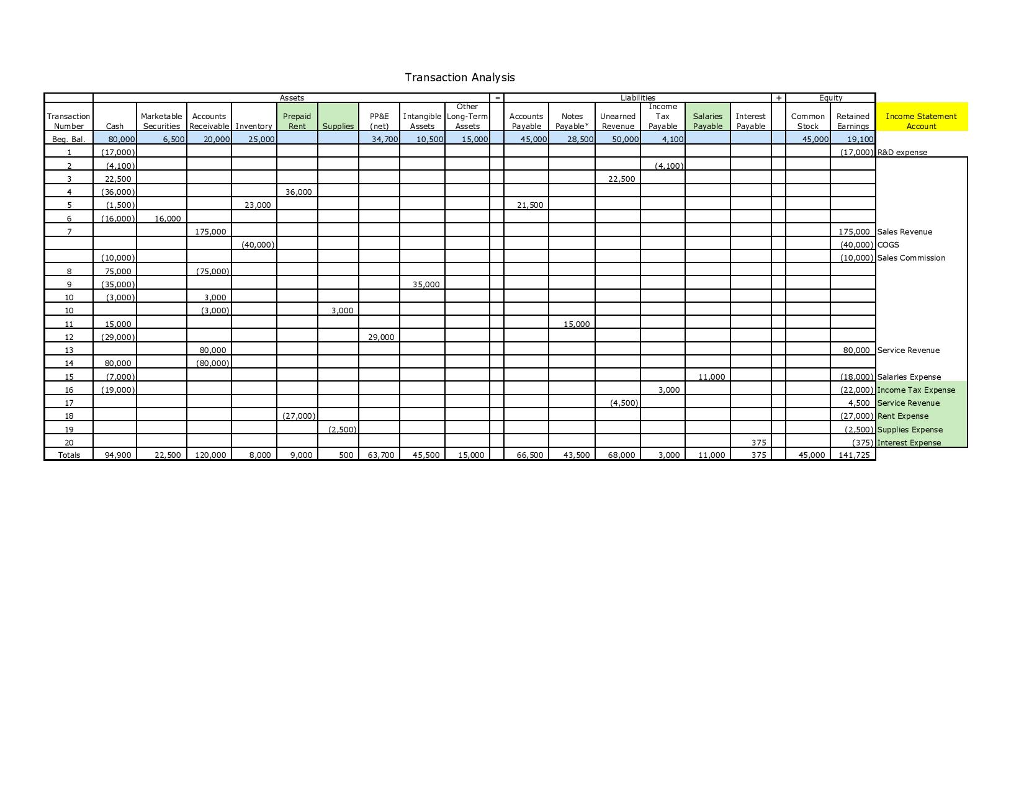

The second part of this assignment is very similar to Part A. You may reference the solution to the transaction analysis spreadsheet from Part A (picture below) to help you in Part B. Your assignment in Part B is to first prepare journal entries in the General Journal tab of this spreadsheet for the same transactions that you analyzed in Part A. After preparing your journal entries, post your entries to the T-accounts in the General Ledger (T-Accounts) tab. Start by inserting the beginning balances in the T-accounts from the Year 0 Balance Sheet and then post your journal entries from the General Journal. Next, calculate the ending balance in each account. Then, prepare Year 1 financial statements based on the ending balances in each T-account. Finally, go back to the General Journal and prepare closing entries. Post your closing entries to the General Ledger T-accounts. Finally, prepare a Post-Closing Trial Balance.

Solution to Part A (picture shown below):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started