Answered step by step

Verified Expert Solution

Question

1 Approved Answer

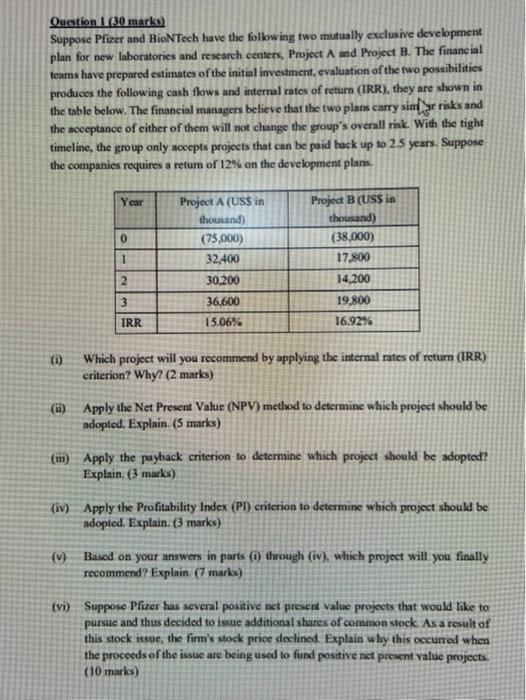

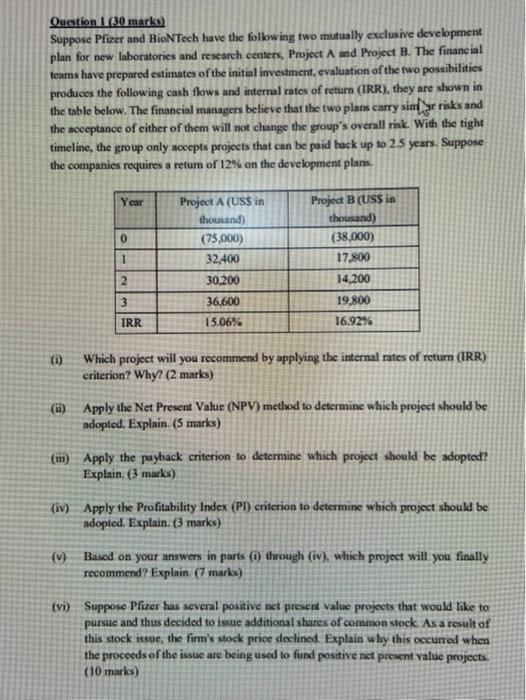

need help!!!! Ouestion 130 marks) Suppose Pfwer and BioNTech have the following two mutually exclusive development plan for new laboratories and research centers, Project A

need help!!!!

Ouestion 130 marks) Suppose Pfwer and BioNTech have the following two mutually exclusive development plan for new laboratories and research centers, Project A and Project B. The financial teams have prepared estimates of the initial investment, evaluation of the two possibilities produces the following cash flows and internal rates of return (IRR), they are shown in the table below. The financial managers believe that the two plans carry simr risks and the acceptance of either of them will not change the group's overall risk. With the tight timeline, the group only accepts projects that can be paid back up to 2.5 years. Suppose the companies requires a retum of 12% on the development plans. Year 0 Project A (US$ in thousand) (75,000) 32,400 30,200 36,600 15.06% Project B (USS in thousand) (38,000) 17,800 14,200 19,800 1 2 3 IRR 16.92% (i) Which project will you recommend by applying the internal rates of return (IRR) criterion? Why? (2 marks) () Apply the Net Present Value (NPV) method to determine which project should be adopted. Explain. (5 marks) (iii) Apply the payback criterion to determine which projeet should be adopted? Explain. (3 marks) (iv) Apply the Profitability Index (P1) criterion to determine which project should be adopted. Explain. (3 marks) () Based on your answers in parts through (iv), which project will you finally recommend? Explain (7 marks) (vi) Suppose Pfizer has several positive net present value projects that would like to pursue and thus decided to issue additional stures of common stock. As a result of this stock issue, the firm's stock price declined. Explain why this occurred when the proceeds of the issue are being used to fund positive net present value projects. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started