need help please

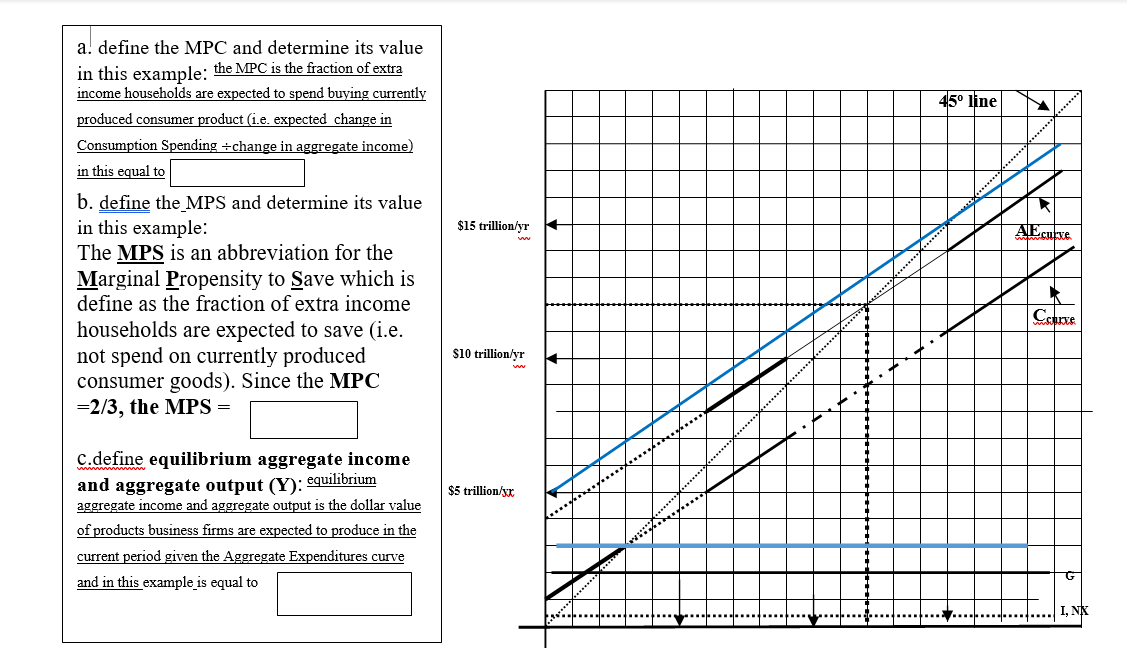

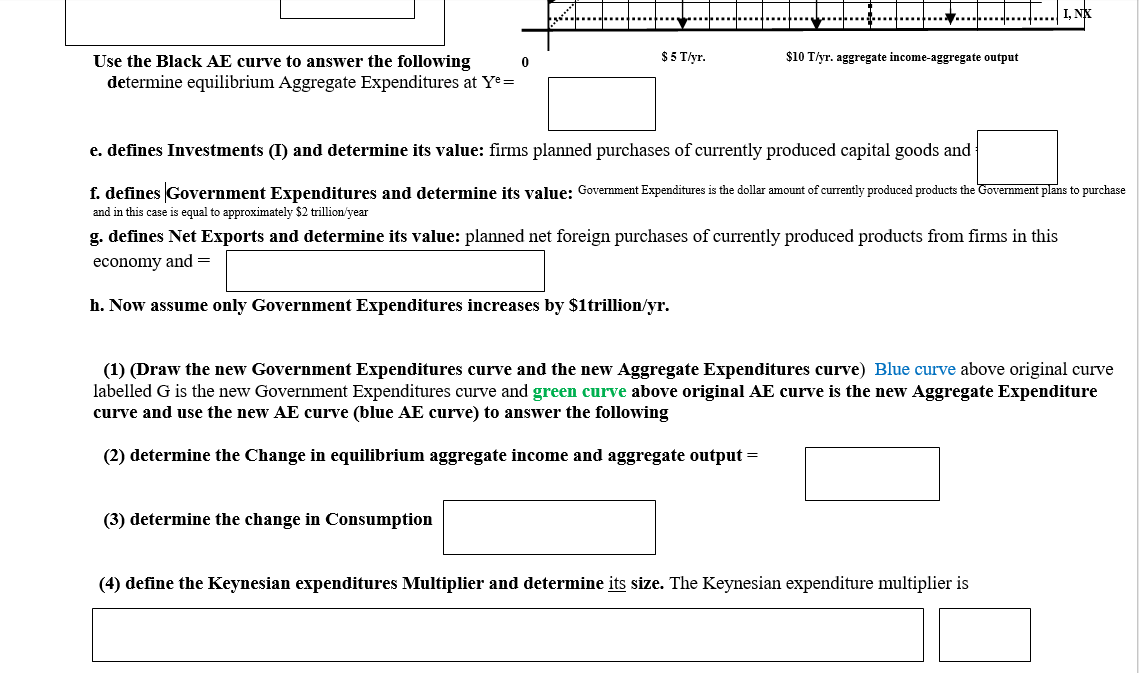

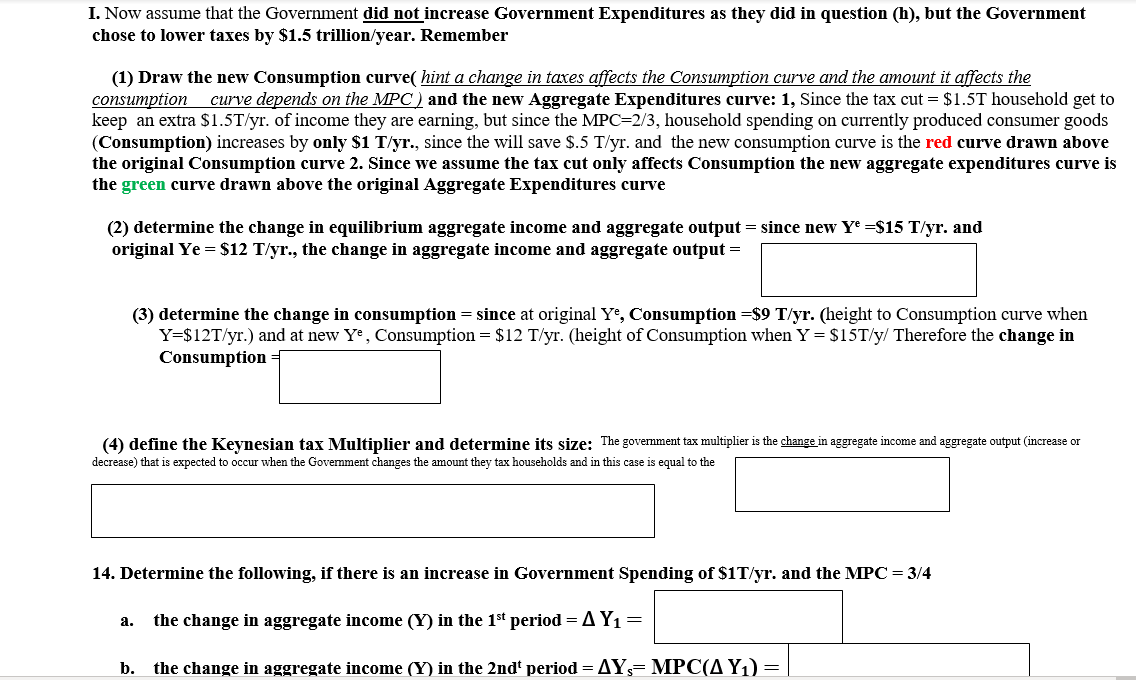

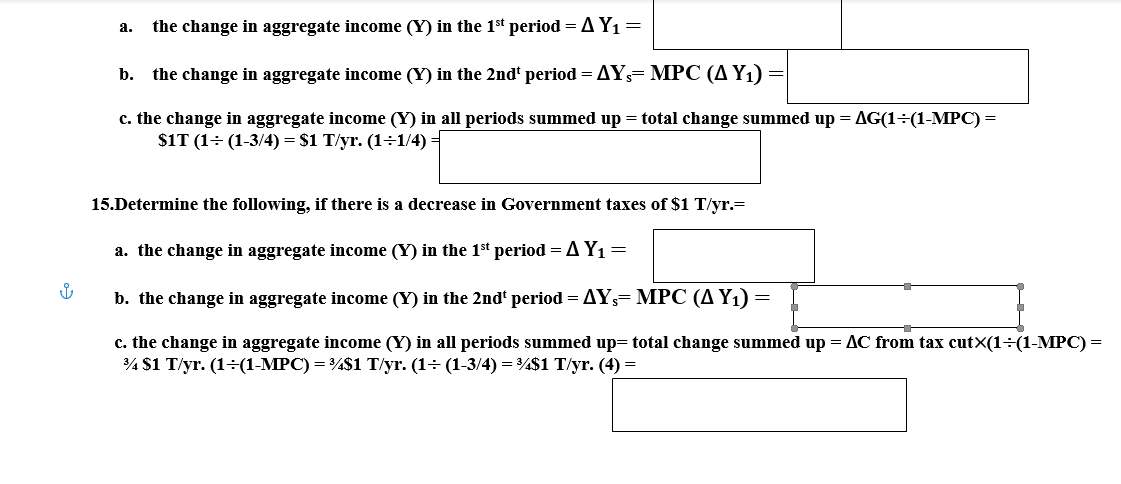

a! define the MPC and determine its value in this example: the MPC is the fraction of extra income households are expected to spend buying currently 450 line produced consumer product (i.e. expected change in Consumption Spending + change in aggregate income) in this equal to b. define the MPS and determine its value in this example: $15 trillion/yr The MPS is an abbreviation for the Marginal Propensity to Save which is define as the fraction of extra income households are expected to save (i.e. not spend on currently produced $10 trillion/yr consumer goods). Since the MPC =2/3, the MPS = c.define equilibrium aggregate income and aggregate output (Y): equilibrium aggregate income and aggregate output is the dollar value $5 trillion/xx of products business firms are expected to produce in the current period given the Aggregate Expenditures curve and in this example is equal to GUse the Black AE curve to answer the following $ 5 T/yr. $10 T/yr. aggregate income-aggregate output determine equilibrium Aggregate Expenditures at Y= e. defines Investments (1) and determine its value: firms planned purchases of currently produced capital goods and f. defines Government Expenditures and determine its value: Government Expenditures is the dollar amount of currently produced products the Government plans to purchase and in this case is equal to approximately $2 trillion/year g. defines Net Exports and determine its value: planned net foreign purchases of currently produced products from firms in this economy and = h. Now assume only Government Expenditures increases by $1trillion/yr. (1) (Draw the new Government Expenditures curve and the new Aggregate Expenditures curve) Blue curve above original curve labelled G is the new Government Expenditures curve and green curve above original AE curve is the new Aggregate Expenditure curve and use the new AE curve (blue AE curve) to answer the following (2) determine the Change in equilibrium aggregate income and aggregate output = (3) determine the change in Consumption (4) define the Keynesian expenditures Multiplier and determine its size. The Keynesian expenditure multiplier isI. Now assume that the Government did not increase Government Expenditures as they did in question (h), but the Government chose to lower taxes by $1.5 trillion/year. Remember (1) Draw the new Consumption curve( hint a change in taxes affects the Consumption curve and the amount it affects the consumption curve depends on the MPC ) and the new Aggregate Expenditures curve: 1, Since the tax cut = $1.5T household get to keep an extra $1.5T/yr. of income they are earning, but since the MPC=2/3, household spending on currently produced consumer goods (Consumption) increases by only $1 T/yr., since the will save $.5 T/yr. and the new consumption curve is the red curve drawn above the original Consumption curve 2. Since we assume the tax cut only affects Consumption the new aggregate expenditures curve is the green curve drawn above the original Aggregate Expenditures curve (2) determine the change in equilibrium aggregate income and aggregate output = since new Y =$15 T/yr. and original Ye = $12 T/yr., the change in aggregate income and aggregate output = (3) determine the change in consumption = since at original Ye, Consumption =$9 T/yr. (height to Consumption curve when Y=$12T/yr.) and at new Ye , Consumption = $12 T/yr. (height of Consumption when Y = $15T/y/ Therefore the change in Consumption = (4) define the Keynesian tax Multiplier and determine its size: The government tax multiplier is the change in aggregate income and aggregate output (increase or decrease) that is expected to occur when the Government changes the amount they tax households and in this case is equal to the 14. Determine the following, if there is an increase in Government Spending of $1T/yr. and the MPC = 3/4 a. the change in aggregate income (Y) in the ist period = A Y1 = b. the change in aggregate income (Y) in the 2ndt period = AYs= MPC(A Y1) =a. the change in aggregate income (Y) in the 1st period = A Y1 = b. the change in aggregate income (Y) in the 2ndt period = AY s= MPC (A Y1) = c. the change in aggregate income (Y) in all periods summed up = total change summed up = AG(1 :(1-MPC) = $1T (1 + (1-3/4) = $1 T/yr. (1=1/4) = 15.Determine the following, if there is a decrease in Government taxes of $1 T/yr.= a. the change in aggregate income (Y) in the ist period = A Y1 = b. the change in aggregate income (Y) in the 2ndt period = AYs= MPC (A Y1) = c. the change in aggregate income (Y) in all periods summed up= total change summed up = AC from tax cutx(1 =(1-MPC) = 34 $1 T/yr. (1 -(1-MPC) =34$1 T/yr. (1= (1-3/4) =3/4$1 T/yr. (4) =