Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP! PLEASE ANSWER ALL! WILL RATE HIGH! For this lab, we will be looking at realistic interest rates when borrowing. You will come up

NEED HELP! PLEASE ANSWER ALL! WILL RATE HIGH!

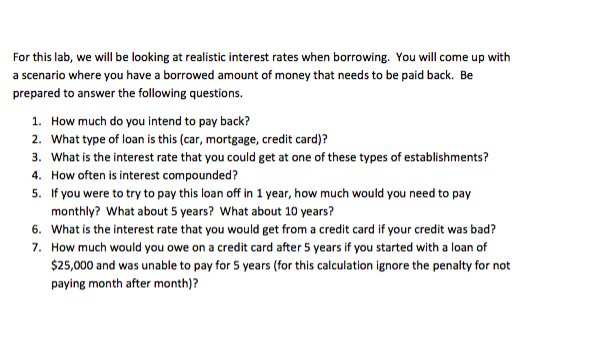

For this lab, we will be looking at realistic interest rates when borrowing. You will come up with a scenario where you have a borrowed amount of money that needs to be paid back. Be prepared to answer the following questions. 1. How much do you intend to pay back? 2. What type of loan is this (car, mortgage, credit card)? 3. What is the interest rate that you could get at one of these types of establishments? 4. How often is interest compounded? 5. If you were to try to pay this loan off in 1 year, how much would you need to pay monthly? What about 5 years? What about 10 years? 6. What is the interest rate that you would get from a credit card if your credit was bad? 7. How much would you owe on a credit card after 5 years if you started with a loan of $25,000 and was unable to pay for 5 years (for this calculation ignore the penalty for not paying month after month)? For this lab, we will be looking at realistic interest rates when borrowing. You will come up with a scenario where you have a borrowed amount of money that needs to be paid back. Be prepared to answer the following questions. 1. How much do you intend to pay back? 2. What type of loan is this (car, mortgage, credit card)? 3. What is the interest rate that you could get at one of these types of establishments? 4. How often is interest compounded? 5. If you were to try to pay this loan off in 1 year, how much would you need to pay monthly? What about 5 years? What about 10 years? 6. What is the interest rate that you would get from a credit card if your credit was bad? 7. How much would you owe on a credit card after 5 years if you started with a loan of $25,000 and was unable to pay for 5 years (for this calculation ignore the penalty for not paying month after month)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started