need help please

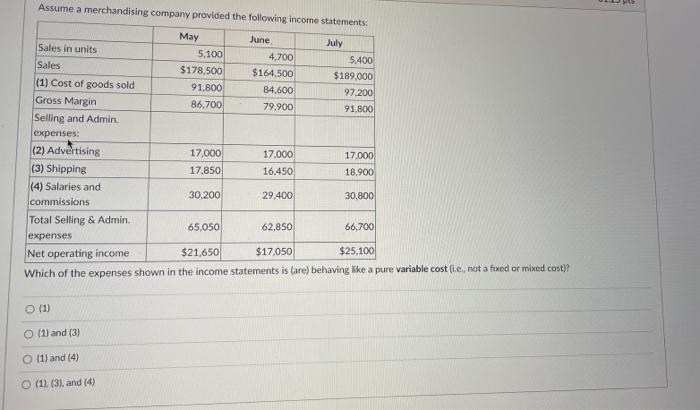

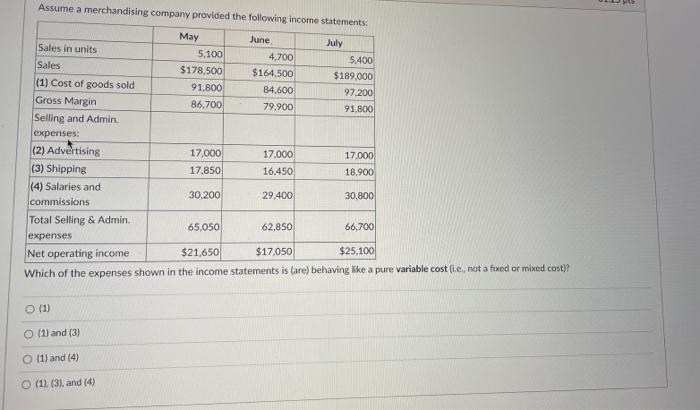

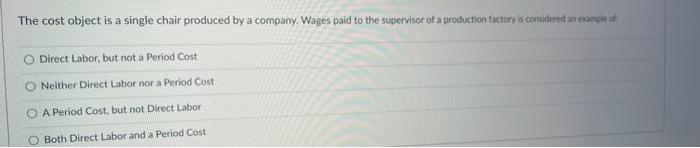

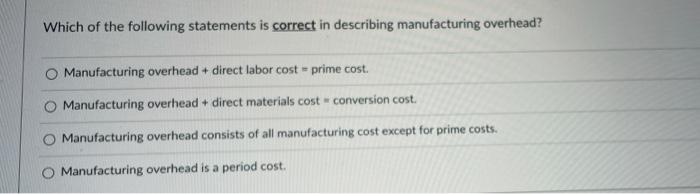

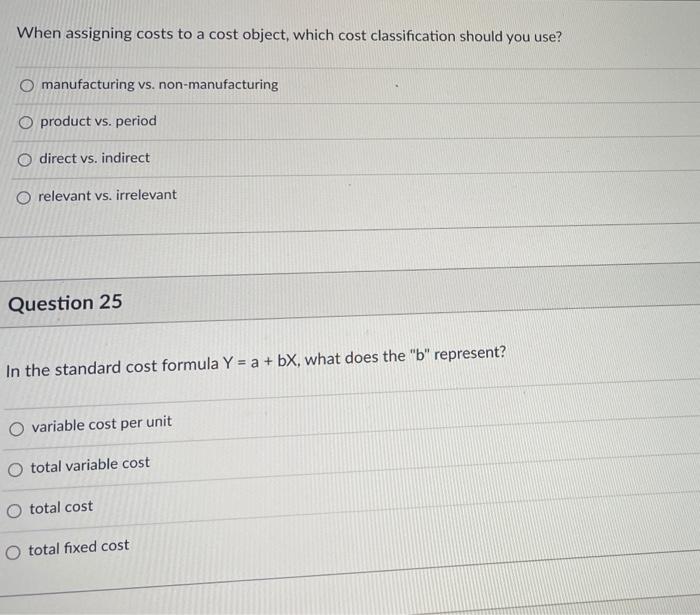

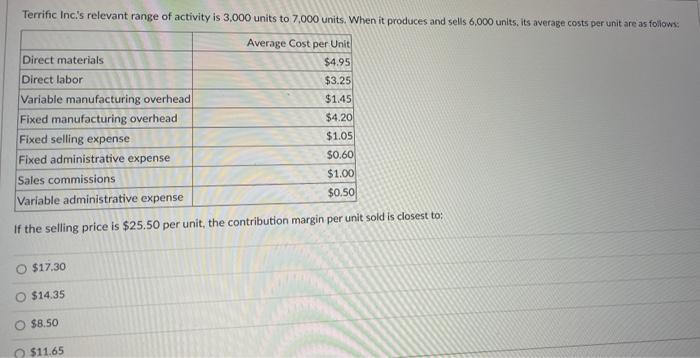

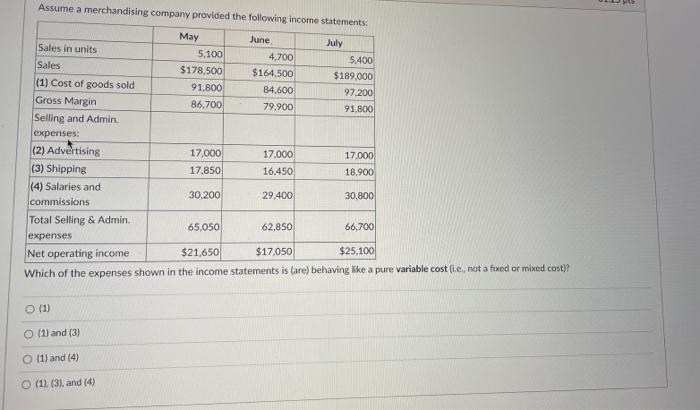

Assume a merchandising company provided the following income statements: May June July Sales in units 5,100 4,700 5.400 Sales $178,500 $164,500 $189.000 (1) Cost of goods sold 91.800 84,600 97,200 Gross Margin 86,700 79,900 91.800 Selling and Admin expenses: (2) Advertising 17,000 17.000 17.000 (3) Shipping 17.850 16.450 18.900 (4) Salaries and 30,200 29.400 30,800 commissions Total Selling & Admin 65,050 62,850 66,700 expenses $21,650 $17,050 $25,100 Net operating income Which of the expenses shown in the income statements is Care) behaving like a pure variable costlie, not a fuxed or mixed cost)? (1) (1) and (3) (1) and (4) (1). (3), and (4) The cost object is a single chair produced by a company. Wages paid to the supervisor of a production factory is considered an comple of Direct Labor, but not a Period Cost O Neither Direct Labor nor a Period Cost O A Period Cost, but not Direct Labor Both Direct Labor and a Period Cost The cost object is a single chair produced by a company, Wages paid to the supervisor of a production factory is considered an example o Direct Labor, but not a Period Cost Neither Direct Labor nor a Period Cost O A Period Cost, but not Direct Labor Both Direct Labor and a period Cost Which of the following statements is correct in describing manufacturing overhead? Manufacturing overhead + direct labor cost - prime cost. Manufacturing overhead + direct materials cost-conversion cost. Manufacturing overhead consists of all manufacturing cost except for prime costs. Manufacturing overhead is a period cost. When assigning costs to a cost object, which cost classification should you use? O manufacturing vs. non-manufacturing O product vs. period direct vs. indirect O relevant vs. irrelevant Question 25 In the standard cost formula Y = a + bX, what does the "b" represent? O variable cost per unit O total variable cost O total cost O total fixed cost Terrific Inc's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 6,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $4.95 Direct labor $3.25 Variable manufacturing overhead $1.45 Fixed manufacturing overhead $4.20 Fixed selling expense $1.05 Fixed administrative expense $0.60 Sales commissions $1.00 $0.50 Variable administrative expense If the selling price is $25.50 per unit, the contribution margin per unit sold is closest to: $17.30 $14.35 O $8.50 $11.65