Need help please

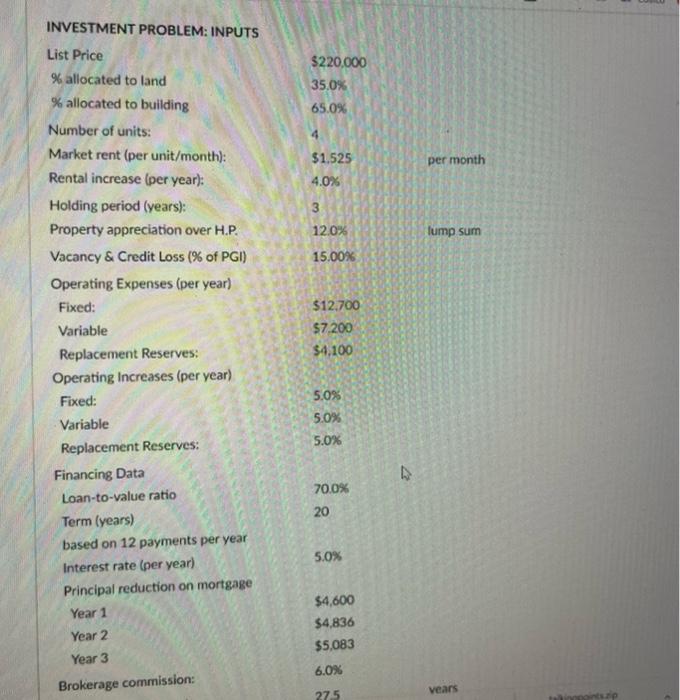

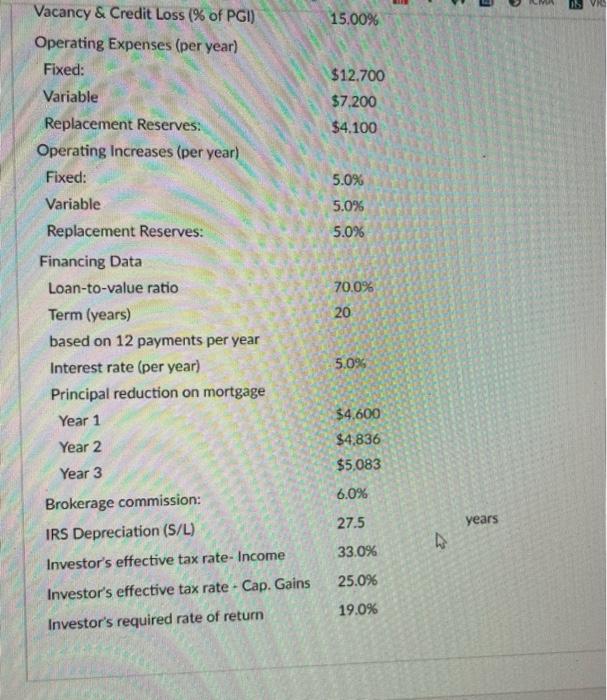

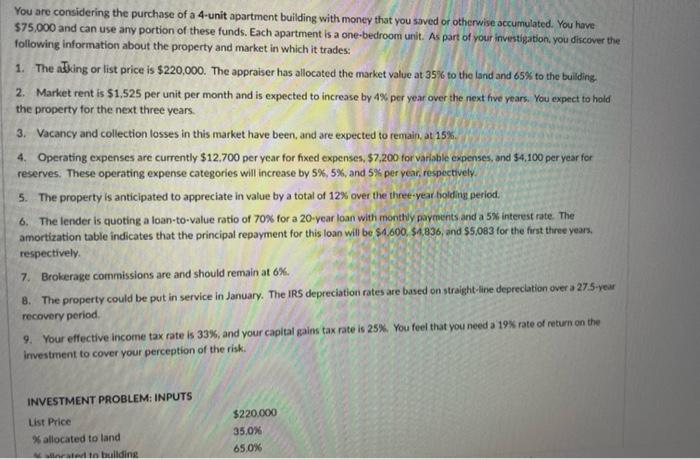

You are considering the purchase of a 4-unit apartment building with money that you saved or otherwise accumulated. You have $75,000 and can use any portion of these funds. Each apartment is a one-bedroom unit. As part of your investigation, you discover the following information about the property and market in which it trades: 1. The aking or list price is $220,000. The appraiser has allocated the market value at 35% to the land and 65% to the building 2. Market rent is $1,525 per unit per month and is expected to increase by 4% per year over the next hive years. You expect to hold the property for the next three years. 3. Vacancy and collection losses in this market have been, and are expected to remain, at 15%. 4. Operating expenses are currently $12.700 per year for fixed expenses. $7.200 for variable expenses, and 54,100 per year for reserves. These operating expense categories will increase by 5%, 5%, and 5% per year, respectively. 5. The property is anticipated to appreciate in value by a total of 12% over the three-year holding period. 6. The lenderis quoting a loan-to-value ratio of 70% for a 20-year loan with monthly payments and a 5% interest rate. The amortization table indicates that the principal repayment for this loan will be $4.600$4836, and $5.083 for the first three years, respectively 7. Brokerage commissions are and should remain at 6%. 8. The property could be put in service in January. The IRS depreciation rates are based on straight-line depreciation over a 275-yew recovery period 9. Your effective income tax rate is 33%, and your capital gains tax rate is 25% You feel that you need a 19% rate of return on the Investment to cover your perception of the risk. INVESTMENT PROBLEM: INPUTS List Price * allocated to land ed to building $220.000 35.0% 65.0% $220.000 35.0% 65.0% 4 $1.525 per month 4.0% 3 12.0% lump sum 15.00% INVESTMENT PROBLEM: INPUTS List Price % allocated to land % allocated to building Number of units: Market rent (per unit/month): Rental increase (per year): Holding period (years): Property appreciation over H.P. Vacancy & Credit Loss (% of PGI) Operating Expenses (per year) Fixed: Variable Replacement Reserves: Operating Increases (per year) Fixed: Variable Replacement Reserves: Financing Data Loan-to-value ratio Term (years) based on 12 payments per year Interest rate (per year) Principal reduction on mortgage Year 1 Year 2 Year 3 $12,700 $7.200 $4,100 5.0% 5.0% 5.0% 70.0% 20 5.0% $4,600 $4,836 $5,083 6.0% Brokerage commission: 275 vears 3 15.00% $12.700 $7.200 Vacancy & Credit Loss (% of PGI) Operating Expenses (per year) Fixed: Variable Replacement Reserves. Operating Increases (per year) Fixed: Variable Replacement Reserves: $4.100 5.0% 5.0% 5.0% 70.0% 20 Financing Data Loan-to-value ratio Term (years) based on 12 payments per year Interest rate (per year) Principal reduction on mortgage Year 1 Year 2 Year 3 5.0% $4,600 $4,836 $5,083 6.0% 27.5 years Brokerage commission: IRS Depreciation (S/L) Investor's effective tax rate-Income 33.0% 25.0% Investor's effective tax rate . Cap. Gains 19.0% Investor's required rate of return You are considering the purchase of a 4-unit apartment building with money that you saved or otherwise accumulated. You have $75,000 and can use any portion of these funds. Each apartment is a one-bedroom unit. As part of your investigation, you discover the following information about the property and market in which it trades: 1. The aking or list price is $220,000. The appraiser has allocated the market value at 35% to the land and 65% to the building 2. Market rent is $1,525 per unit per month and is expected to increase by 4% per year over the next hive years. You expect to hold the property for the next three years. 3. Vacancy and collection losses in this market have been, and are expected to remain, at 15%. 4. Operating expenses are currently $12.700 per year for fixed expenses. $7.200 for variable expenses, and 54,100 per year for reserves. These operating expense categories will increase by 5%, 5%, and 5% per year, respectively. 5. The property is anticipated to appreciate in value by a total of 12% over the three-year holding period. 6. The lenderis quoting a loan-to-value ratio of 70% for a 20-year loan with monthly payments and a 5% interest rate. The amortization table indicates that the principal repayment for this loan will be $4.600$4836, and $5.083 for the first three years, respectively 7. Brokerage commissions are and should remain at 6%. 8. The property could be put in service in January. The IRS depreciation rates are based on straight-line depreciation over a 275-yew recovery period 9. Your effective income tax rate is 33%, and your capital gains tax rate is 25% You feel that you need a 19% rate of return on the Investment to cover your perception of the risk. INVESTMENT PROBLEM: INPUTS List Price * allocated to land ed to building $220.000 35.0% 65.0% $220.000 35.0% 65.0% 4 $1.525 per month 4.0% 3 12.0% lump sum 15.00% INVESTMENT PROBLEM: INPUTS List Price % allocated to land % allocated to building Number of units: Market rent (per unit/month): Rental increase (per year): Holding period (years): Property appreciation over H.P. Vacancy & Credit Loss (% of PGI) Operating Expenses (per year) Fixed: Variable Replacement Reserves: Operating Increases (per year) Fixed: Variable Replacement Reserves: Financing Data Loan-to-value ratio Term (years) based on 12 payments per year Interest rate (per year) Principal reduction on mortgage Year 1 Year 2 Year 3 $12,700 $7.200 $4,100 5.0% 5.0% 5.0% 70.0% 20 5.0% $4,600 $4,836 $5,083 6.0% Brokerage commission: 275 vears 3 15.00% $12.700 $7.200 Vacancy & Credit Loss (% of PGI) Operating Expenses (per year) Fixed: Variable Replacement Reserves. Operating Increases (per year) Fixed: Variable Replacement Reserves: $4.100 5.0% 5.0% 5.0% 70.0% 20 Financing Data Loan-to-value ratio Term (years) based on 12 payments per year Interest rate (per year) Principal reduction on mortgage Year 1 Year 2 Year 3 5.0% $4,600 $4,836 $5,083 6.0% 27.5 years Brokerage commission: IRS Depreciation (S/L) Investor's effective tax rate-Income 33.0% 25.0% Investor's effective tax rate . Cap. Gains 19.0% Investor's required rate of return