Answered step by step

Verified Expert Solution

Question

1 Approved Answer

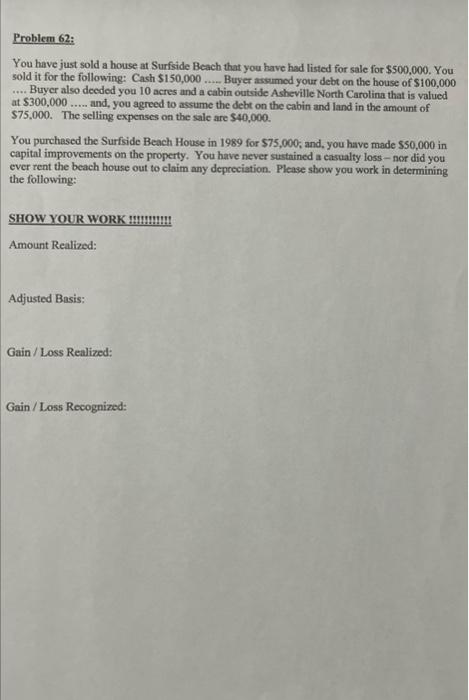

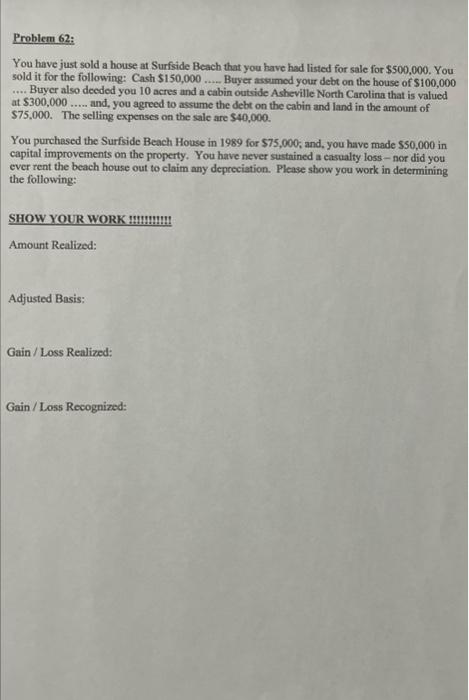

Need help Problem 62: You have just sold a house at Surfside Beach that you have had listed for sale for $500,000. You sold it

Need help

Problem 62: You have just sold a house at Surfside Beach that you have had listed for sale for $500,000. You sold it for the following: Cash $150,000..... Buyer assumed your debt on the house of $100,000 ..... Buyer also deeded you 10 acres and a cabin outside Asheville North Carolina that is valued at $300,000... and, you agreed to assume the debt on the cabin and land in the amount of $75,000. The selling expenses on the sale are $40,000. You purchased the Surfside Beach House in 1989 for \$75,000, and, you have made $50,000 in capital improvements on the property. You have never sustained a castalty loss - nor did you ever rent the beach house out to claim any depreciation. Please sbow you work in determining the following: SHOW YOUR WORK I!!!!!!!! Amount Realized: Adjusted Basis: Gain/Loss Realized: Gain / Loss Recognized: Problem 62: You have just sold a house at Surfside Beach that you have had listed for sale for $500,000. You sold it for the following: Cash $150,000..... Buyer assumed your debt on the house of $100,000 ..... Buyer also deeded you 10 acres and a cabin outside Asheville North Carolina that is valued at $300,000... and, you agreed to assume the debt on the cabin and land in the amount of $75,000. The selling expenses on the sale are $40,000. You purchased the Surfside Beach House in 1989 for \$75,000, and, you have made $50,000 in capital improvements on the property. You have never sustained a castalty loss - nor did you ever rent the beach house out to claim any depreciation. Please sbow you work in determining the following: SHOW YOUR WORK I!!!!!!!! Amount Realized: Adjusted Basis: Gain/Loss Realized: Gain / Loss Recognized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started