Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help question 1 1. Using the Balance Sheets and Income Statements for the Tardis Time Management Company to calculate the following ratios for 2019

need help question 1

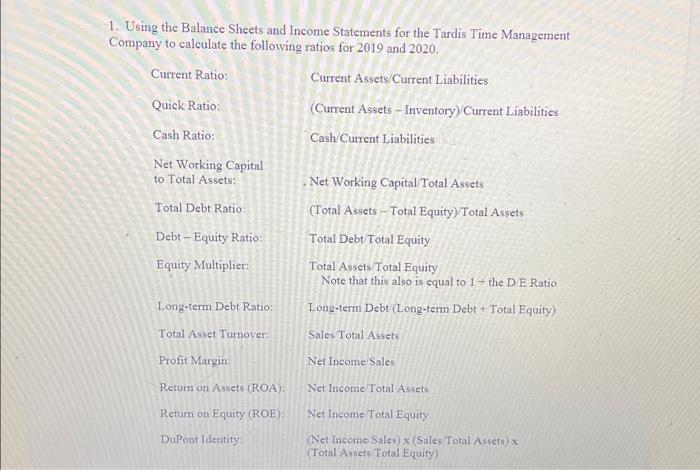

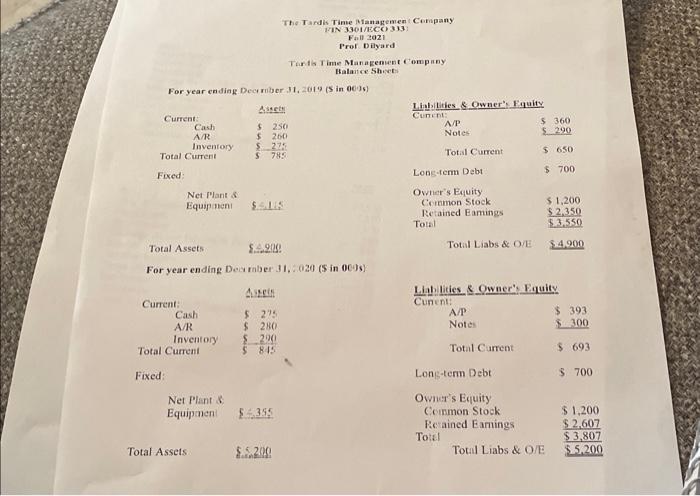

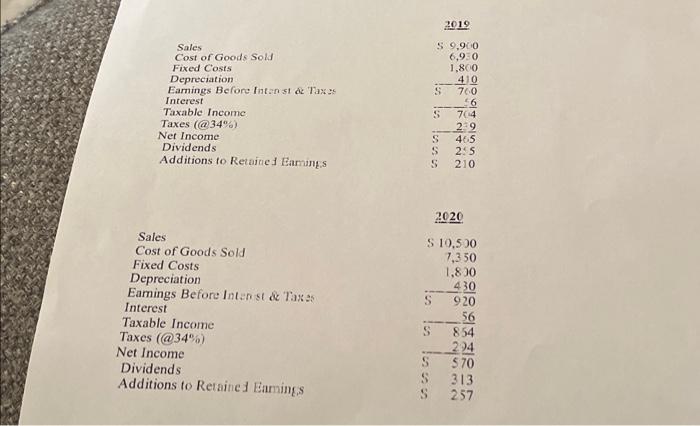

1. Using the Balance Sheets and Income Statements for the Tardis Time Management Company to calculate the following ratios for 2019 and 2020. Current Assets/Current Liabilities Current Ratio: Quick Ratio: Cash Ratio: Net Working Capital to Total Assets: Total Debt Ratio: Debt-Equity Ratio: Equity Multiplier: Long-term Debt Ratio: Total Asset Turnover: Profit Margin: Return on Assets (ROA): Return on Equity (ROE): DuPont Identity: (Current Assets - Inventory)/Current Liabilities Cash/Current Liabilities Net Working Capital/Total Assets (Total Assets - Total Equity)/Total Assets Total Debt/Total Equity Total Assets/Total Equity Note that this also is equal to 1 + the D/E Ratio Long-term Debt/(Long-term Debt + Total Equity) Sales/Total Assets Net Income/Sales Net Income/Total Assets Net Income Total Equity (Net Income/Sales) x (Sales/Total Assets) x (Total Assets/Total Equity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started