Answered step by step

Verified Expert Solution

Question

1 Approved Answer

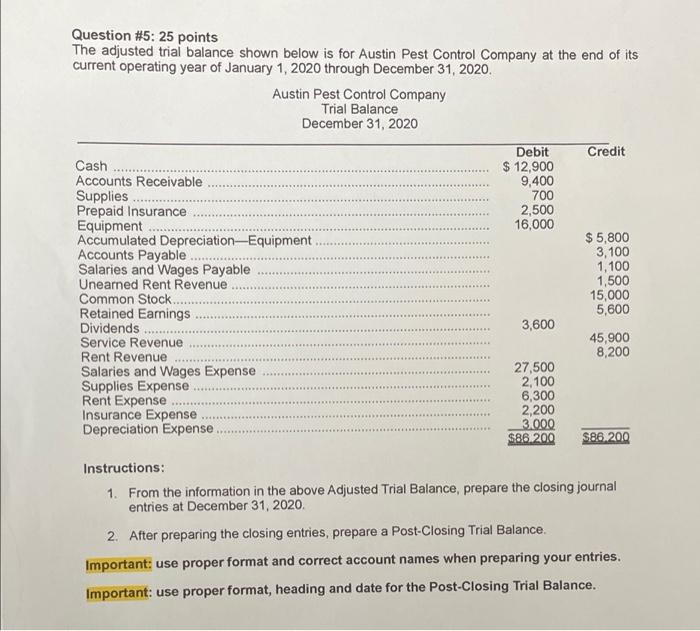

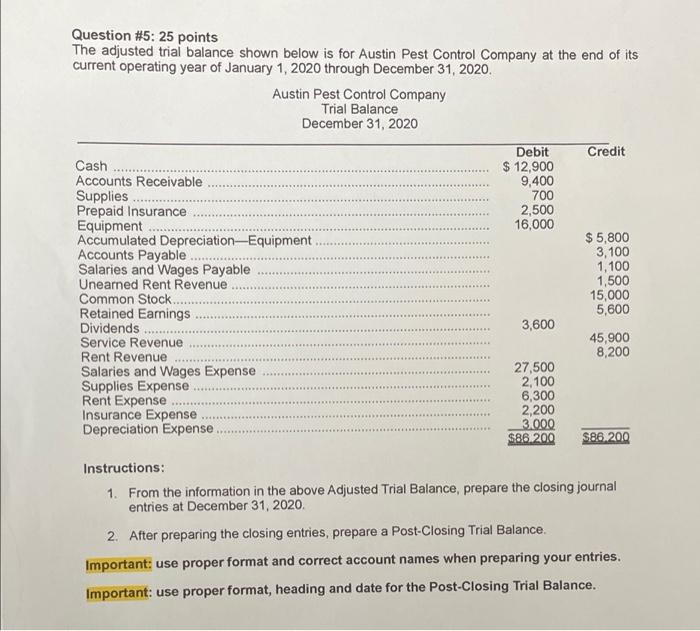

need help Question #5: 25 points The adjusted trial balance shown below is for Austin Pest Control Company at the end of its current operating

need help

Question #5: 25 points The adjusted trial balance shown below is for Austin Pest Control Company at the end of its current operating year of January 1, 2020 through December 31, 2020. Austin Pest Control Company Trial Balance December 31, 2020 Debit Credit Cash $ 12,900 Accounts Receivable 9,400 Supplies 700 Prepaid Insurance 2,500 Equipment 16,000 Accumulated Depreciation Equipment $ 5,800 Accounts Payable 3,100 Salaries and Wages Payable 1,100 Unearned Rent Revenue 1,500 Common Stock 15,000 Retained Earnings 5,600 Dividends 3,600 Service Revenue 45,900 Rent Revenue 8,200 Salaries and Wages Expense 27,500 Supplies Expense 2,100 Rent Expense 6,300 Insurance Expense 2,200 Depreciation Expense 3000 $86.200 586.200 Instructions: 1. From the information in the above Adjusted Trial Balance, prepare the closing journal entries at December 31, 2020, 2. After preparing the closing entries, prepare a Post-Closing Trial Balance Important: use proper format and correct account names when preparing your entries. Important: use proper format, heading and date for the Post-Closing Trial Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started