Answered step by step

Verified Expert Solution

Question

1 Approved Answer

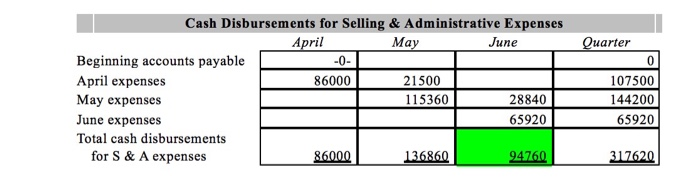

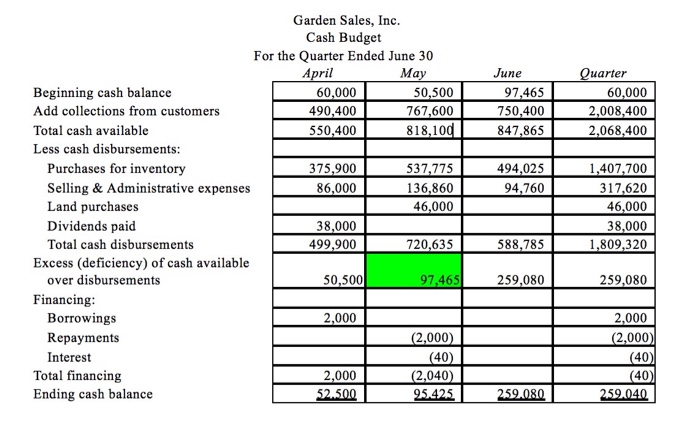

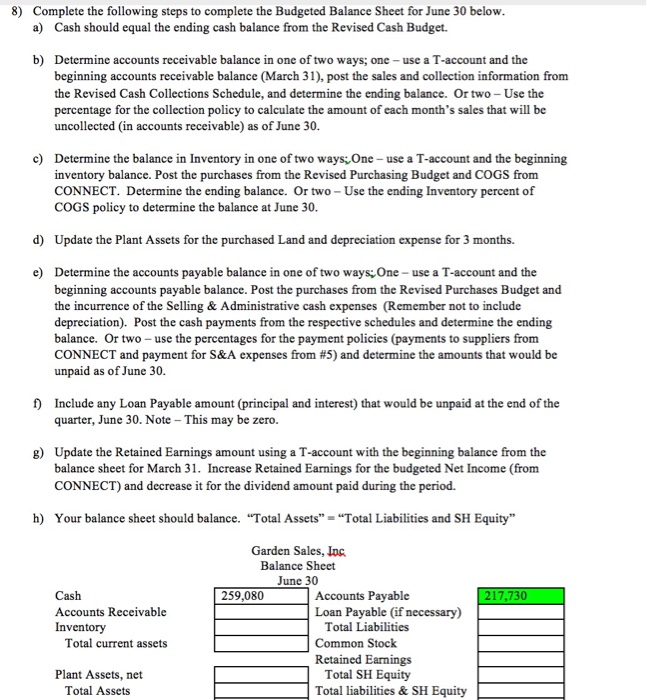

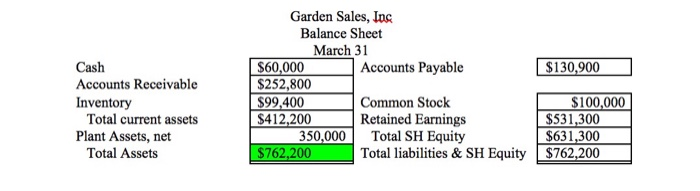

need help solving 8 e) and g) using the following info question 8 below show formula on how to get accounts payable e) 217,730 which

need help solving 8 e) and g) using the following info

question 8 below

show formula on how to get accounts payable e) 217,730 which is correct and make a t account for g)

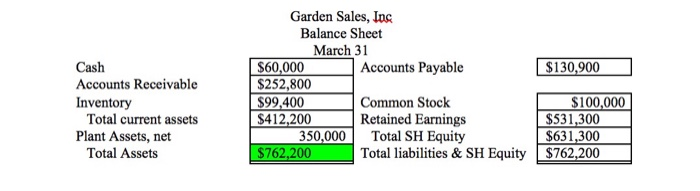

march 31 balance sheet

what you mean not correct?

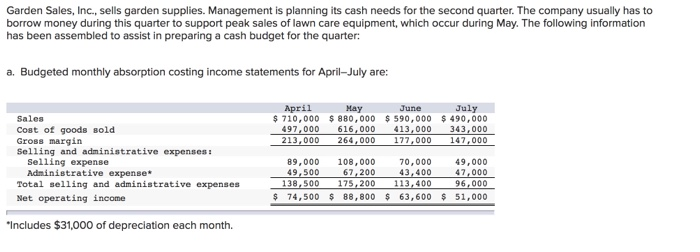

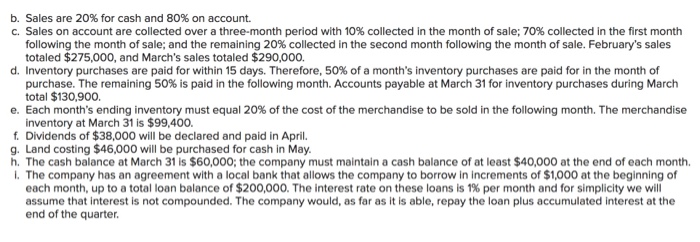

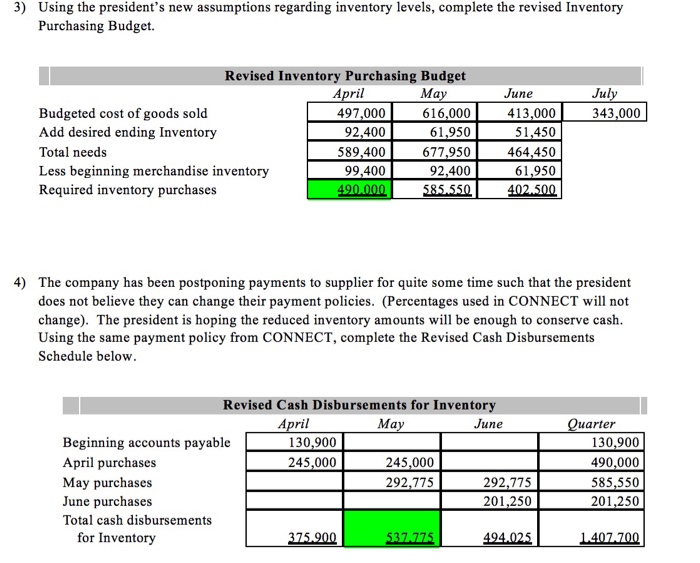

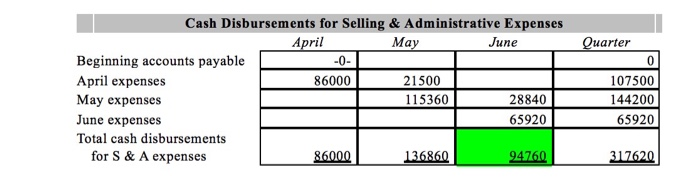

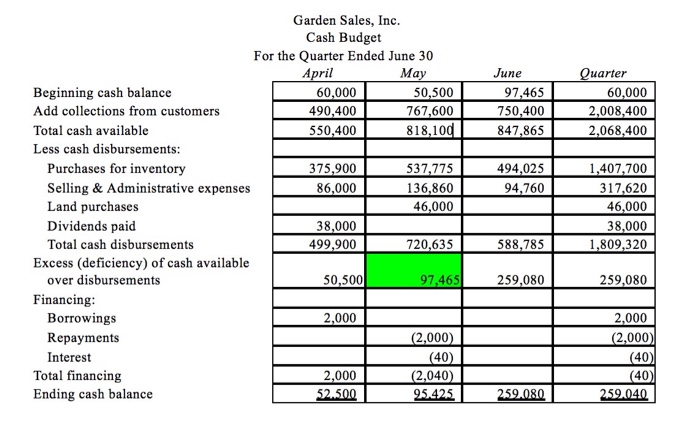

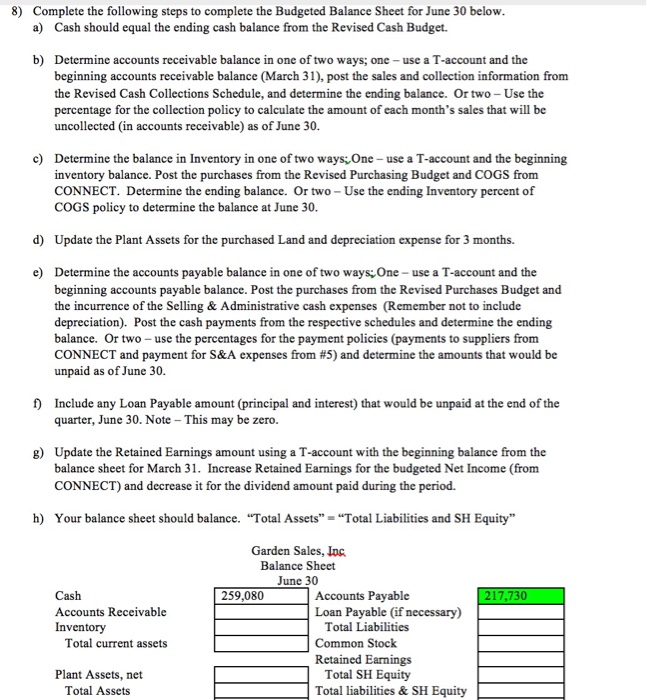

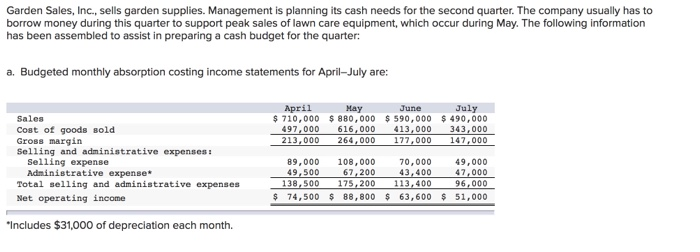

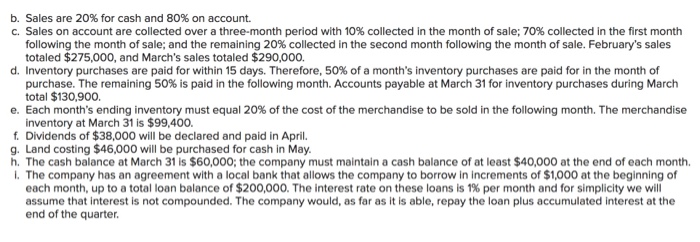

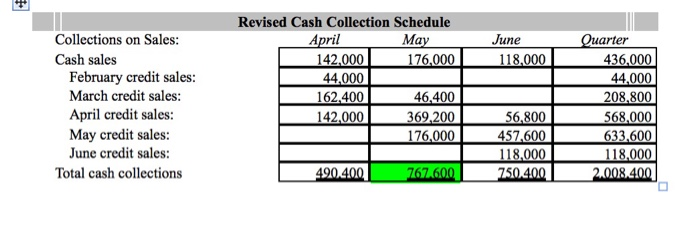

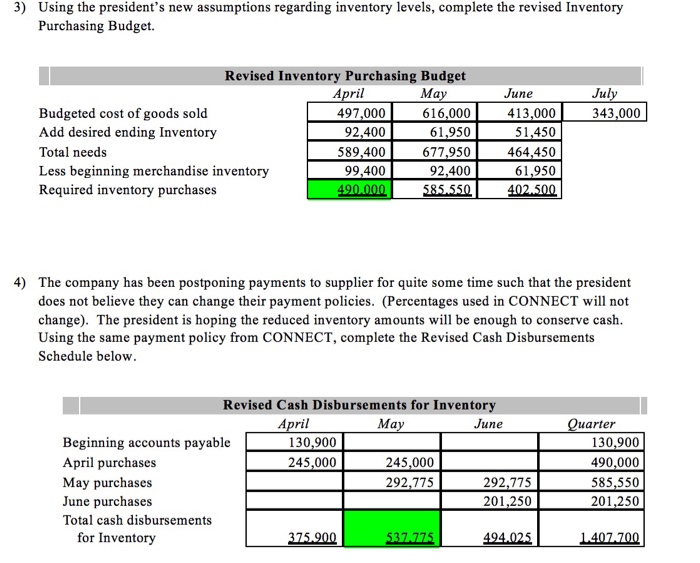

Garden Sales, Inc., sells garden supplies. Management is planning its cash needs for the second quarter. The company usually has to borrow money during this quarter to support peak sales of lawn care equipment, which occur during May. The following information has been assembled to assist in preparing a cash budget for the quarter: a. Budgeted monthly absorption costing income statements for April-July are: April May June July $ 710,000 $ 880,000 $ 590,000 $ 490,000 497,000 616,000 413,000 343,000 213,000 264,000 177,000 147,000 Sales Cost of goods sold Gross margin Selling and administrative expenses : Selling expense Administrative expense* Total selling and administrative expenses Net operating income 89,000 108,000 70,000 49,000 49,500 67,200 43,400 47,000 138,500 175,200 113,400 96,000 $ 74,500 $ 88,800 $ 63,600 $ 51,000 *Includes $31,000 of depreciation each month. b. Sales are 20% for cash and 80% on account. c. Sales on account are collected over a three-month period with 10% collected in the month of sale; 70% collected in the first month following the month of sale; and the remaining 20% collected in the second month following the month of sale. February's sales totaled $275,000, and March's sales totaled $290,000. d. Inventory purchases are paid for within 15 days. Therefore, 50% of a month's inventory purchases are paid for in the month of purchase. The remaining 50% is paid in the following month. Accounts payable at March 31 for inventory purchases during March total $130,900. e. Each month's ending inventory must equal 20% of the cost of the merchandise to be sold in the following month. The merchandise inventory at March 31 is $99,400. f. Dividends of $38,000 will be declared and paid in April. g. Land costing $46,000 will be purchased for cash in May. h. The cash balance at March 31 is $60,000; the company must maintain a cash balance of at least $40,000 at the end of each month. 1. The company has an agreement with a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $200,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The company would, as far as it is able, repay the loan plus accumulated interest at the end of the quarter. June 118,000 Collections on Sales: Cash sales February credit sales: March credit sales: April credit sales: May credit sales: June credit sales: Total cash collections Revised Cash Collection Schedule April May 142.000 176,000 44,000 162.400 46,400 142.000 369,200 176,000 56,800 457,600 118,000 750.400 Quarter 436,000 44,000 208.800 568,000 633,600 118.000 2.008.400 490.400 767.600 3) Using the president's new assumptions regarding inventory levels, complete the revised Inventory Purchasing Budget. July 343,000 Revised Inventory Purchasing Budget April May Budgeted cost of goods sold 497,000 616,000 Add desired ending Inventory 92,400 61,950 Total needs 589,400 677,950 Less beginning merchandise inventory 99,400 92,400 Required inventory purchases 420.000 585.550 June 413,000 51,450 464,450 61,950 402.500 4) The company has been postponing payments to supplier for quite some time such that the president does not believe they can change their payment policies. (Percentages used in CONNECT will not change). The president is hoping the reduced inventory amounts will be enough to conserve cash. Using the same payment policy from CONNECT, complete the Revised Cash Disbursements Schedule below. Revised Cash Disbursements for Inventory April May June Beginning accounts payable 130,900 April purchases 245,000 245,000 May purchases 292,775 292,775 June purchases 201,250 Total cash disbursements for Inventory 375.900 537.775 494.025 Quarter 130,900 490,000 585,550 201,250 1.407.700 -0- Cash Disbursements for Selling & Administrative Expenses April May June Beginning accounts payable April expenses 86000 21500 May expenses 115360 28840 June expenses 65920 Total cash disbursements for S & A expenses 86000 136860 94760 Quarter 0 107500 144200 65920 317620 June 97,465 750,400 847,865 Quarter 60,000 2,008,400 2,068,400 494,025 94,760 Garden Sales, Inc. Cash Budget For the Quarter Ended June 30 April May Beginning cash balance 60,000 50,500 Add collections from customers 490,400 767,600 Total cash available 550,400 818,100 Less cash disbursements: Purchases for inventory 375,900 537,775 Selling & Administrative expenses 86,000 136,860 Land purchases 46,000 Dividends paid 38,000 Total cash disbursements 499,900 720,635 Excess deficiency) of cash available over disbursements 50,500 97,465 Financing: Borrowings 2,000 Repayments (2,000) Interest (40) Total financing 2,000 (2,040) Ending cash balance 52.500 95.425 1,407,700 317,620 46,000 38,000 1,809,320 588,785 259,080 259,080 2,000 (2,000) (40) (40) 259.040 259.080 8) Complete the following steps to complete the Budgeted Balance Sheet for June 30 below. a) Cash should equal the ending cash balance from the Revised Cash Budget. b) Determine accounts receivable balance in one of two ways; one - use a T-account and the beginning accounts receivable balance (March 31), post the sales and collection information from the Revised Cash Collections Schedule, and determine the ending balance. Or two-Use the percentage for the collection policy to calculate the amount of each month's sales that will be uncollected in accounts receivable) as of June 30. c) Determine the balance in Inventory in one of two ways: One - use a T-account and the beginning inventory balance. Post the purchases from the Revised Purchasing Budget and COGS from CONNECT. Determine the ending balance. Or two-Use the ending Inventory percent of COGS policy to determine the balance at June 30. d) Update the Plant Assets for the purchased Land and depreciation expense for 3 months. e) Determine the accounts payable balance in one of two ways One - use a T-account and the beginning accounts payable balance. Post the purchases from the Revised Purchases Budget and the incurrence of the Selling & Administrative cash expenses (Remember not to include depreciation). Post the cash payments from the respective schedules and determine the ending balance. Or two - use the percentages for the payment policies (payments to suppliers from CONNECT and payment for S&A expenses from #5) and determine the amounts that would be unpaid as of June 30. 1) Include any Loan Payable amount (principal and interest) that would be unpaid at the end of the quarter, June 30. Note - This may be zero. g) Update the Retained Earnings amount using a T-account with the beginning balance from the balance sheet for March 31. Increase Retained Earnings for the budgeted Net Income (from CONNECT) and decrease it for the dividend amount paid during the period. h) Your balance sheet should balance. "Total Assets = "Total Liabilities and SH Equity" 217,730 Cash Accounts Receivable Inventory Total current assets Garden Sales, Inc Balance Sheet June 30 259,080 Accounts Payable Loan Payable (if necessary) Total Liabilities Common Stock Retained Earnings Total SH Equity Total liabilities & SH Equity Plant Assets, net Total Assets Cash Accounts Receivable Inventory Total current assets Plant Assets, net Total Assets Garden Sales, Inc Balance Sheet March 31 $60,000 Accounts Payable $130,900 $252,800 $99,400 Common Stock $100,000 $412,200 Retained Earnings $531,300 350,000 Total SH Equity $631,300 $762,200 Total liabilities & SH Equity $ 762,200 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started