Answered step by step

Verified Expert Solution

Question

1 Approved Answer

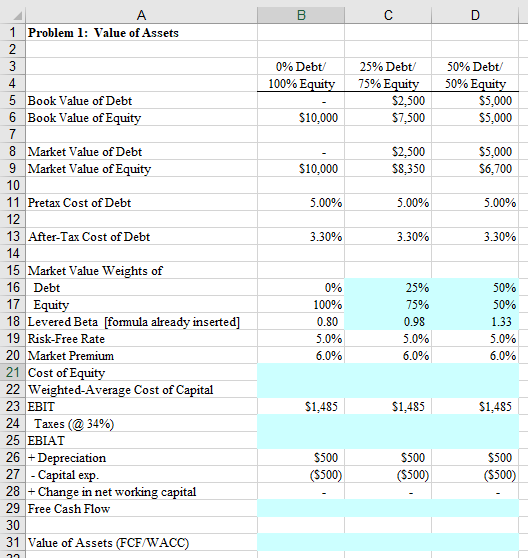

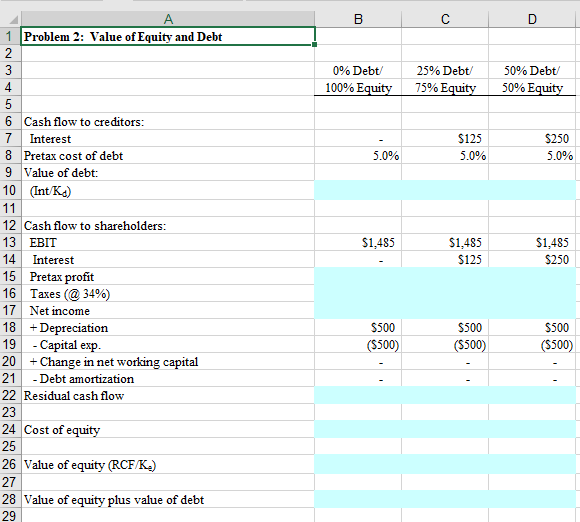

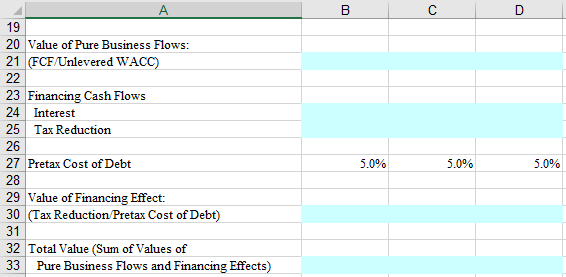

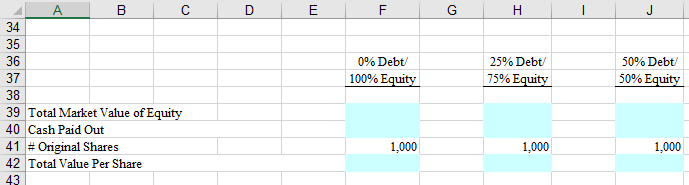

Need help solving light-blue portions. Thanks! B C D 1 Problem 1: Value of Assets 0% Debt 100% Equity 25% Debt 75% Equity $2,500 $7,500

Need help solving light-blue portions. Thanks!

B C D 1 Problem 1: Value of Assets 0% Debt 100% Equity 25% Debt 75% Equity $2,500 $7,500 50% Debt 50% Equity $5,000 $5,000 $10,000 5 Book Value of Debt 6 Book Value of Equity 7 8 Market Value of Debt 9 Market Value of Equity 10 11 Pretax Cost of Debt $2,500 $8,350 $5,000 $6,700 $10,000 5.00% 5.00% 5.00% 12 13 After-Tax Cost of Debt 3.30% 3.30% 3.30% 14 0% 100% 0.80 5.0% 6.0% 25% 75% 0.98 5.0% 6.0% 50% 50% 1.33 5.0% 6.0% 15 Market Value Weights of 16 Debt 17 Equity 18 Levered Beta [formula already inserted] 19 Risk-Free Rate 20 Market Premium 21 Cost of Equity 22 Weighted Average Cost of Capital 23 EBIT 24 Taxes (@34%) 25 EBIAT 26 +Depreciation 27 - Capital exp. 28 +Change in net working capital 29 Free Cash Flow 30 31 Value of Assets (FCF WACC) $1,485 $1,485 $1,485 $500 (5500) $500 (5500) $500 (5500) C D 1 Problem 2: Value of Equity and Debt 0% Debt 100% Equity 25% Debt: 75% Equity 50% Debt 50% Equity 6 Cash flow to creditors: 7 Interest 8 Pretax cost of debt 9 Value of debt: 10 (Int/K) 5.0% $125 5.0% $250 5.0% 11 $1,485 $1,485 $125 $1,485 $250 12 Cash flow to shareholders: 13 EBIT 14 Interest 15 Pretax profit 16 Taxes (@ 34%) 17 Net income 18 + Depreciation 19 - Capital exp. 20 + Change in net working capital 21 - Debt amortization 22 Residual cash flow $500 (5500) $500 (5500) $500 (5500) 23 24 Cost of equity 25 26 Value of equity (RCF/K.) 27 28 Value of equity plus value of debt 29 19 20 Value of Pure Business Flows: 21 (FCF/Unlevered WACC) 22 23 Financing Cash Flows 24 Interest 25 Tax Reduction 26 27 Pretax Cost of Debt 5.0% 5.0% 5.0% 29 Value of Financing Effect: 30 (Tax Reduction Pretax Cost of Debt) 32 Total Value (Sum of Values of 33 Pure Business Flows and Financing Effects) B C D E | 36 0% Debt 100% Equity 25% Debt 75% Equity 50% Debt 50% Equity 38 39 Total Market Value of Equity 40 Cash Paid Out 41 # Original Shares 42 Total Value Per Share 43 1,000 1,000 1,000 B C D 1 Problem 1: Value of Assets 0% Debt 100% Equity 25% Debt 75% Equity $2,500 $7,500 50% Debt 50% Equity $5,000 $5,000 $10,000 5 Book Value of Debt 6 Book Value of Equity 7 8 Market Value of Debt 9 Market Value of Equity 10 11 Pretax Cost of Debt $2,500 $8,350 $5,000 $6,700 $10,000 5.00% 5.00% 5.00% 12 13 After-Tax Cost of Debt 3.30% 3.30% 3.30% 14 0% 100% 0.80 5.0% 6.0% 25% 75% 0.98 5.0% 6.0% 50% 50% 1.33 5.0% 6.0% 15 Market Value Weights of 16 Debt 17 Equity 18 Levered Beta [formula already inserted] 19 Risk-Free Rate 20 Market Premium 21 Cost of Equity 22 Weighted Average Cost of Capital 23 EBIT 24 Taxes (@34%) 25 EBIAT 26 +Depreciation 27 - Capital exp. 28 +Change in net working capital 29 Free Cash Flow 30 31 Value of Assets (FCF WACC) $1,485 $1,485 $1,485 $500 (5500) $500 (5500) $500 (5500) C D 1 Problem 2: Value of Equity and Debt 0% Debt 100% Equity 25% Debt: 75% Equity 50% Debt 50% Equity 6 Cash flow to creditors: 7 Interest 8 Pretax cost of debt 9 Value of debt: 10 (Int/K) 5.0% $125 5.0% $250 5.0% 11 $1,485 $1,485 $125 $1,485 $250 12 Cash flow to shareholders: 13 EBIT 14 Interest 15 Pretax profit 16 Taxes (@ 34%) 17 Net income 18 + Depreciation 19 - Capital exp. 20 + Change in net working capital 21 - Debt amortization 22 Residual cash flow $500 (5500) $500 (5500) $500 (5500) 23 24 Cost of equity 25 26 Value of equity (RCF/K.) 27 28 Value of equity plus value of debt 29 19 20 Value of Pure Business Flows: 21 (FCF/Unlevered WACC) 22 23 Financing Cash Flows 24 Interest 25 Tax Reduction 26 27 Pretax Cost of Debt 5.0% 5.0% 5.0% 29 Value of Financing Effect: 30 (Tax Reduction Pretax Cost of Debt) 32 Total Value (Sum of Values of 33 Pure Business Flows and Financing Effects) B C D E | 36 0% Debt 100% Equity 25% Debt 75% Equity 50% Debt 50% Equity 38 39 Total Market Value of Equity 40 Cash Paid Out 41 # Original Shares 42 Total Value Per Share 43 1,000 1,000 1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started