Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help solving On January 1, 2018, Dakota, Inc., had the following account balances in its general ledger. All accounts have a normal type of

need help solving

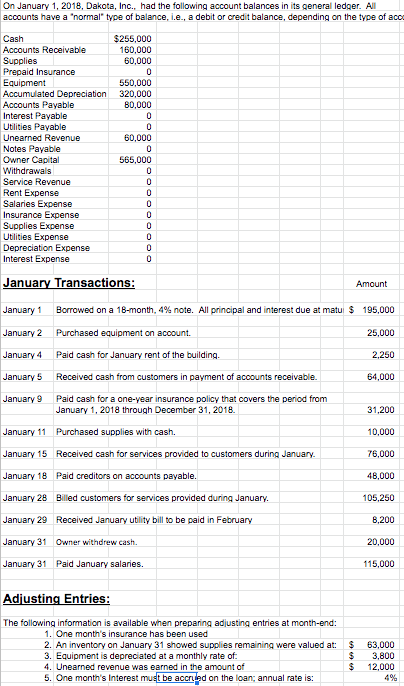

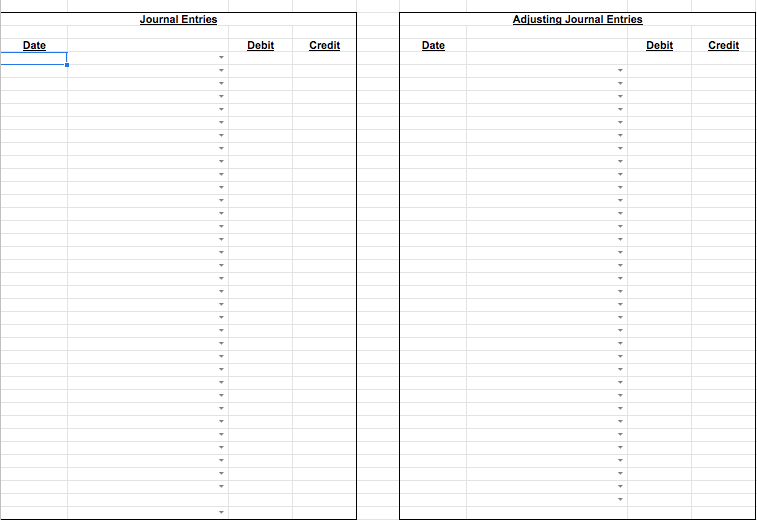

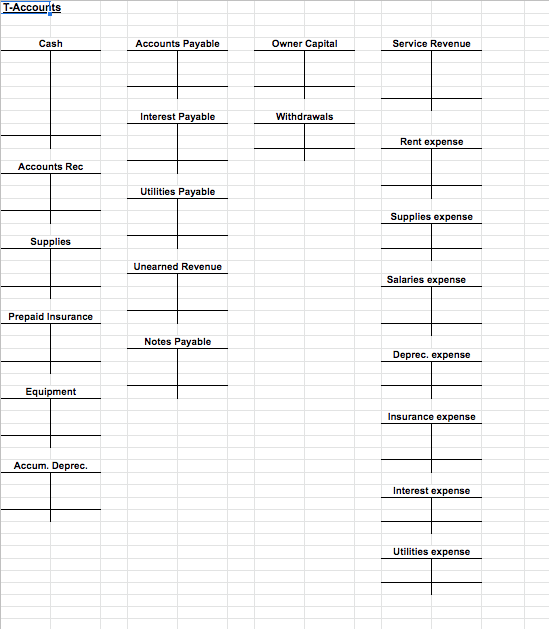

On January 1, 2018, Dakota, Inc., had the following account balances in its general ledger. All accounts have a "normal" type of balance, i.e., a debitor credit balance, depending on the type of acc Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Interest Payable Utilities Payable Unearned Revenue Notes Payable Owner Capital Withdrawals Service Revenue Rent Expense Salaries Expense Insurance Expense Supplies Expense Utilities Expense Depreciation Expense Interest Expense $255,000 160,000 60,000 0 550,000 320,000 80,000 0 0 60,000 0 565,000 0 0 0 0 0 0 0 0 0 January Transactions: Amount January 1 Borrowed on a 18-month. 4% note. All principal and interest due at matu $ 195,000 January 2 Purchased equipment on account. 25,000 January 4 Paid cash for January rent of the building. 2.250 January 5 Received cash from customers in payment of accounts receivable. 64,000 January 9 Paid cash for a one-year insurance policy that covers the period from January 1, 2018 through December 31, 2018 31,200 January 11 Purchased supplies with cash. 10,000 January 15 Received cash for services provided to customers during January 76,000 January 18 Paid creditors on accounts payable. 46,000 January 28 Billed customers for services provided during January 105,250 January 29 Received January utility bill to be paid in February 8,200 January 31 Owner withdrew cash. 20,000 January 31 Paid January salaries. 115,000 Adjusting Entries: The following information is available when preparing adjusting entries at month-end: 1. One month's insurance has been used 2. An inventory on January 31 showed supplies remaining were valued at: 3. Equipment is depreciated at a monthly rate of. 4. Unearned revenue was earned in the amount of 5. One month's Interest must be accrued on the loan: annual rate is: $ $ 63,000 3,800 12,000 4% Journal Entries Adjusting Journal Entries Date Debit Credit Date Debit Credit T-Accounts Cash Accounts Payable Owner Capital Service Revenue Interest Payable Withdrawals Rent expense Accounts Rec Utilities Payable Supplies expense Supplies Unearned Revenue Salaries expense Prepaid Insurance Notes Payable Deprec. expense Equipment Insurance expense Accum. Deprec. Interest expense Utilities expenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started