Need help solving problems 5-1, 5-2, 5-3, and 5-7:

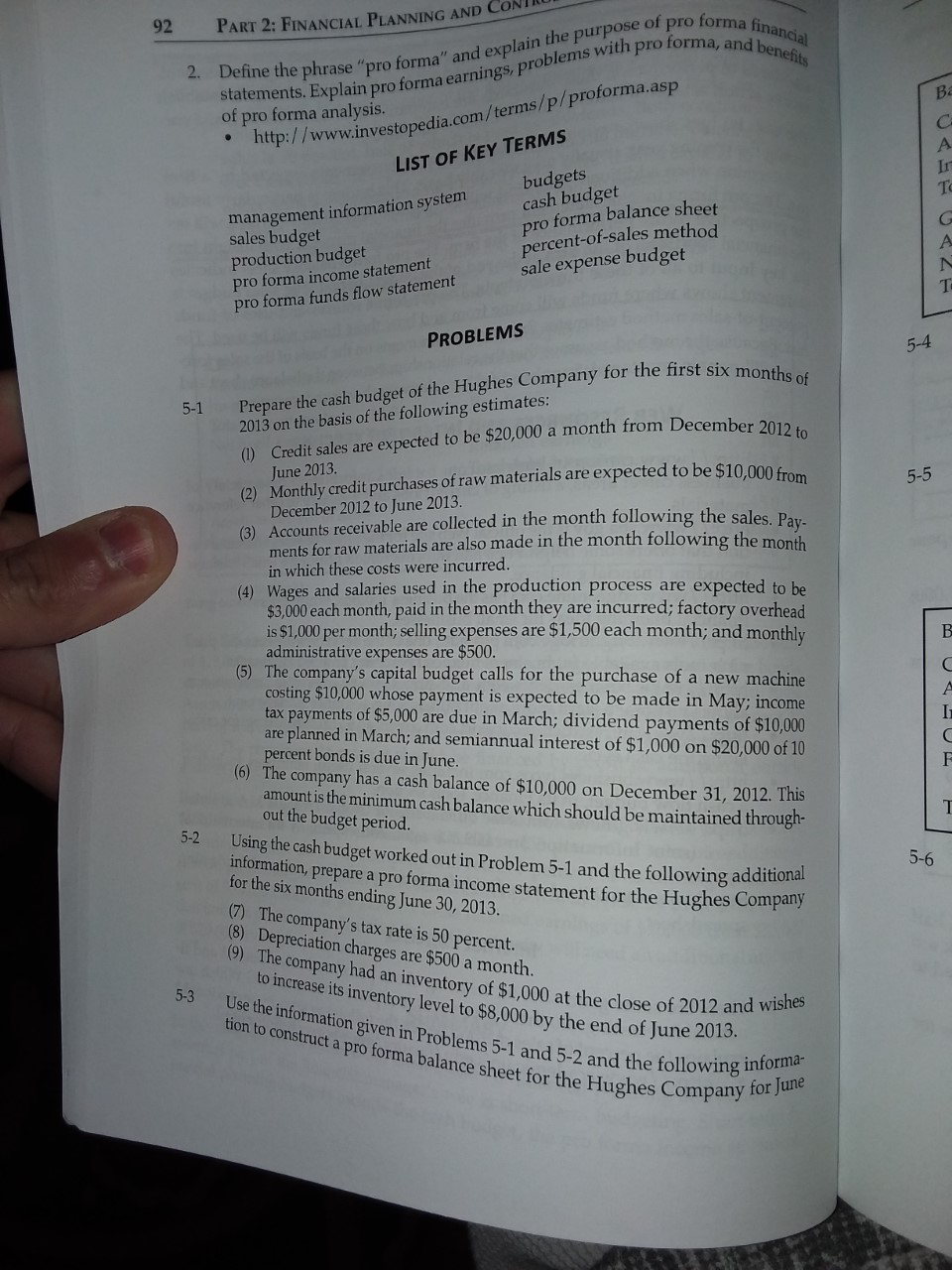

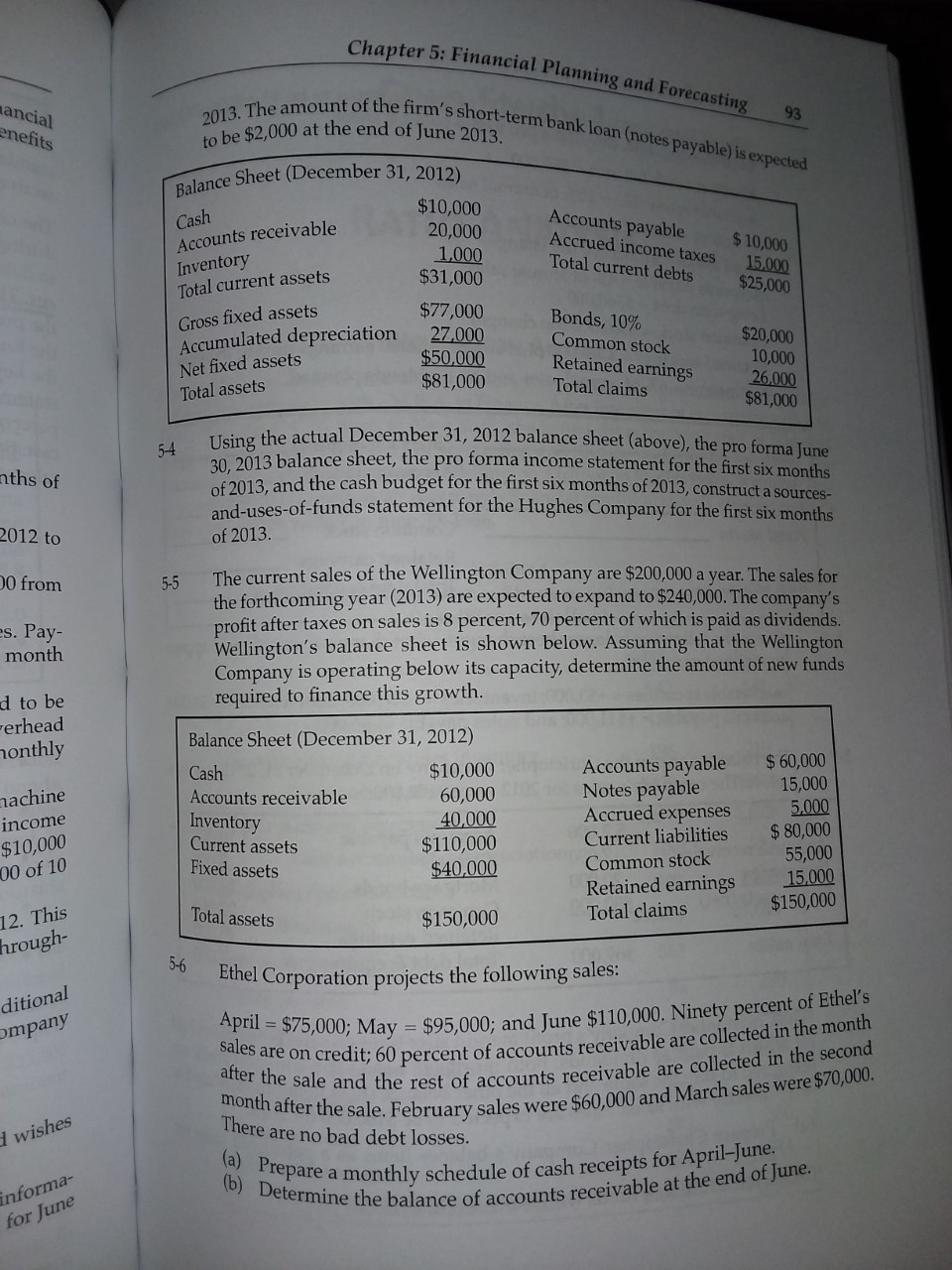

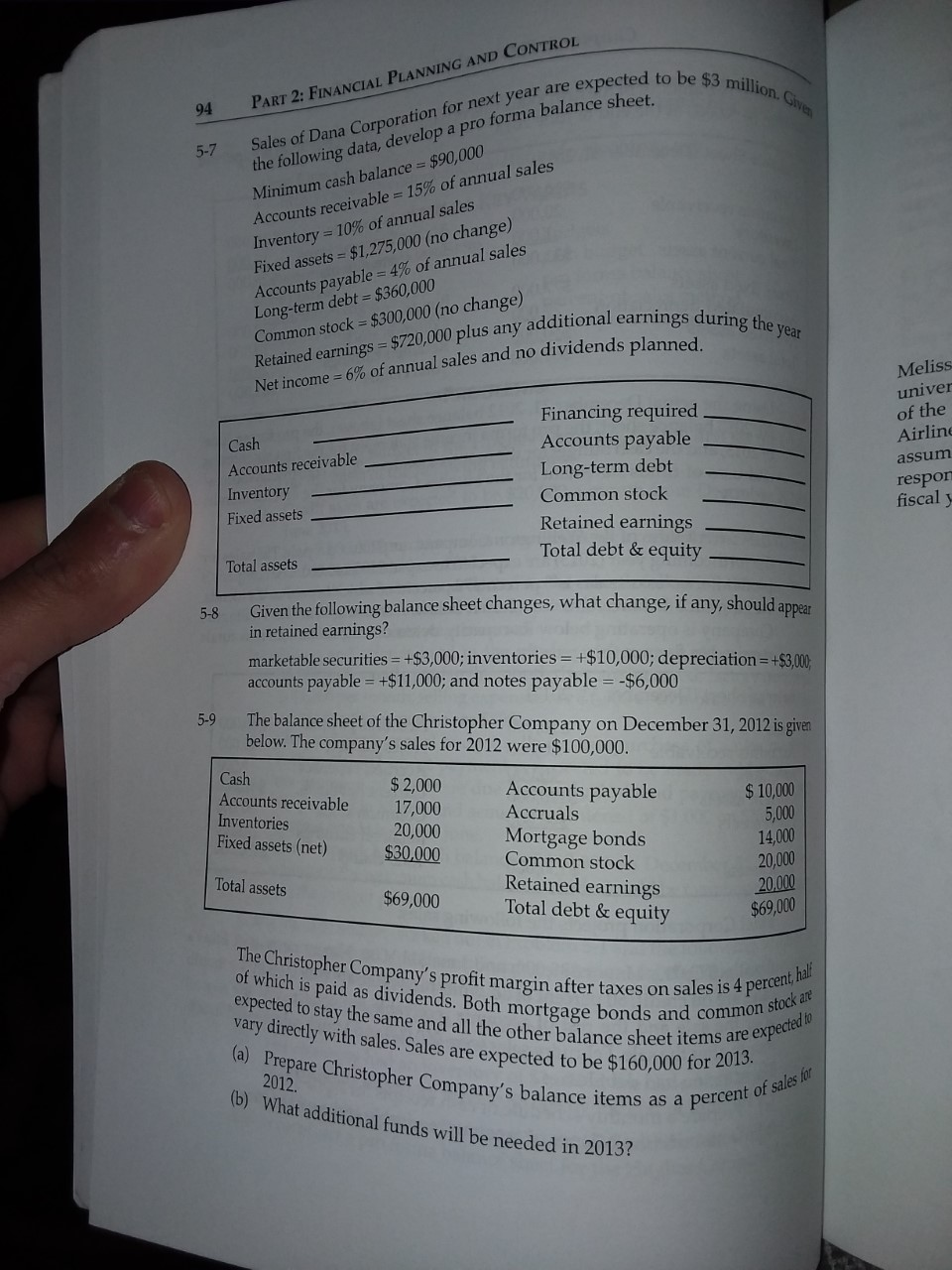

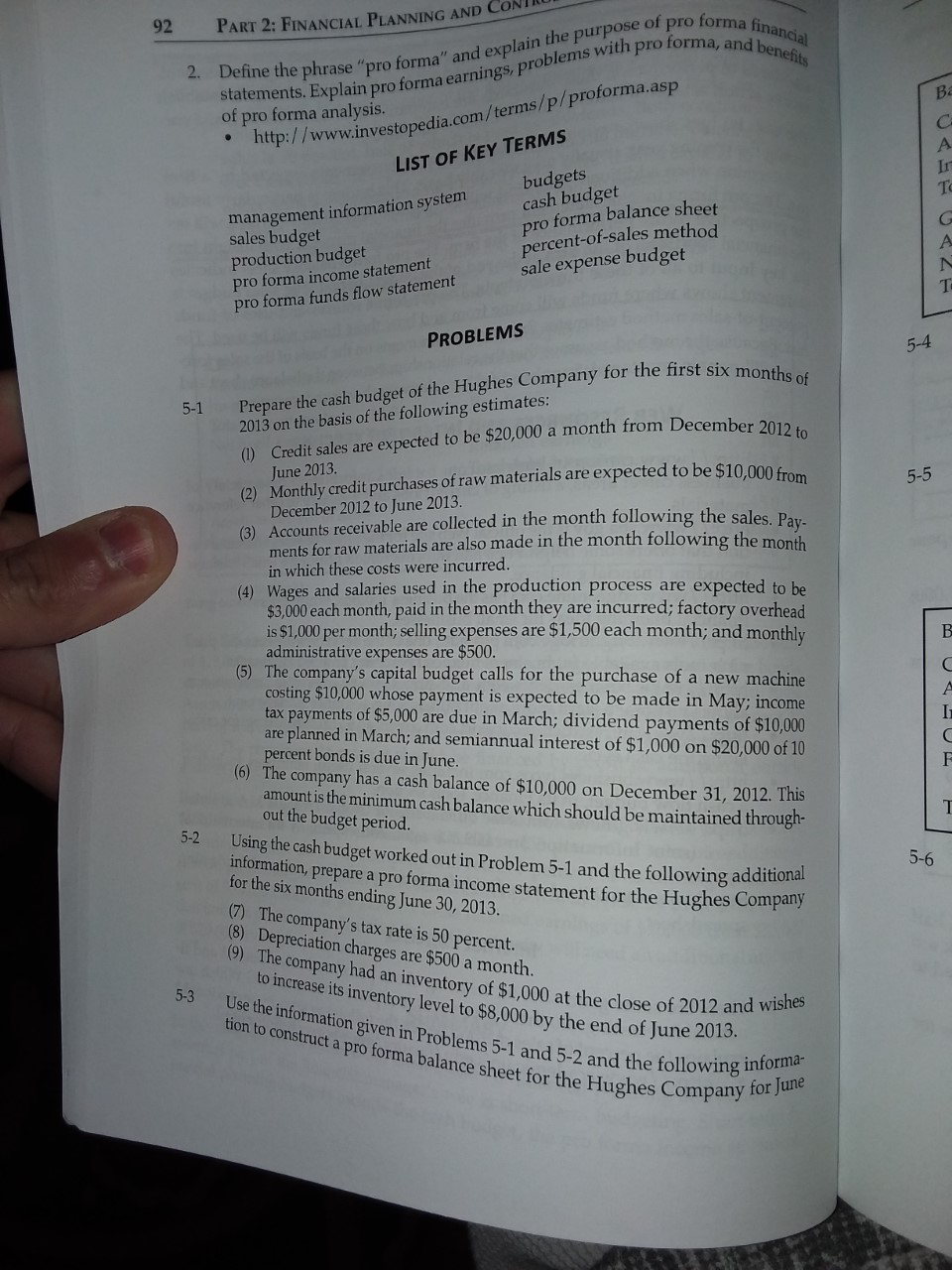

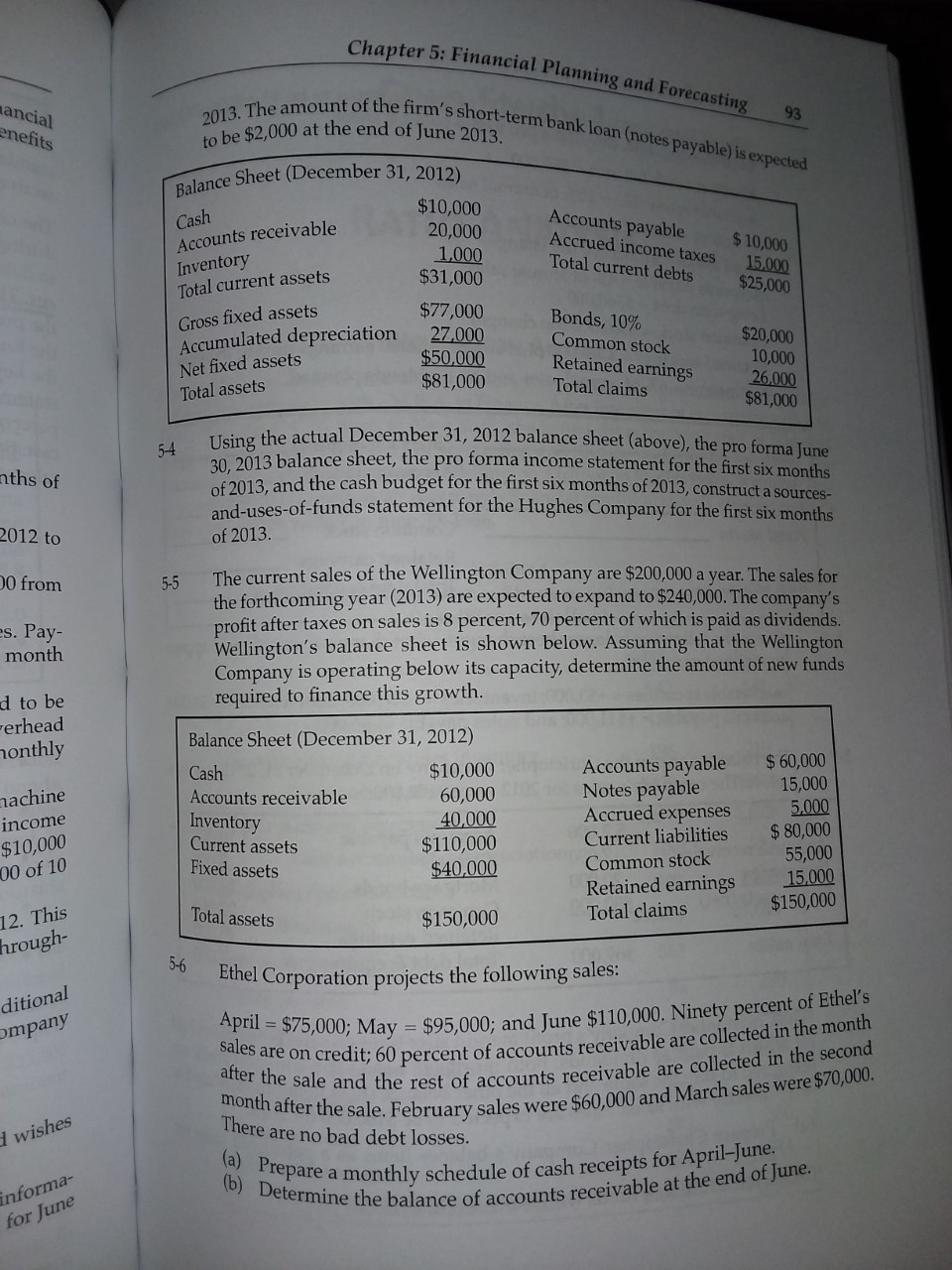

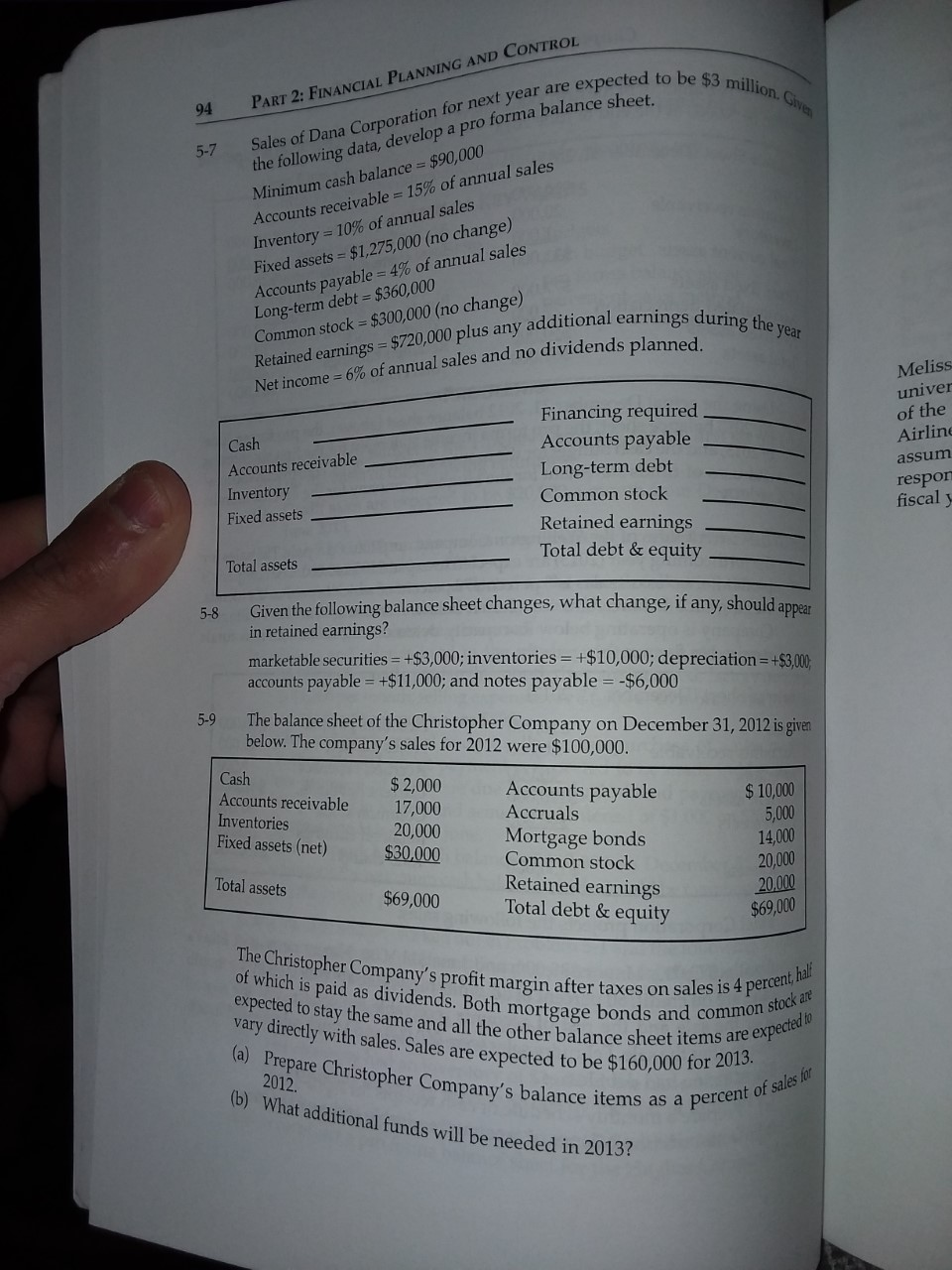

92 PART 2: FINANCIAL PLANNING AND ma financial rpose of pro forma fina ems with pro forma, and b a, and benefits - Define the phrase "pro forma" and explai statements. Explain pro forma earnings, P of pro forma analysis. http://www.investo 9://www.investopedia.com/terms/p/proforma.asp LIST OF KEY TERMS management information system sales budget production budget pro forma income statement pro forma funds flow statement budgets cash budget pro forma balance sheet percent-of-sales method sale expense budget PROBLEMS 5-4 or the first six months of 5-1 nth from December 2012 to cted to be $10,000 from Prepare the cash budget of the Hughes Company for the first six 2013 on the basis of the following estimates: (1) Credit sales are expected to be $20,000 a month from Decemb June 2013 (2) Monthly credit purchases of raw materials are expected to be $10 000 December 2012 to June 2013 (3) Accounts receivable are collected in the month following the sale ments for raw materials are also made in the month following the month in which these costs were incurred. 5-5 h following the sales. Pay- (4) Wages and salaries used in the production process are expected to be $3,000 each month, paid in the month they are incurred; factory overhead is $1,000 per month; selling expenses are $1,500 each month; and monthly administrative expenses are $500. (5) The company's capital budget calls for the purchase of a new machine costing $10,000 whose payment is expected to be made in May; income tax payments of $5,000 are due in March; dividend payments of $10,000 are planned in March; and semiannual interest of $1,000 on $20,000 of 10 percent bonds is due in June. (6) The company has a cash balance of $10,000 on December 31, 2012. This amount is the minimum cash balance which should be maintained through out the budget period. 5-2 Using the cash budget worked out in Problem 5-1 and the following additio information, prepare a pro forma income statement for the Hughes Company for the six months ending June 30, 2013. 5-6 (7) The company's tax rate is 50 percent. (8) Depreciation charges are $500 a month. (9) The company had an inventory of $1,000 at th to increase its inventory level to $8,000 by the end of June 2 5-3 Use the information given in Problems 5-1 and 5-2 and tion to construct a pro forma balance sheet for the Huy the close of 2012 and wishes the following informa- company for June Chapter 5: Financi ter 5: Financial Planning and Forecasting irm's short-term bank loan (notes payable) is expected nancial enefits 93 2013. The amour to be $2,000 at $2,000 at the end of June 2013 Balance Sheet (D Cash nce Sheet (December 31, 2012) $10,000 20,000 Accounts payable Accrued income taxes Total current debts 1,000 $10,000 15.000 $25,000 Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets $31,000 $77,000 27,000 $50,000 $81,000 Bonds, 10% Common stock Retained earnings Total claims $20,000 10,000 26.000 $81,000 5-4 Using the actual Decembe nths of actual December 31, 2012 balance sheet (above), the pro forma lune balance sheet, the pro forma income statement for the first six months of 2013, and the cash budget for the first six months of 2013. construct ad-uses-of-funds statement for the Hughes Company for the first six months of 2013 2012 to 0 from es. Pay- The current sales of the Wellington Company are $200,000 a year. The sales for the forthcoming year (2013) are expected to expand to $240,000. The company's profit after taxes on sales is 8 percent, 70 percent of which is paid as dividends Wellington's balance sheet is shown below. Assuming that the Wellington Company is operating below its capacity, determine the amount of new funds required to finance this growth. month d to be Ferhead monthly $10,000 machine income $10,000 00 of 10 Balance Sheet (December 31, 2012) Cash Accounts receivable 60,000 Inventory 40,000 Current assets $110,000 Fixed assets $40,000 Accounts payable Notes payable Accrued expenses Current liabilities Common stock Retained earnings Total claims $ 60,000 15,000 5,000 $80,000 55,000 15,000 $150,000 Total assets $150,000 12. This hrough- 5-6 Ethel Ethel Corporation projects the following sales: ditional mpany April = $75,000; May = $95,000 sales are on credit; 60 percent after the sale and the rest month after the sale. February Sale There are no bad debt losses. 00; May = $95,000; and June $110,000. Ninety percent of Ethel's edit; 60 percent of accounts receivable are collected in the month the rest of accounts receivable are collected in the second ale, February sales were $60,000 and March sales were $70,000. wishes (a) Prepare an (b) Determine th informa- for June Schedule of cash receipts for April-June. of accounts receivable at the end of June. million. Given 94 PART 2: FINANCIAL PLANNING AND CONTROL Dane Corporation for next year are expected to the following data, develop a pro forma balance shee Minimum cash balance = $90,000 Accounts receivable = 15% of annual sales Inventory = 10% of annual sales Fixed assets = $1,275,000 (no change) Accounts payable = 4% of annual sales Long-term debt = $360,000 Common stock = $300,000 (no change) earnings during the year earnings = $720,000 plus any additional earnings Net income = 6% of annual sales and no dividends plan Meliss univer of the Airling assum respon Cash Financing required Accounts payable Long-term debt Common stock Retained earnings Total debt & equity Accounts receivable Inventory Fixed assets - fiscal Total assets 5-8 Given the following balance sheet changes, what change, if any, should appes in retained earnings? marketable securities = +$3,000; inventories = +$10,000; depreciation = +$3,000 accounts payable = +$11,000; and notes payable = -$6,000 5-9 The balance sheet of the Christopher Company on December 31, 2012 is given below. The company's sales for 2012 were $100,000. Cash $2,000 Accounts payable $ 10,000 Accounts receivable 17,000 Accruals Inventories 20,000 Mortgage bonds Fixed assets (net) $30,000 Common stock 20,000 Total assets Retained earnings $69,000 Total debt & equity 5,000 14,000 20.000 $69,000 y profit margin after taxes on sales is 4 per IS 4 percent half The Christopher Company's profit margin after ta of which is paid as dividends. Both mortgage bonds a expected to stay the same and all the other balance sheet vary directly with sales. Sales are expected to be (a) Prepare Christopher Company's balance Eage bonds and common stock balance sheet items are expecte are expected to be $160,000 for 2013. 2012. (b) What additional funds will be needed in 20 any s balance items as a percento Percent of sales for 92 PART 2: FINANCIAL PLANNING AND ma financial rpose of pro forma fina ems with pro forma, and b a, and benefits - Define the phrase "pro forma" and explai statements. Explain pro forma earnings, P of pro forma analysis. http://www.investo 9://www.investopedia.com/terms/p/proforma.asp LIST OF KEY TERMS management information system sales budget production budget pro forma income statement pro forma funds flow statement budgets cash budget pro forma balance sheet percent-of-sales method sale expense budget PROBLEMS 5-4 or the first six months of 5-1 nth from December 2012 to cted to be $10,000 from Prepare the cash budget of the Hughes Company for the first six 2013 on the basis of the following estimates: (1) Credit sales are expected to be $20,000 a month from Decemb June 2013 (2) Monthly credit purchases of raw materials are expected to be $10 000 December 2012 to June 2013 (3) Accounts receivable are collected in the month following the sale ments for raw materials are also made in the month following the month in which these costs were incurred. 5-5 h following the sales. Pay- (4) Wages and salaries used in the production process are expected to be $3,000 each month, paid in the month they are incurred; factory overhead is $1,000 per month; selling expenses are $1,500 each month; and monthly administrative expenses are $500. (5) The company's capital budget calls for the purchase of a new machine costing $10,000 whose payment is expected to be made in May; income tax payments of $5,000 are due in March; dividend payments of $10,000 are planned in March; and semiannual interest of $1,000 on $20,000 of 10 percent bonds is due in June. (6) The company has a cash balance of $10,000 on December 31, 2012. This amount is the minimum cash balance which should be maintained through out the budget period. 5-2 Using the cash budget worked out in Problem 5-1 and the following additio information, prepare a pro forma income statement for the Hughes Company for the six months ending June 30, 2013. 5-6 (7) The company's tax rate is 50 percent. (8) Depreciation charges are $500 a month. (9) The company had an inventory of $1,000 at th to increase its inventory level to $8,000 by the end of June 2 5-3 Use the information given in Problems 5-1 and 5-2 and tion to construct a pro forma balance sheet for the Huy the close of 2012 and wishes the following informa- company for June Chapter 5: Financi ter 5: Financial Planning and Forecasting irm's short-term bank loan (notes payable) is expected nancial enefits 93 2013. The amour to be $2,000 at $2,000 at the end of June 2013 Balance Sheet (D Cash nce Sheet (December 31, 2012) $10,000 20,000 Accounts payable Accrued income taxes Total current debts 1,000 $10,000 15.000 $25,000 Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets $31,000 $77,000 27,000 $50,000 $81,000 Bonds, 10% Common stock Retained earnings Total claims $20,000 10,000 26.000 $81,000 5-4 Using the actual Decembe nths of actual December 31, 2012 balance sheet (above), the pro forma lune balance sheet, the pro forma income statement for the first six months of 2013, and the cash budget for the first six months of 2013. construct ad-uses-of-funds statement for the Hughes Company for the first six months of 2013 2012 to 0 from es. Pay- The current sales of the Wellington Company are $200,000 a year. The sales for the forthcoming year (2013) are expected to expand to $240,000. The company's profit after taxes on sales is 8 percent, 70 percent of which is paid as dividends Wellington's balance sheet is shown below. Assuming that the Wellington Company is operating below its capacity, determine the amount of new funds required to finance this growth. month d to be Ferhead monthly $10,000 machine income $10,000 00 of 10 Balance Sheet (December 31, 2012) Cash Accounts receivable 60,000 Inventory 40,000 Current assets $110,000 Fixed assets $40,000 Accounts payable Notes payable Accrued expenses Current liabilities Common stock Retained earnings Total claims $ 60,000 15,000 5,000 $80,000 55,000 15,000 $150,000 Total assets $150,000 12. This hrough- 5-6 Ethel Ethel Corporation projects the following sales: ditional mpany April = $75,000; May = $95,000 sales are on credit; 60 percent after the sale and the rest month after the sale. February Sale There are no bad debt losses. 00; May = $95,000; and June $110,000. Ninety percent of Ethel's edit; 60 percent of accounts receivable are collected in the month the rest of accounts receivable are collected in the second ale, February sales were $60,000 and March sales were $70,000. wishes (a) Prepare an (b) Determine th informa- for June Schedule of cash receipts for April-June. of accounts receivable at the end of June. million. Given 94 PART 2: FINANCIAL PLANNING AND CONTROL Dane Corporation for next year are expected to the following data, develop a pro forma balance shee Minimum cash balance = $90,000 Accounts receivable = 15% of annual sales Inventory = 10% of annual sales Fixed assets = $1,275,000 (no change) Accounts payable = 4% of annual sales Long-term debt = $360,000 Common stock = $300,000 (no change) earnings during the year earnings = $720,000 plus any additional earnings Net income = 6% of annual sales and no dividends plan Meliss univer of the Airling assum respon Cash Financing required Accounts payable Long-term debt Common stock Retained earnings Total debt & equity Accounts receivable Inventory Fixed assets - fiscal Total assets 5-8 Given the following balance sheet changes, what change, if any, should appes in retained earnings? marketable securities = +$3,000; inventories = +$10,000; depreciation = +$3,000 accounts payable = +$11,000; and notes payable = -$6,000 5-9 The balance sheet of the Christopher Company on December 31, 2012 is given below. The company's sales for 2012 were $100,000. Cash $2,000 Accounts payable $ 10,000 Accounts receivable 17,000 Accruals Inventories 20,000 Mortgage bonds Fixed assets (net) $30,000 Common stock 20,000 Total assets Retained earnings $69,000 Total debt & equity 5,000 14,000 20.000 $69,000 y profit margin after taxes on sales is 4 per IS 4 percent half The Christopher Company's profit margin after ta of which is paid as dividends. Both mortgage bonds a expected to stay the same and all the other balance sheet vary directly with sales. Sales are expected to be (a) Prepare Christopher Company's balance Eage bonds and common stock balance sheet items are expecte are expected to be $160,000 for 2013. 2012. (b) What additional funds will be needed in 20 any s balance items as a percento Percent of sales for