Need help solving these problems. You will find the excel sheet for the part one of the problem which needs to be used for the second part that I'm stuck on.

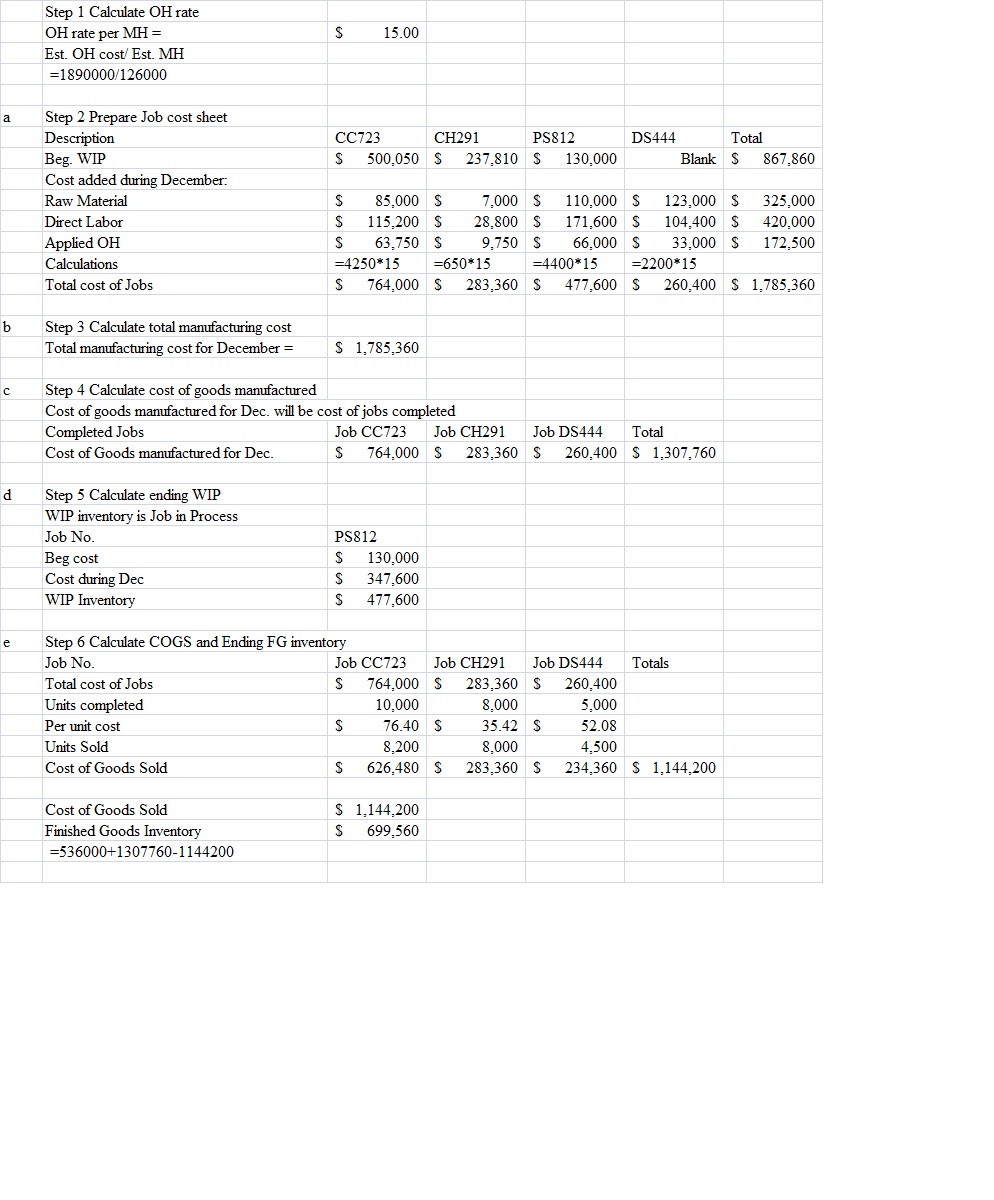

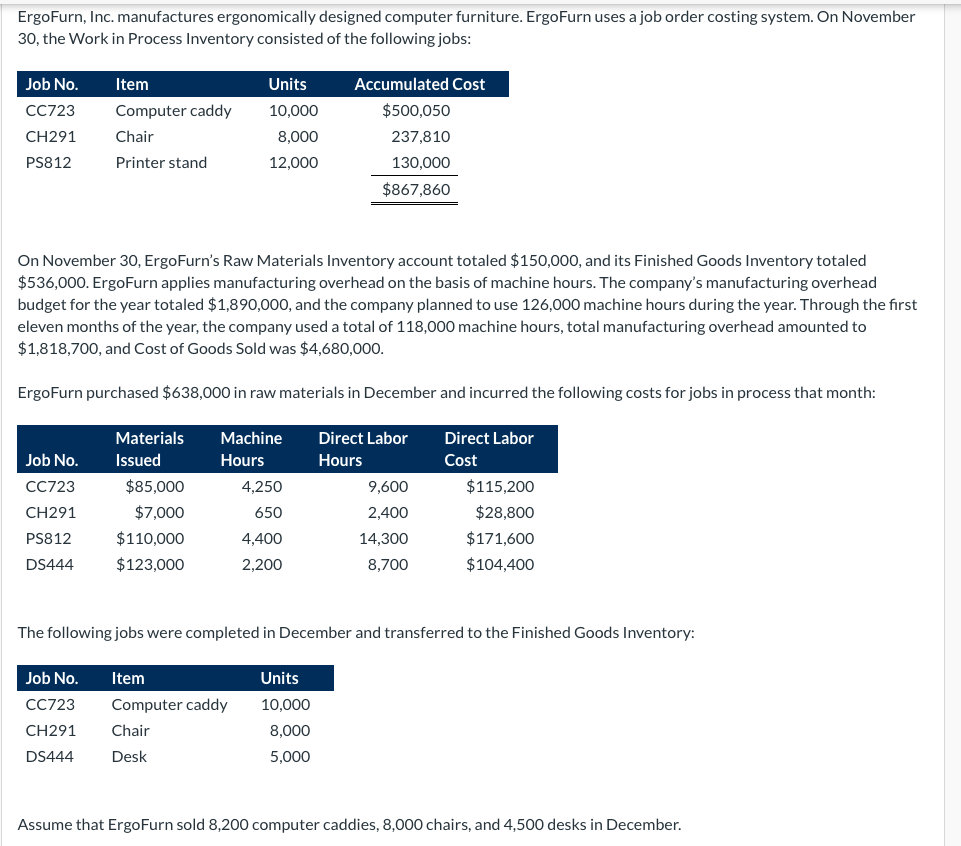

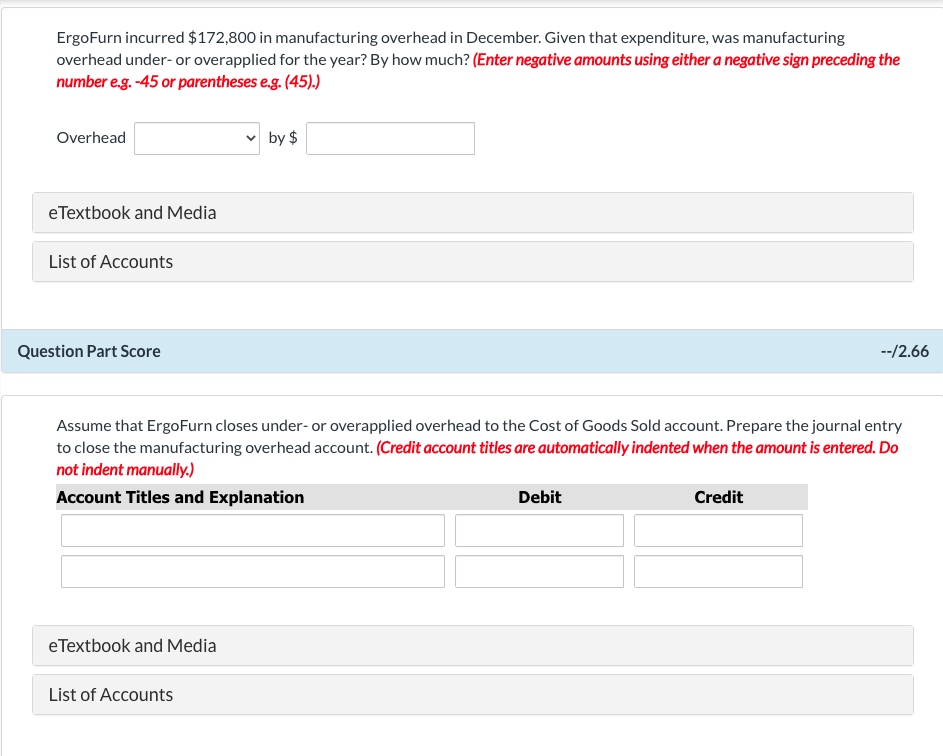

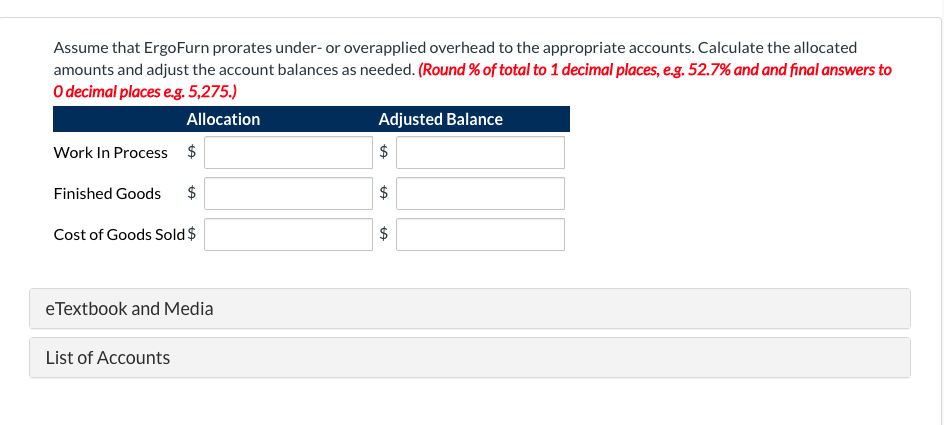

Step 1 Calculate OH rate OH rate per MH = S 15.00 Est. OH cost/ Est. MH =1890000/126000 Step 2 Prepare Job cost sheet Description CC723 CH291 PS812 DS444 Total Beg. WIP $ 500,050 S 237,810 $ 130,000 Blank $ 867,860 Cost added during December: Raw Material S 85,000 S 7,000 $ 110,000 $ 123,000 $ 325,000 Direct Labor S 115,200 $ 28,800 $ 171,600 $ 104,400 $ 420,000 Applied OH 63,750 S 9.750 $ 66.000 S 33.000 S 172.500 Calculations =4250*15 =650*15 =4400*15 =2200*15 Total cost of Jobs S 764,000 $ 283,360 $ 477,600 $ 260,400 $ 1,785,360 Step 3 Calculate total manufacturing cost Total manufacturing cost for December = $ 1,785,360 Step 4 Calculate cost of goods manufactured Cost of goods manufactured for Dec. will be cost of jobs completed Completed Jobs Job CC723 Job CH291 Job DS444 Total Cost of Goods manufactured for Dec. $ 764,000 $ 283,360 $ 260,400 $ 1,307,760 d Step 5 Calculate ending WIP WIP inventory is Job in Process Job No. PS812 Beg cost S 130.000 Cost during Dec S 347.600 WIP Inventory 477,600 Step 6 Calculate COGS and Ending FG inventory Job No. Job CC723 Job CH291 Job DS444 Totals Total cost of Jobs S 764,000 $ 2 283,360 $ 260,400 Units completed 10,000 8,000 5,000 Per unit cost S 76.40 S 35.42 $ 52.08 Units Sold 8,200 8.000 4,500 Cost of Goods Sold $ 626,480 $ 283,360 $ 234,360 $ 1,144,200 Cost of Goods Sold $ 1,144,200 Finished Goods Inventory 699.560 =536000+1307760-1144200ErgoFurn, Inc. manufactures ergonomically designed computer furniture. ErgoFurn uses a job order costing system. On November 30, the Work in Process Inventory consisted of the following jobs: Job No. Item Units Accumulated Cost CC 723 Computer caddy 10,000 $500,050 CH291 Chair 8,000 237,810 P88 12 Printer stand 12,000 130,000 $867,860 On November 30, ErgoFurn's Raw Materials Inventory account totaled $150,000, and its Finished Goods Inventory totaled $536,000. ErgoFurn applies manufacturing overhead on the basis of machine hours. The company's manufacturing overhead budget for the year totaled $1,890,000, and the company planned to use 126,000 machine hours during the year. Through the rst eleven months of the year, the company used a total of 118,000 machine hours, total manufacturing overhead amounted to $1,818,700, and Cost of Goods Sold was $4,680,000. ErgoFurn purchased $638,000 In raw materials In December and incurred the following costs forjobs in process that month: Materials Machine Direct Labor Direct Labor Job No. Issued Hours Hours Cost CC723 $85,000 4,250 9,600 $115,200 CH291 $7,000 650 2,400 $28,800 P5812 $110,000 4,400 14,300 $171,600 D5444 $123,000 2,200 8,700 $104,400 The fol lowingjobs were completed in December and transferred to the Finished Goods Inventory: Job No. Item Units CC723 Computer caddy 10,000 CH291 Chair 8,000 D5444 Desk 5,000 Assume that Ergo Furn sold 8,200 computer caddies, 8,000 chairs, and 4,500 desks in December. ErgoFurn incurred $172,800 in manufacturing overhead in December. Given that expenditure, was manufacturing overhead under- or overapplied for the year? By how much? (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Overhead by $ eTextbook and Media List of Accounts Question Part Score --/2.66 Assume that ErgoFurn closes under- or overapplied overhead to the Cost of Goods Sold account. Prepare the journal entry to close the manufacturing overhead account. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit eTextbook and Media List of AccountsAssume that ErgoFurn prorates under- or overapplied overhead to the appropriate accounts. Calculate the allocated amounts and adjust the account balances as needed. {Round 96 of total to 1 decimal places, 23. 52.7% and and nal answers to 0 decimal places es. 5.2?5.) Allocation Adjusted Balance Work In Process 35 l | 55 I l Finished Goods $ l | 55 I l Cost of Goods Sold$ l 55 I eTextbook and Media List of Accounts