Answered step by step

Verified Expert Solution

Question

1 Approved Answer

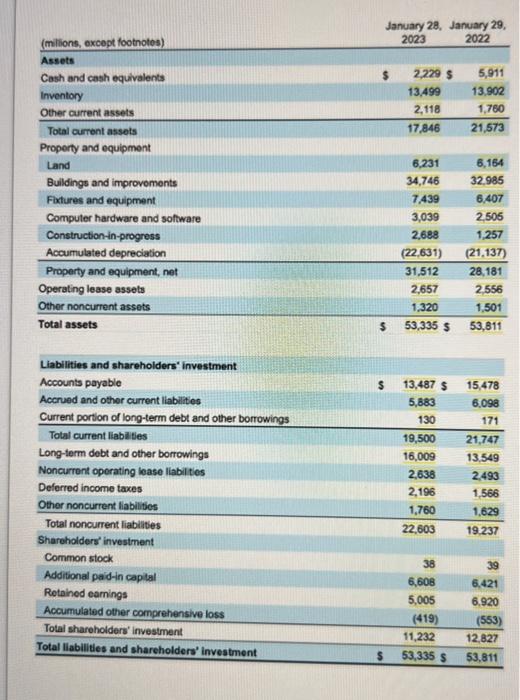

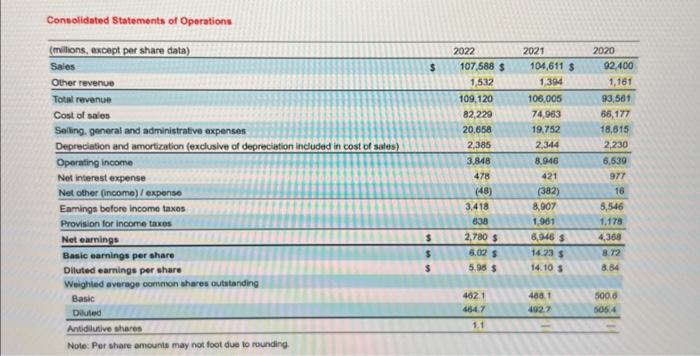

need help solving these ratios for both years. nunbers are in millions market value is 79.24 for 2022 and 75.60 for 2021. fixed asset turnover

need help solving these ratios for both years. nunbers are in millions

market value is 79.24 for 2022 and 75.60 for 2021.

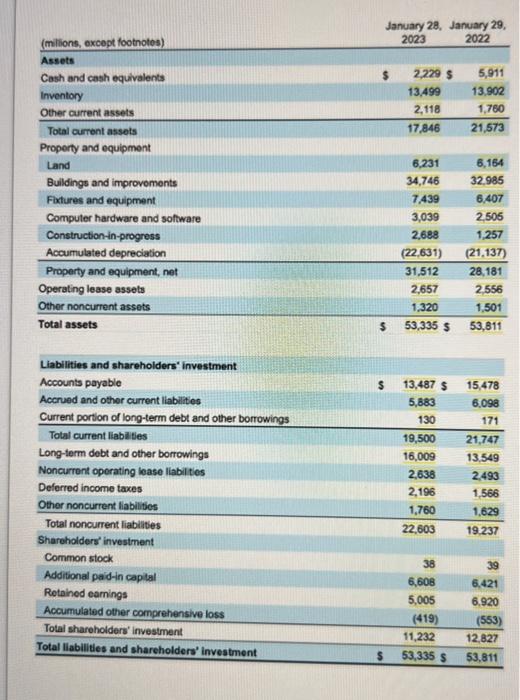

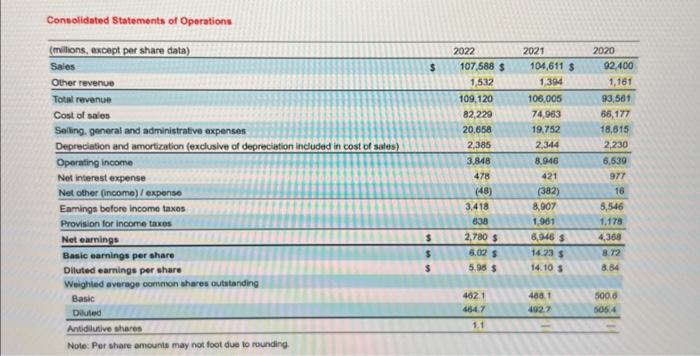

fixed asset turnover accounts receivable days Accounts payable days Inventory turnover EBIT /interest expense price-to-earning ratio market-to-book ratio return on equity Liabilities and shareholders' investment Shareholders' investment Common stock Additional paidin captal Rotained eamings Accumulated other comprehensive loss Total shareholders' investment Total liabilities and shareholders' investment Consolidated Statements of Operations fixed asset turnover accounts receivable days Accounts payable days Inventory turnover EBIT /interest expense price-to-earning ratio market-to-book ratio return on equity Liabilities and shareholders' investment Shareholders' investment Common stock Additional paidin captal Rotained eamings Accumulated other comprehensive loss Total shareholders' investment Total liabilities and shareholders' investment Consolidated Statements of Operations Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started