Answered step by step

Verified Expert Solution

Question

1 Approved Answer

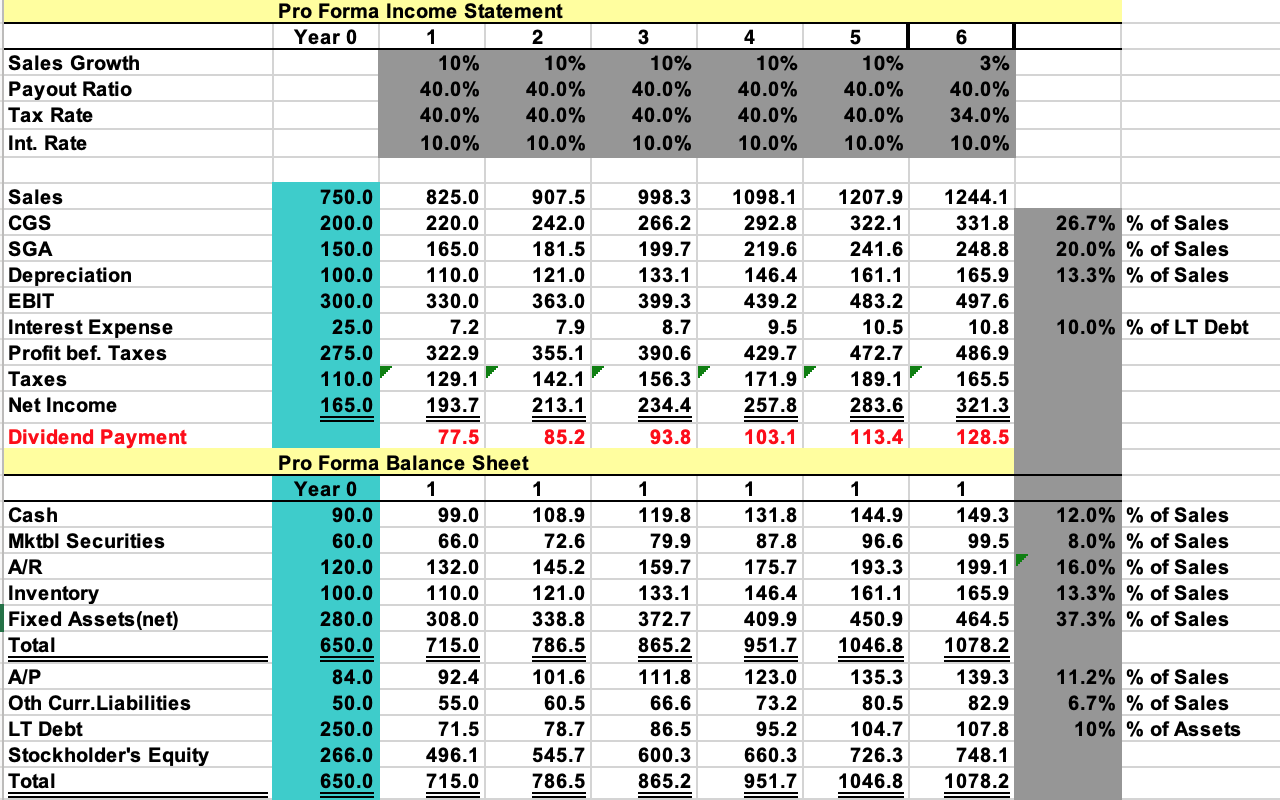

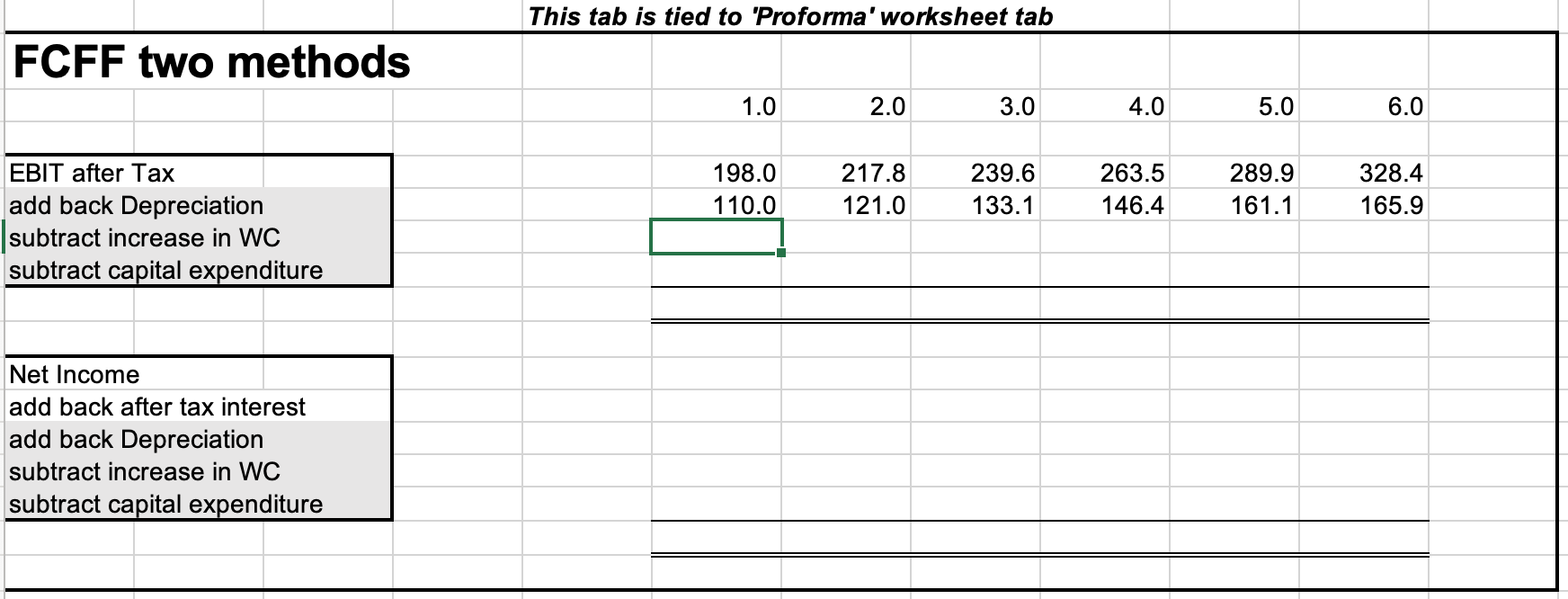

NEED HELP to: 1. Find Increase in WC and Capital expenditures 2.Find net borrowing and the equity repurchase ---Can you show the step in excel?

NEED HELP to:

1. Find Increase in WC and Capital expenditures

2.Find net borrowing and the equity repurchase

---Can you show the step in excel?

Sales Growth Payout Ratio Tax Rate Int. Rate Pro Forma Income Statement Year 0 1 2 10% 10% 40.0% 40.0% 40.0% 40.0% 10.0% 10.0% 3 10% 40.0% 40.0% 10.0% 4 10% 40.0% 40.0% 10.0% 5 10% 40.0% 40.0% 10.0% 6 3% 40.0% 34.0% 10.0% 26.7% % of Sales 20.0% % of Sales 13.3% % of Sales Sales CGS SGA Depreciation EBIT Interest Expense Profit bef. Taxes Taxes Net Income Dividend Payment 998.3 266.2 199.7 133.1 399.3 8.7 390.6 156.3 234.4 1098.1 292.8 219.6 146.4 439.2 9.5 429.7 171.9 257.8 103.1 1207.9 322.1 241.6 161.1 483.2 10.5 472.7 189.1 283.6 113.4 1244.1 331.8 248.8 165.9 497.6 10.8 486.9 165.5 321.3 128.5 10.0% % of LT Debt 93.8 750.0 825.0 907.5 200.0 220.0 242.0 150.0 165.0 181.5 100.0 110.0 121.0 300.0 330.0 363.0 25.0 7.2 7.9 275.0 322.9 355.1 110.0 129.1 142.1 165.0 193.7 213.1 77.5 85.2 Pro Forma Balance heet Year 0 1 1 90.0 99.0 108.9 60.0 66.0 72.6 120.0 132.0 145.2 100.0 110.0 121.0 280.0 308.0 338.8 650.0 715.0 786.5 84.0 92.4 101.6 50.0 55.0 60.5 250.0 71.5 78.7 266.0 496.1 545.7 650.0 715.0 786.5 1 1 12.0% % of Sales 8.0% % of Sales 16.0% % of Sales 13.3% % of Sales 37.3% % of Sales Cash Mktbl Securities AIR Inventory Fixed Assets (net) Total A/P Oth Curr.Liabilities LT Debt Stockholder's Equity Total 119.8 79.9 159.7 133.1 372.7 865.2 111.8 66.6 86.5 600.3 865.2 131.8 87.8 175.7 146.4 409.9 951.7 123.0 73.2 95.2 660.3 951.7 1 144.9 96.6 193.3 161.1 450.9 1046.8 135.3 80.5 104.7 726.3 1046.8 1 149.3 99.5 199.1 165.9 464.5 1078.2 139.3 82.9 107.8 748.1 1078.2 11.2% % of Sales 6.7% % of Sales 10% % of Assets This tab is tied to 'Proforma' worksheet tab FCFF two methods 1.0 2.0 3.0 4.0 5.0 6.0 198.0 110.0 217.8 121.0 239.6 133.1 263.5 146.4 289.9 161.1 328.4 165.9 EBIT after Tax add back Depreciation | subtract increase in WC subtract capital expenditure Net Income add back after tax interest add back Depreciation subtract increase in WC subtract capital expenditure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started