need help to check if my work is correct. thank you!

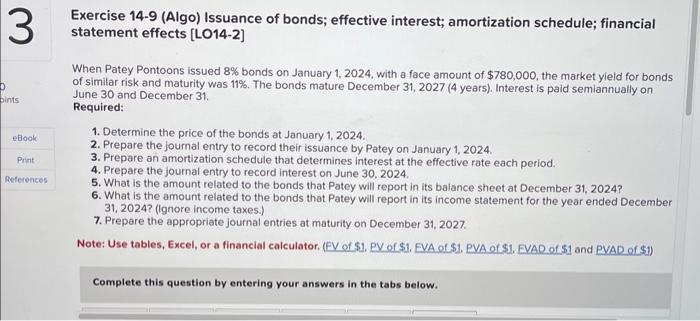

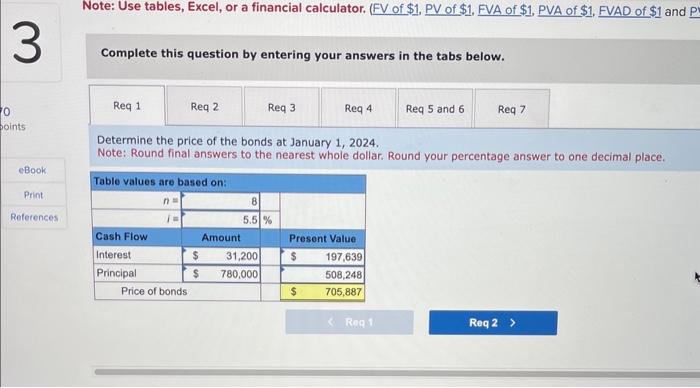

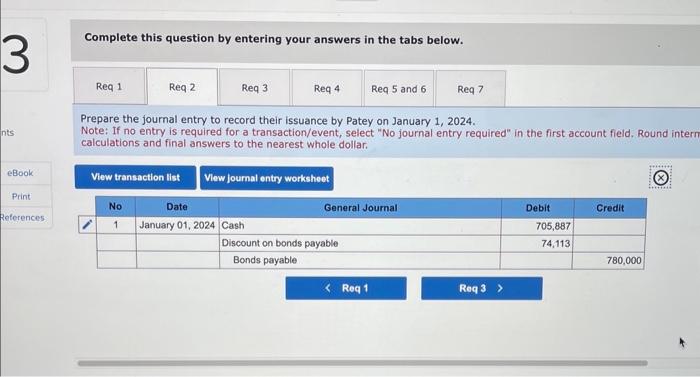

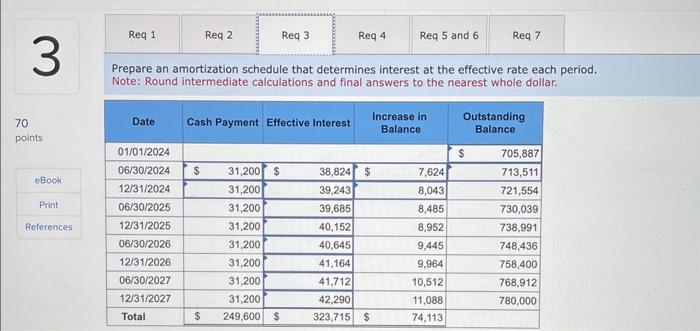

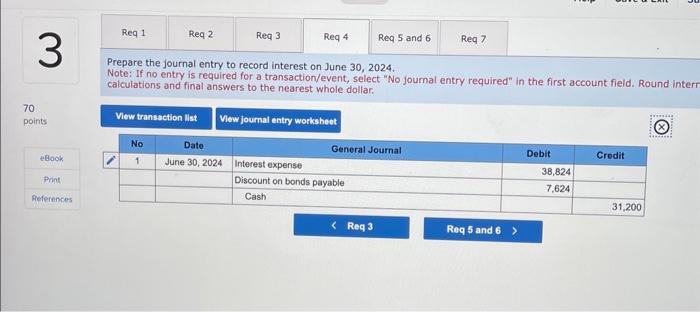

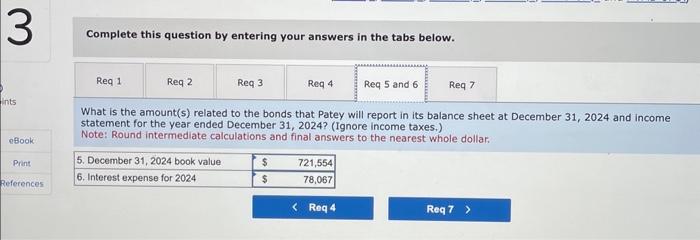

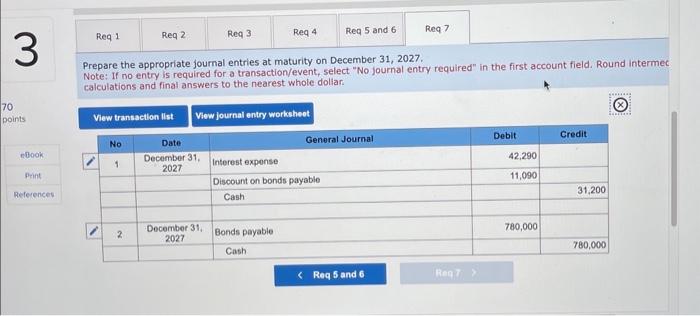

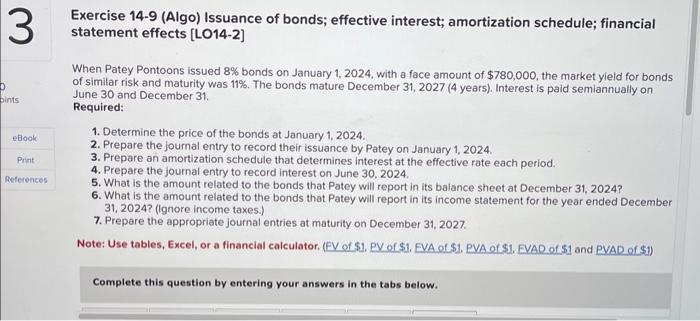

Exercise 14-9 (Algo) Issuance of bonds; effective interest; amortization schedule; financial statement effects [LO14-2] When Patey Pontoons issued 8% bonds on January 1, 2024, with a face amount of $780,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31,2027 ( 4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1,2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30,2024 . 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31,2024 ? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (lgnore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027. Note: Use tables, Excel, or a financial calculator. (EV of \$1, EV of \$1. EVA of \$1, PVA of \$1. EVAD of S1 and Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1,FVAD of $1 and Complete this question by entering your answers in the tabs below. Determine the price of the bonds at January 1, 2024. Note: Round final answers to the nearest whole dollar. Round your percentage answer to one decimal place. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record their issuance by Patey on January 1,2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round inter calculations and final answers to the nearest whole dollar. Prepare an amortization schedule that determines interest at the effective rate each period. Note: Round intermediate calculations and final answers to the nearest whole dollar: Prepare the journal entry to record interest on June 30,2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round inte calculations and final answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. What is the amount(s) related to the bonds that Patey will report in its balance sheet at December 31,2024 and income statement for the year ended December 31, 2024? (Ignore income taxes.) Note: Round intermediate calculations and final answers to the nearest whole dollar. Prepare the appropriate journal entries at maturity on December 31,2027. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round interme calculations and final answers to the nearest whole doliar. Exercise 14-9 (Algo) Issuance of bonds; effective interest; amortization schedule; financial statement effects [LO14-2] When Patey Pontoons issued 8% bonds on January 1, 2024, with a face amount of $780,000, the market yield for bonds of similar risk and maturity was 11%. The bonds mature December 31,2027 ( 4 years). Interest is paid semiannually on June 30 and December 31. Required: 1. Determine the price of the bonds at January 1,2024. 2. Prepare the journal entry to record their issuance by Patey on January 1, 2024. 3. Prepare an amortization schedule that determines interest at the effective rate each period. 4. Prepare the journal entry to record interest on June 30,2024 . 5. What is the amount related to the bonds that Patey will report in its balance sheet at December 31,2024 ? 6. What is the amount related to the bonds that Patey will report in its income statement for the year ended December 31, 2024? (lgnore income taxes.) 7. Prepare the appropriate journal entries at maturity on December 31, 2027. Note: Use tables, Excel, or a financial calculator. (EV of \$1, EV of \$1. EVA of \$1, PVA of \$1. EVAD of S1 and Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1,FVAD of $1 and Complete this question by entering your answers in the tabs below. Determine the price of the bonds at January 1, 2024. Note: Round final answers to the nearest whole dollar. Round your percentage answer to one decimal place. Complete this question by entering your answers in the tabs below. Prepare the journal entry to record their issuance by Patey on January 1,2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round inter calculations and final answers to the nearest whole dollar. Prepare an amortization schedule that determines interest at the effective rate each period. Note: Round intermediate calculations and final answers to the nearest whole dollar: Prepare the journal entry to record interest on June 30,2024. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round inte calculations and final answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. What is the amount(s) related to the bonds that Patey will report in its balance sheet at December 31,2024 and income statement for the year ended December 31, 2024? (Ignore income taxes.) Note: Round intermediate calculations and final answers to the nearest whole dollar. Prepare the appropriate journal entries at maturity on December 31,2027. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round interme calculations and final answers to the nearest whole doliar