Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help with #1, 2, 4, 5, and 7 3.6 Problems 1. Find the equivalent of winting and maintaining a pumping system whose estrated cost

need help with #1, 2, 4, 5, and 7

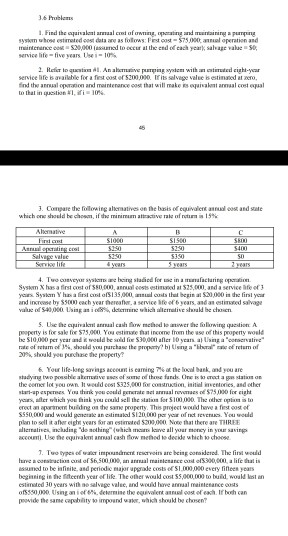

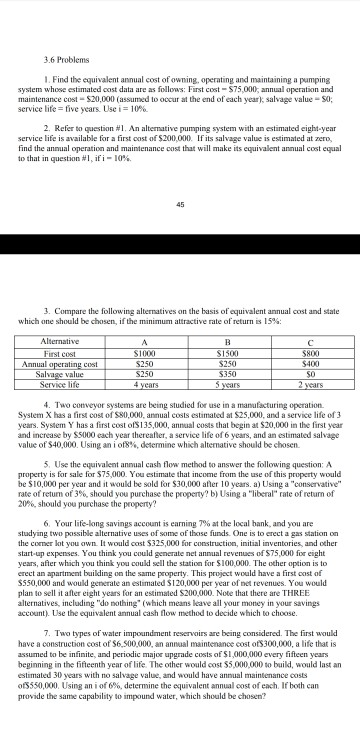

3.6 Problems 1. Find the equivalent of winting and maintaining a pumping system whose estrated cost data are as follows: est cost 750 ml operation and rience 520,000 und to see the end of each year, salvage value 50, service life-five years -10% 2. Relicar lo questa Analitive puring wysdem with a centrated eight-year service life is available for a festcost 5200,000. tris salvage value is estimated at ero find the anal price and maintenance cost that will make spisakmamal costal to that inquit, 10% 3. Compare the following alternatives on the basis of equivalent al cost and state which one should be chose, if the minimum attractive rate of return is 15% Alternative A S1000 5150 B S1500 5:30 S350 C SH) 54 sn AWE Salvage value SES 4. Tuo conveyor system anstadied for use in a facturing at Sysm X has a first cost of $80.000. aasts ested at $25,000and a service life of your Systen Yhes a first 135,000 mail.construit begin at $20,000 in the first year and increase by $5000 each year thereafter a service life of years and an estimated salvage value od 540,000. Using and determine which alleative stuld be chien S. Use the equival al cash flow method tower the following question A property is for sale for $75,000 You estimate that income from the use of this property would be $10,000 per year and it would be sold fix 530,000 after 10 yeana Using a conservative rate of return shall your purchase the property hanya berlate retum of 29 should you purchase the property? 6. Your life-long savings account is coming the local busk, and you are shadying two posible alive sex of some the funds One is create the comer let you can I do 325,000 for construction initial investories, and other yours, after which you think you could sell the status for 5100,000. The other post crest an apartment building on the same property. This project would have a fiest oostek 5550.000 and would generate an estimated $120.000 per year of rect severs. You would plan to sell it after eight years for an estimated 300.000 Note that there are THREE wiele, including death which we all your money in your saving art. Use the equivatal cash flow method to decide which to choose 1. Two types of water in de recrein are being considered. The first would luve a construction of $6.500.000, in anal maintenance and 530,000a life that is assumed to be infinite and periodic major upgrade costs CS1.000.000 every fifteen years beginning in the fifteenth year of life. The other would cost $5,000,000 to build would listen Estimated 30 years with no salvage value, and would have anual maintenance costs 015550.00. Using an iofs determine the equivalent al cost of each. If both can provide the same capability to impound water, which should be chosen? 3.6 Problems 1. Find the equivalent annual cost of owning, operating and maintaining a pumping system whose estimated cost data are as follows: First cost - $75,000, annual operation and maintenance cost-$20.000 (assumed to occur at the end of each year), salvage value - So; service life = five years. Use i = 10% 2. Refer to question #1. An alternative pumping system with an estimated eight-year service life is available for a first cost of $200,000. If its salvage value is estimated at zero, find the annual operation and maintenance cost that will make its equivalent annual cost equal to that in question #1, if i -10% 45 3. Compare the following alternatives on the basis of equivalent annual cost and state which one should be chosen, if the minimum attractive rate of return is 15% Alternative First cost Annual operating cost Salvage value Service life A S1000 S250 S250 4 years B S1500 S250 $350 5 years C 5800 $400 $0 2 years 4. Two conveyor systems are being studied for use in a manufacturing operation. System X has a first cost of $80,000 annual costs estimated at $25,000, and a service life of 3 years. System Y has a first cost of 135,000, annual costs that begin at $20,000 in the first year and increase by S5000 each year thereafter, a service life of 6 years, and an estimated salvage value of $40,000. Using an iof8%, determine which alternative should be chosen 5. Use the equivalent annual cash flow method to answer the following question: A property is for sale for $75,000. You estimate that income from the use of this property would be $10,000 per year and it would be sold for $30,000 after 10 years. a) Using a conservative rate of retum of 3%, should you purchase the property? b) Using a "liberal" rate of return of 20%, should you purchase the property? 6. Your life-long savings account is earning 7% at the local bank, and you are studying two possible alternative uses of some of those funds. One is to erect a gas station on the comer lot you own. It would cost $325,000 for construction, initial inventories, and other start-up expenses. You think you could generate net annual revenues of $75,000 for eight years, after which you think you could sell the station for $100,000. The other option is to erect an apartment building on the same property. This project would have a first cast of SS50,000 and would generate an estimated $120,000 per year of net revenues. You would plan to sell it after eight years for an estimated $200,000. Note that there are THREE alternatives, including "do nothing (which means leave all your money in your savings account). Use the equivalent annual cash flow method to decide which to choose. 7. Two types of water impoundment reservoirs are being considered. The first would have a construction cost of $6,500,000, an annual maintenance cost of 300,000, a life that is assumed to be infinite, and periodic major upgrade costs of $1,000,000 every fifteen years beginning in the fifteenth year of life. The other would cost 55,000,000 to build, would last an estimated 30 years with no salvage value, and would have annual maintenance costs of$550,000. Using an i of 6%, determine the equivalent annual cost of each. If both can provide the same capability to impound water, which should be chosen? 3.6 Problems 1. Find the equivalent of winting and maintaining a pumping system whose estrated cost data are as follows: est cost 750 ml operation and rience 520,000 und to see the end of each year, salvage value 50, service life-five years -10% 2. Relicar lo questa Analitive puring wysdem with a centrated eight-year service life is available for a festcost 5200,000. tris salvage value is estimated at ero find the anal price and maintenance cost that will make spisakmamal costal to that inquit, 10% 3. Compare the following alternatives on the basis of equivalent al cost and state which one should be chose, if the minimum attractive rate of return is 15% Alternative A S1000 5150 B S1500 5:30 S350 C SH) 54 sn AWE Salvage value SES 4. Tuo conveyor system anstadied for use in a facturing at Sysm X has a first cost of $80.000. aasts ested at $25,000and a service life of your Systen Yhes a first 135,000 mail.construit begin at $20,000 in the first year and increase by $5000 each year thereafter a service life of years and an estimated salvage value od 540,000. Using and determine which alleative stuld be chien S. Use the equival al cash flow method tower the following question A property is for sale for $75,000 You estimate that income from the use of this property would be $10,000 per year and it would be sold fix 530,000 after 10 yeana Using a conservative rate of return shall your purchase the property hanya berlate retum of 29 should you purchase the property? 6. Your life-long savings account is coming the local busk, and you are shadying two posible alive sex of some the funds One is create the comer let you can I do 325,000 for construction initial investories, and other yours, after which you think you could sell the status for 5100,000. The other post crest an apartment building on the same property. This project would have a fiest oostek 5550.000 and would generate an estimated $120.000 per year of rect severs. You would plan to sell it after eight years for an estimated 300.000 Note that there are THREE wiele, including death which we all your money in your saving art. Use the equivatal cash flow method to decide which to choose 1. Two types of water in de recrein are being considered. The first would luve a construction of $6.500.000, in anal maintenance and 530,000a life that is assumed to be infinite and periodic major upgrade costs CS1.000.000 every fifteen years beginning in the fifteenth year of life. The other would cost $5,000,000 to build would listen Estimated 30 years with no salvage value, and would have anual maintenance costs 015550.00. Using an iofs determine the equivalent al cost of each. If both can provide the same capability to impound water, which should be chosen? 3.6 Problems 1. Find the equivalent annual cost of owning, operating and maintaining a pumping system whose estimated cost data are as follows: First cost - $75,000, annual operation and maintenance cost-$20.000 (assumed to occur at the end of each year), salvage value - So; service life = five years. Use i = 10% 2. Refer to question #1. An alternative pumping system with an estimated eight-year service life is available for a first cost of $200,000. If its salvage value is estimated at zero, find the annual operation and maintenance cost that will make its equivalent annual cost equal to that in question #1, if i -10% 45 3. Compare the following alternatives on the basis of equivalent annual cost and state which one should be chosen, if the minimum attractive rate of return is 15% Alternative First cost Annual operating cost Salvage value Service life A S1000 S250 S250 4 years B S1500 S250 $350 5 years C 5800 $400 $0 2 years 4. Two conveyor systems are being studied for use in a manufacturing operation. System X has a first cost of $80,000 annual costs estimated at $25,000, and a service life of 3 years. System Y has a first cost of 135,000, annual costs that begin at $20,000 in the first year and increase by S5000 each year thereafter, a service life of 6 years, and an estimated salvage value of $40,000. Using an iof8%, determine which alternative should be chosen 5. Use the equivalent annual cash flow method to answer the following question: A property is for sale for $75,000. You estimate that income from the use of this property would be $10,000 per year and it would be sold for $30,000 after 10 years. a) Using a conservative rate of retum of 3%, should you purchase the property? b) Using a "liberal" rate of return of 20%, should you purchase the property? 6. Your life-long savings account is earning 7% at the local bank, and you are studying two possible alternative uses of some of those funds. One is to erect a gas station on the comer lot you own. It would cost $325,000 for construction, initial inventories, and other start-up expenses. You think you could generate net annual revenues of $75,000 for eight years, after which you think you could sell the station for $100,000. The other option is to erect an apartment building on the same property. This project would have a first cast of SS50,000 and would generate an estimated $120,000 per year of net revenues. You would plan to sell it after eight years for an estimated $200,000. Note that there are THREE alternatives, including "do nothing (which means leave all your money in your savings account). Use the equivalent annual cash flow method to decide which to choose. 7. Two types of water impoundment reservoirs are being considered. The first would have a construction cost of $6,500,000, an annual maintenance cost of 300,000, a life that is assumed to be infinite, and periodic major upgrade costs of $1,000,000 every fifteen years beginning in the fifteenth year of life. The other would cost 55,000,000 to build, would last an estimated 30 years with no salvage value, and would have annual maintenance costs of$550,000. Using an i of 6%, determine the equivalent annual cost of each. If both can provide the same capability to impound water, which should be chosen

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started