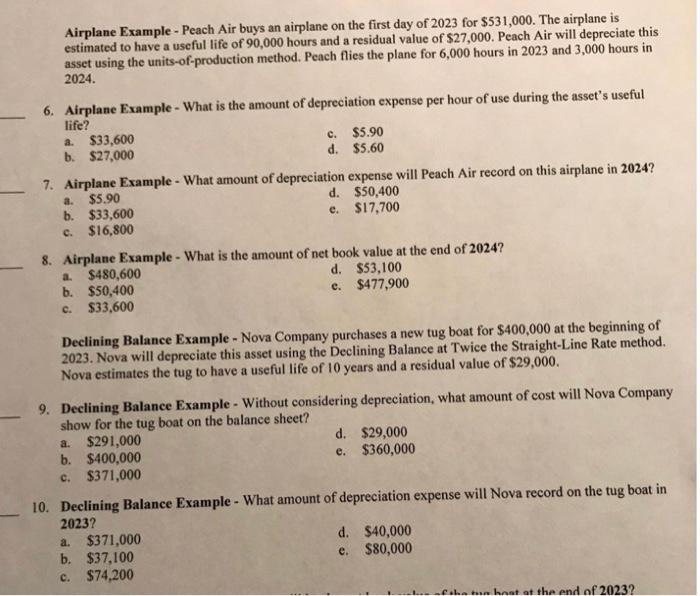

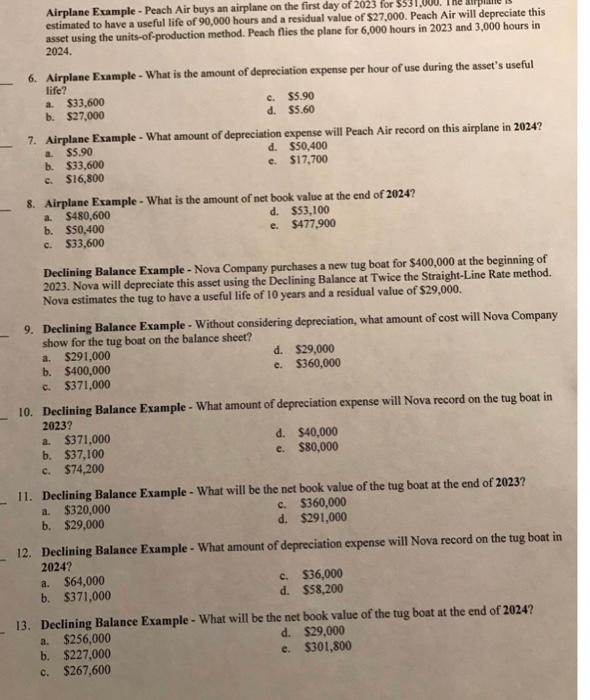

a. Airplane Example - Peach Air buys an airplane on the first day of 2023 for $531,000. The airplane is estimated to have a useful life of 90,000 hours and a residual value of $27,000. Peach Air will depreciate this asset using the units-of-production method. Peach flies the plane for 6,000 hours in 2023 and 3,000 hours in 2024. 6. Airplane Example - What is the amount of depreciation expense per hour of use during the asset's useful life? $33,600 c. $5.90 b. $27,000 d. $5.60 7. Airplane Example - What amount of depreciation expense will Peach Air record on this airplane in 2024? $5.90 d. $50,400 b. $33,600 e. $17,700 c. $16,800 8. Airplane Example - What is the amount of net book value at the end of 2024? a $480,600 d. $53,100 b. $50,400 e. $477,900 c. $33,600 a. Declining Balance Example - Nova Company purchases a new tug boat for $400,000 at the beginning of 2023. Nova will depreciate this asset using the Declining Balance at Twice the Straight-Line Rate method. Nova estimates the tug to have a useful life of 10 years and a residual value of $29,000. 9. Declining Balance Example - Without considering depreciation, what amount of cost will Nova Company show for the tug boat on the balance sheet? a. $291,000 d. $29,000 b. $400,000 e. $360,000 c. $371,000 10. Declining Balance Example - What amount of depreciation expense will Nova record on the tug boat in 20232 a. $371,000 d. $40,000 b. $37,100 e. $80,000 c. $74,200 she heat at the end of 20232 Airplane Example - Peach Air buys an airplane on the first day of 2023 for estimated to have a useful life of 90,000 hours and a residual value of $27.000. Peach Air will depreciate this asset using the units-of-production method. Peach flies the plane for 6,000 hours in 2023 and 3,000 hours in 2024 6. Airplane Example - What is the amount of depreciation expense per hour of use during the asset's useful life? a $33,600 c. $5.90 b. $27,000 d. $5.60 7. Airplane Example - What amount of depreciation expense will Peach Air record on this airplane in 2024? $5.90 d. $50,400 b. $33.600 e $17,700 $16,800 8. Airplane Example - What is the amount of net book value at the end of 2024? a $480,600 d. $53,100 b. $50,400 c. $477,900 c. $33,600 Declining Balance Example - Nova Company purchases a new tug boat for $400,000 at the beginning of 2023. Nova will depreciate this asset using the Declining Balance at Twice the Straight-Line Rate method. Nova estimates the tug to have a useful life of 10 years and a residual value of $29,000. 9. Declining Balance Example - Without considering depreciation, what amount of cost will Nova Company show for the tug bout on the balance sheet? a. $291,000 d. $29,000 b. $400,000 c. $360,000 c. $371,000 10. Declining Balance Example - What amount of depreciation expense will Nova record on the tug boat in 20232 a $371,000 d. $40,000 b. $37.100 c. $80,000 c. $74,200 11. Declining Balance Example - What will be the net book value of the tug boat at the end of 2023? a. $320,000 c. $360,000 b. $29,000 d. $291,000 12. Declining Balance Example - What amount of depreciation expense will Nova record on the tug boat in 2024? a. $64,000 c. $36.000 b. $371,000 d. $58,200 13. Declining Balance Example - What will be the net book value of the tug boat at the end of 2024? a. $256.000 d. $29,000 b. $227,000 e. $301.800 c. $267,600