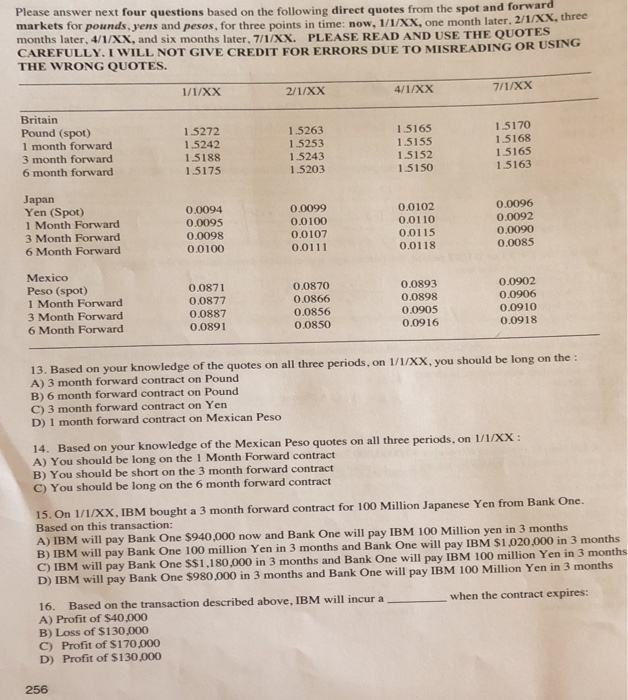

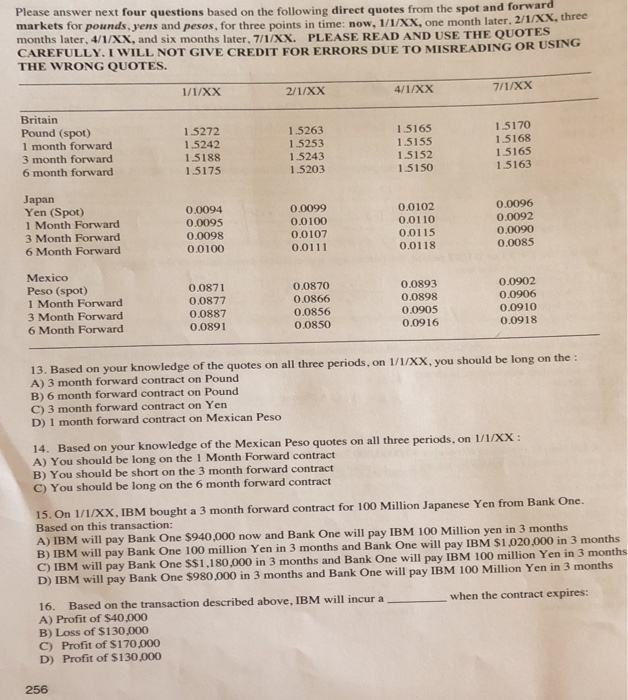

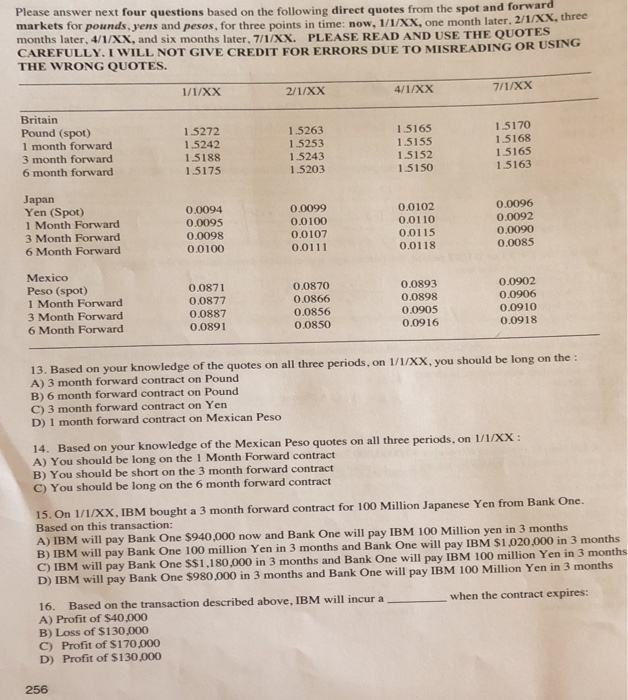

Need help with 13-16 and if you could explain why its the answer please. Thank you

Please answer next four questions based on the following direct quotes from the spot and forward markets for pounds, yens and pesos, for three points in time: now, 1/1/XX, one month later months later, 4/1/XX, and six months later, 7/1/XX. PLEASE READ AND USE THE QUOTE CAREFULLY. I WILL NOT GIVE CREDIT FOR ERRORS DUE TO MISREADING OR US THE WRONG QUOTES NG Britain Pound (spot) 1 month forward 3 month forward 6 month forward 1.5272 1,5242 15188 1.5175 1.5263 1.5253 1.5243 1.5203 1.5170 1.5168 1.5165 1.5152 1.5163 Yen (Spot) 1 Month Forward 3 Month Forward 6 Month Forward 0.0094 0.0095 0.0098 0.0100 0.0099 0.0100 0.0107 0.0111 0.0102 0.0110 0.0115 0.0118 0.0096 0.0092 0.0090 0.0085 Mexico Peso (spot) 1 Month Forward 3 Month Forward 6 Month Forward 0.0871 0.0877 0.0887 0.0891 0.0870 0.0866 0.0856 0.0850 0.0893 0.0898 0.0905 0.0916 0.0902 0.0906 0.0910 0.0918 13. Based on your knowledge of the quotes on all three periods, on 1/1/XX, you should be long on A) 3 month forward contract on Pound B) 6 month forward contract on Pound C) 3 month forward contract on Yen D) 1 month forward contract on Mexican Peso the 14. Based on your knowledge of the Mexican Peso quotes on all three periods, on 1/1/XX A) You should be long on the 1 Month Forward contract B) You should be short on the 3 month forward contract C) You should be long on the 6 month forward contract 15. On 1/1/XX, IBM bought a 3 month forward contract for 100 Million Japanese Yen from Bank One. Based on this transaction: A) IBM will pay Bank One $940,000 now and Bank One will pay IBM 100 Million yen in 3 months C) IBM will pay Bank One $$1,180,000 in 3 months and Bank One will pay IBM 100 million Yen in 3 months D) IBM will pay Bank One 100 million Yen in 3 months and Bank One will pay IBM $1,020.000 in 3 months will pay Bank One $980,000 in 3 months and Bank One will pay IBM 100 Million Yen in 3 months 16. Based on the transaction described above, IBM will incur a A) Profit of $40,000 B) Loss of $130,000 C) Profit of $170,000 D) Profit of $130,000 when the contract expires: 256 Please answer next four questions based on the following direct quotes from the spot and forward markets for pounds, yens and pesos, for three points in time: now, 1/1/XX, one month later months later, 4/1/XX, and six months later, 7/1/XX. PLEASE READ AND USE THE QUOTE CAREFULLY. I WILL NOT GIVE CREDIT FOR ERRORS DUE TO MISREADING OR US THE WRONG QUOTES NG Britain Pound (spot) 1 month forward 3 month forward 6 month forward 1.5272 1,5242 15188 1.5175 1.5263 1.5253 1.5243 1.5203 1.5170 1.5168 1.5165 1.5152 1.5163 Yen (Spot) 1 Month Forward 3 Month Forward 6 Month Forward 0.0094 0.0095 0.0098 0.0100 0.0099 0.0100 0.0107 0.0111 0.0102 0.0110 0.0115 0.0118 0.0096 0.0092 0.0090 0.0085 Mexico Peso (spot) 1 Month Forward 3 Month Forward 6 Month Forward 0.0871 0.0877 0.0887 0.0891 0.0870 0.0866 0.0856 0.0850 0.0893 0.0898 0.0905 0.0916 0.0902 0.0906 0.0910 0.0918 13. Based on your knowledge of the quotes on all three periods, on 1/1/XX, you should be long on A) 3 month forward contract on Pound B) 6 month forward contract on Pound C) 3 month forward contract on Yen D) 1 month forward contract on Mexican Peso the 14. Based on your knowledge of the Mexican Peso quotes on all three periods, on 1/1/XX A) You should be long on the 1 Month Forward contract B) You should be short on the 3 month forward contract C) You should be long on the 6 month forward contract 15. On 1/1/XX, IBM bought a 3 month forward contract for 100 Million Japanese Yen from Bank One. Based on this transaction: A) IBM will pay Bank One $940,000 now and Bank One will pay IBM 100 Million yen in 3 months C) IBM will pay Bank One $$1,180,000 in 3 months and Bank One will pay IBM 100 million Yen in 3 months D) IBM will pay Bank One 100 million Yen in 3 months and Bank One will pay IBM $1,020.000 in 3 months will pay Bank One $980,000 in 3 months and Bank One will pay IBM 100 Million Yen in 3 months 16. Based on the transaction described above, IBM will incur a A) Profit of $40,000 B) Loss of $130,000 C) Profit of $170,000 D) Profit of $130,000 when the contract expires: 256