Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with 16-1,16-2,16-3 and 16-4 how your firm's 16-9 Your can be viewed as an option. Why might he want to increase the riskiness

Need help with 16-1,16-2,16-3 and 16-4

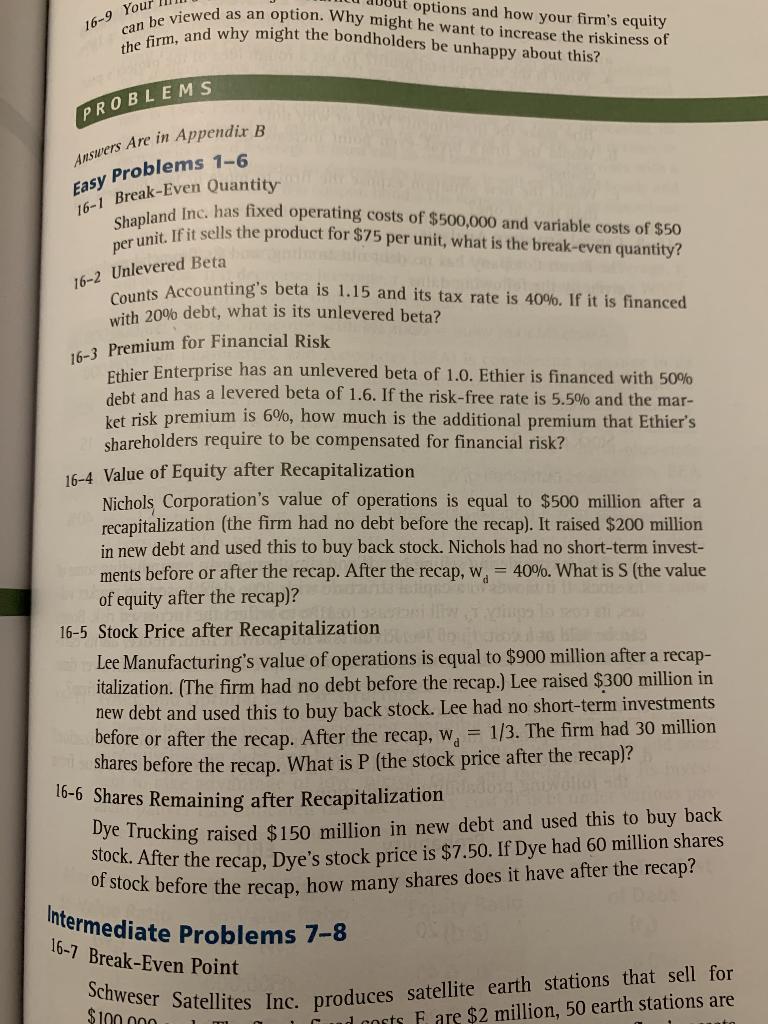

how your firm's 16-9 Your can be viewed as an option. Why might he want to increase the riskiness of the firm, and why might the bondholders be unhappy about this? PROBLEMS Answers Are in Appendir B Easy Problems 1-6 16-1 Break-Even Quantity Shapland Inc. has fixed operating costs of $500,000 and variable costs of $50 per unit. If it sells the product for $75 per unit, what is the break-even quantity? 16-2 Unlevered Beta Counts Accounting's beta is 1.15 and its tax rate is 40%. If it is financed with 20% debt, what is its unlevered beta? 16-3 Premium for Financial Risk Ethier Enterprise has an unlevered beta of 1.0. Ethier is financed with 50% debt and has a levered beta of 1.6. If the risk-free rate is 5.5% and the mar- ket risk premium is 6%, how much is the additional premium that Ethier's shareholders require to be compensated for financial risk? 16-4 Value of Equity after Recapitalization Nichols Corporation's value of operations is equal to $500 million after a recapitalization (the firm had no debt before the recap). It raised $200 million in new debt and used this to buy back stock. Nichols had no short-term invest- ments before or after the recap. After the recap, w, = 40%. What is S(the value of equity after the recap)? 16-5 Stock Price after Recapitalization Lee Manufacturing's value of operations is equal to $900 million after a recap- italization. (The firm had no debt before the recap.) Lee raised $300 million in new debt and used this to buy back stock. Lee had no short-term investments before or after the recap. After the recap, w, = 1/3. The firm had 30 million shares before the recap. What is P (the stock price after the recap)? 16-6 Shares Remaining after Recapitalization Dye Trucking raised $150 million in new debt and used this to buy back Stock . After the recap, Dye's stock price is $7.50. If Dye had 60 million shares of stock before the recap, how many shares does it have after the recap? Intermediate Problems 7-8 16-7 Break-Even Point Schweser Satellites Inc. produces satellite earth stations that sell for $100.000 1 ud costs F are $2 million, 50 earth stations areStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started